Beijing No Longer Seems Interested In Footing The Bill For Electric Vehicles

EVs were once thought to be the unlimited silver lining behind an automotive industry that has all but collapsed into severe recession in China.

But now, it’s looking like Beijing isn’t so excited to help sustain the EV niche of the market anymore, according to the Wall Street Journal.

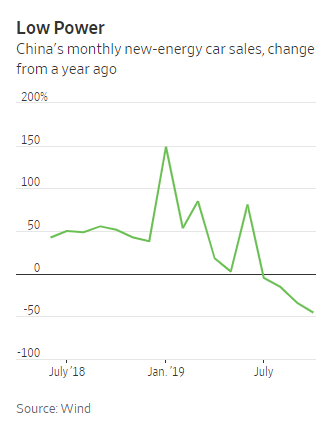

And Beijing’s ambivalence is starting to show up in the numbers. EV sales fell off a cliff after June of this year, when the government slashed purchase subsidies. From July to October, sales of new energy cars were down 28% from the year prior.

Many buyers prior to this had purchased vehicles in anticipation of the subsidy cut, which makes the sales “hangover” even worse. But the drop, on its own, still suggests that demand could be waning under the surface without government incentive. EVs are still priced above conventional cars when they are not stapled to a government subsidy.

Luxury EVs have buyers in places like Shanghai and Beijing, partially because they are exempt from the country’s license plate rationing in these areas. But restrictions on convention ICE cars are now starting to relax as the government continues to seek ways to end the country’s auto recession. Shenzhen and Guangzhou increased their license-plate quota in June and other cities may do the same.

Bernstein analyst Robin Zhu predicts that ride sharing and taxi companies accounted for about 70% of EV sales in the country and that they could represent a large portion of the remaining demand, as they have less sensitivity to subsidy cuts.

But Beijing hasn’t given up on EVs entirely. It still wants one in four new cars sold by 2025 to be electric, according to a draft of its 15 year plan released this week. This raises its previous target released two years ago. EVs currently only make up about 5% of the country’s market.

Subsidies are unlikely to come back, however, to meet this target. The government is now aiming for “quality instead of just quantity”, noting that subsidies would be more costly than they were a few years ago, when the market was smaller. Instead, Beijing will spend the money on building out its infrastructure, like its charging stations.

Maybe Tesla could take a hint from this idea…

Regardless, automakers will continue to push out EVs in China, even if they aren’t profitable. The same is expected to happen in the EU. Beijing, similar to Brussels, requires a certain percentage of cars to meet new energy requirements, which could cause a glut in the market.

One last shred of demand hope comes from channel stuffing actually comes from the automakers themselves, many of whom are setting up their own ride sharing networks. With this being the case, the “ride” for the EV market looks like it could be bumpy and grim going forward…

Tyler Durden

Thu, 12/05/2019 – 19:45

via ZeroHedge News https://ift.tt/2ORxqBE Tyler Durden