Repo Crisis Averted With Third “Undersubscribed” Turn Repo

It seems that the year-end repocalypse that Credit Suisse’s repo market guru Zoltan Pozsar predicted exactly two weeks ago, is not going to happen this year after all, and all it took was a “bigger than QE4” $500 billion liquidity injection/backstop by the Fed.

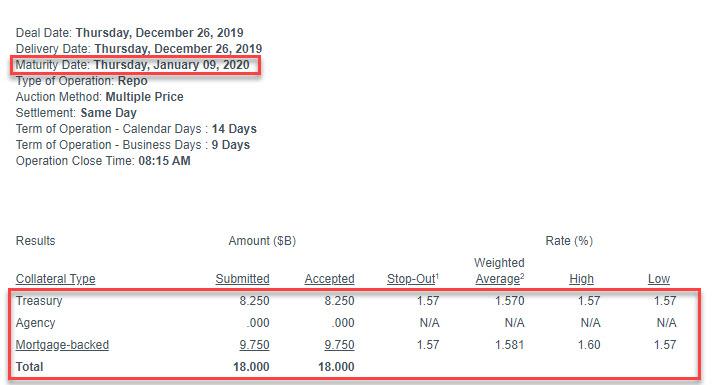

Today’s “turn” Term Repo which matures on January 9 saw only $18BN in security submissions ($8.25BN in TSYs, $9.75BN in MBS), below the $35BN in total availability.

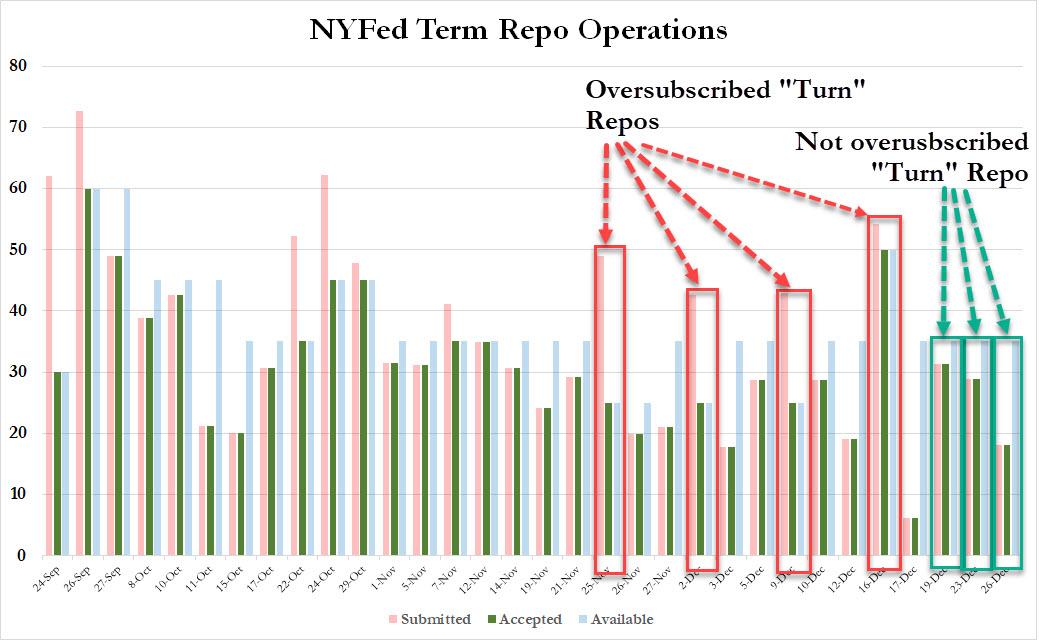

As such, this was the third term repo since the start of the Fed’s emergency repo program that covered the year-end “turn” that was not fully overalotted. As shown in the chart below, the first four “turn” term repos were all oversubscribed (boxed in red), while today’s was the second “turn” repo that saw a less than full allotment.

As such, it now appears that banks have reached their fill of what they believe will be sufficient year-end liquidity, and all subsequent “turn” repos will likely see a lower allotment as the Fed’s $500BN liquidity backstop bazooka ends up being underutilized, if not by much.

