“Great Slowdown” – Indian Economy Headed Towards ICU, Warns Former Economic Official

The former Indian Chief Economic Adviser Arvind Subramanian warned that the Indian economy is headed for increased financial hardships, reported Business Today.

Subramanian said the country’s current economic slowdown is considered a “Great Slowdown.” He suggested that the economy is headed towards an “intensive care unit,” referencing how the economy is on life support.

He warned that the second wave of twin balance sheet (TBS) crises is crushing the economy, which will develop into an even more massive crisis, expected to unfold in the year ahead.

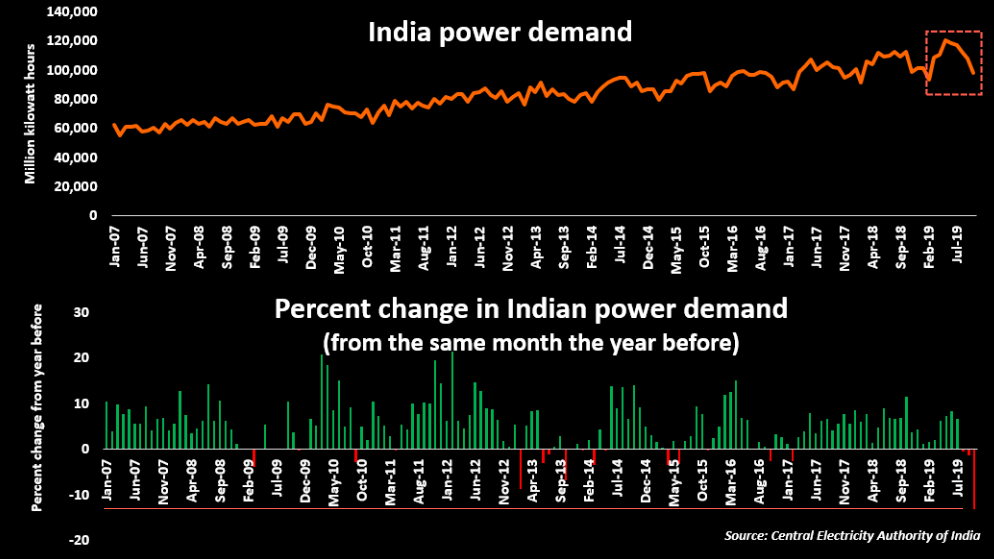

“Look at electricity generation growth, it’s falling off the bottom, and it’s never been like this ever. So this is the sense in which I would say this is not just any slowdown, this is the great slowdown that India is experiencing and we should look at it with all seriousness …and the economy seems headed for the intensive care unit,” Subramanian said during a conference at Harvard University’s Centre for International Development.

Subramanian also warned about the TBS crisis in 2014 when he was Chief Economic Advisor under the Modi government.

TBS refers to the developing problems in corporate debt and increasing non-performing assets have led to difficulties in the country’s banking sector that have weighed on credit growth. This has further slowed the economy and will likely lead to more deceleration through 2020.

Subramanian said IL&FS Ltd, or Infrastructure Leasing & Finance Services crisis in 2018, was a “seismic event” as it triggered panic in banks and raised questions about sustainability.

The TBS problem in India will push the economy much lower into 2020. Already, growth in Q3 stood at its lowest in six years.

