New Data Reveals Which College Grads Earn Most And Which Carry The Most Debt

Prospective college students now have official government data they can use to gauge which colleges and which major programs will make the most fiscal sense. The Trump administration released the data last week, which offers the nation’s most granular look into the finances of recent college graduates yet.

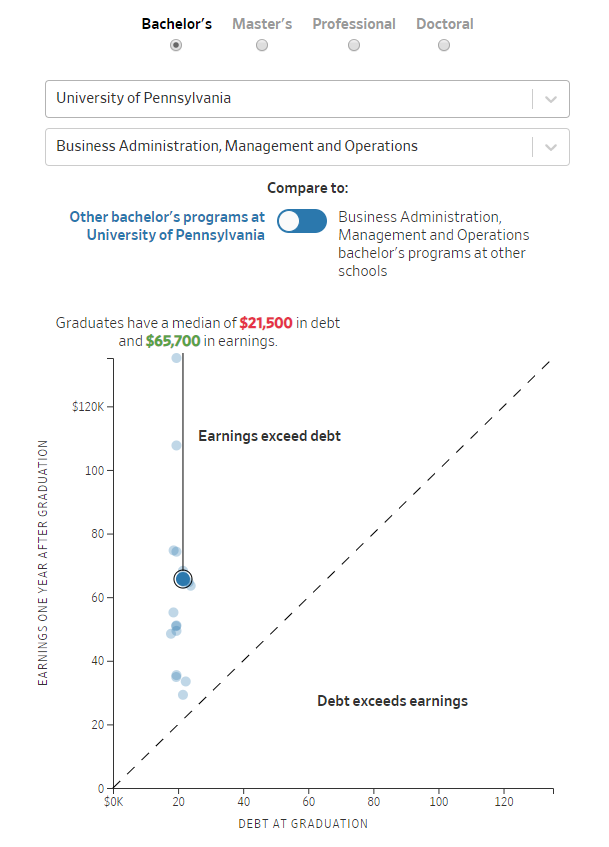

By looking at the median income versus the median debt of graduates from different schools and different levels of degrees, the data finally offers a tangible risk/reward for students considering a range of colleges and degrees. And some of the examples of the data are stunning, according to the Wall Street Journal.

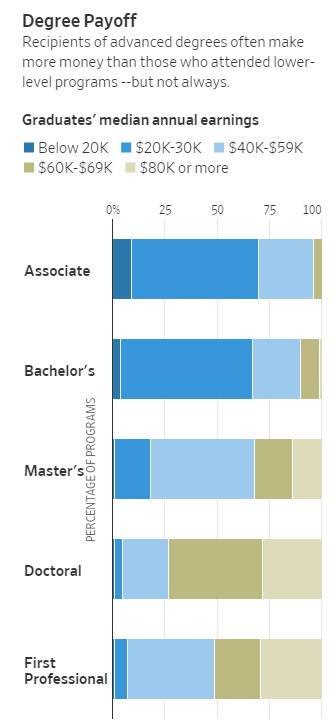

For example, Bismarck State College can now say its business majors earned a median of $100,500 one year after graduating – higher than many elite business schools. And highlighting the amount of debt that students left college with also becomes and important part of the equation. Dentists leaving NYU’s graduate program, for example, left school with a median of $387,660 in debt while earning just $69,600.

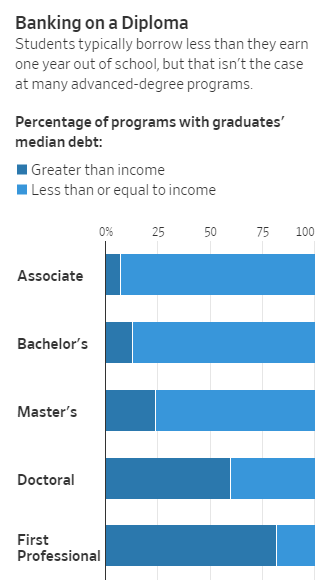

The data shows that graduates typically earned more in their first year than what they borrowed in total, but 15% of programs resulted in graduates carrying a debt load greater than their income. In 2% of instances, graduates owed more than twice their annual salaries.

The data was uploaded to a consumer website that was initially created by the Obama administration called the “College Scorecard”. It offers data on more than 36,000 programs at about 4,400 colleges. The data allows consumers to compare programs and “defies years of efforts by the higher-education lobby to keep much of this information hidden.”

For profit colleges may not like some of the comparisons. Computer engineering students leaving DeVry University-Illinois, for example, owed $53,391 at graduation while earning just $37,800. Meanwhile, students at Wichita State in Kansas leave the same program with just $31,000 in debt while earning $61,800.

The effort is part of a Trump administration ethos that making the college landscape a more competitive free market will help bring tuition and student debt down. The administration has been working with companies like Google to find ways to make the data more accessible to families. And to protect privacy, the government isn’t introducing data on programs with limited numbers of students.

Education Secretary Betsy DeVos said in a statement: “The best way to attack the ever-rising cost of college is to drive real transparency.”

The debt and earnings data only represents students who got federal financial aid, which can be a small number at some universities. The figures also exclude debt take on by parents on behalf of their children, which has been a growing way for parents to help shoulder the load of student debt for their kids.

The data reflects common sense at some points. Science and engineering majors at top schools earned the most. MIT math majors earned a median of $120,300 after graduating while borrowing just $8,219. Those who earned master’s degrees at USC for drama and theater arts shouldered $100,796 in debt while earning just $30,800 their first year out.

And the data is surprising elsewhere. Ivy League schools don’t always see the top salaries. Columbia University rhetoric and writing graduates earned just $19,700 their first year out of school, while taking on $28,556 in debt.

Some students have simply struggled to find work in their field after graduating. 22 year old Johnna Ueltschi borrowed about $32,000 to study psychology and criminal justice at UCF in Orlando. She says she has struggled to find a job and now works as a hostess making $10/hour.

“I was a good student, I graduated on time, I did everything that I was conventionally supposed to do. Finding a job is a lot harder than they lead it on to be when you’re in school.”

You can explore all of the data using the Wall Street Journal’s online search tool here.

Tyler Durden

Fri, 12/06/2019 – 19:25

via ZeroHedge News https://ift.tt/33YQWAt Tyler Durden