In his latest comment on the repo market, Curvature’s Scott Skyrm noted that “once the term RP operations switch to being undersubscribed, it either means most of the Street’s year-end funding need is fulfilled, or banks are close to their balance sheet limits.” His full comment below:

The Fed took out the bazooka last Thursday and proposed to flood the Repo market with liquidity. If needed. That’s the catch. The Primary Dealers might not take all of the cash the Fed is offering. Either they won’t need it or they won’t want it. So there are two scenarios as we get close to the end of the month. Either Primary Dealer banks do not take all of the Fed cash because their balance sheets are full or because they don’t need the cash. Wrightson estimates that only $300 billion to $350 billion* of the ~$500 billion will be taken by the Primary Dealers. We can see whether the Fed RP ops are oversubscribed or undersubscribed by watching the results. Back on November 25, the $25 billion term RP operation to January 6 was oversubscribed by $24 billion. The $50 billion operation to January 17 on Monday was only oversubscribed by $4.25 billion. Once the term RP operations switch to being undersubscribed, it either means most of the Street’s year-end funding need is fulfilled, or banks are close to their balance sheet limits.

This means that today’s repo is either good news, or bad news: good news if banks don’t need any additional liquidity for year end, but bad news if they are simply prevented from seeking more Fed reserves due to balance sheet limitations (and how many securities they can pledge), even as the overall funding in the repo market remains insufficient.

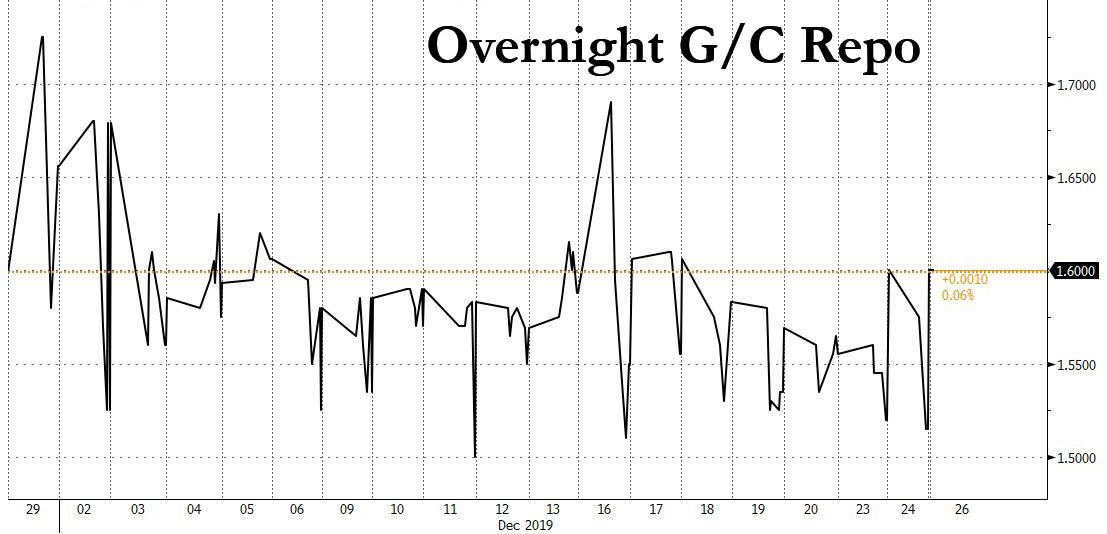

As usual, keep a track on the overnight repo rate for confirmation if things are getting better or worse. Incidentally, today the rate picked up modestly to 1.60% from 1.54%…

… which suggests that all else equal, the tempest in the repo market – and the Fed’s expansion of QE4 as Pozsar predicted – may not happen after all.

Meanwhile, despite the lack of oversubscribed repo for two operations in a row, repo doomsayer Pozsar refuses to throw in the towel and in an interview posted by Bloomberg on Friday, the Credit Suisse analyst said “it’s not over” yet, saying that “if the year-end is less of a problem because of the repo bazooka we got from the Fed, and if the message of my report played a part in getting that bazooka, then that’s a nice way to be proven wrong.” However, he then added ominously that “now we’re getting into a point in the year when balance-sheet problems are going to flare up, and I think the system will get gummed up again.“

In other words, the world’s foremost repo expert expects more fireworks in the coming week.

He has just a handful of days in which to be proven right: there is one more term repos in 2019 on Dec 30. Absent some crisis on or around those days, it appears that the Fed managed to avoid the repo doomsday that Pozsar predicted two weeks ago.

Tyler Durden

Thu, 12/26/2019 – 08:52

via ZeroHedge News https://ift.tt/2PYf3eQ Tyler Durden