JPMorgan Issues 2020 Alert: Recession Odds Jump After The Election, As The Fed’s Credibility Is Questioned

When it comes to Wall Street’s recent flurry of 2020 forecasts, most banks – perhaps with the notable exception of SocGen – agree that the first half of next year will be more of the same smooth sailing for US equities observed for much of 2019 (if not the violent rotations we witnessed below the surface that crippled quant returns this year).

Where where the consensus goes downhill and things gets stormy, is the outlook for the second half of 2020, whose dominant feature will be the November presidential election. And few are as concerned about what the second half of next year may bring than JPMorgan. The bank, which has been steadfastly bullish stocks – and in retrospect correctly so, if for all the wrong reasons (for example, JPM’s bull thesis was predicated on economic growth, not its inverse, and certainly not the barrage of global rate cuts and the Fed’s launch of QE4), retains its cheerful forecast for the first half of 2019, but when it comes to the second half of 2020, not even JPM’s chief equity strategist, Mislav Matejka warns that the “negatives could begin to materialize” and the market might start to discount these some time in the second half of 2020.

Among the factor listed by Matejka are that US politics could become a lose-lose proposition, and trade uncertainty, as well as hard Brexit risk, could come back. Worse, in a striking admission, none other than the largest US bank admits that next year, the “Fed’s credibility might start to be questioned,” as earnings overshoot their trend, while rising credit concerns could come to the fore.

Finally, while JPMorgan repeats that it has “consistently” argued that one should not expect the next US recession ahead of the presidential elections, it then spoils the ending, and in previewing what happens after next November, says that “the odds of a recession might go up significantly.”

** *

We will spare readers the cheerful side of JPM’s year ahead forecast as it is a repeat of many themes covered here previously by the “bullish” JPM and instead focus on the gloomier aspects of the bank’s year ahead predictions, as those are decidedly new and represent a reversal to JPM’s years of relentless optimism.

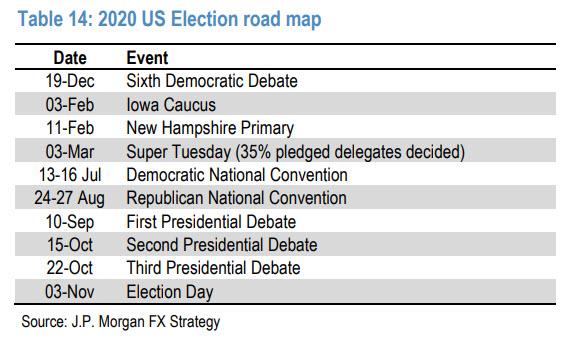

The first notable item is the US election road map

According to JPM, both the US election and US politics in general, could become a dominant issue relatively soon, as the Democratic nomination process will be heating up towards the end of Q1.

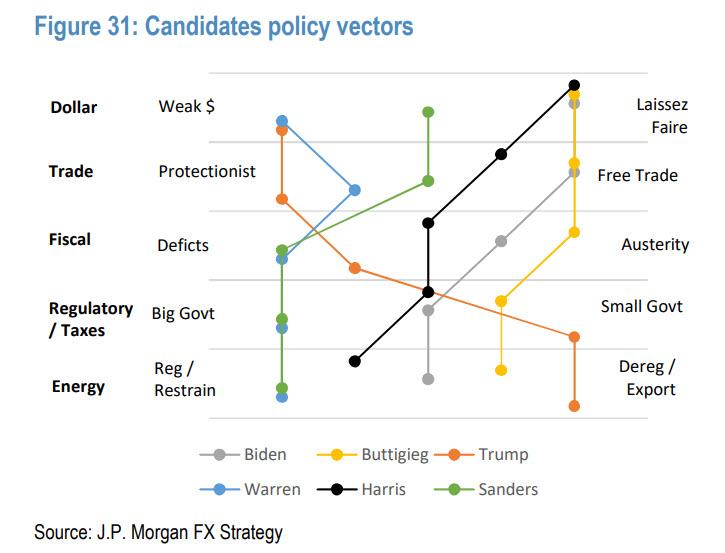

As JPM notes, “we might end up with two candidates who are potentially on the extreme ends of the political spectrum. The exhibit above compares the policies of a select number of Democratic candidates and president Trump, based on our interpretation of published policies and public comments. The divergence of policy proposals between the different Democratic candidates is probably as extreme as the comparison between Trump’s policies and that of any of his Democratic adversaries.”

Of the prominent Democratic candidates, Biden’s nomination is likely to be seen as more market favourable than a Warren nomination, but at the same time the probability of Trump winning vs Biden could be seen as smaller than the probability that he beats Warren.

