Meanwhile In Canada: “Terrible” Jobs Report, Worst Since The Financial Crisis

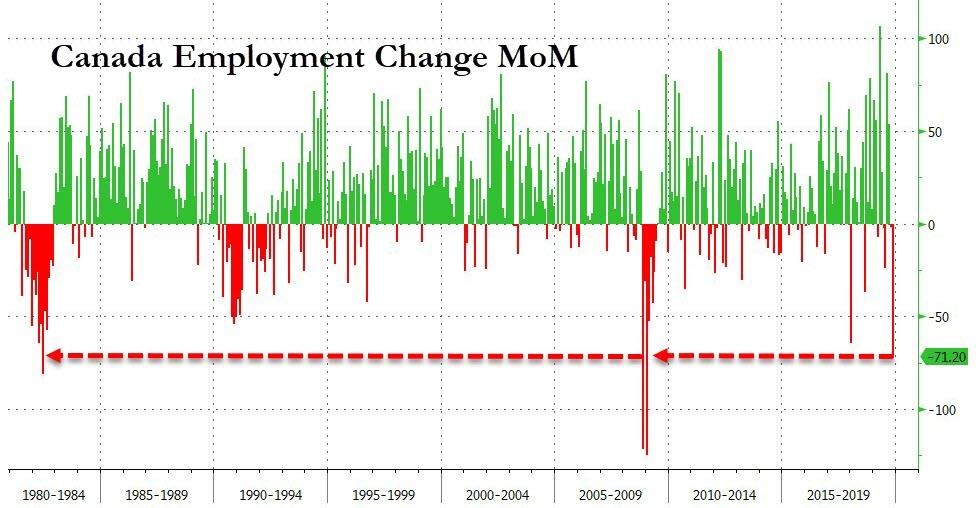

As the US was basking in the warm glow of the best jobs report since January, it was a different story over in Canada, where BMO’s chief economist Robert Kavcic had one recommendation to clients: “avert your eyes.” Here’s why: Canadian employment unexpectedly tumbled by 71,200 in November, the biggest decline since the financial crisis.

For those hoping that the details might serve up better news, they too were disappointed: Full-time employment was down 38.4k, and the private sector shed 50.2k. The jobless rate also rose sharply, up four ticks, and also the biggest monthly jump since the recession, to 5.9%.

Hours worked fell 0.3%, and remain an area of persistent disappointment—they’re now up just 0.25% y/y, much more muted than the 1.6% annual job gain. Oddly enough, the one area of strength was wages, with growth accelerating to match a cycle high at 4.5% y/y, according to Kavcic.

Putting it together, BMO’s “grading system” gave this report a 12.1 rating out of 100, which is pretty much as bad as it can possibly get (it is in fact the worst rating in about six years of tracking).

The BMO economist wasn’t alone in slamming the report: it’s a “terrible jobs report,” said Wells Fargo strategist Brendan Mckenna. “There’s really not much you can point to that is positive about those numbers. We’ll probably hover around these levels til year-end.”

With that said, the LFS has been known to have some violent swings, and we could be getting a lot of payback for previous outsized strength in one fell swoop. Looking at 1.6% y/y job growth, and an average monthly gain of 26k through November, those numbers look pretty consistent with underlying economic performance.

The “terrible” number may force the BOC to reassess its monetary policy. Earlier this week, the Bank of Canada presented a strong defense of its decision to stand pat on its policy rate for a ninth straight meeting. Deputy Governor Timothy Lane said policy makers believe Canada’s economy is near capacity. Recent developments, both domestic and global, have bolstered the central bank’s confidence that growth is poised to accelerate over the next couple of years, despite “enduring” uncertainty, he said.

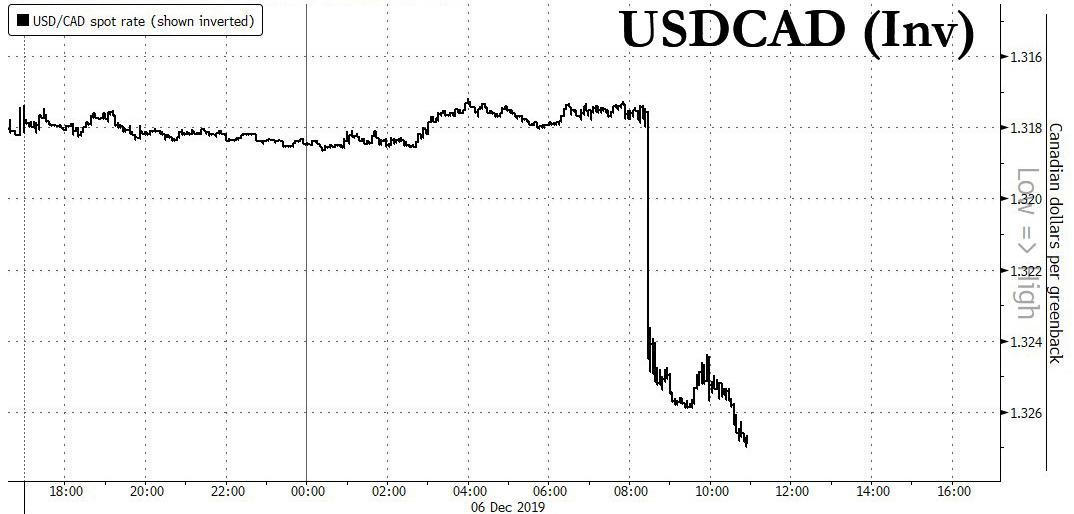

In response to the jobs report, and anticipating a resumption in central bank easing, the loonie plunged as much as 0.7% to 1.3259 per dollar, its biggest decline since October…

.. putting it in a neck-and-neck race with the British pound for the No. 1 spot among major currencies in 2020 and threatening its status as one of this year’s top performing major currencies. Both the loonie and the pound have strengthened close to 3% this year against the greenback.

Tyler Durden

Fri, 12/06/2019 – 10:57

via ZeroHedge News https://ift.tt/2s3QYcU Tyler Durden