FOMC Minutes Give Timeline Of Fed “Transitioning Away” From Repo Liquidity Bailout

Since statement and press conference on Dec 11th, where Powell reiterated that The Fed would be on hold unless something yuuge “material reassessment in the outlook” happened, gold is the best performing asset-class (outpacing stocks) as the dollar has been the laggard…

Source: Bloomberg

And while it has been volatile, expectations for Fed actions (implied by the market) in 2020 are now slightly more dovish than before the Fed meeting…once again pricing in at least one rate-cut this year…

Source: Bloomberg

Thirteen of 17 officials forecast rates would be unchanged through the 2020 U.S. presidential election year, according to updated economic projections issued at the time, with four penciling in a quarter-point increase.

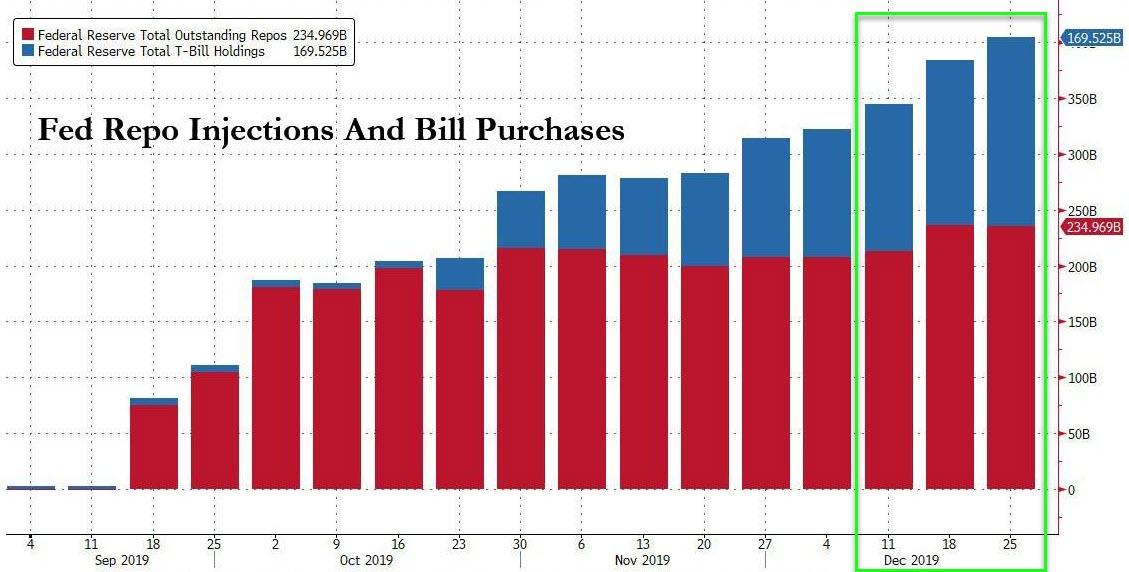

Of course, the big issue that The Fed was quietly panicking about was the repo crisis, which they have extinguished (for now) thanks to hundreds of billions of dollars puked across the ‘turn’ to ensure the holes are filled. As we noted previously, the price of year-end stability was $414 billion… $256 billion in repo injections ($211.4 term and $44.3 in overnight) and $157.5 bn in Bill purchases.

Source: Bloomberg

All of which has lifted stocks globally…

Source: Bloomberg

And as a reminder, The Fed has begun – for all intent and purpose – monetizing US debt.

* * *

So what exactly are investors looking for in the Minutes that could spook markets? Not much in the traditional sense:

“There is a satisfaction of where they are with monetary policy but there’s uncertainty about the repo market and how it is working,” said Diane Swonk, chief economist with Grant Thornton in Chicago.

“The Fed is trying to keep the market liquid. Their comfort with the repo market is much less clear-cut. It does feel like a work in progress.”

But money-market participants are anxiously awaiting any signals that The Fed might give on its longer-run operational plans (as Fed’s Evans hinted earlier today at a standing repo facility – bailout fund – going forward).

“Any views on repo markets outlined in the minutes should probably be adjusted for the year-end results, which on net have likely bolstered the Fed’s confidence that they have regained control of repo markets,” NatWest strategists led by Blake Gwinn say in Friday note

Information on the Fed’s longer-run operational plans or even their “perceived role in stabilizing funding rates or tolerance for volatility,” would be welcomed, they said. NatWest expects the central bank to start pulling back on their direct repo involvement in early 2020, and to start tapering their reserve-adding bill purchases in 2Q

And so the highlights from the Minutes include:

-

*FED: RATES LIKELY APPROPRIATE FOR A TIME ABSENT MATERIAL CHANGE

-

*FED: MANY SAW RISKS SOMEWHAT TO DOWNSIDE, SOME RISKS HAD EASED

But…

-

*FED: EXPECT TO TRANSITION AWAY FROM ACTIVE REPO OPS MID-JAN

That is not what the market was hoping for.

* * *

Full FOMC Minutes below…

Tyler Durden

Fri, 01/03/2020 – 14:03

via ZeroHedge News https://ift.tt/39LJ75o Tyler Durden