Class 8 Market Continues Collapse As Navistar Cuts 1,300 More Jobs

Job cuts and bankruptcies in the world of heavy duty trucking have been a way of life over the last 18 months, as we have documented, with the industry steeped in recession as it reflects a larger, global slowdown in manufacturing.

That trend looks to be well in tact, with major transportation company Navistar reporting this week that it was going to be eliminating more than 1,300 jobs in North American production.

The company reported lower net income and revenue during Q4 as the industry’s falling demand for trucks continued. Net income also fell for the year. The maker of international trucks said it would lay off 10% of its workforce and slashed its forecast for 2020 revenue to below the lowest estimate among analysts, which sent its share down more than 10%.

It was the biggest drop for the company’s shares since October 2018.

Troy Clarke, Navistar chairman, president and CEO, said: “We are taking actions to adjust our business to current market conditions, including reducing production rates and selling, general and administrative expenses while restructuring our global and export operations. Building on the strong gains achieved over the last several years, Navistar has a clear roadmap in place for sustained growth that will set it apart from the industry.”

Profits in the company’s truck segment fell to $86 million in the fourth quarter, down from $197 million a year earlier. For the year, it posted net income of $221 million, down 58% from the $340 million it posted last year.

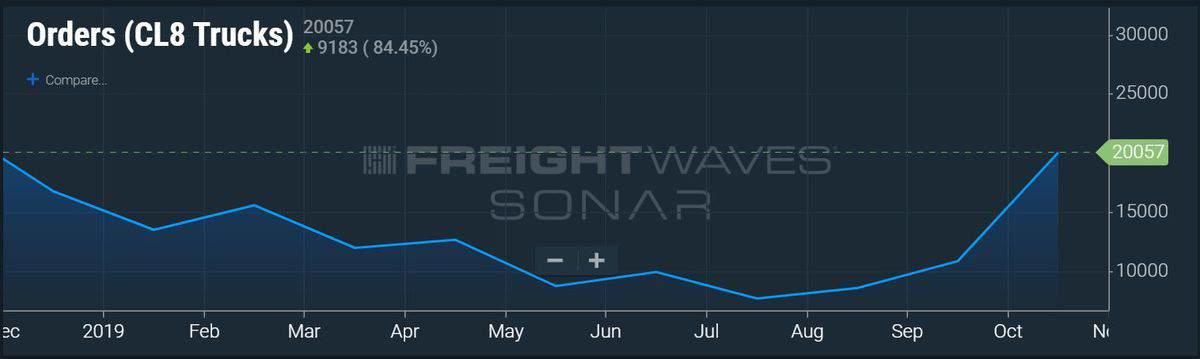

Recall, we noted at the beginning of the month that November’s Class 8 order numbers across the industry were collapsing.

November culminated a dismal year that some thought had seen a reprive with October’s improved bookings. But data from FreightWaves showed that the collapse had continued its trend, indicating that the sluggish economy is to blame for lackluster replacement demand.

Orders totaled 17,300 units for November, which marked the slowest November since 2015 and a 39% collapse from November 2018. The slowdown in orders is also prompting layoffs by companies like Daimler Trucks North America, Volvo Trucks North America and Paccar Inc.

Other names in the Class 8 supply chain are also dealing with these negative trends. For instance, engine manufacturer Cummins Inc. is “laying off 2,000 white-collar employees globally in the first quarter of 2020”.

Meanwhile, November used to be a month when fleets would be busy placing orders for the upcoming year. After October’s slight tick up in orders, many analysts thought November could follow suit. That didn’t happen, and sequentially November’s order book was down 21% from October.

Don Ake, FTR vice president of commercial vehicles commented: “The stalling of freight growth is causing fleets to exercise caution in placing orders for 2020. There will still be plenty of freight to haul, so we expect fleets will continue to be profitable and to replace older equipment. However, there won’t be a need for much additional equipment on the roads.”

“The industry thrives on stability, but we are now on a rocky road,” Ake concluded.

Tyler Durden

Fri, 12/20/2019 – 22:05

via ZeroHedge News https://ift.tt/35FVKfI Tyler Durden