Futures Tumble, Oil, VIX And Gold Soar As Markets Brace For Iran’s “Severe Retaliation”

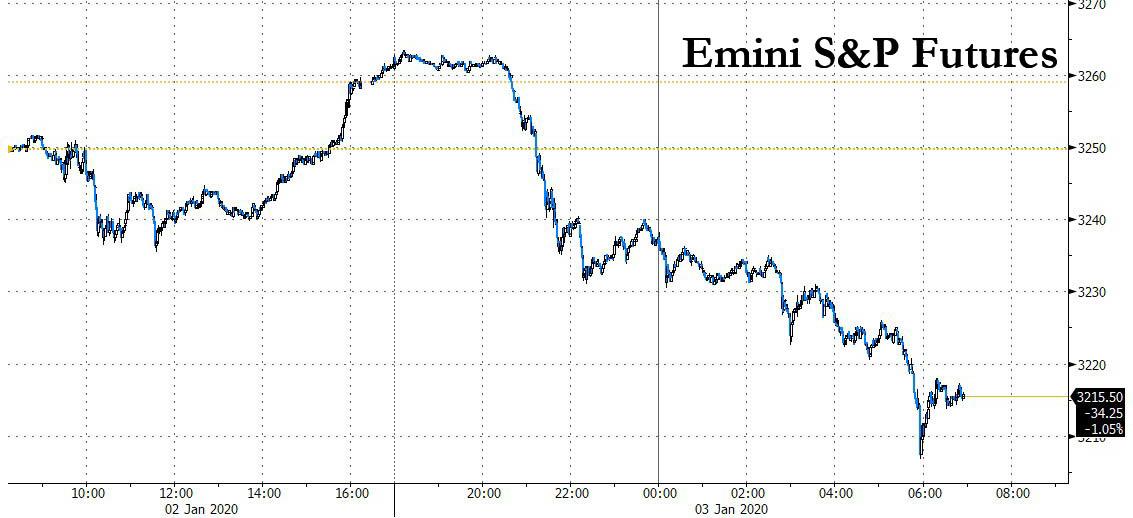

It has been a turbulent start to 2020 with markets soaring on the first day of trading of the new year and decade, only to tumble overnight after a U.S. air strike in Iraq killed a top Iranian commander, sharply escalating geopolitical tensions in the Middle East and denting risk appetite, sending world markets sharply lower and US equity futures down more than 1% overnight…

