Futures Near Record High On Burst Of “Trade Deal Optimism”

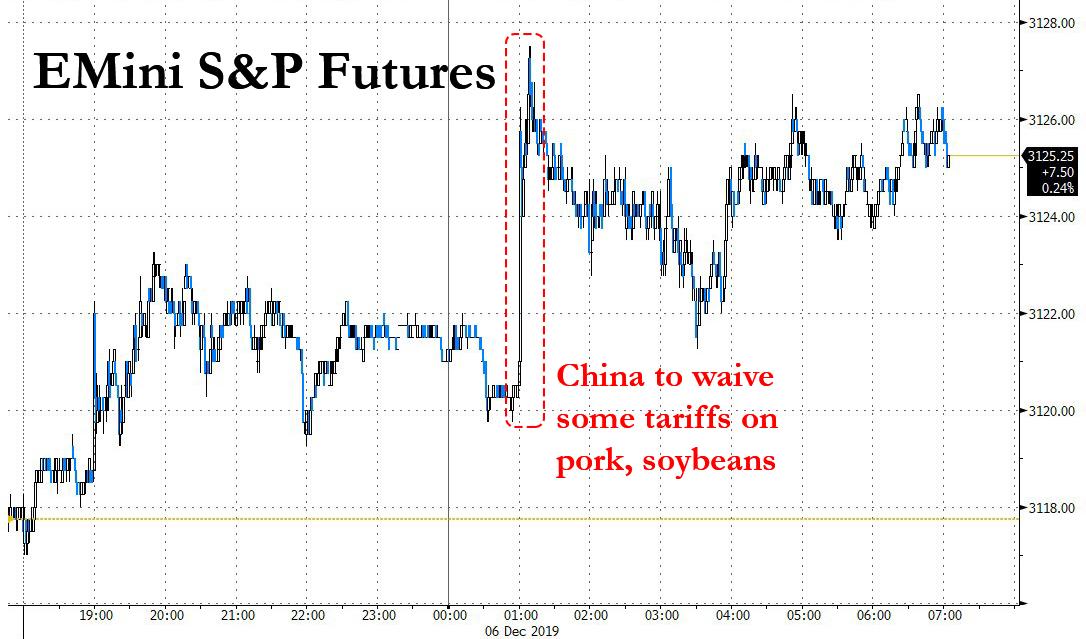

With the much anticipated November jobs report looming (see preview here), futures are back to trading just shy of all time highs, enjoying a burst of trade deal optimism when first President Trump said China trade deal talks were “moving right along”, and then, at 1am ET, China announced it would waive import tariffs imposed last year on some U.S. soybean and pork shipments… which of course is hardly a concession as Beijing is rushing to source more meat to fill a record hole in its pork inventory and production.

Trump’s upbeat comments on Thursday and China’s fake concession was enough to encourage algos to BTFATH, despite once again there being no agreement over whether existing tariffs should be dropped as part of an initial deal to ease the long standoff. European shares, including the broader Stoxx 600 gained 0.5% in early trade before grinding sideways, with indexes in Frankfurt and Paris up by similar amounts. The UK’s FTSE 100 outperformed, gaining 0.75% as GBP slips back below 1.3150. Retailers, travel names and miners outperform with only the health care sector in negative territory

Europe’s Friday euphoria promptly ignored the latest disastrous German industrial output, which unexpectedly plunged in October, pointing to persistent weakness in the backbone of the economy. Berlin said, however, that new orders and business expectations suggest output may stabilize.

The buoyant mood to end the week – at least until today’s NFP print is announced – mirrored the risk appetite in Asia, where MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.5%, with Asian stocks rising for a second day, led by technology companies, as China worked toward waiving retaliatory tariffs on imports of U.S. pork and soy. Most markets in the region were up, with Hong Kong and South Korea leading gains. The MSCI Asia Pacific Index is set for its first weekly advance in a month. The Topix edged higher, supported by machinery and construction firms. Japanese household spending dropped the most in three and a half years.

