AsiaPac Manufacturing PMIs Slump, But China Retail Sales Surge Amid Inflation Spike

The day started off poorly in AsiaPac with Aussie PMIs notably disappointing (both Services and Manufacturing in contraction).

The latest Commonwealth Bank Flash Composite PMI® pointed to a further marginal decrease in business activity across the manufacturing and service sectors in the final month of 2019. Weakness was particularly evident at manufacturers, which saw the sharpest decline in the 44-month survey history.

Commenting on the Commonwealth Bank Flash PMI data, CBA Chief Economist, Michael Blythe said:

“The PMI readings indicate that the Australian economy ended 2019 on a softish note. The RBA’s “gentle turning point” for the economy remains elusive. And the weakness in private spending evident in the Q3 GDP data looks to have continued in Q4, with a flow on to labour demand as well. There were also some early indications that the disruptions associated with the terrible bushfires around Sydney and elsewhere are having some impact.”

This was followed by New Zealand Institute of Economic Research lowering GDP growth expectations to 2.2% (from 2.3% in previous survey published in September), lowering wage inflation expectations as well as employment and raising overall inflation forecasts.

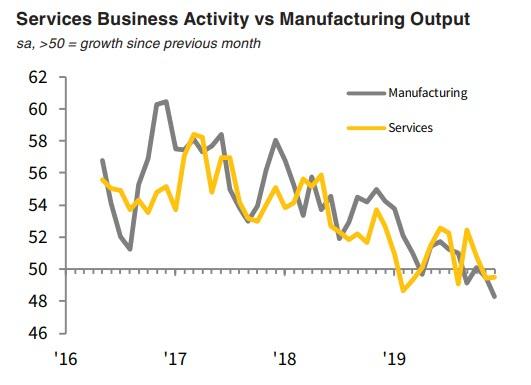

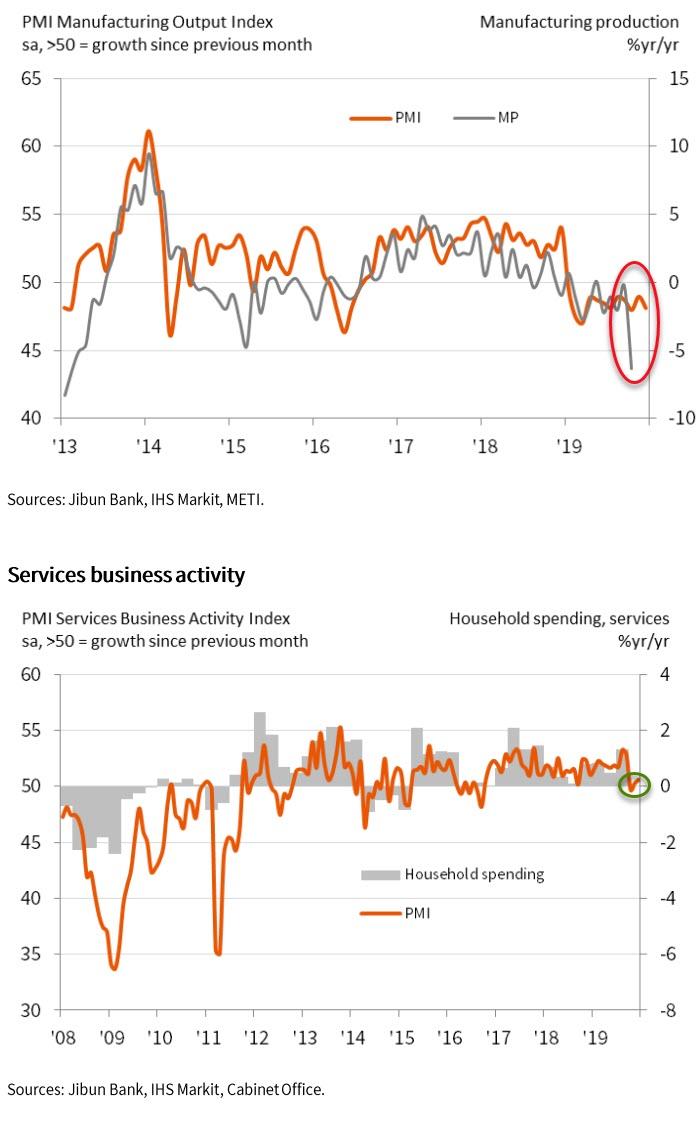

Then Japan’s PMIs hit with manufacturing contracting further and Services rebounding modestly (as the composite Japan PMI was flat from November (and still in contraction).

Commenting on the latest survey results, Joe Hayes, Economist at IHS Markit, said:

“Latest survey data showed that the Japanese economy remained stagnant in December, following on from a similar outturn in November. Taking fourth quarter survey data as a whole, the poor performance in October could see Japan’s economy dip into contraction.

