Investment Grade Credit Faces Party Hangover In 2020

Authored by Bloomberg macro commentator, Sebastian Boyd

Rising corporate leverage will shut down the investment-grade credit party in 2020 after posting a whopping 14% return in 2019. Making money in this space was easy after the 4Q 2018 sell-off and the Fed’s dovish shift at the start of January. Next year will be a very different story.

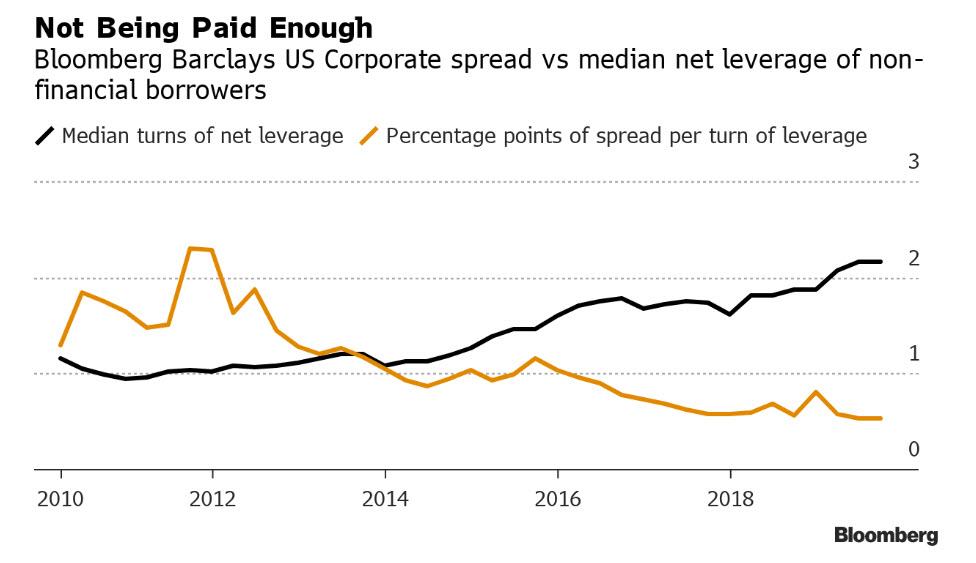

At the end of 3Q, the spread on the Bloomberg Barclays U.S. Corporate index was 115 bps, or 53 bps per median turn of leverage for the non-financial borrowers in it. That’s the lowest in 10 years. Muted expectations for corporate earnings suggest companies may struggle to deleverage.

Spreads haven’t returned to the lows they reached in 2018, but investment-grade yields tumbled. The last time they fell as steeply as they did this year was in 2009 and 2010, just after the Lehman Brothers bankruptcy.