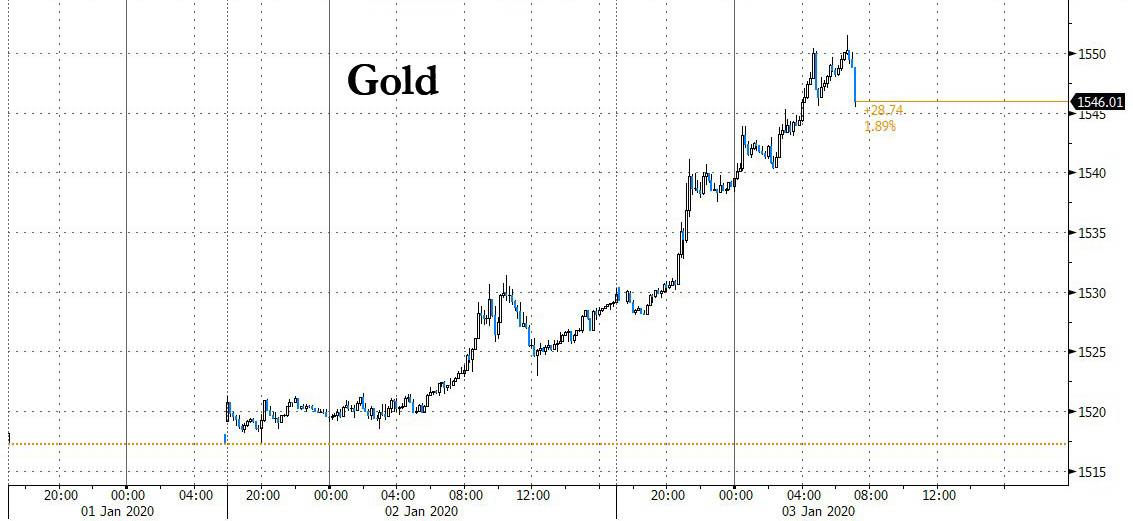

…. while safe havens such as gold jumped…

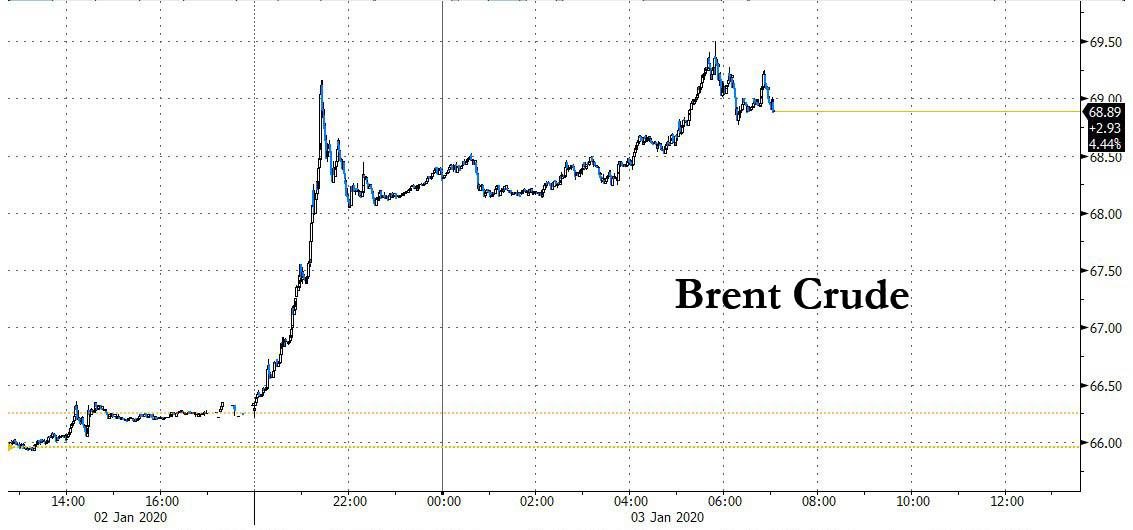

… and oil soared $3 a barrel with safe havens such as Treasurys and the yen jumping.

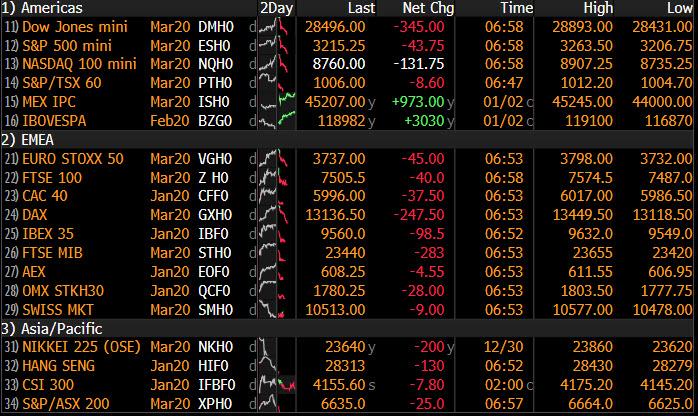

At 5am ET, Dow e-minis were down 347 points, or 1.2%. S&P 500 e-minis EScv1 were down 44 points, or 1.35% and Nasdaq 100 e-minis were down 139.75 points, or 1.57%, while world stocks were a sea of red. Looking ahead, focus will be on magnitude of the response from Iran and the subsequent response to any measure by other regional powers and of course the US.

Iran’s Supreme Leader Ayatollah Ali Khamenei vowed “severe retaliation” after Suleimani was killed in the air strike in Baghdad that was authorized by President Donald Trump and Iraqi President Barham Salih condemned the move, while China urged restraint to avoid further tensions. Iranian Supreme Leader Khamenei said harsh revenge awaits those who assassinated Senior IRGC Commander Soleimani and added that the killing will double motivation for resistance against the US and Israel.

Iranian Revolutionary Guard Corp officer said Iran will take revenge on the US for the death of Soleimani, while Iranian Foreign Minister Zarif tweeted “The US’ act of international terrorism, targeting & assassinating General Soleimani is extremely dangerous & a foolish escalation”, and added that US will bear responsibility for all consequences. Iran’s top security body is to meet to discuss the “criminal attack” against Senior IRGC Commander Soleimani, according to a spokesperson quoted by FARS.