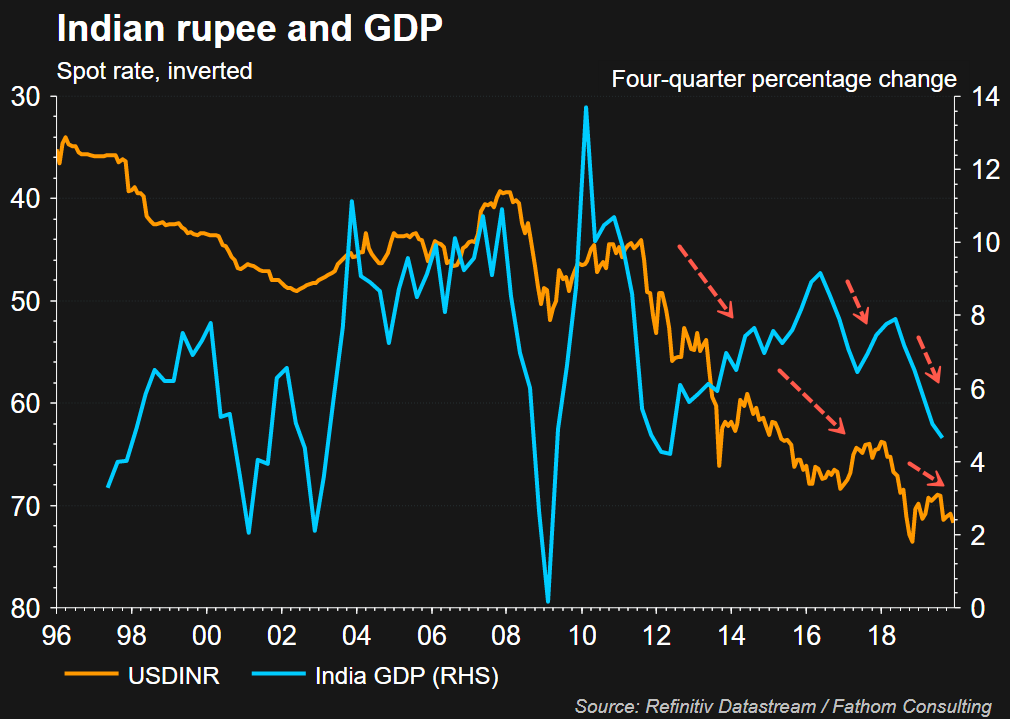

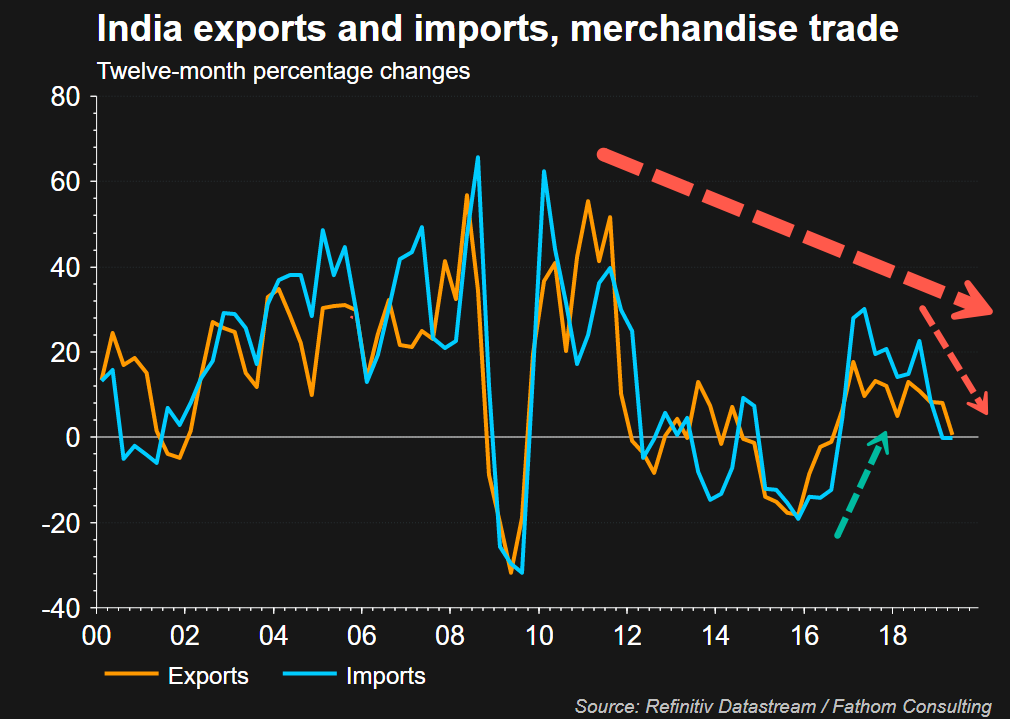

As economic growth rapidly slows, the Indian rupee has tumbled.