China stocks posted their biggest weekly advance in nearly two months, with the blue-chips up 0.6%. The Shanghai Composite Index climbed, with Kweichow Moutai and Jiangsu Hengrui Medicine among the biggest boosts. U.S. merchandise imports from China dropped to a fresh three-year low amid prolonged trade negotiations. India’s Sensex slid, heading for its first weekly drop since October, as banks weighed on the gauge. Consumer confidence in the country fell to the lowest in more than five years.

The MSCI world equity index added 0.2%, and was not far off a record high of 550.63 hit last January but still on track for a weekly fall.

While investors continue to hope and expect the two sides to reach a compromise to at least avoid a new batch of tariffs on about $156 billion of Chinese exports, due to take effect on Dec. 15, markets had originally expected the sides to seal the initial deal in November. Instead, investors are nervously watching the approaching deadline for the new U.S. levies.

“The difficulty with this is it’s very difficult to time and to trade,” said Unigestion strategist Jeremy Gatto. “We are relatively favourable towards riskier assets in general – but with hedges.” Gatto said those hedges include currencies such as the U.S. dollar, Japanese yen and Australian dollar, as well as options.

There is economic data too: today investors are looking at the November U.S. jobs data, and a nonfarm payrolls report which is expected to show 183,000 new jobs created in November, up from 128,000 a month earlier.

“Markets are in consolidation phase,” said Salman Ahmed, chief investment strategist at Lombard Odier. “It’s wait and watch for first, how does the non-farm payrolls look and, more importantly, the Dec. 15 tariff deadline.”

While markets have largely priced in the view that the world economy has dodged the bullet of recession, there are still signs of fragility in many major economies, and one could clearly see their signs in the price of the world’s most important commodity: oil lost ground overnight as investors awaited a meeting of OPEC and its allies later on Friday, which is expected to formally agree to more output curbs in early 2020.

Details of the agreement and how the cuts will be distributed among producers still need to be ratified at a meeting of OPEC and non-OPEC nations, otherwise known as OPEC+, in Vienna. Brent crude futures were flat at $63.46 a barrel after earlier gaining ground. The agreement coincided with the IPO of state oil firm Saudi Aramco, which was priced at the top of its range and raised $25.6 billion in the world’s biggest IPO, valuing the Saudi state company at $1.7 trillion.

In rates, Treasury yields are near the middle of ranges in place since mid October, the 10-year at ~1.79%. A survey by BMO found erosion of dip-buying mentality, with 38% inclined to buy if the data spark a sell-off vs a six-month average of 57%. The October jobs report and two others of the past six had fleeting impact on Treasuries; August and May reports spurred rallies, June data sparked a sell-off. Median survey estimates for the November data include nonfarm payrolls gain of 183k, 3.6% jobless rate and a 0.3% month-on-month increase in average hourly earnings. Euro-area bonds were mostly steady, underperforming Treasuries; a large upside buyer of five-year U.S. Treasury options targeted the yield to fall below 1.4%, following earlier block trades in two-, five- and seven-year Treasury futures that appeared to fade Tuesday’s dovish Fed repricing.

In FX, the British pound stepped back some 0.2%, its first drop in six days. Sterling spiked to a seven-month high of $1.3166 on Thursday on bets that next week’s election will give the Conservative party the majority it needs to deliver Brexit, ending near-term uncertainty. The pound last stood at $1.313. It hit 2-1/2-year highs versus the euro.

Bloomberg Dollar Spot Index erased most of its losses after slipping for a sixth day, its worst streak since September 2017.New Zealand’s currency is poised for its biggest weekly gain in a year after the central bank said the economy is near a turning point; the comments by Reserve Bank Deputy Governor Geoff Bascand further damped rate-cut expectations.

To the day ahead now, the headline release comes this afternoon though with the November employment report in the US, while later on we’ll also get the preliminary December University of Michigan consumer sentiment survey, October wholesale inventories and October consumer credit. In terms of politics Germany’s Social Democrats gather for a three-day convention while tonight will see UK PM Johnson and Labour’s Corbyn take their places in a televised head to head debate.

