Stocks Hit Record Euphoria Amid “Explosive” Increase In Hedge Fund Net Exposure

So much can change in one year.

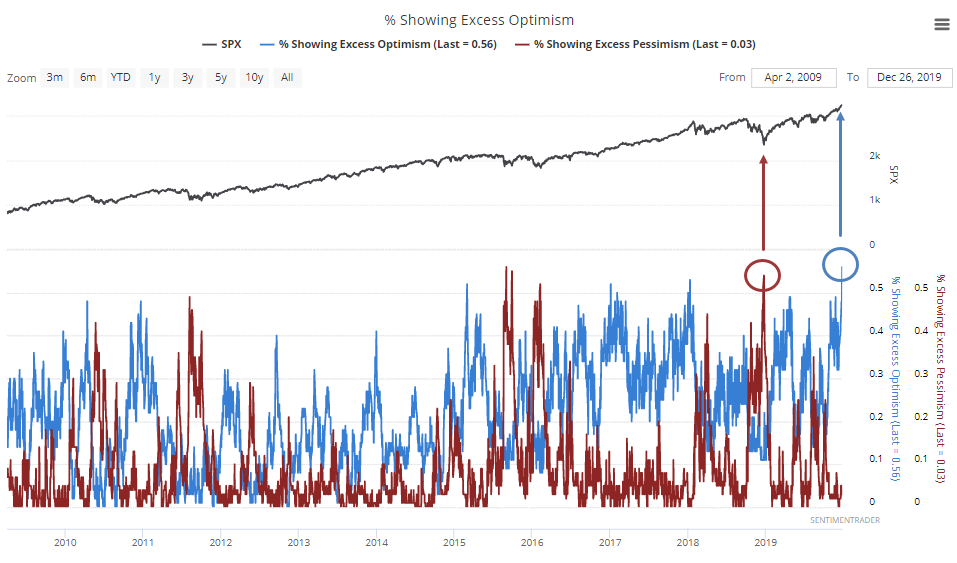

As Sentiment Trader pointed out this morning, one year after December 24, 2018, when 54% of the indicators the market positioning service tracked showed extreme pessimism, on December 26 of this year a mirror image was observed, with 55% of indicators now representing extreme optimism “the most in 15 years.“

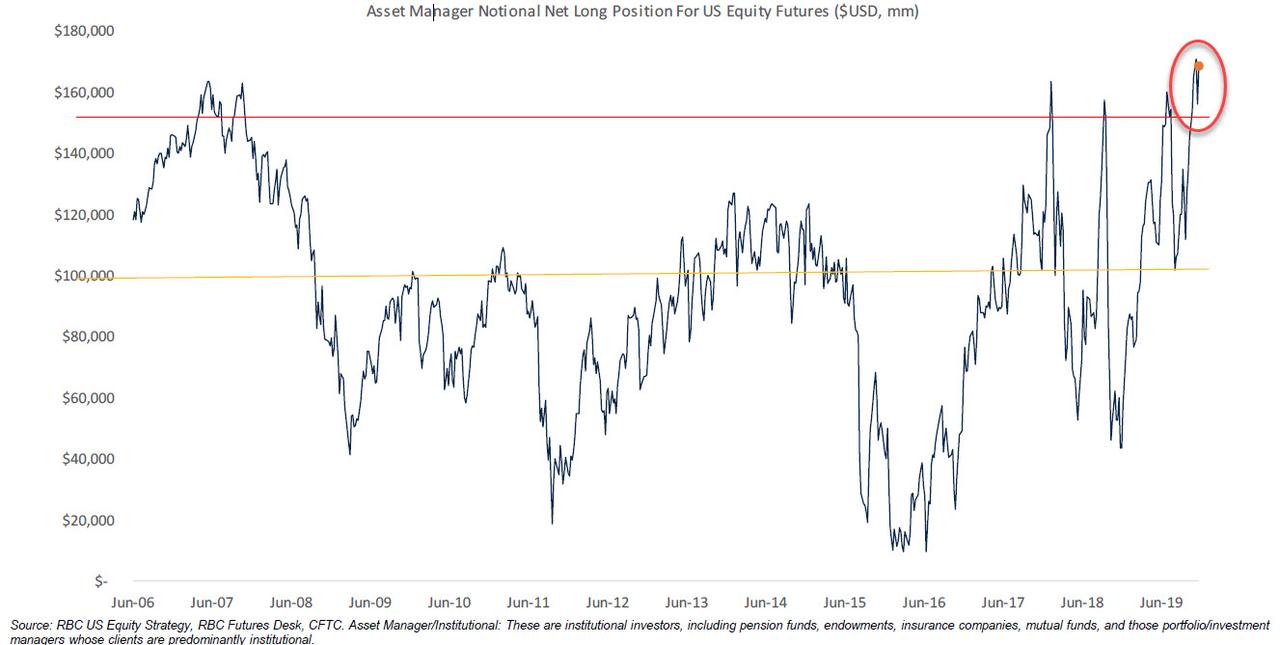

The latest RBC US Equity Investor Survey confirmed this observation. As RBC’s Lori Calvasina noted last week, in July 2019, CFTC data on US equity futures positioning returned to the highs of January 2018 and September 2018, which in turn were in line with pre-Financial Crisis highs. This told the bank’s chief equity strategist that “institutional investor positioning was euphoric and that the US stock market was vulnerable to bad news.” Sure enough, in August, positioning on this indicator fell sharply, getting about halfway back down to the May and December 2018 lows before stabilizing when the Fed launched its repo-market bailout and, shortly therafter, QE4.

