US Manufacturing PMI Rebound Stalls

With ugly PMIs overnight across AsiaPac, and anything but Lagarde’s stability in Europe (and UK) this morning, preliminary December US PMIs were expected to extend their rebound (despite a slump in economic surprise data) in the last month.

-

Markit US Manufacturing PMI (Small Miss) 52.5 vs 52.6 exp and 52.6 prior – 2-month low

-

Markit US Services PMI (Small Beat) 52.2 vs 52.0 exp and 51.6 prior – 5-month high

Source: Bloomberg

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The surveys bring welcome signs of the economy continuing to regain growth momentum as 2019 draws to a close, with the outlook also brightening to fuel hopes of a strong start to 2020. Business activity, order book and jobs growth all accelerated to five-month highs in December, buoyed by rising domestic sales and further signs of renewed life in export orders.

“December’s expansion was led by an improved performance of the vast services sector, accompanied by another month of steady manufacturing growth. Encouragingly, expectations for business activity in the year ahead lifted higher in both sectors to reach the highest since June to suggest the expansion will continue to gain momentum as we head into the New Year. Optimism reflected reduced fears over trade wars and more favorable financial conditions.”

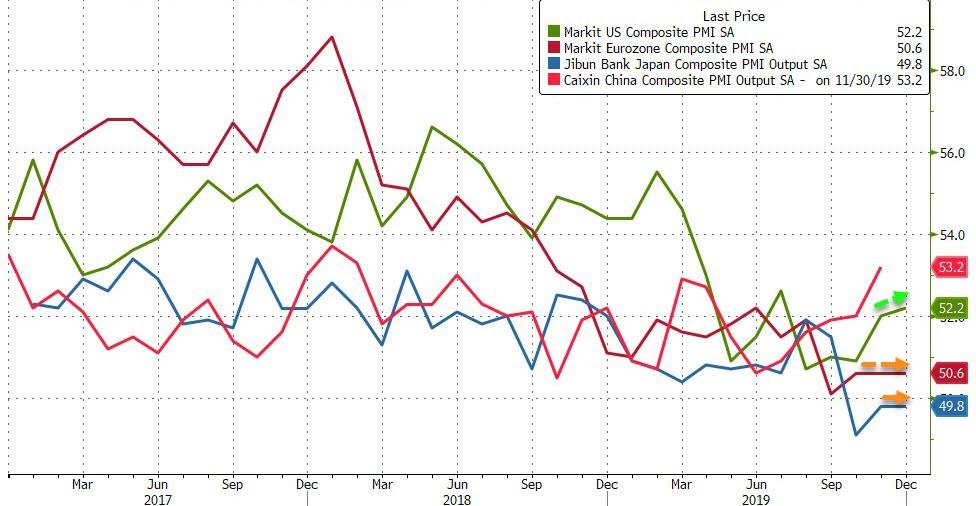

Mixed data from China overnight (but not PMI yet) but Japan and Europe remain flat at the composite PMI level but the US composite rose from 52.0 to 52.2 in December’s flash data…

Source: Bloomberg

However, Williamson suggests some caution is warranted:

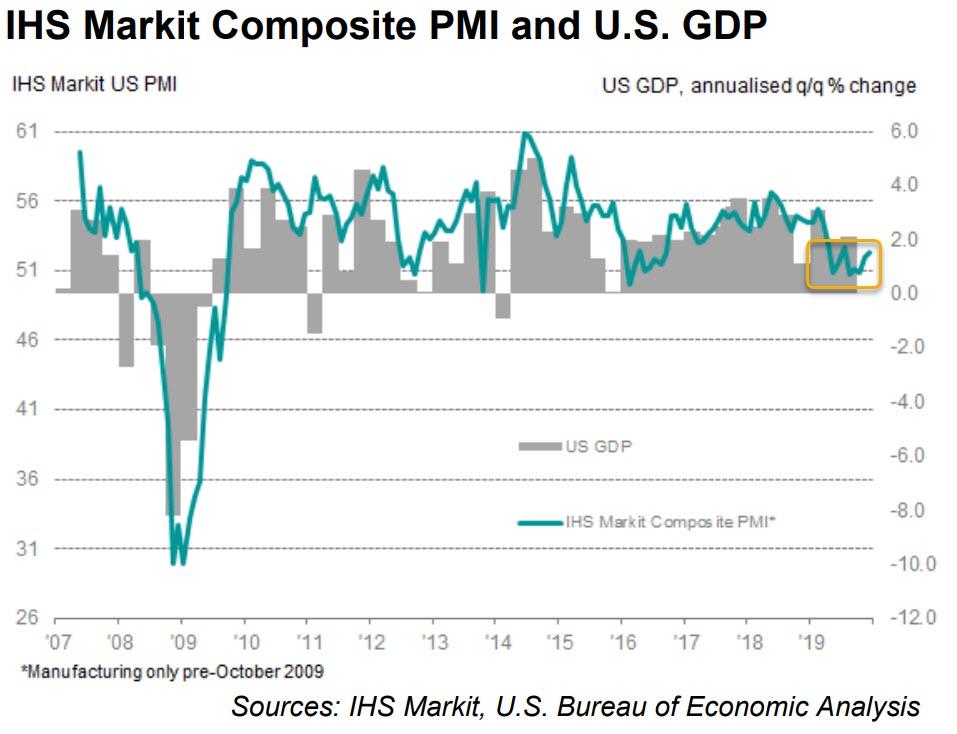

“The brighter news needs to be caveated, as the overall rate of economic expansion signalled by the surveys remains well below that seen this time last year, commensurate with GDP rising at an annualised rate of just over 1.5%.

Importantly, however, the welcome signs of improvement help to ward off recession risks and should keep the Fed on hold in the coming months. The upward trajectory in the surveys support our expectations that the US economy is on course to see another year of above potential GDP growth of approximately 2.2% in 2020.”

Will that be enough – along with “phase 2 trade talks going well” bullshit – to keep stocks alive until November?

Tyler Durden

Mon, 12/16/2019 – 09:54

via ZeroHedge News https://ift.tt/2RWyiqw Tyler Durden