Life Comes At Us Way Too Fast: One Banker’s Striking Explanation Why Nothing Makes Sense Any More

Deutsche Bank’s postmodern philosopher-cum-credit strategist Aleksandar Kocic, who missed his true calling and instead of writing a sequel to Ulysses, Finnegan’s Wake or some other pomo stream of consciousness piece in the style of Lacan, Derrida, Deleuze (or even Foucault, Beckett, Ginsberg or Burroughs) was reduced, no pun intended, to predicting the future by describing the shift in yield curves or their “Greek” derivatives, has always had a way with words and he certainly uses them in his 2020 vol market outlook which can be summarized – and we use the term very loosely – as follows, in his own words: “We see last year as the final stage of an on-going process of vega collapse caused by the chronic lack of demand, disruption of the vol/leverage cycle, and activity of the Central Banks. At the core of these developments resides an emerging new perspective of uncertainty: On top of the structural drivers, low volatility levels, compressed vol risk premia, and flat vol forwards present an articulation of the flattening of horizons.”

Like we said, “a way with words.”

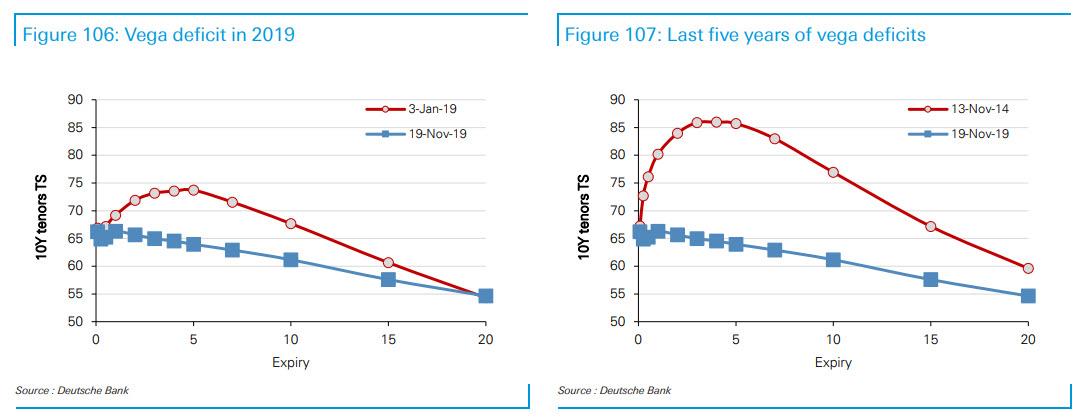

While it would be an injustice to the Deutsche Banker to summarize what he talks about in simplistic terms (the problem with post-modernism is that it can’t by definition be reduced, hence why nobody really reads it), what the Serbian strategist focuses on in broad strokes is the ongoing collapse of vega (and its deficit), which however may be approaching the “boundaries of vol decline” (i.e., the moment when the Fed loses control so to speak)…

… the persistence of low volatility risk premia, with Implied/Realized vol ratios free-falling from nearly 130% during the summer to current 70-80% range, even as volatility risk premia away from rates remain above 100%, as central banks do everything to surpress rate vol…

… amid a structural shift in the vol market across two decades, the first culminating with the 2008 crisis, in which the “vol market was demand driven”, a period of “unprecedented systematization of mortgage hedging practices and concentration of negative mortgage convexity in a relatively small number of portfolios, as well as an aggressive growth of the hedge funds

community…”

… which however was followed by a “new equilibrium” defined by the post-2008 regulatory changes, nationalization of mortgage negative convexity, reduction of risk appetite, and recentering of supply and demand. In this decade, Kocic proposes that “the most significant change was the disappearance of the mortgage related demand, severance of the transmission mechanisms and the new role of Central Banks.” To wit, the “Fed has transformed from uninvolved player to an active convexity manager and its major supplier.” And with mortgage hedgers’ role nowhere nearly as significant as before the crisis, “as a consequence of regulatory changes, vol market in the second decade has been operating in an insurance mode (with more flows in out of the money vol) resulting in lumpy negative convexity distribution.”

Putting these vol market shifts in context, Kocic notes that in contrast to the beginning of the first decade, when net demand was about 50MM, or about 5% of total flows, second decade’s finale is dominated by nearly 20MM of vega surplus, or about 2% of total flows.

