McElligott’s 2020 Outlook: Why Nomura’s Quant Is Fading The Reflationary Groupthink

By Nomura’s Charlie McElligott

I received a number of follow-up inquiries regarding the tactical trade I discussed Wednesday morning on CNBC, where I advocated a “1 month reversal” strategy in US Equities beginning for the month of January

Before I get into the tactical trade for January, at the core of the view is my belief that as opposed to this sudden “reflationary growth in 2020” outlook which we’ve seen investors spasm into over the past months (repositioning themselves out of what I thematically called over the course of 2019’s “long worst-case scenario, short good news” portfolio), my 2020 view is much more realistic “return to goldilocks” US economic environment–where by the end of the upcoming year that UST yields aren’t very far from current levels—as opposed to some of this outright giddy “reflation” thematic which we currently see trading in the market

Yes, all year I have advocated that things are FAR LESS BAD than the “Everything Duration” trade was indicating (particularly due to the “negative convexity spasms in Mar and Aug creating this “imminent recession” false optic in Rates) and that’s why we nailed the September Bond selloff on even the slightest “less bad” inputs (particularly from US / China trade and global data), which then triggered our anticipated reversals in US Equities “Momentum / Value” “Defensives / Cyclicals” and our “Long Breakevens on risk / reward” calls

However and as a contrarian, consensual group-think views into the year-ahead are often exaggerated and “fade-able”:

- Recall last year at this time you had GS projecting another 4 Fed rate HIKES over the course of 2019, while the Bloomberg MLIV user survey taken Dec ’18 was forecasting UST 10Y Yields to finish 2019 at 3.03%, while the consensus from economists was 3.32% (!!!)—versus the current reality of 1.93% LOL!

- Even more hilariously for Bunds, last year’s Bloomberg MLIV reader survey was projecting a median forecast of 0.45% for German 10Y yields by end of this year, while economists forecast 0.90%–versus the current -0.23% (that’s NEGATIVE) reality

Simply-put, there is a lot of “sudden optimism” as investors get caught up in a positioning swing that has upset the prior legacy “end of cycle slowdown into recession” narrative—and are now chasing from one side of the “extreme outcome” boat to the other

Now however, I am beginning to see signs that this shift to a more “growth optimistic” and “reflationary” footing into 2020 is little more than a “rental,” because there remains NO TRUE “IMPULSE” REFLATIONARY GROWTH CATALYSTS beyond this rebalancing of the prior positioning extremes to a simply more reasonable level

There are a number of factors will keep US Yields in a “rangier” trade than what many are suddenly anticipating in this sudden “impulse reflation” trade:

- The Fed, whose asymmetric policy response reality going-forward sees almost “no bar” to CUT, versus an impossibly “high bar” to HIKE (requiring a sustained inflation overshoot); Thus, the current “still-benign” inflation dynamic will keep the Fed’s MonPol “easy” and focused on maintaining the current 20m lows in US “Financial Conditions”

- “Goldilocks” US Economy is back, neither too hot nor too cold, with the same old “American exceptionalism” and labor data indicative of the health of the consumer, yet with such “tame” inflation—which means rates stay range-bound and can’t really break of out of this same 1.60-2.00 yields range (i.e. the past two weeks, despite upbeat developments on US / China “Phase 1,” a big US Payrolls beat and CPI upside surprise, better Chinese data, constructive UK election outcome etc)

- Secularly, the “Three D’s” will continue to create a long-term investor “buy-in” to a slow disinflation “bleed”: the overall trajectory in the growth of Debt being disinflationary; fading Demographics being disinflationary; and tech Disruption being disinflationary; Long term then and ironically / perversely, it will take an actual economic crash into “hard recession” in order to force a change of footing both politically and policy wise, which would see widespread embrace of much more aggressive FISCAL policy embrace globally (MMT / universal income, Infrastructure, Green Bonds, Chinese reacceleration of the PSL “shantytown” program)

- And finally, US Treasury Bonds will remain supported near current levels based around my view that the Fed’s current “QE-Lite” of T-Bill purchases / Open Market Operations will ultimately over the course of 2020 turn into something that is closer to “OUTRIGHT QE” (as they have to begin shifting from purely front-end towards purchases directly into USTs / “Duration”), all in order to add reserves to an extent that can help offset the regulatory capital requirements and “broken” participant incentives which are plaguing Funding / Repo markets

AGAIN, I’M NOT SAYING UST 10Y YIELDS ARE GOING BELOW 1.00; I AM SIMPLY SAYING THAT I DON’T SEE SCOPE FOR A BIG “PARADIGM-SHIFTING” FIXED-INCOME SELLOFF over the course of- / by the end of- 2020, and that means that next year in general can look like an “everything rally,” as stable Rates suppress cross-asset volatility and provide a constructive backdrop for both Bonds and Risk-Assets in standard “QE / Goldilocks” fashion