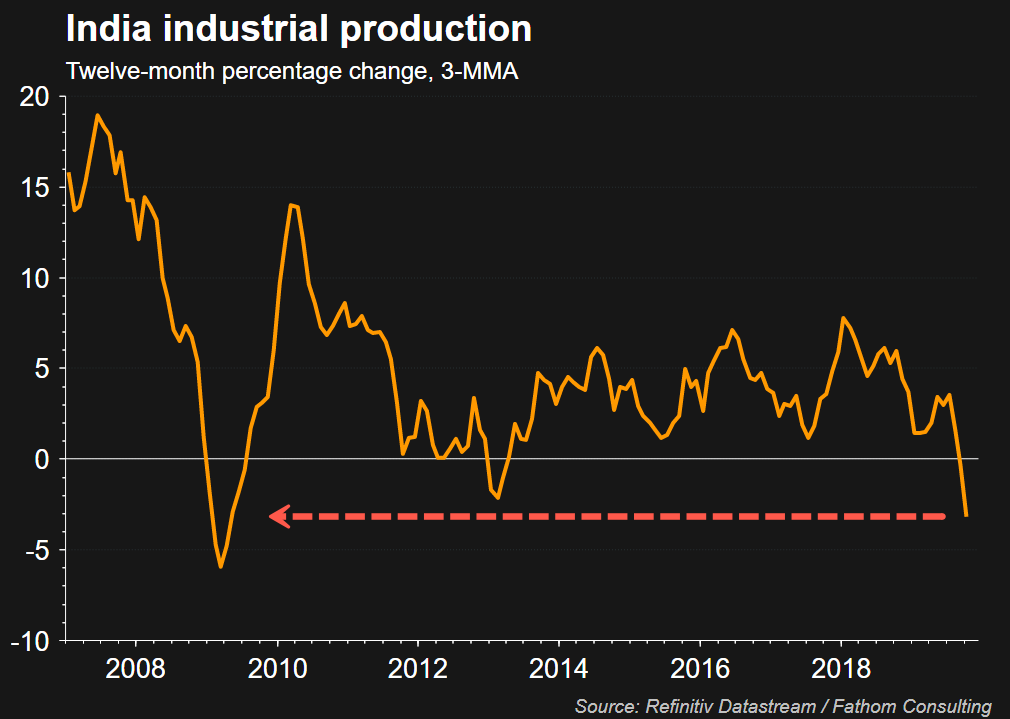

Industrial production growth is at the weakest level in a decade.

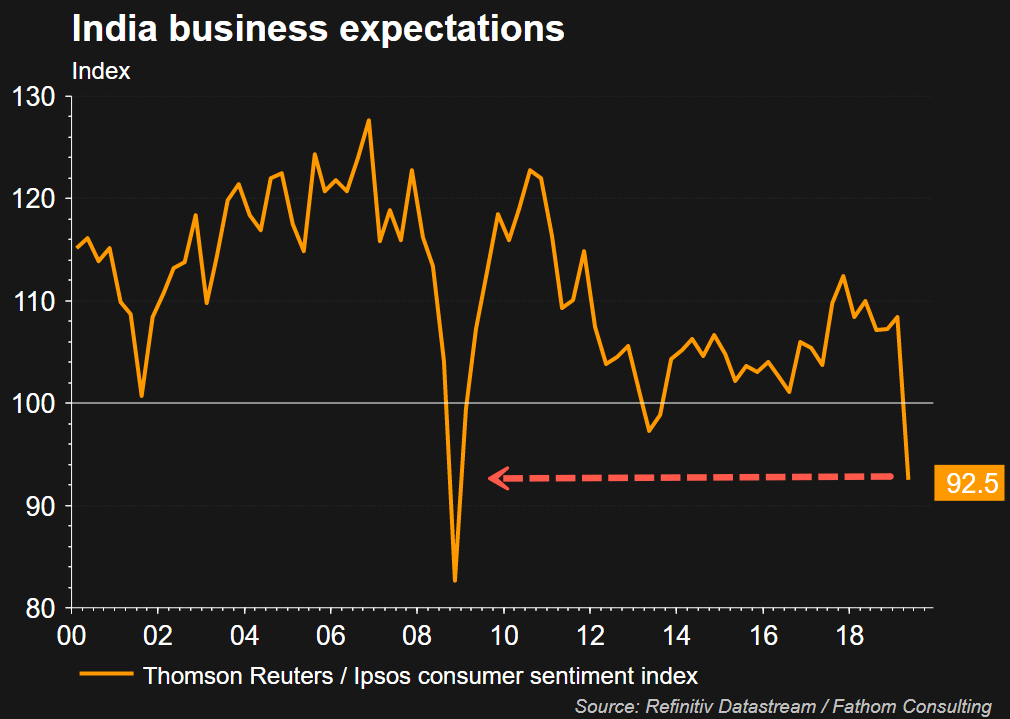

Business confidence has also plunged to decade lows.

