Morgan Stanley Sees Melt-Up Lasting Until April, After Which Markets Will “Confront World With No Fed Support”

When laying out the performance of the market in 2019, Morgan Stanley delineated three distinct phases, with the third and most important one starting in mid-September, which has seen the S&P rise almost in a straight line since…

… and which just happened to coincide with the period in which the Fed announced that in response to the broken repo market (which as a reminder only “broke” because JPMorgan decided it should “break“), it will inject tens of billions if liquidity into the market via both repos and directly Bill purchases.

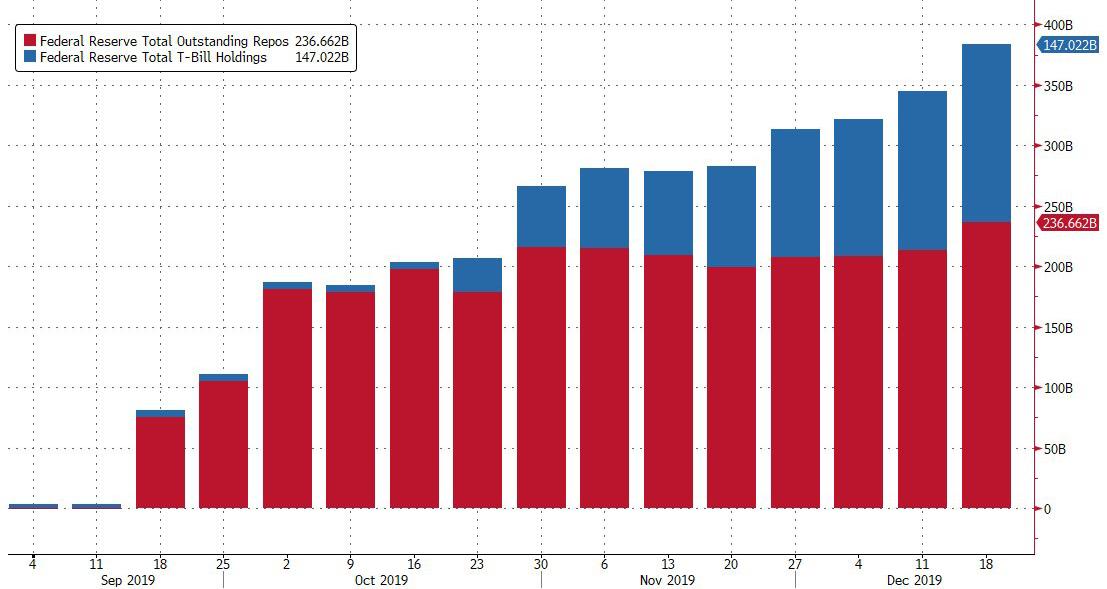

And speaking of liquidity injections, since mid-September, the Fed has actively injected $237 billion via “temporary” repos and $147 billion via not so temporary Bill purchases, and which Zoltan Pozsar believes will soon convert into all out coupon purchases (i.e., QE4) to prevent an even more catastrophic lockup in the repo market.

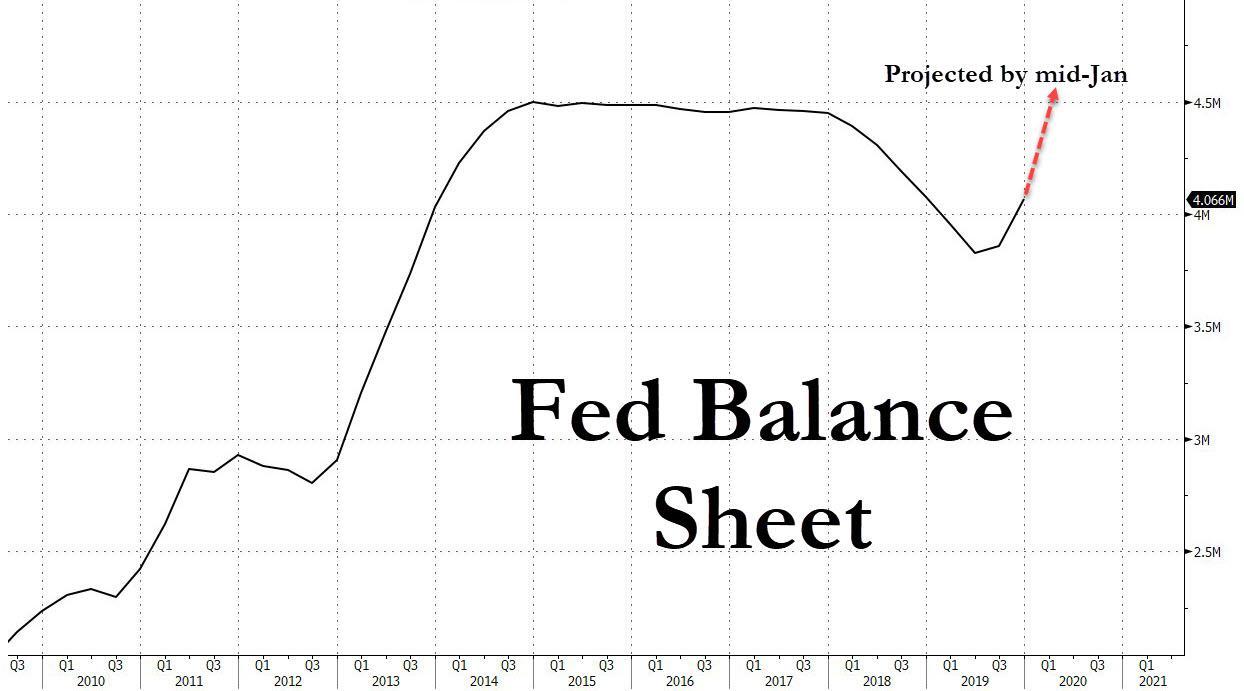

Now, we also know that in order to delay the repo market doomsday so vividly described by Credit Suisse strategist Zoltan Pozsar, the Fed has vowed to backstop about $500 billion in liquidity between mid-December and mid-january, which means that one month from now, the Fed’s balance sheet will likely have breached its previous record and reach new all time highs.