Market Snapshot

- S&P 500 futures up 0.2% to 3,124.75

- STOXX Europe 600 up 0.4% to 404.23

- MXAP up 0.4% to 164.97

- MXAPJ up 0.5% to 525.05

- Nikkei up 0.2% to 23,354.40

- Topix up 0.1% to 1,713.36

- Hang Seng Index up 1.1% to 26,498.37

- Shanghai Composite up 0.4% to 2,912.01

- Sensex down 0.7% to 40,497.53

- Australia S&P/ASX 200 up 0.4% to 6,707.02

- Kospi up 1% to 2,081.85

- German 10Y yield fell 0.4 bps to -0.298%

- Euro down 0.01% to $1.1103

- Brent Futures down 0.02% to $63.38/bbl

- Italian 10Y yield rose 7.9 bps to 1.022%

- Spanish 10Y yield fell 0.5 bps to 0.484%

- Brent Futures down 0.02% to $63.38/bbl

- Gold spot down 0.1% to $1,473.97

- U.S. Dollar Index unchanged at 97.41

Top Overnight News from Bloomberg

- China is in the process of waiving retaliatory tariffs on imports of U.S. pork and soy by domestic companies, a procedural step that may also signal a broader trade agreement with the U.S. is drawing closer

- German industrial production unexpectedly extended its decline, raising concerns that some of the early signs of a manufacturing revival may have already been smothered

- North Korea may be preparing to conduct engine tests at a long-range rocket launch site, stepping up pressure on President Donald Trump ahead of a year-end deadline it imposed to get a better deal from the U.S. in nuclear disarmament talks

- The survival of Chancellor Angela Merkel’s government hangs in the balance as her disgruntled coalition partner wrestles with its future. A three-day convention for the Social Democrats, starting Friday in Berlin, marks the party’s latest effort to get itself on track after reluctantly entering a coalition to support Merkel for her fourth term two years ago

- Political uncertainty is playing havoc with the U.K. labor market, with demand for workers rising at the slowest pace for a decade, according to a report by KMPG and the Recruitment and Employment Confederation

- Speaker Nancy Pelosi set the House in motion toward a historic vote to impeach President Donald Trump on a rapid timetable that could bring the process to conclusion before the Christmas holiday

- U.S. trade with China extended its decline in October as goods imports from the nation fell to a fresh three-year low amid prolonged talks between the two largest economies on a trade deal.

- Oil held near $58 a barrel as the OPEC+ coalition failed to pin down the details of an agreement to adjust its official output target even after six hours of talks in Vienna

- Japanese household spending slumped in October, suggesting the economy may have taken a bigger than expected hit from a sales tax increase and extreme weather. Finance Minister Taro Aso says need to see more data to gauge sales tax impact

- Treasury Secretary Steven Mnuchin said the Trump administration opposes the World Bank’s latest plan for low- interest loans to China, which has received more than $1 billion a year from the lender

Asian equity markets were higher across the board as the recent US-China trade optimism reverberated in the region, but with gains capped as the OPEC/OPEC+ meetings stole much of the limelight and as looming US NFP jobs data kept participants tentative. ASX 200 (+0.4%) and Nikkei 225 (+0.2%) traded positively in which gold miners outperformed the broad but mostly tepid gains for Australia’s sectors, while upside in Tokyo was also limited by recent currency strength and after Household Spending contracted by the most in over 5 years. Hang Seng (+1.0%) and Shanghai Comp. (+0.4%) were kept afloat after the PBoC conducted a CNY 300bln MLF operation which was larger than the prior operation of CNY 200bln and the CNY 187.5bln of maturing loans, while the trade rhetoric continued to suggest talks are going well and are on track with a phase 1 deal said to be close, although other reports were less optimistic and noted the sides were still at odds on agriculture purchases. Finally, 10yr JGBs were lower which was initially the aftermath of the prior day’s pullback amid gains in riskier assets, while prices remained subdued ahead of the December 2019 futures contract rolling over this weekend and with the BoJ’s presence in the market for JPY over 1.1tln of JGBs in 1yr-10yr maturities doing little to spur a rebound.