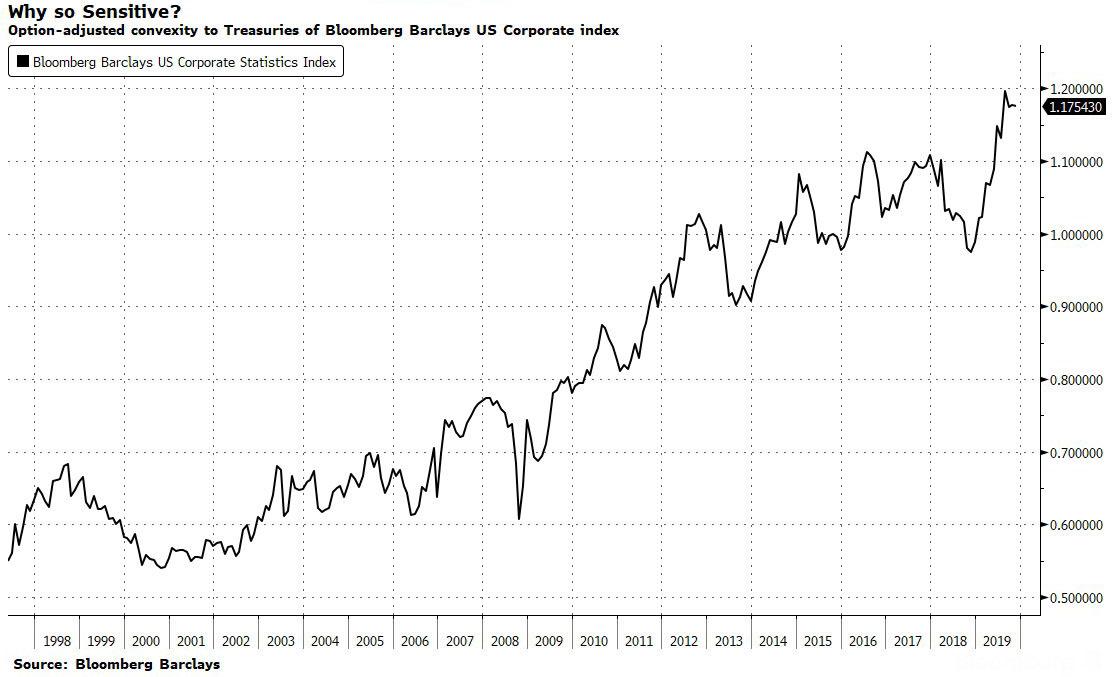

Modified duration in the Bloomberg Barclays index is the highest since the late 1970s, and convexity is the highest in at least two decades. That’s a result of falling coupons and lower yields, and taken together it means high-grade debt is very sensitive to shifts in Treasury yields.

The amount of U.S. corporate bonds maturing in the next 12 months is greater than at any point since 2017, according to the Bloomberg Barclays Short Term U.S. Corporate index — 97% of which is due in a year or less. Supply based on refinancing isn’t necessarily bad news for bondholders, except that it will likely come with lower yields.

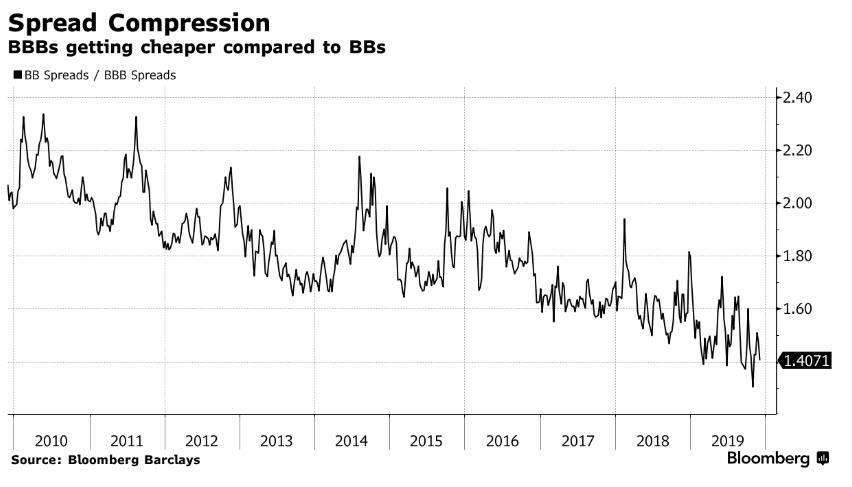

While there has been spread decompression in high yield, we haven’t seen the same in investment grade. The gap between BBB and AA spreads is in line with the three-year average. But that’s not necessarily a good thing, since the last three years have been a time of exuberance and spread compression.

On the other hand, the flow story remains solid. In these days of low yields and rising risk, investment- grade credit appeals. Taiwanese life insurers are big buyers of Yankee bonds and are likely to remain a source of demand unless the Taiwan dollar significantly appreciates versus the greenback.