Shares of oil majors Exxon Mobil Corp and Chevron Corp rose 1.3% and 1.2%, respectively, in early premarket trading as oil prices jumped more than 4%. Occidental Petroleum Corp and Schlumberger rose about 2% each, leading premarket gains among S&P 500-listed stocks.

The VIX Index soared from its Thursday close around 12.50 to as high as 16, its biggest one day move a closing basis since August.

The Stoxx Europe 600 Index dropped 1% though energy companies bucked the retreat after West Texas oil rallied more than 4%. The Middle East-focused oil markets saw the most dramatic moves, with Brent crude futures jumping nearly $3, or 4.5%, to $69.20 a barrel – also to the highest since September.

Earlier in the session, Asian stocks reversed early gains as risk-on sentiment quickly faded amid surging Middle East tensions. The MSCI Asia Pacific excluding Japan Index fell 0.2%. Oil stocks rallied, with a sub-industry index jumping 0.8% on a spike in crude. Hong Kong’s Hang Seng Index reversed a rally, dragged by large financial stocks like China Construction Bank Corp. and HSBC Holdings Plc. Australia’s S&P/ASX 200 managed to stay in the green. Japan remained closed for a holiday

“Geopolitics has come back to the table, and this is something that could have major cross-asset implications,” said Lombard Odier’s chief investment strategist, Salman Ahmed.

The flare-up could “dash market hopes for a rebound of the global economy that is still to emerge from under the cloud of the U.S.-China trade war,” said Valentin Marinov, the London-based head of G-10 currency research at Credit Agricole SA. “Risk sentiment should remain fragile also because central banks may be slow to respond or simply no longer have the arsenal to respond in an adequate way.”

The assassination of Suleimani derailed a bullish mood that pushed the S&P 500 to a record high Thursday. Traders had returned from holidays to the news that China’s central bank had moved to support the economy and President Donald Trump expected to sign the first phase of a trade deal with the Asian nation on Jan. 15. Beijing has yet to confirm the date.

As traders fled risk, gold hit the highest in four months and the yield on 10-year Treasuries looked poised for the biggest drop in three weeks as government bonds globally rallied. Data showing German unemployment increased by more than forecast compounded the cautious mood in Europe, and the euro extended losses as the DAX Index led equity declines.

In FX, the yen advanced to the strongest since November, and the Swiss franc hit its highest against the euro since September. The Bloomberg Dollar Spot Index extended gains in the London session, with the Swedish krona and Australian dollar leading losses; the Swiss franc strengthened against the euro. Yields on 10-year Treasuries touched the lowest since Dec. 12; money markets now almost fully expect the Federal Reserve to cut interest rates in January 2021, compared with an 80% probability on Thursday.

In commodities, WTI and Brent are significantly firmer this morning, currently trading with gains in excess of $3/bbl and have eclipsed their overnight highs. In terms of the crux of the newsflow, overnight the US assassination of Iranian Military General Soleimani sparked significant upside for the complex and a broad risk-off tone. Subsequently, the Iranian Government has stated the response to this is not far away and will be strong.

Moving to metals, where spot golds action is also dictated by the risk-off geopolitical news. The yellow metal BRIEFLY just eclipsed the USD 1550/oz mark and of note is the 2019 high at USD 1557.11/oz; it is worth caveating that the USD is also experiencing a safe-haven bid this morning which will be hindering the precious metals progress.