Top Asian News

- Bank Indonesia Signals Cautious Approach to Further Easing

- BlackRock, Vanguard Among Fund Giants Flocking to Chinese Market

- Tencent-Backed iDreamSky Said in Talks to Buy Gaming Firm Leyou

- Gold Imports by India Slide for a Fifth Month as Economy Slows

Major European bourses (Euro Stoxx 50 +0.4%) are in the green, as the region benefits from overnight US/China trade tailwinds, although the onset of pre-NFP caution is keeping trade subdued. As a reminder, US President Trump yesterday said that “something” could happen with regards to tariffs on December 15th, although it is not being discussed yet, but the US is holding discussions with China which are going well. The FTSE 100 (+0.7%) outperforms its peers as Sterling pulls back from recent highs. The DAX (+0.3%) is comparatively muted, after German industrial data this morning disappointed which suggests “that the German economy is continuing to flirt with stagnation and contraction in the final quarter of the year”, according to ING. The CAC 40 (+0.5%) continues to brush off ongoing strikes that have brought much of the country to a standstill. Sectors are all in the green, with the more risk sensitive sectors the outperformers; Tech (+0.8%) and Consumer Discretionary (+0.7%) are the current leaders, while Health Care (+0.1%), Utilities (+0.2%) and Telecoms (+0.1%). In terms of individual movers; Ipsen (-20.6%) shares tanked after the Co. partially delayed two studies into Palovarotene. Swiss Re (+2.6%) was buoyed on the news that the Co. is to sell its Reassure unit to Phoenix Group (+0.3%) in a cash and stock deal valued at GBP 3.2bln. In terms of earnings, Carl Zeiss (-6.5%) is under pressure despite solid gains in FY19 revenue and EBIT; traders were reportedly disappointed by margin targets and, following a run of recent strong earnings reports. Finally, in broker moves, upgrades for Lufthansa (+1.3%), Ryan Air (+1.3%) and Pernod Ricard (+0.7%) saw their respective shares supported, while downgrades for Sanofi (-0.6%), Siemens Healthineers (-1.9%) and Petrofac (-1.6%) saw their shares under pressure.

Top European News

- U.K. House Prices Rise Most in Seven Months, Halifax Says

- Why the Russia-Ukraine Gas Dispute Worries Europe: QuickTake

- Merkel’s Coalition at Stake as SPD Wrestles With Its Future

- Medacta Falls Most Since IPO to Record Low After Profit Warning

In FX, the broad Dollar and index trades on a firmer footing heading into the much-anticipated US Labour market data (albeit more on the back of a softer GBP – see below), with forecasts for 180k jobs to be added in November, slightly ahead of 3-,6- and 12-month trends rates (Full preview available on the NEWsquawk research suite). DXY remains in the green at time of writing, and just above the middle of the current 97.36-44 intraday band ahead of the main event. Alongside this, Canada will also be releasing its respective jobs report, with the region expected to have added 10k jobs in November. USD/CAD trades at the whim of energy prices thus far as the OPEC+ cartel convenes. The pair resides just under the 1.3200 mark with USD 750mln of options expiring between strikes at 1.3165-75. In terms of pertinent levels, the pair sees its 21 WMA at 1.3212, 100 WMA at 1.3118 and its 200 WMA at 1.3080.

- GBP, JPY, EUR – Sterling trades softer on the day with little fresh fundamental news-flow, although participants could be cashing in on the impressive gains seen throughout the week ahead of the last batch of weekend polling prior to the election. In terms of the latest, Britain Elects/New Stateman tracker of polls points to a strong lead for the Tories over Labour, but the spread has modestly narrowed. Meanwhile, Ipsos Mori’s poll also showed a slight narrowing in Tory’s lead over Labour. Participants remain on the lookout for the Panelbase poll which may be released today. GBP/USD retains a 1.31+ status at time of writing, but off its current daily and weekly high of 1.3166 (vs. intraday low of 1.3111), with touted support at 1.3080 should it break the 1.3100 psychological mark. That said, today’s options expiries include ~GBP 750mln at strike 1.3100 which could influence price action, contingent on the NFP numbers Stateside and any UK election polling released in the interim. Meanwhile, the JPY remains supported by the GBP/JPY cross which dipped below 142.50 in early trade, although the Sterling softness did provide the Dollar with some impetus and thus keeps USD/JPY at bay just above the 108.50 as the pair bides its time ahead of the US labour market report. Finally, EUR/USD saw downside amid the aforementioned Dollar strength in early EU trade, with the pair dipping below the 1.1100 mark to a low of around 1.1095 ahead of touted support at 1.1090. EUR/USD options today see EUR 1.1bln expiring between 1.1095-1.1100 and EUR 1.3bln around 1.1120-25 – again, options’ influence today is contingent on the US jobs numbers.