THUS, MY TACTICAL TRADE FOR JANUARY—U.S. EQUITIES “1M PRICE REVERSAL” STRATEGY TO EXPLOIT THE POWERFUL JANUARY SEASONAL ‘REBALANCING’ PHENOMENON WITNESSED OVER THE PAST 30 YEARS:

- My favorite TACTICAL (short-term / 1 month) contrarian trade out of the gates for January in order to fade (or hedge) this sudden shift to a “reflationary growth” 2020 outlook is a “1m Reversal” strategy in US Equities

- Essentially this strategy takes the monthly performance snapshot of the Russell 1000 leadership deciles, then on a once a month basis, would go LONG the bottom decile (worst 10% of the index) versus SHORT the top decile performers (the top 10% of names in R1k) on the month

- In this case, you’re effectively reversing the current performance dynamics we are seeing so far in December, which is this large outperformance of Cyclicals / Value / High Beta over Duration Sensitives i.e. Secular Growth and Defensives / Min Vol

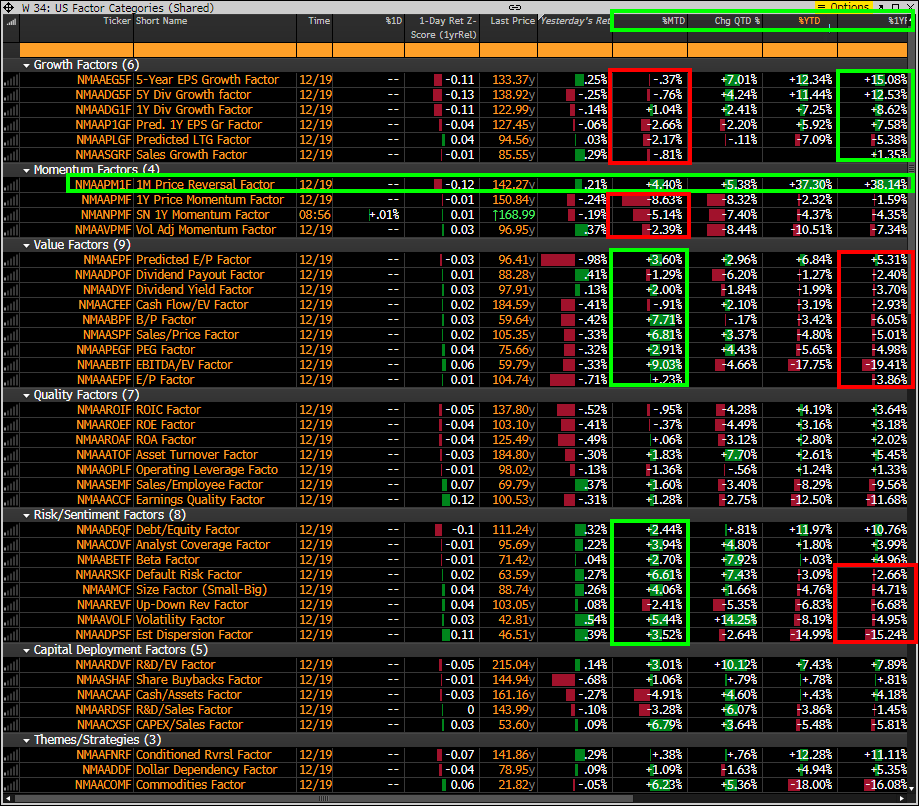

- This “1 month Reversal” strategy YTD is up an astounding 37.3% in 2019….1) outperforming the long-only S&P 500 Total Return Index by over 6% YTD, which is almost inconceivable considering it’s a market neutral strategy running Long-Short with no net exposure and 2) speaking to the massive-impact that “passive” / “mechanical” rebalancing is seemingly having on market price-action

