Rosenblatt Goes Full Bear On Apple With $150 Target As China iPhone Sales Slump

Rosenblatt Securities analyst Jun Zhang maintained a sell rating on Apple with a price target of $150 per share, citing a decline in iPhone sales in China is leading to a wave of production cuts by the company.

“Based on our recent channel checks, we believe Apple’s total iPhone sales in China were down ~-30% y/y in November,” said Zhang in a note to clients on Tuesday.

Zhang stated that consumers are opting for cheaper models than the iPhone 11 Pro, which retails for around $1,100.

Rosenblatt’s sell rating on Apple has a price target of $150 per share, about -46% difference from the current price on Tuesday morning.

It was only last week when Credit Suisse warned about declining iPhone shipments in China:

CS said iPhone shipments in China dropped a shocking 35.4% YoY in November (following a 10.3% YoY drop in October). This compares to a 0.2% increase in the broader regional smartphone market. Additionally, CS reports that total shipments in China are now down 7.4% since the launch of the iPhone 11 line.

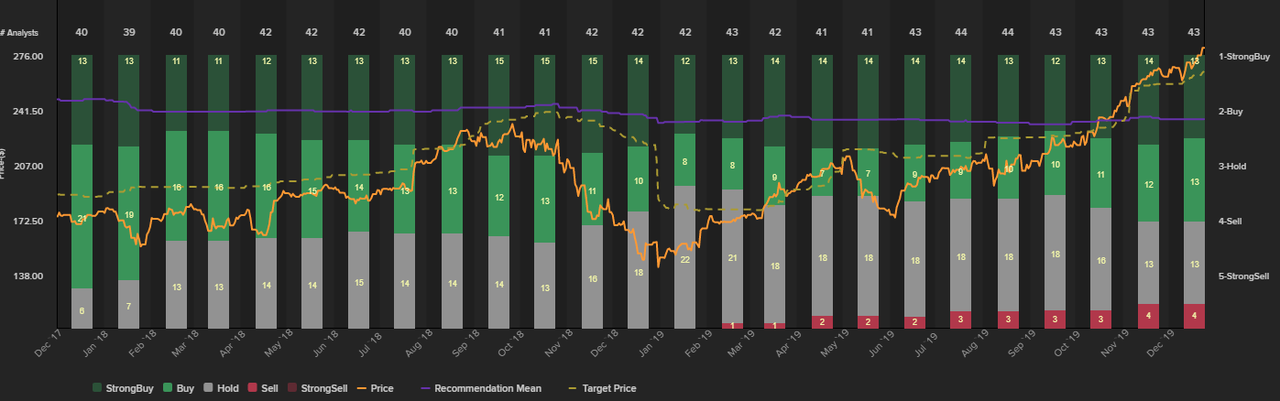

Besides Rosenblatt and CS offering their gloomy outlooks on Apple, Maximum Group has a recent selling rating with $190 price target, -32% from current prices; Elazar Advisors’ neutral rating with a $204 price target, -27% from current prices, and Wells Fargo Securities’ equal weight with a $245 price target, a 12% difference from current prices.

Tyler Durden

Tue, 12/17/2019 – 13:05

via ZeroHedge News https://ift.tt/35GPqEZ Tyler Durden