There is another observation of this ubiquitous collapse in vol: as Kocic “explains”, low volatility is no longer perceived as ominous, “its persistence emerges as likely while flat or inverted curve is no longer meant to be a forecast of recession. Volatility and curve are now causally trapped by each other: For volatility to return in a meaningful way, the right side of the (rates) distribution needs to open up and, for (long) rates to be liberated, risk (and volatility) has to be brought back.”

Yet for those who have followed Kocic’s observations in the rates market over the past few years, the above is not new. What may be new, however, are Kocic’s latest thoughts on why the “new normal” no longer strikes even skeptics as surreal or bizarre.

As the DB strategist writes, the persistence of low volatility levels and compressed risk premia together with their continuous decline “remains particularly puzzling in the context of the current environment where long-term risks remain abundant and substantial.”

This, of course, is another way of saying (much more simply) that vol should be far higher considering the accrued risks form a decade of capital misallocation, rising political instability, and a market that is now as illiquid and fragile as it was during the financial crisis.

So going back to what is new in Kocic’s latest report, is hiw interpretation of why the market no longer seems to care about, well, stuff. This is what he says: “in our view, such state of affairs reflects less the distribution of long-term risks then indifference to what lies ahead.”

We can admit, that we live in a time when algos and traders all seem to ignore newsflow that does not fit a given, mostly bullish, narrative and blissfully trade purely based on irrelevant, non-discounting “signals” such as momentum, or frontrunning what others are doing. This in turn traps the Fed as markets, which are no longer efficient, discounting mechanisms as a result of central bank interventions – a theory first proposed by Citi’s Matt King in 2016 – get pushed even further from equilibrium, and force the Fed to intervene after even a modest drawdown as the alternative is nearly instant risk of catastrophic market collapse should markets be forced to reappraise assets in some fundamental value context.

The implication is striking, because according to Kocic it suggests that reality itself has become too surreal:

“Given the underlying political entropy and reality contortions which it continues to produce, we are forced to abandon as inadequate the tools and frameworks that used to provide insight and access beyond immediate future and, in the absence of their replacement, confine our efforts to short-term horizons.“

What is the origin of this change in perspective? Here is Kocic again:

Perspective is not a static concept, it is a function of condition under which it is formed. In skydiving, eyeballing consists in visually assessing our distance from the ground during the fall. We evaluate our altitude and work out the exact moment we need to open our parachute based on a dynamic visual impression. At 2000 meters, immediately after the jump, we cannot see the ground approaching. But when we reach the 800 to 600 meter mark, we start to see it “coming”. The sensation is very different than when observing the ground from a “static” perspective, e.g. from the plane at the same (600m) altitude. Speed affects our perspective: As the ground “rushes” towards us, the apparent diameter of objects increases faster and faster than our distance from the ground shrinks, and we suddenly have the feeling we are not seeing them closer but seeing them move apart suddenly, as though the ground were splitting open. Perspective is dependent on speed — it is a function of acceleration.

And the punchline, which one can loosely paraphrase as “life comes at you too fast”:

When extreme events begin to saturate the info-sphere on daily basis (sometimes even intraday), reality unfolds too fast – we no longer remember (or don’t care about) the headlines from two or three weeks ago. Our perspective and assessment of the horizon (“cognitive eyeballing”) is distorted. We are blinkered by intensity of information we have to process – overwhelmed by both its quantity and speed of its arrival – and no longer seem to be unable to properly assess the risks ahead of us, and have become insensitive to them. The distorted perspective downplays the risk of “hitting the ground”. The informational intensity transcends our capacity for statistical approximation and this rarefication of control affects the temporal regime of our decision making. As a consequence, our horizons flatten and everything that resides beyond immediate future is bundled as “long-term” — we appear to be indifferent to its temporal distance — it is all equally remote and equally out of grasp and we capitulate on our efforts to forecast beyond short term horizons.

We find it amusing that it is the Wall Street strategist who tends to find delight in the absurd turns of the financial equivalents of post-modernism, not only in its linguistic realm but also its philosophy and how it applies to capital markets, that found it fitting to conclude his year ahead forecast with what can only be described as peak absurdity: to paraphrase Kocic, reality is now so perverted, with a barrage of flashing read headlines, news and events “coming at you” so fast that one can no longer discern what is signal and what is noise, that trying to not only predict the future but explain the present is at best an exercise in futility which is why markets no longer care and are “forced to abandon as inadequate the tools and frameworks that used to provide insight and access beyond immediate future”, instead focusing only on the moment.

Tyler Durden

Sat, 12/28/2019 – 16:30

via ZeroHedge News https://ift.tt/2QskJgb Tyler Durden