- NZD, AUD – Both modestly firmer in early EU trade in a continuation of support seen during the back end of yesterday’s session, and with potential buoyancy from reports that China could be implementing tariff waivers for some purchases of soybeans and pork; a possible olive branch to the US. The Kiwi outperforms its Aussie counterpart on the back of optimistic reiterations from RBNZ’s Deputy Governor, who touched upon persisting downside risk appearing to be more balance now. Bascand also took note of strong commodity prices supporting the New Zealand economy, while adding that fiscal stimulus could increase the country’s growth next year. NZD/USD took out yesterday high (0.6562) and resides just off session highs of 0.6573 (vs. low 0.6541) at the time of writing. Meanwhile, its Aussie counterpart inches towards the 0.6850 mark having found an intraday base at 0.6830 and with around AUD 1.0bln in options expiring at strike 0.6835.

In commodities, crude markets are jittery, with participants keeping their powder dry ahead of key risk events in the form of the US jobs report at 13:30 GMT and the outcome of today’s OPEC+ meeting, where a final decision on output cuts will be finalised. The complex has been relatively unresponsive to the latest headlines; consensus is for OPEC+ to agree to 500k bpd worth of additional cuts, which could be split 2/3 for OPEC and 1/3 for Non-OPEC, according to the latest sources. This is relatively in-line with the thinking yesterday that the split would 350k bpd to 150k bpd in cuts for OPEC and Non-OPEC countries respectively. However, ING flag the risk of potential market disappointment; “the key question is whether these reported cuts will actually reflect fresh cuts, and so help to reduce the surplus in 1Q20, or whether they will just formalise the over-compliance that we have seen from the group as a whole (thanks to Saudi Arabia)”. The latter would constitute disappointment, the analysts believe. Elsewhere, Russia, who had expressed reluctance to agree to deeper cuts, appear to have been brought on side by having their request to remove the condensate portion of its output removed from its production cut quotas, meaning roughly 800k bpd in Russian output will not be subject to any output cuts. Elsewhere, Angola reportedly stormed out of the talks in protest to the consensus for deeper cuts and now wants to quit the cartel. Furthermore, yesterday’s post meeting press conference was cancelled, with talks reportedly dragging on due to issues with Iraq, although the Iraqi Oil Minister has since said the country will comply with the agreed cuts. Today’s OPEC+ meeting has already begun, with a press conference pencilled in for 13:00 GMT, although, as is usually the case with OPEC+, timings are more a guideline. WTI and Brent front month contracts sees losses as US participants enter the market with the former dipping below USD 58/bbl and the latter eyeing USD 63/bbl. In terms of metals, copper and gold are subdued ahead of NFP, the latter consolidating around the USD 1475/oz mark, although with a slight downwards bias on account of the market’s more constructive risk tone.

