ISM Manufacturing Survey Crashes To Lowest Since June 2009

Manufacturing surveys from ISM and Markit have decoupled in the last few months (the latter rising, the former falling) but Markit’s PMI slipped back in December and expectations were for today’s ISM data to print slightly higher but still in contraction (sub-50).

However, the situation was considerably worse, ISM Manufacturing printed 47.2 in December (below the 49.0 expectation and 48.1 prior). This is the fifth straight month of contraction…

Source: Bloomberg

The deterioration was driven by the weakest gauges of new orders and production since April 2009. The data show American factories remain plagued by pullbacks in business investment at home, softer demand throughout the world and, until recently, an escalating trade war between the U.S. and China.

-

Production fell to 43.2 vs 49.1; lowest level since April 2009

-

New orders fell to 46.8 vs 47.2

-

Employment fell to 45.1 vs 46.6

-

Supplier deliveries rose to 54.6 vs 52.0

-

Inventories rose to 46.5 vs 45.5

-

Customer inventories fell to 41.1 vs 45.0

-

Prices paid rose to 51.7 vs 46.7

-

Backlog of orders rose to 43.3 vs 43.0

Overall, inputs indicate:

(1) supply chains began to stress in December and

(2) companies remained cautious that materials received would be consumed by the end of the fourth quarter.

Prices increased for the first time since May 2019, an inflation signal that The Fed is not expecting:

“Starting to see suppliers try to pass on costs associated with tariffs. Uncertainty on the trade front continues to keep agricultural markets on the defensive.”

But, despite the tumble, ISM’s Fiore is hopeful…

“Global trade remains the most significant cross-industry issue, but there are signs that several industry sectors will improve as a result of the phase-one trade agreement between the U.S. and China. Among the six big industry sectors, Food, Beverage & Tobacco Products remains the strongest, while Transportation Equipment is the weakest. Overall, sentiment this month is marginally positive regarding near-term growth.”

This is the lowest ISM print since June 2009. Year-over-year, ISM Manufacturing looks dismal – at levels that have historically lined up perfectly with US recessions…

Source: Bloomberg

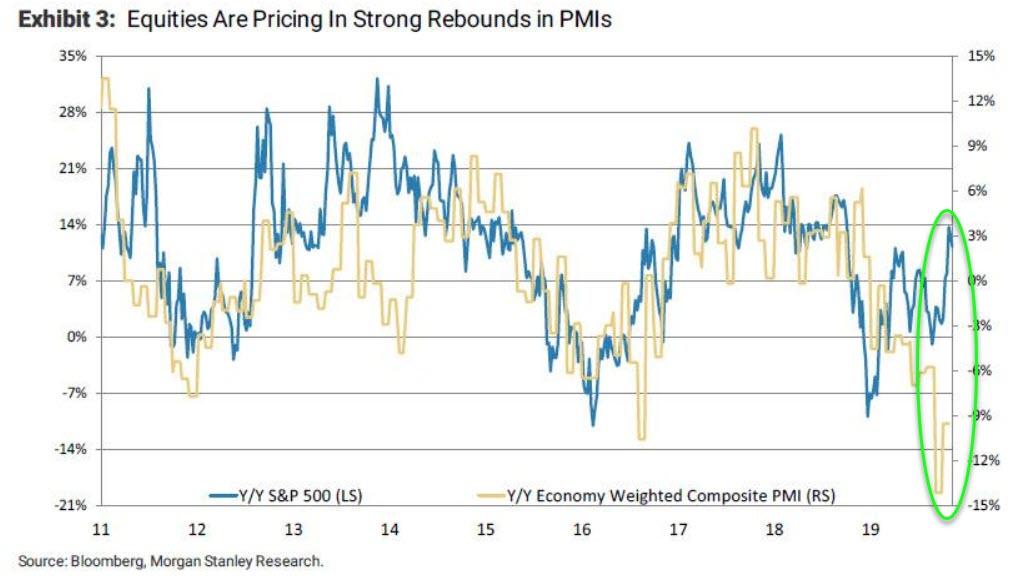

Better pay attention though as US equity markets have more than priced in a dramatic rebound in Manufacturing…

Trade Accordingly.

Tyler Durden

Fri, 01/03/2020 – 10:07

via ZeroHedge News https://ift.tt/2sITbLF Tyler Durden