Fast forward to today, when this indicator has moved up again in 4Q19, and as of December 10th was not only slightly above the levels that have marked significant peaks in the stock market over the past few years, but was at an all time high! (here the bank notes that each of the recent peaks are associated with policy catalysts (Tax Reform, Trade War, Fed Cuts.)

And to think all it took was one phone call…

Yet while institutions are now clearly at peak euphoria levels if only when responding to meaningless surveys, are they putting their money where their mouths are?

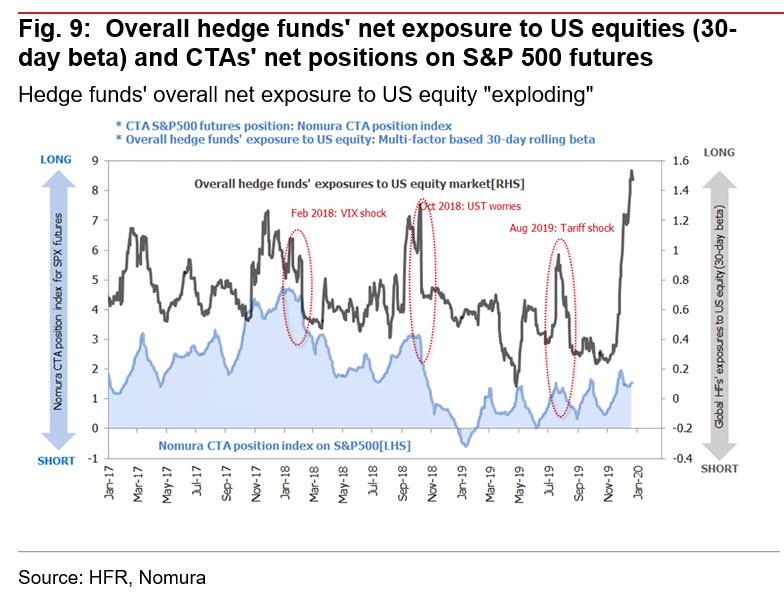

To answer that question we go to a recent note from Nomura’s quant Masanari Takada who points out that CTAs, which emerged as some of the most important marginal price setters in the past year, are currently looking to build long positions in equity futures. But, as Takada notes, “it also appears that, above and beyond the current US equity buying by trend-followers, the persistent buying of long positions in US equities by strategies of all types has led to an “explosive” increase in net exposure among hedge funds overall. For example, fundamentals-focused long/short funds and global macro hedge funds have also all been buying US equities (expanding gross long positions) in December.”

Needless to say, whereas a slow, gradual meltup is traditionally seen by markets as conducive to further gains, euphoria such as this tends to be a harbinger of a violent market reversal, and in some cases, an outright flash crash. So will the current sentiment tumble in the coming weeks, or in other words, is a flash crash imminent? While we will have more to say on this especially pertinent topic, here is the punchline from Nomura’s Takada who notes that at least for now, the main focus should be whether an unforeseen rise in 10yr UST yields will cause hedge funds overall to cool off on their US equity long positions, which have already reached a saturation point.

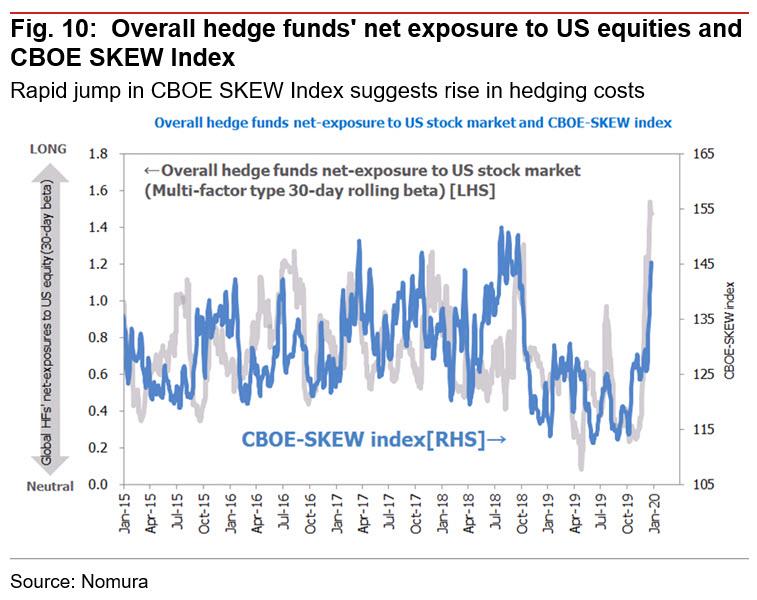

Meanwhile, don’t tell the bulls, but the CBOE SKEW Index (also known as the black swan index) has been steadily rising recently.

Still, as Takada explains, “this should be seen not as straightforwardly forecasting a sharp stock market correction but rather as indicating that hedging costs against the risk of an unexpected downward adjustment in share prices within one month have risen as a result of rapid growth in equity long positions by hedge funds overall.”

So while a flash crash may not be imminent, some investors are starting to quietly brace for one, and as Nomura concludes, “some hedge funds appear to have begun to show wariness toward a backlash from optimism even against the backdrop of a ‘melt-up’ in global equities.”

Tyler Durden

Fri, 12/27/2019 – 13:39

via ZeroHedge News https://ift.tt/2Q1Rz8D Tyler Durden