More Firms Go Uncovered As MiFid II Decimates Ranks Of Sell-Side Analysts

Sell-side analysis was never perfect.

Banks’ competition for lucrative deal flow has always ensured that the “Chinese wall” that’s supposed to exist between the front office and research department is about as impenetrable as a sieve. And then there’s the overpowering pressure for analysts to conform to the consensus, which works like this: If you conform to the consensus, then when everyone is wrong, you don’t look so bad, and you don’t need to worry about losing your job as head analyst.

But if you take a contrarian position and miss, then you’re at risk.

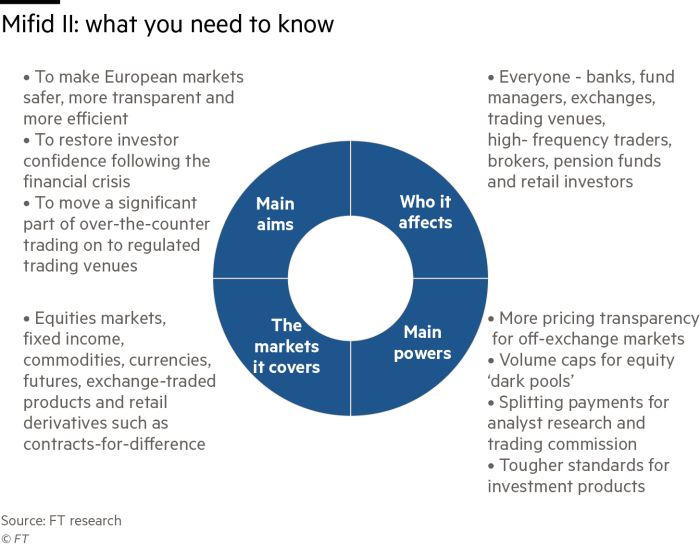

Unfortunately for those who have chosen to make a career in the research departments of big sell-side banks, new European banking regulations (MiFid II) are already forcing banks to reduce research department headcount, according to the FT.

Since MiFid forced banks to explicitly charge for research, new pricing structures being adopted by sell-side research departments have raised the cost for clients, forcing firms to pick and choose which banks they will continue paying for research.

The result? Wall Street research now comes with more fees than discount airlines.

And with fewer bodies in the research department, megabanks are increasingly being forced to dedicate limited resources to only the most lucrative businesses: I.e. large-cap companies who will bring in the research subscriptions from asset managers, and companies that might offer an M&A payoff.