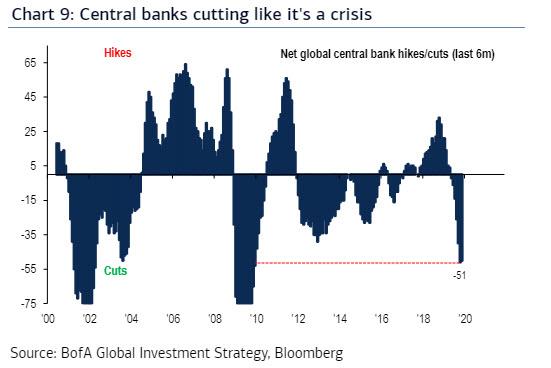

Of course, it’s not just the Fed: as Bank of America noted recently, central banks are currently “cutting like it’s a crisis.” Of course, there is no crisis… unless one defines a crisis where the S&P doesn’t rise by 20 points every single day.

Meanwhile, recall that the Fed’s “NOT QE” will continue “at least into the second quarter of next year” as the New York Fed explained back in October.

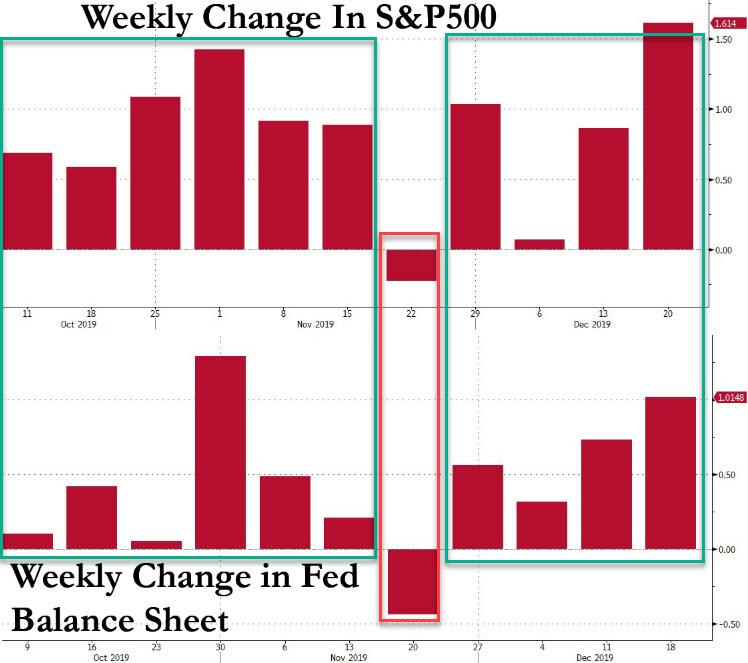

And, one final observations: since the launch of the Feds’ “NOT QE” on Oct 11, every week that the Fed’s balance sheet has risen, so has the S&P500… and vice versa, on the one occasion the two contracted together.

Extrapolating this unprecedented correlation, means that as long as the Fed’s balance sheet is rising, so will the S&P500.

Putting this all together reveals the following picture:

- The Fed will continue to inject anywhere between $60-100 billion each month through Bill purchases and repos, with a burst of liquidity injections taking place now through mid-January.

- Every week that the Fed’s balance sheet increases, so does the market, and vice versa.

- The Fed’s Balance Sheet will continue to increase for at least another 4-5 months.

What does this mean for stock prices? Well, unless something drastic changes in the next few weeks, it likely means that the “supernova market” forecast by BofA’s Michael Hartnett, which sees the S&P hitting 3,333 by 3/3 (March 3), may prove conservative. Recall that last week we noted that “BOfA expects returns to be front-loaded in 2020, with the S&P500 hitting 3,333 by March 3rd, and the 10Y Treasury rising to 2.2% by 2/2 (Feb 2).”

Of course, as Hartnett cautions, such front-loaded returns – which are entirely on the back of the Fed’s latest QE – will reverse as soon the Fed tapers the current massive liquidity injection, and will go into sharp reverse once the Fed is forced to shrink its balance sheet.

Morgan Stanley echoes this worry, and in the year’s final report by the bank’s cross-asset expert Andrew Sheets, he writes that the bank’s interest rate strategists “expect the Fed to expand its balance sheet through April/May.” That also roughly coincides with BofA’s 3,333 target which will mark the market top for the current cycle.

What happens then? Here’s Morgan Stanley again:

After that, markets may once again have to confront a world with limited trade progress and no further Fed support.

Where we disagree with Morgan Stanley is the concept of a world with “no further Fed support” because if there is anything 2018 taught us is that a modest, 20% bear market is more than enough to crush any hawkish sentiment among all Fed members and force a complete policy reversal, not just in the US but across the globe. This will be even more so in an election year where Trump slams any drop in the market as the Fed’s fault.

As such while we agree that the market meltup may continue until April or May, we are not so sure the Fed will no longer support it beyond that date; after all, the economy is now the market, and while a garden variety bear market would ensure a recession, a crash such as the one needed to wipe out the central bank excesses of the past decade, would result in the biggest global depression ever. Which is why the status quo will never allow it to happen, and such a “market event” would only be possible in a time of great social and political upheaval.

Tyler Durden

Mon, 12/23/2019 – 15:10

via ZeroHedge News https://ift.tt/2sesMoM Tyler Durden