The key point here, is that the US politics could end up looking like a “lose-lose” proposition for the markets in the runup to and post the US elections according to Matejka. To summarize the possible outcomes, we might either have 2nd Trump’s term, but with the return to confrontational China stance, as he will not be constrained by the markets anymore, or we might have a shift to less equity friendly tax and regulatory regime, in the event of a Democrat victory.

The risk of trade uncertainty escalating again, post the current truce

JPM’s base case over the past months was that Trump will be compelled to move towards a truce with China, given what were the rising risks to the economy, and in particular to the US consumer. The risk is that the current improving sentiment with respect to trade doesn’t hold for too long, and that potentially re-elected Trump resumes his aggressive stance.

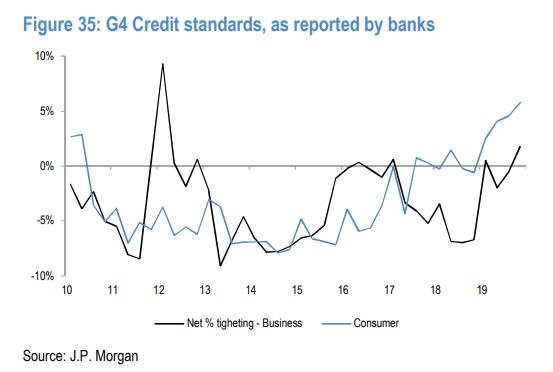

An inflecting credit cycle

Some of the credit indicators will soon be turning into a headwind for equities, as we move through 2020.

Notably, G4 credit standards appear to be tightening for both the businesses and for the consumer of late. One typically sees tightening standards ahead of the downturns.

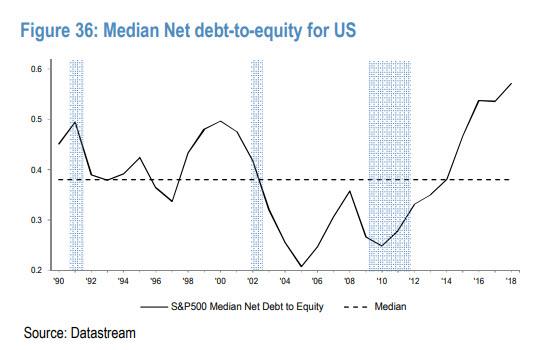

Corporate leverage is surging

US corporates have been levering up over the past years, with median US company net debt-to-equity ratio at the record highs.

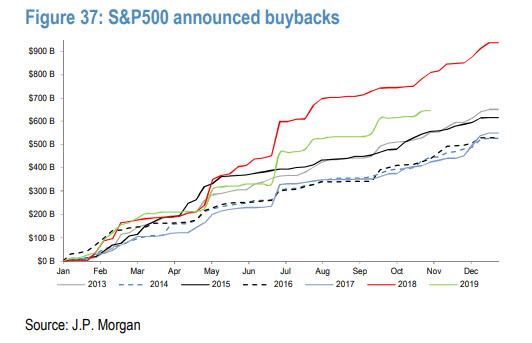

Why is this a risk? Because “if the credit markets weaken, this could reduce the pace of corporate buybacks.” Because where would we be without buybacks…

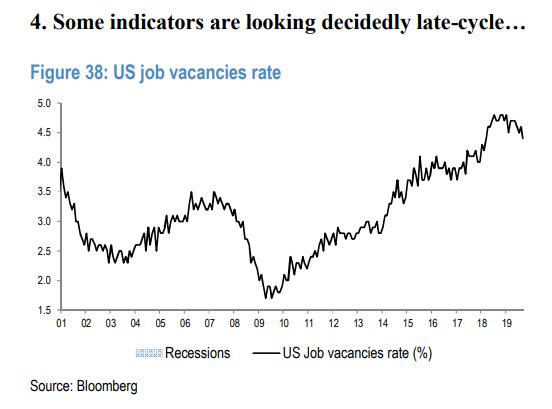

Economic indicators are looking decidedly late-cycle

The US cycle is now officially the longest one since the WW2, and some of the cycle indicators appear to be rolling over. One such indicator is that job opening rate appears to have peaked. This is what usually happens ahead of the downturns.