US Event Calendar

- 8:30am: Underemployment Rate, prior 7.0%

- 8:30am: Change in Nonfarm Payrolls, est. 183,000, prior 128,000

- 8:30am: Change in Private Payrolls, est. 179,000, prior 131,000

- 8:30am: Change in Manufact. Payrolls, est. 40,000, prior -36,000

- 8:30am: Unemployment Rate, est. 3.6%, prior 3.6%

- 8:30am: Average Hourly Earnings MoM, est. 0.3%, prior 0.2%

- 8:30am: Average Hourly Earnings YoY, est. 3.0%, prior 3.0%

- 8:30am: Average Weekly Hours All Employees, est. 34.4, prior 34.4

- 10am: Wholesale Inventories MoM, est. 0.2%, prior 0.2%; Wholesale Trade Sales MoM, prior 0.0%

- 10am: U. of Mich. Sentiment, est. 97, prior 96.8; Current Conditions, est. 112.8, prior 111.6; Expectations, est. 87.5, prior 87.3

DB’s Jim Reid concludes the overnight wrap

If this is the last EMR ever then it’s been nice knowing you. I’ve bought a one-way ticket to LA and am now looking at digs in Hollywood. Yes today I’m taking a couple of hours off work to attend my 4-year old daughter Maisie’s nativity play. Last year in her old nursery she played a “jingle bell” and I didn’t go. However this year at her full time school she’s secured the plumb role of Mary and I’m going to make sure I speak to all the agents likely to be there. I’ve done some reading and statistically children who play Mary or Joseph are likely to be higher earners later in life. So that made me happy. However I should say that a) only 30% of her class are girls and b) she’s the oldest in the whole year. So I’ll curb my pride for now and enjoy the show. Her first line (which we’ve been practising at home) gives me the shivers a little though as it’s “Joseph, come quick. I have great news. We are going to have a baby.” I’ll be having a word with Joseph immediately after the show!

Anyway, from Hollywood to payrolls Friday. Today’s is unlikely to be a blockbuster though as the Fed have made it quite clear that they are on hold until further notice and although we have an FOMC next week its very very unlikely that today’s jobs report will change anything. In terms of a preview, the consensus for November nonfarm payrolls is pegged at 185k (vs. 128k in October) but after Wednesday’s disappointing ADP (67k vs. 135k expected) print it’s likely that the whisper number is lower. Our economists forecast 145k, with around 46,000 of that attributable to the resolution of the GM strike. They also expect average hourly earnings to have risen +0.3% mom, the unemployment rate to hold steady at 3.6%, and hours work hold steady at 34.4 hours – all of which is in line with the wider consensus. All eyes on the data at 1.30pm GMT then.

Ahead of this, the last 24 hours has actually been fairly quiet relative to the trade-inspired volatility of this week. Still, after a quiet day, trade had the final say as late session comments from President Trump (more below) helped the S&P 500, NASDAQ, DOW and Semi-Conductor indices gain +0.16%, +0.05%, +0.10%, and +0.37% last night. President Trump said that talks are “moving along well” but that “we’ll have to see” about the December 15 date. That seemed to re-open the door to a potential deferral of the planned tariffs, though Trump said that “we are not discussing that yet.” Elsewhere in Washington, focus was centered on the House of Representatives where Speaker Pelosi said that the House will draft articles of impeachment against Trump. They are likely to vote on the articles next week, which will then send the issue to the Senate (possibly in January), where the 100 Senators will act as jurors at a trial and rule on whether or not to remove Trump from office. A reminder that the Republicans control the Senate by a 53-47 split so it’s highly unlikely that this will have enough momentum to pass.

Back to markets and the more bullish trend from the latter part of the US session has continued into Asia this morning where the Nikkei (+0.28%), Hang Seng (+0.64%), Shanghai Comp (+0.08%) and Kospi (+0.75%) are all up. Elsewhere, futures on the S&P 500 are up +0.12%. As for overnight data releases, Japan’s October real cash earnings came in at +0.1% yoy (vs. -0.3% yoy expected) but balanced by the previous months revision to +0.2% yoy from +0.6% yoy. We also saw Japan’s October household spending data at -5.1% yoy (vs. -3.2% yoy expected) impacted by the October sales tax hike and the typhoon.

We’ve also seen news reports from the SCMP overnight suggesting that China’s 2020 GDP growth target is likely to be set at ‘around 6%’ at the Central Economic Work Conference expected to take place later this month. The report added that the policy meeting is set to allow modest expansion of fiscal and monetary policies to support the economy without resorting to massive stimulus.

