Tiffany’s Disastrous Earnings Explains Company’s Eagerness To Sell To LVMH

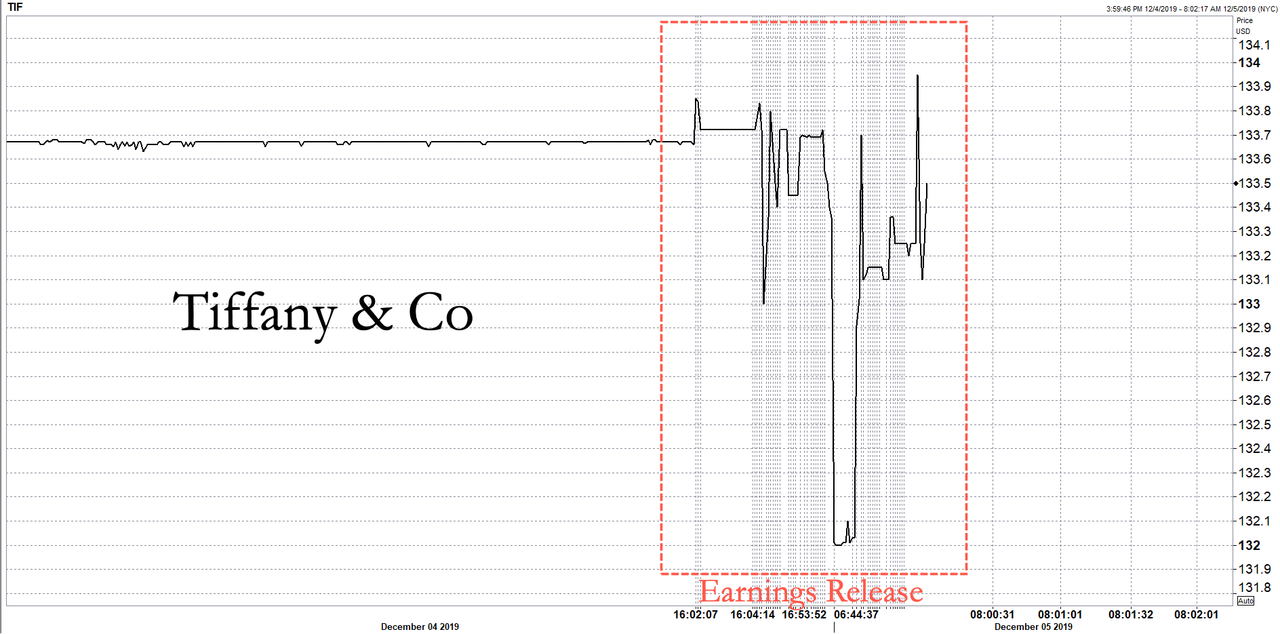

Tiffany & Co shares slid Thursday morning after missing Wall Street expectations for quarterly profits and sales, reported Reuters.

Net Sales in North America dropped 4% in 3Q, mostly due to a deteriorating consumer. Sales in the Asia-Pacific region were flat, crushed by a 49% drop in Hong Kong amid deepening socio-economic chaos.

Mainland China bucked the trend, recorded double-digit growth for sales, according to Refinitiv data

Net earnings for the company declined to $78.4 million, or about 65 cents per share, in 3Q, from $94.9 million, or 77 cents, last year.

Wall Street was betting the company would earn 85 cents per share on the quarter, mostly because of trade war optimism and the hopes for a strong US consumer. Though, the hope hasn’t translated into any meaningful pick up in growth in 2H. Net sales were flat in the quarter at $1.01 billion.

Last week, the boards of both LVMH Moët Hennessy and Tiffany approved a deal that would sell Tiffany for $16.2 billion, or at $135 per share in cash to LVMH. The transaction is expected to be completed in early 2020, explains the eagerness of Tiffany’s board to unload the company after today’s disastrous earnings.

As we’ve been reporting in recent months, a sudden pullback in spending by the consumer could ripple through the service economy, which is about 70% of GDP.

Already an employment downturn is at risk of becoming more profound and will likely shift consumer sentiment lower.

Ahead of recessions, consumers tend to pull back on jewelry purchases as pessimism changes spending habits.

It’s clear that Tiffany’s board knows the next recession is imminent, they’re attempting to unload the company at the peak.

Tyler Durden

Thu, 12/05/2019 – 09:24

via ZeroHedge News https://ift.tt/2OQD9rs Tyler Durden