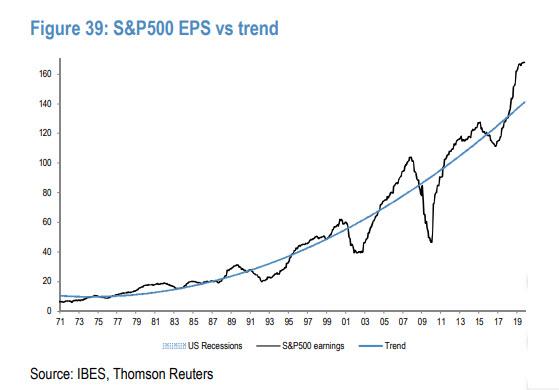

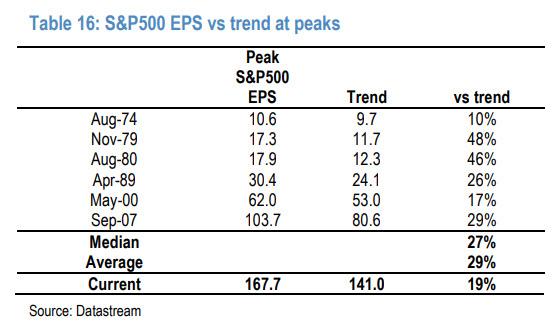

Earnings have significantly overshot the trendline

Another key JPMorgan concern is that US profits are now starting to appear stretched vs their long term trendline.

Here Matejka notes that one of the arguments that kept him bullish all this time was the finding that US profits don’t tend to peak for the cycle before they significantly overshoot their long term trend. The size of these overshoots was on average of the order of 20-30%. The current overshoot is at 19%

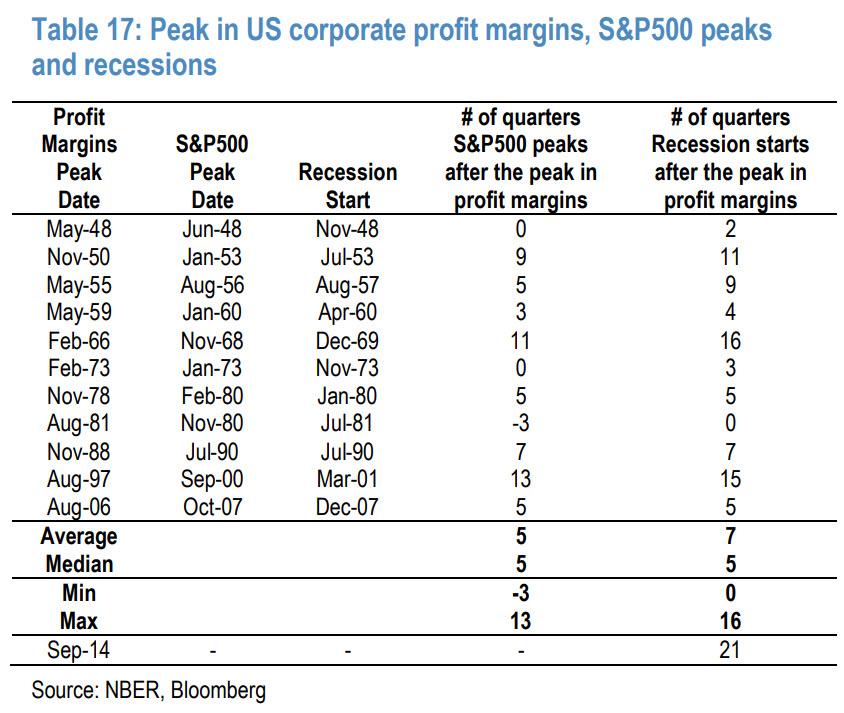

Profit margins have peaked, which typically bodes negatively for the longevity of the expansion cycle

As we noted recently when discussing real, operating profits, one doesn’t usually have a recession before US profit margins, as measured by NIPA, peaked. The lead-lag between margins peak and the next recession was sometimes very significant.

However, as of this moment, JPM finds that “we are now in unchartered territory”, with US profit margins appearing to have peaked in Q3 ’14, leading to the longest lead-lag on record, and counting…

… while a key profit margin proxy – a difference between the output prices and the input costs – appears to be deteriorating further.

* * *

Putting it together, JPM concedes that while “the time is likely approaching when one should be contrarian again”, this time around through turning bearish vs presently growing consensus bullishness, the bank still thinks that “one should not cut risk-on trades too early, as the bear capitulation, which is currently under way, could have legs.” The only question is when does someone, or something, pull the rug from under the market’s melt-up, triggering what even JPMorgan now see as a coming, and long overdue, day of reckoning for the markets

Tyler Durden

Thu, 12/05/2019 – 20:26

via ZeroHedge News https://ift.tt/2YnkAOH Tyler Durden