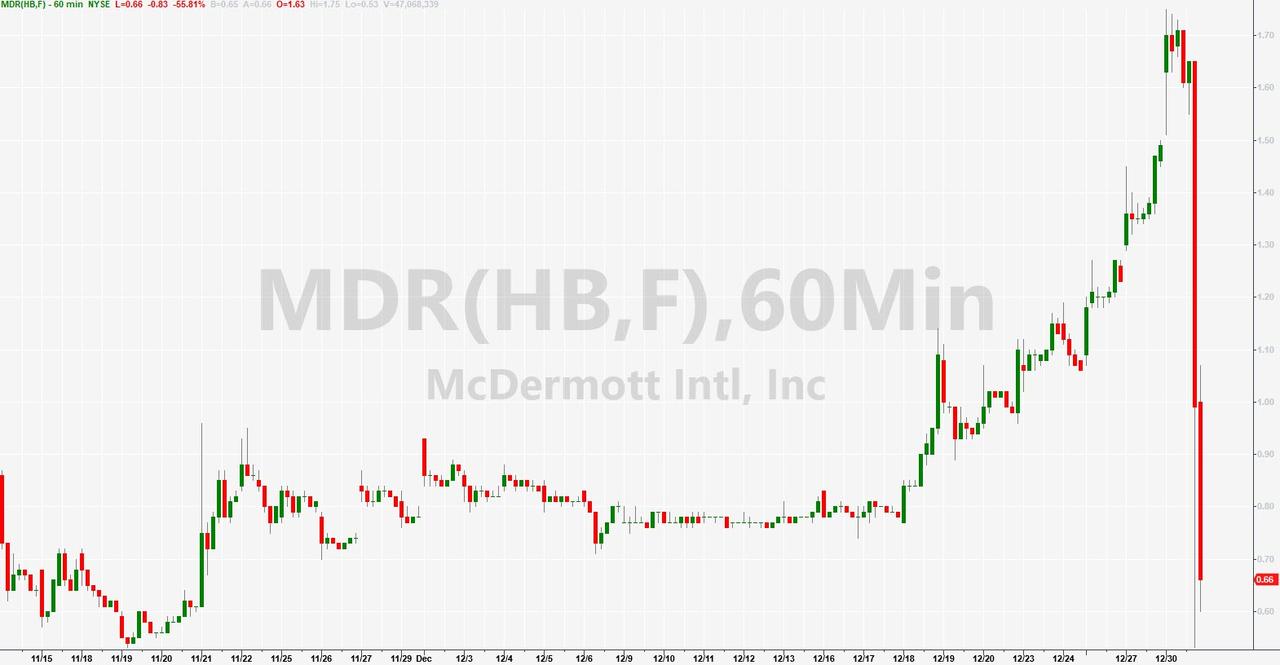

McDermott Plunges On Report Bankruptcy Filing Could Come “Within Weeks”

It’s been a bad year for McDermott shareholders and it’s about to get even worse.

The Houston-based engineering and construction giant, which has struggled this year after it reported losses on some big liquefied natural gas construction projects, and which saw its stock crushed from $10 to as low as $1 amid speculation it may restructure…

… saw its stock plunge as much as 50% on Monday afternoon before being halted, after the WSJ reported it was in talks with its lenders “to file for bankruptcy within weeks.”

According to the report, a group of lenders led by HPS Investment Partners and value investing icon Baupost, are in talks to provide a DIP loan of around $2 billion to keep the company’s operations running during bankruptcy.

The DIP loan will allow McDermott the ability to provide letters of credit, which are crucial for the construction company to continue financing projects while operating under Chapter 11 protection. Most of McDermott’s letters of credit expire within a year and need to be renewed for the company to continue its work on projects. McDermott would also will need to obtain an exit loan with the ability to provide letters of credit to emerge from bankruptcy as a viable business.

As part of the company’s proposed restructuring plan, McDermott will continue to pursue a sale process for its Lummus Technology unit in bankruptcy, the people said. The company has said it received unsolicited bids for the business, which was valued at $2.5 billion.

McDermott stock initially plunged earlier this year when it disclosed it was being investigated over disclosures about projected losses surrounding a Louisiana liquefied natural gas project. The facility, known as Cameron LNG, is being built as a joint venture between McDermott and Japan’s Chiyoda Corp.

However, as part of the year-end euphoria, the company’s loans, which dropped as low as 47 cents on the dollar in November, managed to recover some ground with prices up to more than 59 cents on the dollar on Dec. 27, according to IHS Markit even as MDR stock traded down as far as 60 cents a share, losing more than 90% of its value in the past year.

As the WSJ notes, in October, McDermott’s lenders agreed to make a $1.7 billion loan to the company in several tranches if the company met certain conditions. In early December, the company’s lenders released the second tranche—a $350 million portion of the loan.

Ahead of what now appears to be an imminent bankcuprtcy, McDermott, which has a total of some $4.3 billion in debt on its books, entered a forbearance agreement with a group of bondholders that expires on Jan. 15. It now appears that the company plans on filing for bankruptcy around that date, and has secured a DIP loan to continue operation even as it files for creditor protection.

Tyler Durden

Mon, 12/30/2019 – 15:57

via ZeroHedge News https://ift.tt/2tiltfO Tyler Durden