Oil Jumps After OPEC Agrees To 500,000 bpd Production Cut

One day after the latest OPEC summit in Vienna ended in chaos and disarray, with the cartel unable to decide whether it will cut output further or instead punish violators of the current quote, leaving oil journalists asking questions and begging for pizza, on Friday Saudi Arabia and Russia surprised markets when they spearheaded a deal in which OPEC and non-OPEC nations committed to some of the deepest oil output cuts this decade aiming to avert oversupply and support prices amid declining global demand.

The group of more than 20 producers agreed to an extra 500,000 barrels per day in cuts for the first quarter of 2020, taking the total to 1.7 million bpd, or 1.7% of global demand, in hopes of boosting sagging oil prices in an environment where Saudi Arabia has been increasingly vocal in accusing cartel members and other producers of not sticking to pre-agreed quota levels.

Under the new deal, OPEC will agree to 372,000 bpd in fresh cuts and non-OPEC producers – mostly Russia – an extra 131,000 bpd.

Brent jumped more than 2%, rising above $64 a barrel after Saudi Energy Minister Prince Abdulaziz bin Salman said effective cuts could be as much as 2.1 million bpd as Saudi would carry on cutting more than its quota.

The impetus behind the cut was all Saudi Arabia, which has been eager to provide a floor for oil in the aftermath of the Aramco IPO which priced yesterday at the top of its range, yet some $300BN below the $2 trillion target previously revealed by Crown Prince MbS.

“The Saudi goal was not necessarily to push oil prices significantly higher, but rather – fresh on the heels of the Aramco IPO – to put a firm floor under them during the first quarter to temper any seasonal weakness,” said Amrita Sen, co-founder of Energy Aspects, quoted by Reuters.

“Best outcome you could have expected. Puts floor under prices at $60 Brent but (we’re) still likely in $60-65 Brent market until the global economy improves and then we could see $65 to $70 Brent in Q2,” said Gary Ross, founder of Black Gold Investors

As Reuters notes, OPEC+ will deepen cuts for the first three months of 2020, shorter than the six- or 12-month scenarios some OPEC members wanted. That said, the net impact of today’s auction may be a wash as the new cuts merely offset expected increases from non-OPEC nations, including top producer the United States, where shale producers are pumping oil at a furious, record pace – yet unprofitably – in order to stave of defaults.

Eleven of OPEC’s 14 member states are participating while embargo-targets Iran, Libya and Venezuela are exempt. OPEC adds Russia and nine others – Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, South Sudan and Sudan.

Compliance has been a sticking point since the coordinated cuts began in 2017 with Saudi Arabia cutting more than required in order to offset overproduction from Iraq and Nigeria.

Saudi Prince Abdulaziz said he would continue cutting 400,000 bpd below target and its new ceiling would be 9.744 million bpd. It makes sense that Riyadh would should the bulk of the cuts: Saudi Arabia needs prices of at least $80 per barrel – some $15 higher – to balance its budget, much higher than most other producers, and also needs to support the share flotation of its national oil company Saudi Aramco, whose shares are expected to begin trading next Wednesday.

Prince Abdulaziz told reporters he expected the company to be worth more than $2 trillion in a few months, taking a page out of the Trump playbook in that all officials care about is the affirmation of the market.

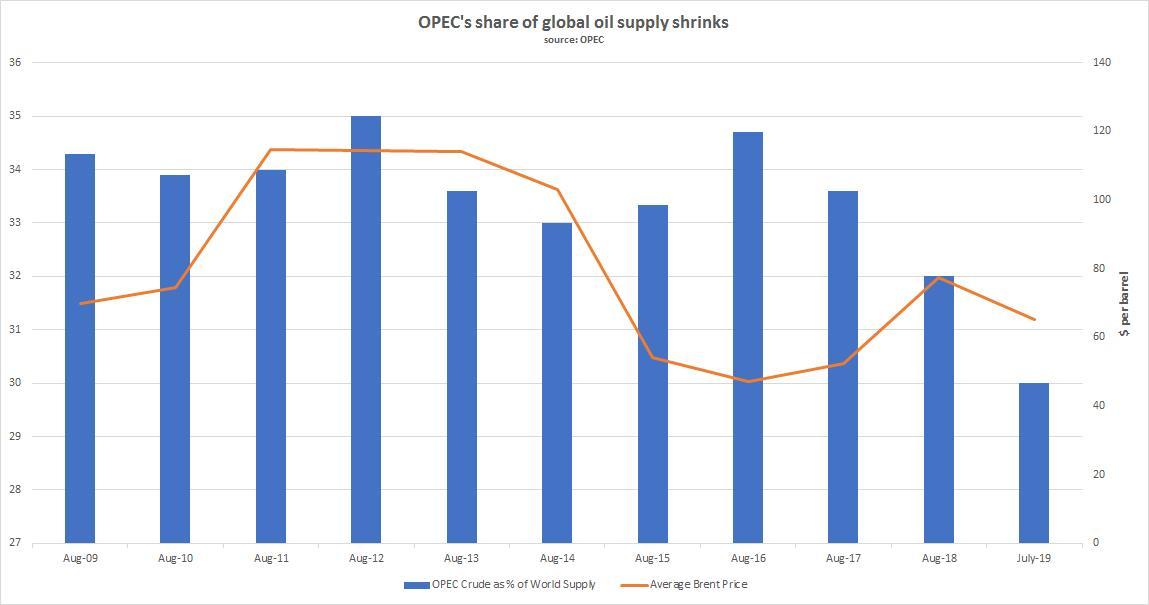

Despite oil’s kneejerk jump, the question remains: with OPEC’s share of global oil supply now the lowest on record…

… thanks to US shale and Russian production, will today’s deal amount to much if global demands continues to shrink?

Tyler Durden

Fri, 12/06/2019 – 12:22

via ZeroHedge News https://ift.tt/2rbKZ65 Tyler Durden