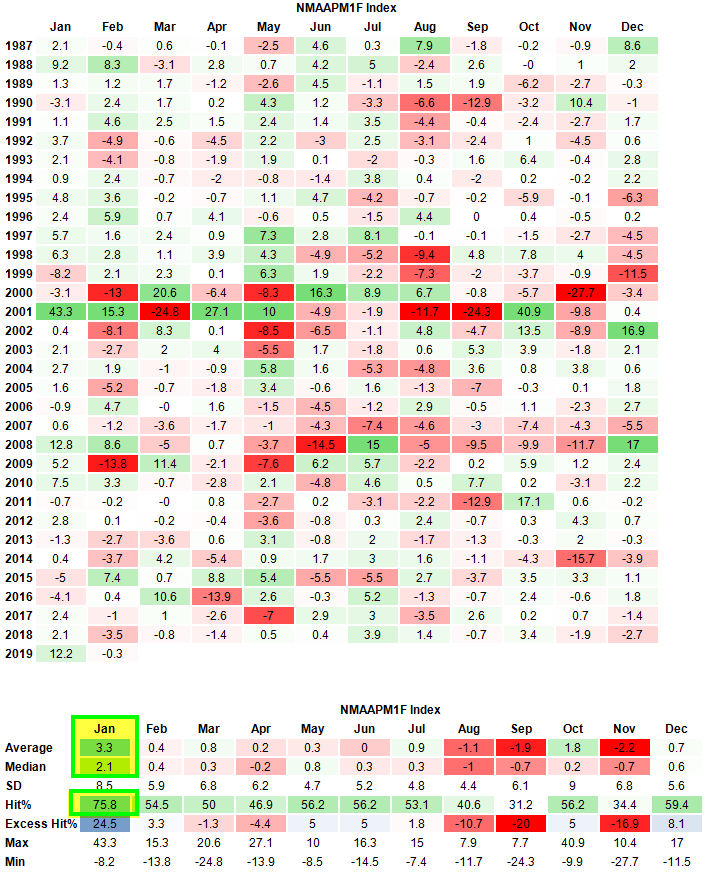

- And it just so happens that back-testing all the way back to 1986, we see that January by far is the best historical return month for this “1m Reversal” strategy +3.3% on average with a 76% “hit” rate higher, picking-up widespread “rebalancing” into the new year and reversal of December “gross-down” year-end behavior

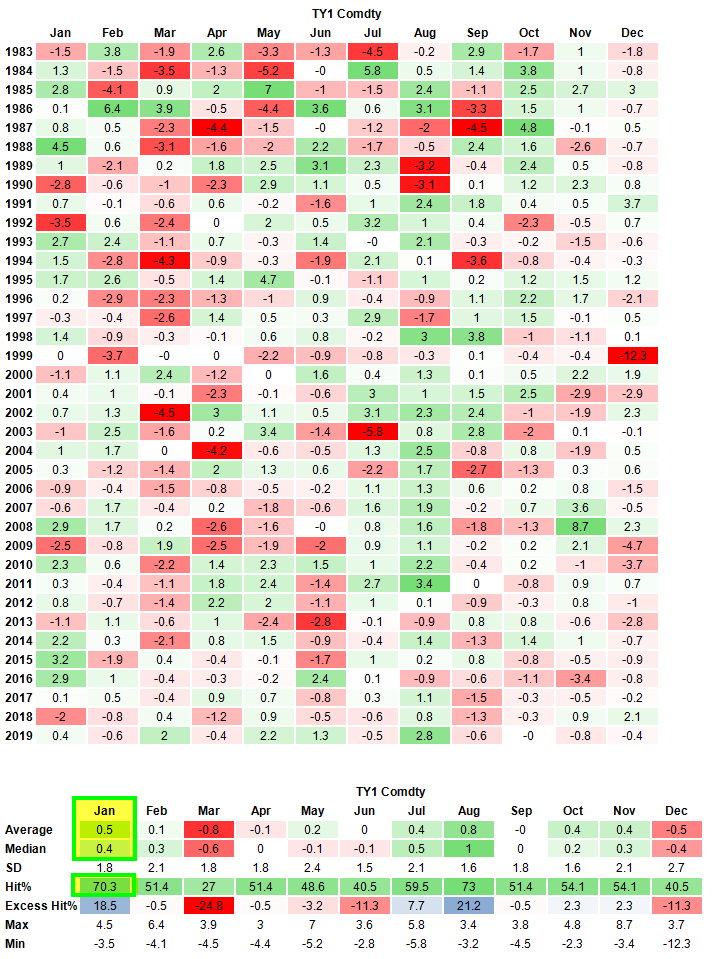

- Further support then for this view that we see a “reversal of the Q4 reversal” in January, meaning that I’d expect duration sensitives like secular growth tech and defensive sectors to outperform cyclicals? That dating back to 1983, we see January as a top 3 month of the year for Ten Year US Treasury future, higher with a 70% hit rate

- This is then supportive of fixed-income out of the gates and likely speaks to fading the crowd who believes that in January you’ll see UST yields rocketing higher to start 2020, which in-turn many then expect to lead to further extension of this rebalancing trade INTO cyclicals out of duration sensitives (secular growth and defensives); conversely, I think Bond proxies hold just fine and can in-fact outperform said “cyclical renaissance” in January due to this likely “passive rebalancing” phenomenon

U.S. EQUITIES “1 MONTH PRICE REVERSAL” STRATEGY MONTHLY RETURNS SHOWS THAT THE PHENOMENON IS BY FAR MOST PRONOUNCED IN JANUARY:

WHILE SEASONALITY IN UST 10Y TREASURY FUTURE ALSO SHOWS JANUARY AS A TOP 2 / 3 AVERAGE RETURN MONTH SINCE 1983—WHICH TOO SHOULD HELP REVERSE THE RECENT IMPULSE MOVE INTO CYCLICALS AND OUT OF DURATION-SENSITIVES:

US EQUITIES FACTOR MONITOR CAPTURES THE RECENT REBALANCING / ROTATIONARY PIVOT, WHILE TOO SHOWING THE DOMINANCE OF THE AFOREMENTIONED “1 MONTH PRICE REVERSAL” STRATEGY IN 2019 / +37.3% YTD INTO TODAY:

Tyler Durden

Fri, 12/20/2019 – 14:33

via ZeroHedge News https://ift.tt/34DdSFK Tyler Durden