“The most disconcerting takeaway from fourth quarter survey data has been the marked loss of momentum in the service sector, which alongside domestic consumption, has been a key driving force of the economy in 2019, negating much of the manufacturing malaise. It is now clear that the service sector is unable to offset the industrial weakness, which does not bode well for growth prospects in 2020.

“That said, the recent stimulus package launched by Abe has the potential to breathe life back into the domestic economy. Indeed, this will certainly alleviate pressure on the Bank of Japan to take immediate policy action if the economic outlook worsens.”

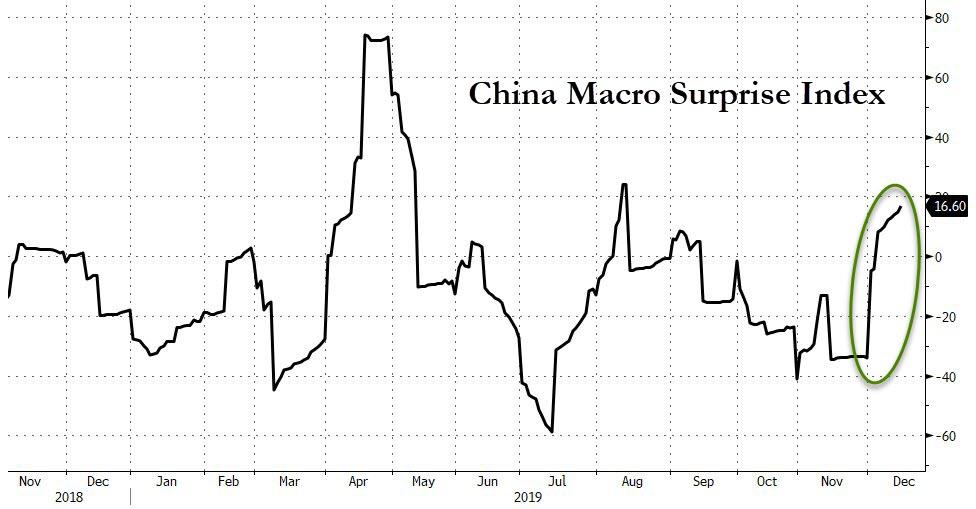

And finally, the big kahuna, China released its November data – all of which were expected to improve sequentially after disappointing weakness in October.

Chinese data has miraculously rebounded in the last few weeks with China’s manufacturing PMIs coming in on the high side for November, with both the official and the Caixin gauges beating the median forecast and showing some improvement from October.

Source: Bloomberg

So here is tonight’s smorgasbord of ‘managed’ misinformation from China…

China’s New Home Prices rose at just 0.3% MoM – below expectations and the weakest growth since Feb 2018…

Source: Bloomberg

And then the rest of the China data avalanche hit…

-

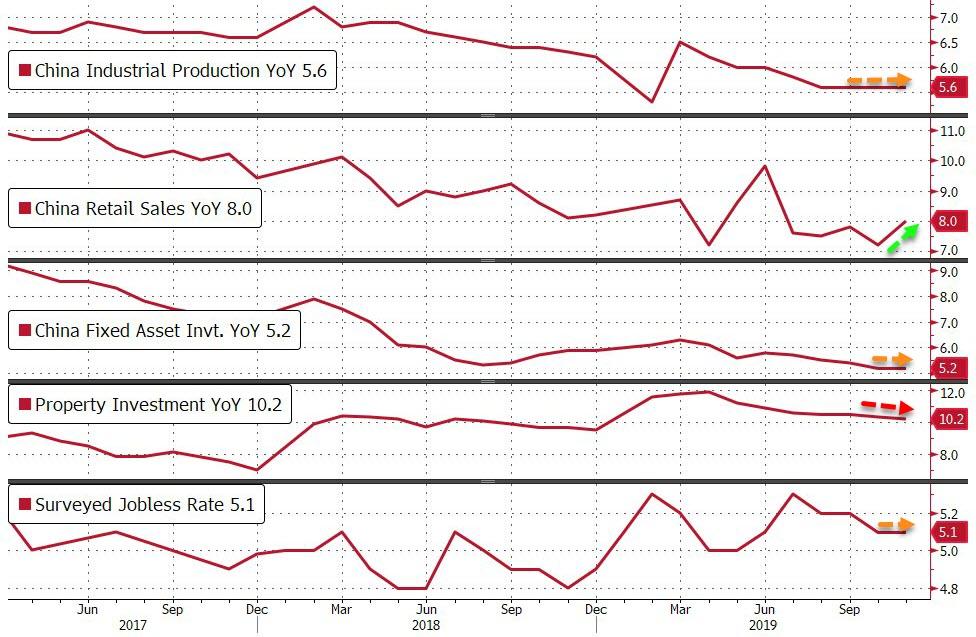

China’s Fixed Assets Investment YoY was +5.2% as expected and the same as October

-

China Industrial Production YoY rose by 5.6% (the same as October but better than the expected 5.5% rise)

-

China Retail Sales YoY jumped to +8.0% (from +7.2% and better than the 7.6% expected) but the impact of inflation, which will push the nominal level higher. CPI rose 4.5% in November year on year (thanks to soaring pork prices driving food inflation dramatically higher), well above the 3.8% rise in October.