Market Snapshot

- S&P 500 futures down 1.1% to 3,223.50

- STOXX Europe 600 down 0.7% to 416.66

- MXAP down 0.04% to 171.85

- MXAPJ down 0.2% to 556.75

- Nikkei down 0.8% to 23,656.62

- Topix down 0.7% to 1,721.36

- Hang Seng Index down 0.3% to 28,451.50

- Shanghai Composite down 0.05% to 3,083.79

- Sensex down 0.5% to 41,439.23

- Australia S&P/ASX 200 up 0.6% to 6,733.50

- Kospi up 0.06% to 2,176.46

- German 10Y yield fell 5.8 bps to -0.281%

- Euro down 0.2% to $1.1149

- Brent Futures up 3.6% to $68.60/bbl

- Italian 10Y yield rose 0.2 bps to 1.243%

- Spanish 10Y yield fell 5.2 bps to 0.393%

- Brent Futures up 3.6% to $68.60/bbl

- Gold spot up 1.3% to $1,548.28

- U.S. Dollar Index up 0.1% to 96.94

Top Overnight News from Bloomberg

- A U.S. airstrike in Iraq ordered by President Donald Trump killed one of Iran’s most powerful generals, sending global markets tumbling as Iran’s Supreme Leader threatened “severe retaliation”

- Gold rose to a four-month high after the U.S. airstrike, while silver, platinum and palladium all advanced; Oil jumped toward $70 a barrel in London

- The Federal Reserve may drop a hint on plans for the repo market in minutes of its December meeting, plus what it would take to shift the view among officials that interest rates are on hold all year

- Just as the world economy was stabilizing after its worst performance in a decade, a U.S. airstrike in Iraq that killed one of Iran’s most powerful generals is a jolting reminder of how fragile the outlook remains

- German unemployment rose at the end of 2019, signaling that Europe’s biggest economy remains mired in uncertainty as manufacturing contracts and the government resists calls for fiscal stimulus

- Spain is set to finally get a new government after the acting premier, Pedro Sanchez, persuaded a Catalan separatist party to help him take office for a second term.

Asian equities failed to benefit from the rally seen by global peers in which the major bourses on Wall Street headed into the close in fresh record territory. Tech-giant Apple briefly surpassed the USD 300/shr milestone for the first time, whilst chip names were bolstered by AMD’s +7% surge after a 45% price target boost by analysts at Instinet. In overnight trade, US equity futures alongside regional bourses saw downside which coincided with reports of North Korea’s official newspaper warning of “immediate and powerful” strikes against threats and with sentiment dampened by concerns in the Middle East. Japanese markets remained closed amid an extended New Year holiday, whilst ASX 200 (+0.7%) was bolstered in early trade with all sectors initially in the green and with the heavily weighted financial sector leading the gains. Similarly, South Korea’s KOSPI (U/C) also saw early upside with heavyweight chipmaker SK Hynix advancing over 3% as semiconductor names piggy-backed on Wall Street’s stellar chip performance – similar gains were seen in TSMC shares at the Taiwan open. Hang Seng (-0.3%) was originally kept afloat by energy giants benefitting from the sudden rise in oil prices before the index conformed to the overall risk appetite, whilst Shanghai Comp (U/C) traded somewhat lacklustre following a net weekly liquidity drain of CNY 550bln by the PBoC.

Top Asian News

- Top Iranian Commander Killed in U.S. Airstrike in Iraq

- Here’s What You Need to Know About Asia Stock Markets Today

- Hong Kong Dollar Surges to Strongest Since 2017 as Shorts Unwind

- How Qassem Soleimani Helped Shape the Modern Mideast: QuickTake

European bourses are subdued this morning by the risk-off tone given geopolitical events in the middle-east which has dominated price action thus far (more information available in the Commodity section below, as well as the Newsquawk headline feed). Bourses are in negative territory across the board with no notable laggard; however, the FTSE 100 (-0.3%) is holding up somewhat better than its peers gleaning assistance from the upside in Energy names given the crude complex’s action, for instance BP (+1.7%), Shell (+1.4%). Additionally, at the tope of the FTSE 100, is Fresnillo (+2.4%) shining alongside other mining names given the safe-haven bid in gold today. In terms of sectors, unsurprisingly given the aforementioned newsflow, energy names are the only sector in positive territory; with the remaining sectors experiencing broad-based losses. In terms of individual movers, and sticking with the geopolitical tensions, flight names including Air France (-7.8%), Lufthansa (-7.0%) and easyJet (-3.5%) suffering on the higher oil prices. Aside from the crude-related movers, tobacco names are firmer this morning following on from the FDA’s issuance of new guidance. While UK gambling names were subdued at the open on reports that the gambling commission is considering a ban on VIP schemes in Britain; for reference, a number of the relevant Co’s are heavily dependent on such schemes.