Meanwhile, the US Treasury Secretary Steven Mnuchin said overnight that the Trump administration opposes the World Bank’s latest plan for low-interest loans to China, which has received more than $1 bn a year from the lender. Mr. Mnuchin was speaking to lawmakers and said that China should be removed from the World Bank’s loan program. He said “China is now the world’s second largest economy and its per capita income is well above the level at which countries are supposed to ‘graduate’ from needing World Bank assistance,” and added, “The United States is the World Bank’s largest contributor and the spending bill that funds the World Bank includes a provision for a big capital increase for the bank. That’s an opportunity for Congress to weigh in and we should take it.”

In other news, the French unions extended their strike until Monday to protest against the pension reform. Bloomberg also reported that French PM, Edouard Philippe, is expected to unveil the details of the pension reform as soon as next week.

Back to yesterday and bonds were weaker with 10y Treasuries closing up +2.8bps last night and back above 1.80%. In fairness that is the smallest absolute move this week after a zig-zag few days. This morning they are -1.5bps in Asia. Core yields in Europe were also up a similar amount to the US yesterday (Bunds +2.1bps) but Italy (+8.2bps) led the periphery wider due to concerns of a rift between the coalition partners. From memory Italy has seen 91 governments in just under 120 years so news of a rift within a young government would not go down as the most surprising news in global politics at the moment.

Elsewhere, in commodity markets gold edged up another +0.10% and Brent crude oil +0.68% following headlines that OPEC+ is considering a quota cut of 500k barrels a day. In other news, yesterday’s data included a 10k decline in jobless claims to 203k and the lowest reading since early April. That also lowered the four-week moving average to 218k, however it didn’t go unnoticed that continuing claims jumped unexpectedly to 1693k (vs. 1660k expected). Overall though the job news was seen as positive and helped yields rise yesterday. Elsewhere, the October trade balance revealed a narrowing in the deficit to $47.2bn (vs. $48.5bn expected) while factory orders for October were in line with expectations at +0.3% mom.

Here in Europe, the final Q3 GDP reading for the Euro Area was unrevised at +0.2% qoq, putting the year-over-year rate at +1.2%. October retail sales were weaker than expected for the Euro Area (-0.6% mom vs. -0.5% expected) while Q3 employment came in weak at just +0.1% qoq. So more soft data in Europe. Finally, October factory orders in Germany were also weak (-0.4% mom vs. +0.4% expected).

Staying with Germany, it’s worth noting that the Social Democrats are due to gather for a three-day convention starting today. Ahead of it, Walter-Borjans, who was elected co-chief of the party last weekend, said that the SPD is seeking a “massive spending increase”. However it seems that a desire to push for fresh investment has been downplayed ahead of the conference as the party seems to be reigning in their new leadership already. Nevertheless its worth keeping an eye on the headlines over the next few days.

Looking further afield and to the big event here in the UK next week, yesterday DB’s Oliver Harvey provided a policy primer for the UK general election. Oli notes that the fragmented UK political landscape mean that a number of scenarios are plausible when the next government is formed. The most likely is a Conservative government and the medium-term outlook will be determined by policy on Brexit. Should there be no extension to the transition period beyond 2020 and a limited FTA with the EU, Oli sees the medium-term outlook for growth and UK asset prices as negative, but this could change if Brexit policy becomes more pragmatic. In the event that a Labour government is elected, the initial reaction is likely to be one of concern. But if Labour are constrained in implementing a business unfriendly policy mix by other parties, deliver a second Brexit referendum and highly expansionary fiscal policies, the medium-term trajectory for growth and sterling could be more positive.

To the day ahead now, which datawise this morning includes October industrial production in Germany and October trade data in France. The headline release comes this afternoon though with the November employment report in the US, while later on we’ll also get the preliminary December University of Michigan consumer sentiment survey, October wholesale inventories and October consumer credit. In terms of politics Germany’s Social Democrats gather for a three-day convention while tonight will see UK PM Johnson and Labour’s Corbyn take their places in a televised head to head debate.

Tyler Durden

Fri, 12/06/2019 – 07:54

via ZeroHedge News https://ift.tt/2OVhC0N Tyler Durden