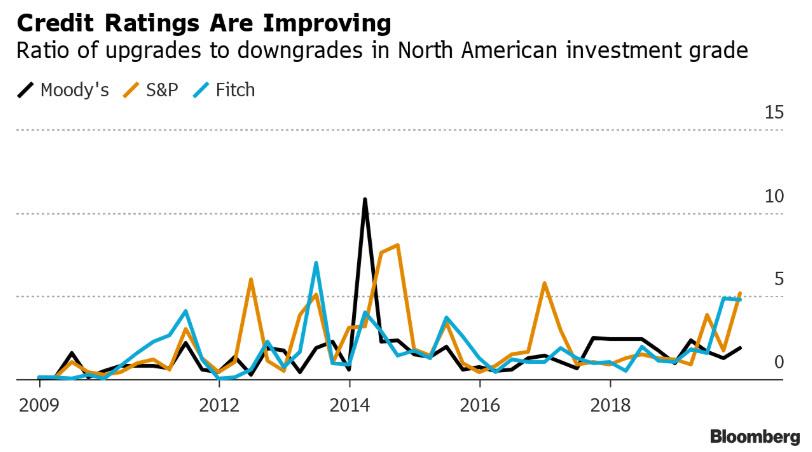

Despite rising leverage among investment-grade companies, cash flow has improved and credit-raters are being generous. The ratio of upgrades to downgrades has risen in recent quarters, which is hard to correlate with either growth or leverage.

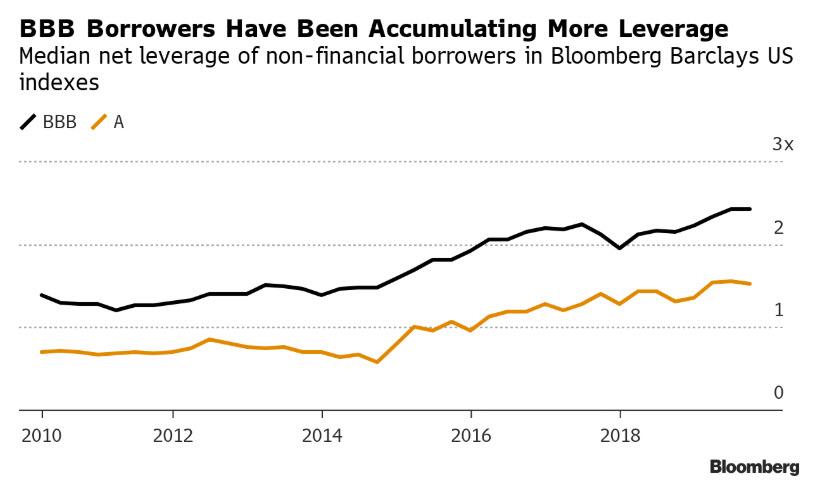

The famous BBB time bomb hasn’t blown up yet. There are reasons to think it might not explode at all, helped by the benign attitude of ratings firms. The chart below shows how the leverage of companies currently rated BBB has been rising. A number of those were downgraded to BBB specifically because of rising leverage, so the picture may not be as bad as it looks. But what it does suggest is that those companies haven’t been deleveraging.

The BBB index paid 62 bps per median turn of leverage at the end of 3Q. That’s low historically but pretty much in line with where it has been since 2Q 2017. You’re not getting paid enough to own that risk, but you haven’t been for a while. On the other hand, the widening of BBBs versus BBs means the higher-grade bonds appear relatively cheap.

Taken together, it’s clear that the story of high-grade debt next year will be told through deleveraging. Yields tumbled in 2019, which helped spur a great year for investors, and borrowing likely will remain relatively cheap in 2020. Some will be able to profit from that. But leverage levels are elevated — and it doesn’t look like companies will have the cash to substantially reduce their debt loads. Without a substantial deleveraging push, it’s hard to see what would enable the market to sustain it’s high.

Tyler Durden

Tue, 12/10/2019 – 12:25

via ZeroHedge News https://ift.tt/2s9R5nr Tyler Durden