Ugly 2Y Auction Hit With Lowest Bid To Cover In 11 Years

Unlike last month’s stellar 2Y auction which we assumed was an attempt by investors to frontrun the expansion of the Fed’s “NOT QE” T-bill monetization into purchases of coupon paper such as 2Y notes, today’s 2Y treasury auction was quite ugly.

Stopping at a high yield of 1.653%, the sale of $40BN in paper priced “on the screws” with the 1.653% When Issued, and just above last month’s 1.601%, so hardly catastrophic.

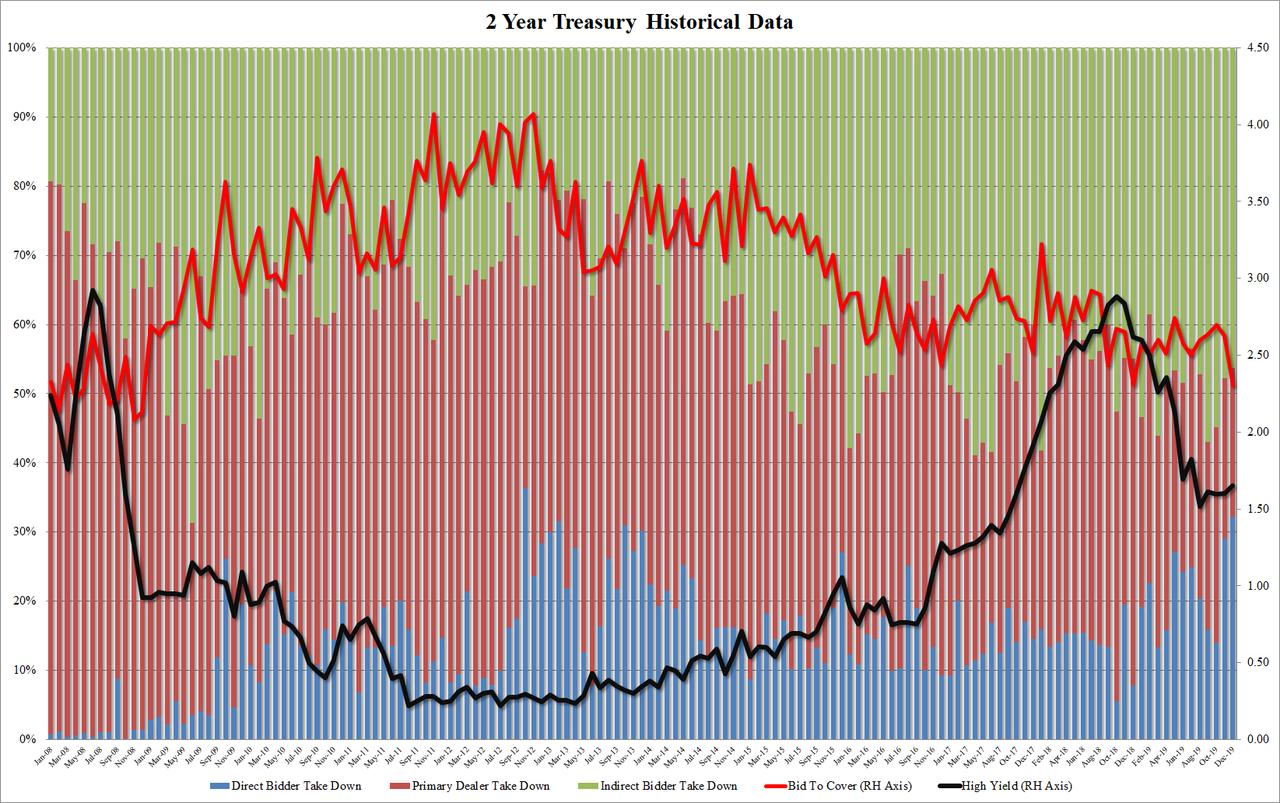

And yet, much was left to be desired after the Bid to Cover in today’s auction tumbled from 2.626 to just 2.305, not only far below the 2.61 six auction average, but this was the lowest Bid to Cover in 11 years, or since December 2008, indicating that suddenly the buyside had very little interest in short-dated US paper.

The internals were lousy as well, with Indirects sliding from 47.8% to 46.3%, below the recent average of 49.8%, and the lowest since July 2019. And with Directs also taking down less, or 21.5% vs 29.11% last month, Dealers we left with 32.3%, or the most since August.

Overall, a poor auction where not only the overall plunge in Bids to Cover indicated far less buyside demand – perhaps as a result of the holiday-shortened week – but the drop in Indirects suggests that the Fed will have to get far more active on the short-end to make sure there are no demand concerns heading into 2020.

Tyler Durden

Mon, 12/23/2019 – 13:14

via ZeroHedge News https://ift.tt/2tLuOND Tyler Durden