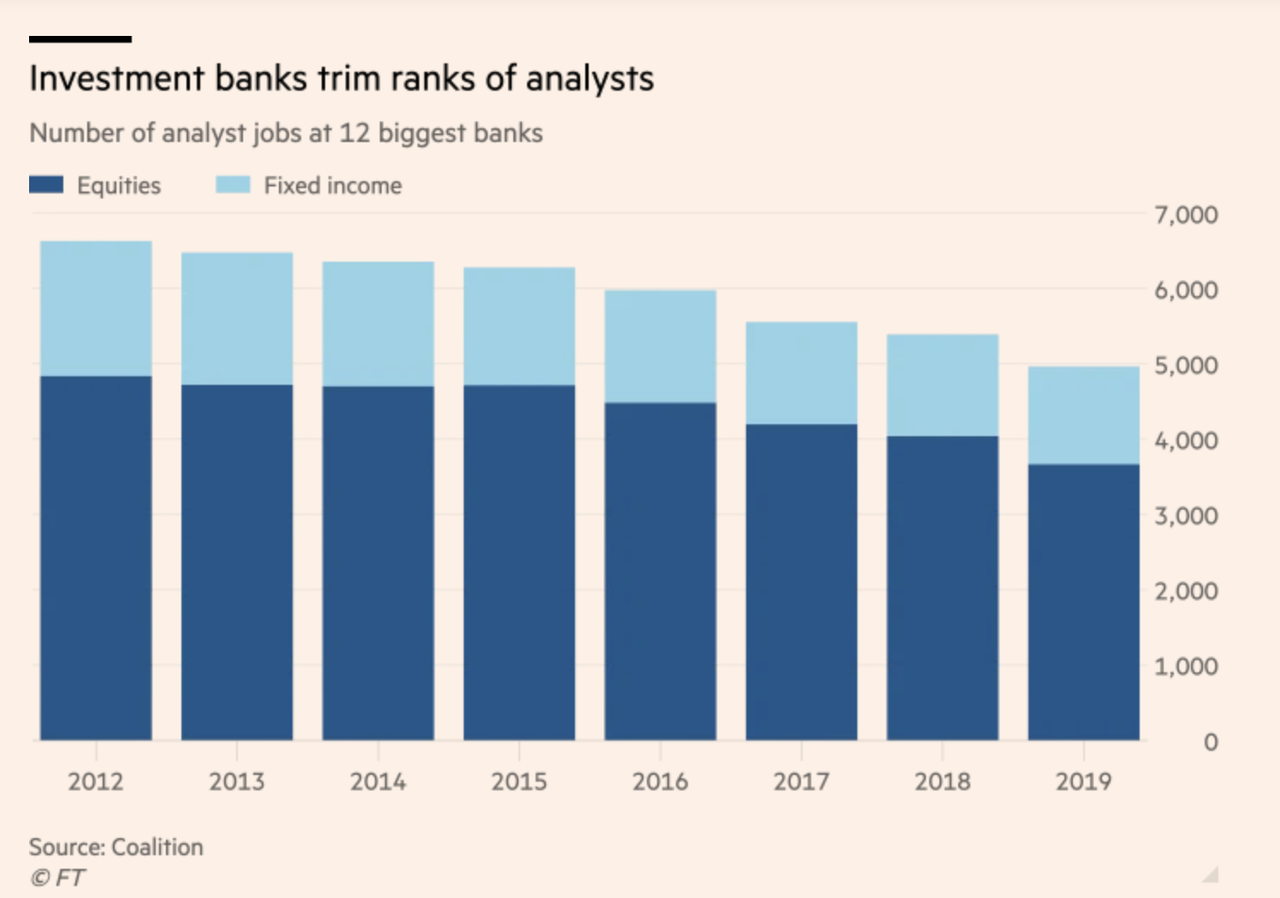

At any rate, in less than a decade, the average number of analysts covering the biggest European companies has fallen by nearly a quarter, largely because of MiFid 2.

The average number of analysts who cover European companies with a market capitalisation of $100bn or more has dropped 22 per cent since 2011, according to StarMine numbers compiled by Bank of America. Those companies with a market value of $10bn to $100bn have seen their coverage contract by 26 per cent, it found.

The numbers underscore how investment banks prefer to focus their limited resources on companies of a size necessary to interest big asset management clients, or those that may yield dealmaking work for the banks themselves. Coverage is declining everywhere but the trend is particularly acute in Europe, where the introduction of the Mifid II regulatory package in January 2018 has forced asset managers to “unbundle” payment for research from trading business.

As a result of having to pay directly for research, many investment groups have sharply curtailed how much they use. But the impact has been felt everywhere.

The number of equity analysts working at the 12 biggest banks has fallen below 4,000, which risks leaving dozens of important companies without any analysts covering them.

As the head of research at JPM explained, Mifid II is going to make everyone more conscious of the research they’re consuming…and it’s also ratcheting up the competition to be the top ranked analysts.

“Mifid II has made everyone a lot more aware of the research they consume, whether they’re directly affected by Mifid or not,” said Joyce Chang, chair of research at JPMorgan. “You’re not going to call 10 analysts, you’re only going to call the top people, so we have to work hard to stay comprehensive…if you’re numbers five through 10, it will be harder to stay on everyone’s radar.”

While headcount is falling in research departments everywhere, Europe has been particularly hard hit. And with most banks bracing for an economic downturn by trimming fat wherever they can, the full-year number for 2019 will likely be even lower.

Tyler Durden

Thu, 12/05/2019 – 02:45

via ZeroHedge News https://ift.tt/2sOAuWH Tyler Durden