Top European News

- U.K. Consumer Credit Grows at Weakest Pace in Six Years

- U.K. Construction in Longest Slump Since Financial Crisis

- Commerzbank Buys Comdirect Shares From Petrus, Holds >90%

In FX, the Dollar revival from turn of the year and decade lows continues, as the DXY inches above 97.000 from sub-96.500, and the latest rebound has been fuelled by safe-haven demand amidst heightened US-Iran tensions following an airstrike reportedly sanctioned by President Trump targeting and killing an IRGC general. Technically, a clear breach of the big figure could see an extension or further retracement to Xmas Day lows of 97.344 ahead of 97.350, 97.500 and the high of December 27 (97.552) before the index slumped on all round Greenback selling.

- JPY/XAU/CHF – The Yen and Gold are both still bucking the overall trend and outperforming due to their status as ultimate ports of security in a storm, though Usd/Jpy has bounced from circa 107.91 and Xau/Usd could not sustain momentum through the psychological 1500/oz level as the Buck built on gains more broadly, while chart watchers will be aware that support lies at 107.89 for the Dollar and last year’s Bullion peak was 1557.11. Elsewhere, the Franc remains somewhat betwixt and between, with Usd/Chf firmly elevated towards the upper end of a 0.9690-0.9743 range in stark contrast to Eur/Chf that is looking at 2019 lows within a 1.0825-55 band.

- CAD/EUR/NOK/SEK/AUD/NZD/GBP – All victims of the aforementioned return to risk aversion, albeit to varying degrees as the Loonie and Norwegian Krona glean some protection/support from the spike in oil prices to trade back over 1.3000 vs the US Dollar and close to 9.8500 against the Euro respectively. However, the single currency has unwound more of its appreciation vs the Greenback and is now testing the 21 DMA (around 1.1128-30) having fallen below the 200 DMA (1.1142), while the Swedish Crown is back under 10.5000 in Euro cross terms and Antipodes even further away from recent pinnacles against their US counterpart, with Aud/Usd and Nzd/Usd sub-0.6950/0.6650 respectively. Finally, and fittingly in terms of current G10 rankings, Cable has given up more ground and another round number at 1.3100 in wake of a much weaker than forecast UK construction PMI.

- EM – Widespread losses on the risk-off positioning, but again the pain for Turkey’s Lira has been more apparent after stronger than expected CPI data, the inflated cost of crude and ongoing geopolitical concerns all nudging Usd/Try closer to the 6.0000 handle.

In commoditis, WTI and Brent are significantly firmer this morning, currently trading with gains in excess of USD 3.0/bbl at present, and have eclipsed their overnight highs. In terms of the crux of the newsflow, overnight the US assassination of Iranian Military General Soleimani sparked significant upside for the complex and a broad risk-off tone. Subsequently, the Iranian Government has stated the response to this is not far away and will be strong. Looking ahead, focus will be on magnitude of the response from Iran and the subsequent response to any measure by other regional powers and of course the US. Elsewhere, today’s other focus point for the crude complex is the delayed EIA weekly metrics, although their impact on price action could be diminished given the geopolitical factors; nonetheless, expectations are for a headline draw of 3.288mln barrels, which is slightly smaller than the previous draw of 5.474mln barrels. Moving to metals, where spot golds action is also dictated by the risk-off geopolitical news. The yellow metal has, at best, just eclipsed the USD 1550/oz mark and of note is the 2019 high at USD 1557.11/oz; it is worth caveating that the USD is also experiencing a safe-haven bid this morning which will be hindering the precious metals progress. Elsewhere, iron ore hit its highest level for around 5-months as restocking continues ahead of the China New Year, as China produces around half of the global steel supply; support also stems from Brazil’s Iron ore exports posting a decline for the month of December. Foreign oil companies have reportedly evacuated employees who are US citizens from Iraq’s Basra., Company Sources; note this will not affect their production.

US Event Calendar

- 10am: Construction Spending MoM, est. 0.4%, prior -0.8%

- 10am: ISM Manufacturing, est. 49, prior 48.1

- 2pm: FOMC Meeting Minutes

Tyler Durden

Fri, 01/03/2020 – 07:40

via ZeroHedge News https://ift.tt/2MTRQbL Tyler Durden