-

China Surveyed Jobless Rate remained at 5.1%

-

China Property Investment YoY slowed modestly to +10.2%

So all in all, flat to positive reports from China

Source: Bloomberg

So the big question is, how much of a lift retail sales got from inflation.

Additionally, Bloomberg reports that Iris Pang, an economist at ING Bank, says retail sales are distorted somewhat by a long holiday in October that had depressed some spending. But, she does see the numbers overall as positive for growth.

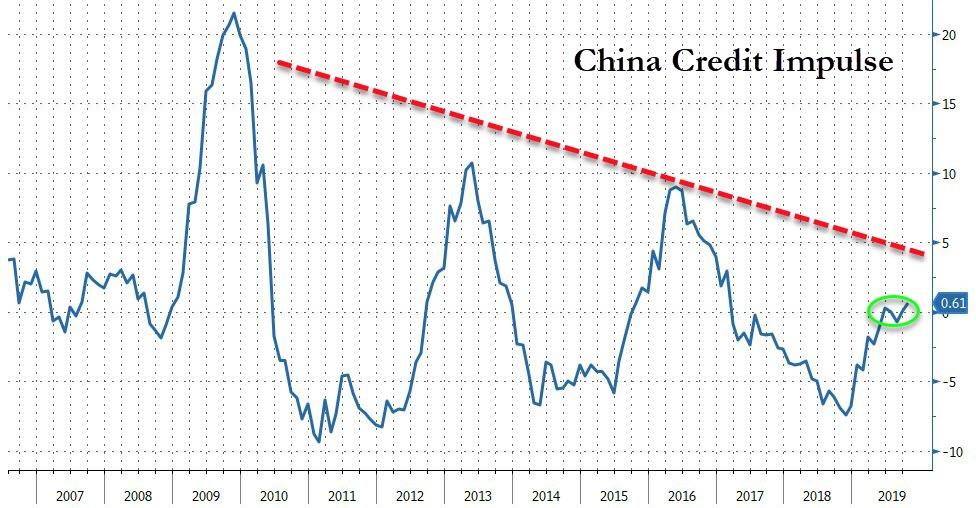

As China’s credit impulse inched into the positive… (despite Chinese policy makers’ crackdown on shadow lending – credit extended outside of bank balance sheets – which has contracted for at least 14 straight months – and has been a major dampener for growth.)

Source: Bloomberg

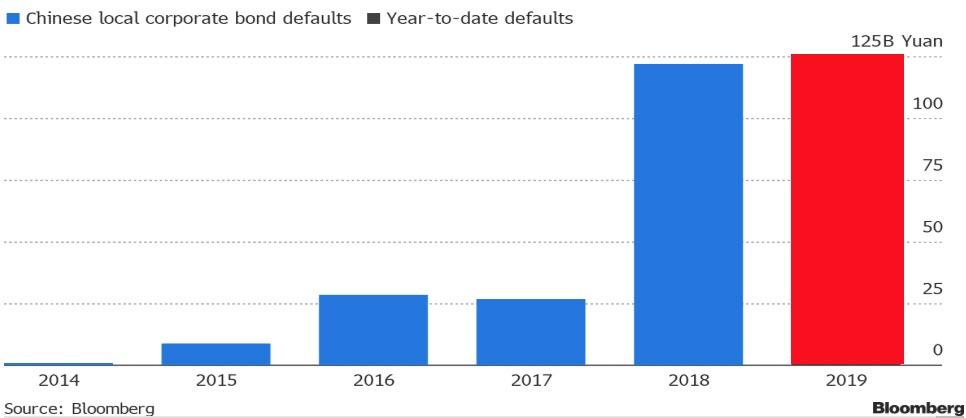

And China defaults are soaring…

Source: Bloomberg

Of course, given the “phase one” deal that is being heralded by so many, all of this will be cleared up and economic growth will soar to the moon, alice. Or maybe, just maybe, none of the slowdown in economic growth was related to trade wars’ de minimus tariffs at all, and in fact, the limit of printing money, raising debt, and forcing consumption has been reached globally.

PBOC fixed the yuan below 7.00 (at 6.9915), the strongest since August 6th, and we note that Chinese stocks opened lower (despite the trade deal).

Tyler Durden

Sun, 12/15/2019 – 21:07

via ZeroHedge News https://ift.tt/2tk0A3X Tyler Durden