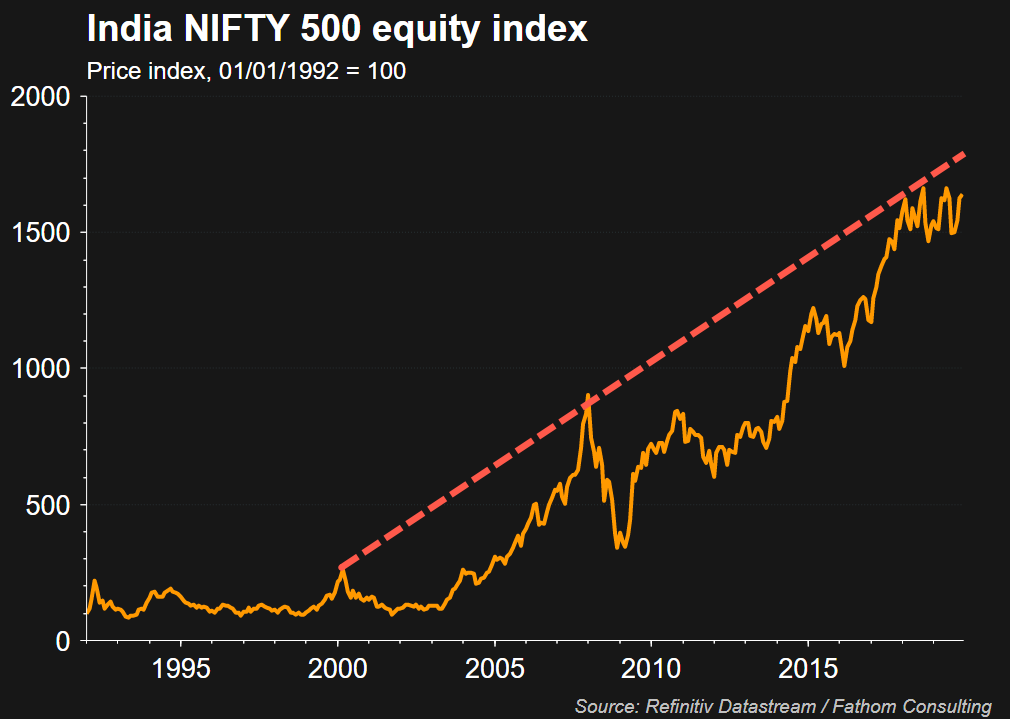

And maybe because the 2016 recovery is over, a much longer-term downturn has resumed.

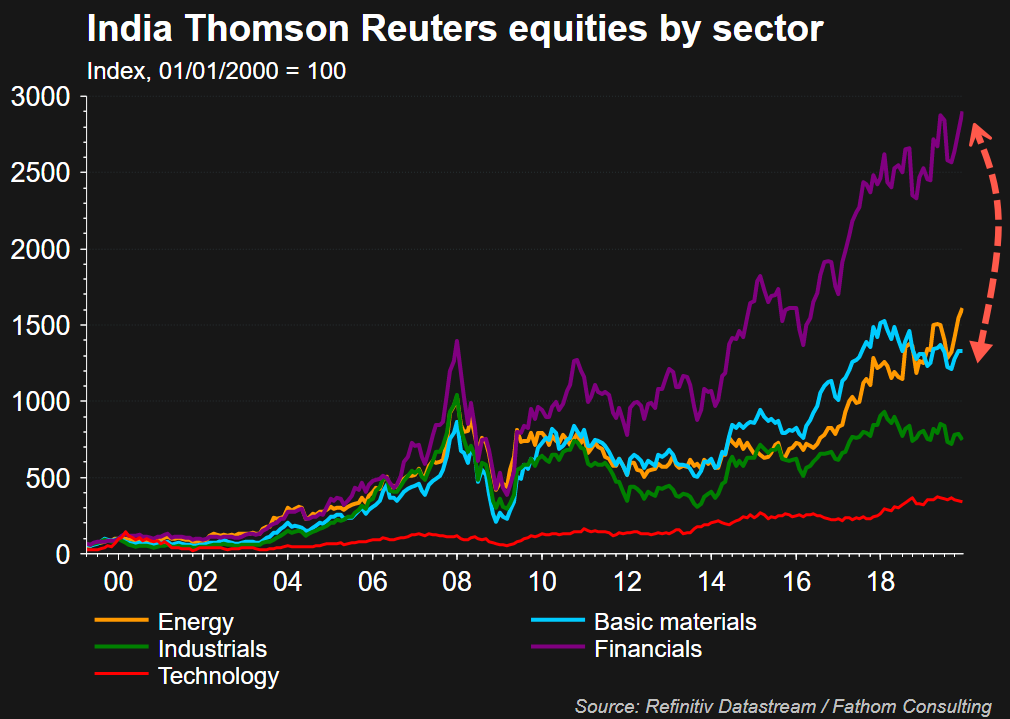

Clearly, the financial sector is the most significant imbalance in the system that could be corrected as the economy continues to decelerate.

Indian stocks are bumping up against a two-decade diagonal resistance line.

Saxo Bank’s Christopher Dembik, global head of macro research, warned on Twitter earlier this month, that “All the leading indicators point out it will get worse.”

India’s slowdown has certainly been the most under-appreciated aspect of the current global downturn. In Q3 this year, the Indian economy reached a 6-year low at 4.5% YoY, down from 5% in the previous quarter. All the leading indicators point out it will get worse. pic.twitter.com/sGajxI9Q4u

— Christopher Nicolas Dembik (@Dembik_Chris) December 2, 2019

Putting this all together, it means that central banks’ are failing to stabilize the global economy as it seems their policies are becoming less effective than ever before. This also means desynchronization continues to persist in the global economy, and really in manufacturing hubs around the world, indicating that a massive rebound in global growth, already priced in by global equity markets for early 2020, might be a fantasy at the moment.

Tyler Durden

Sun, 12/15/2019 – 20:10

via ZeroHedge News https://ift.tt/2YRpjbv Tyler Durden