Rail Traffic Continues To Plunge Amid Industrial Recession

US freight railroads have long been used as a barometer of the country’s economic health, continue to show declines in traffic, suggesting the industrial recession could persist into 2020.

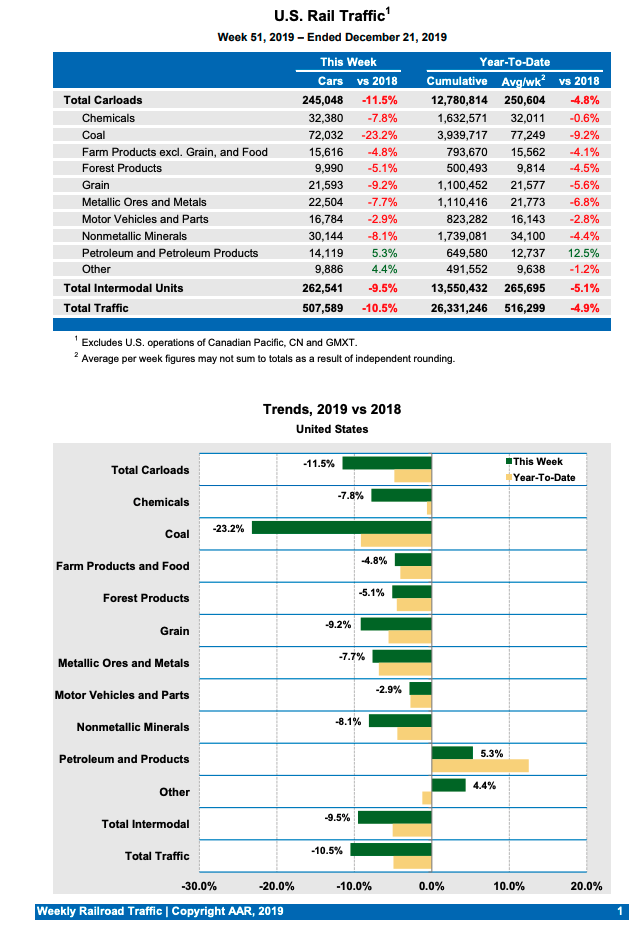

The Association of American Railroads (AAR) published a new report that shows US weekly rail traffic for the week ending December 21 was down 10.5% to 507,589 carloads and intermodal units compared with the same week last year.

Total carloads for the week were 245,048 carloads, down 11.5% compared with the same week in 2018, while weekly intermodal volume was down 9.5% to 262,541 containers and trailers.

The AAR tracks ten carload commodity groups on a weekly basis — with Petroleum and Petroleum Products and Other segments showed marginal growth over the week as all other segments including Chemicals; Coal; Farm Products excl. Grain, and Food; Forest Products, Grain, Metallic Ores and Metals; Motor Vehicles and Parts; and Nonmetallic Minerals registered declines.

For the first 51 weeks of 2019, US rail traffic across all segments was 12,780,814 carloads, down 4.8% from the same period last year; and 13,550,432 intermodal units, down 5.1% from last year. Total rail traffic in the first 51 weeks was 26,331,246 carloads and intermodal units, a 5.9% drop over last year.

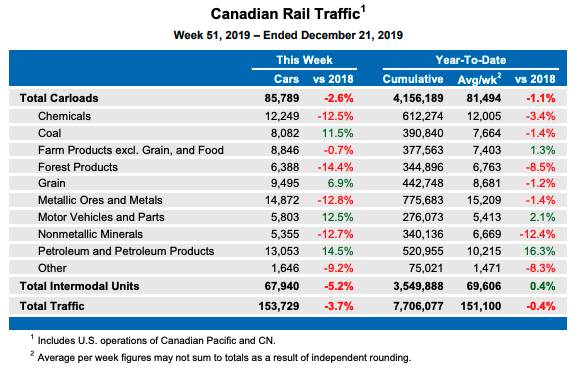

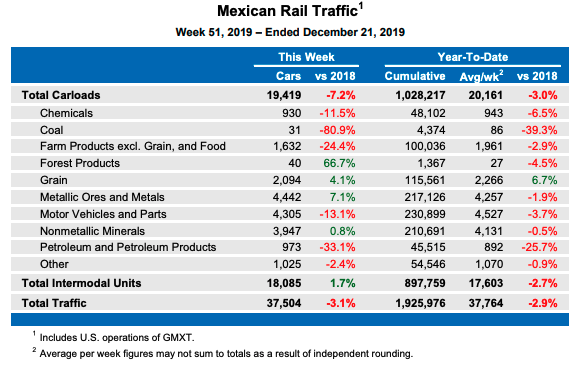

Canadian and Mexican railroads also reported traffic declines for the week and in the first 51 weeks as both countries are teetering if not already in a recession.

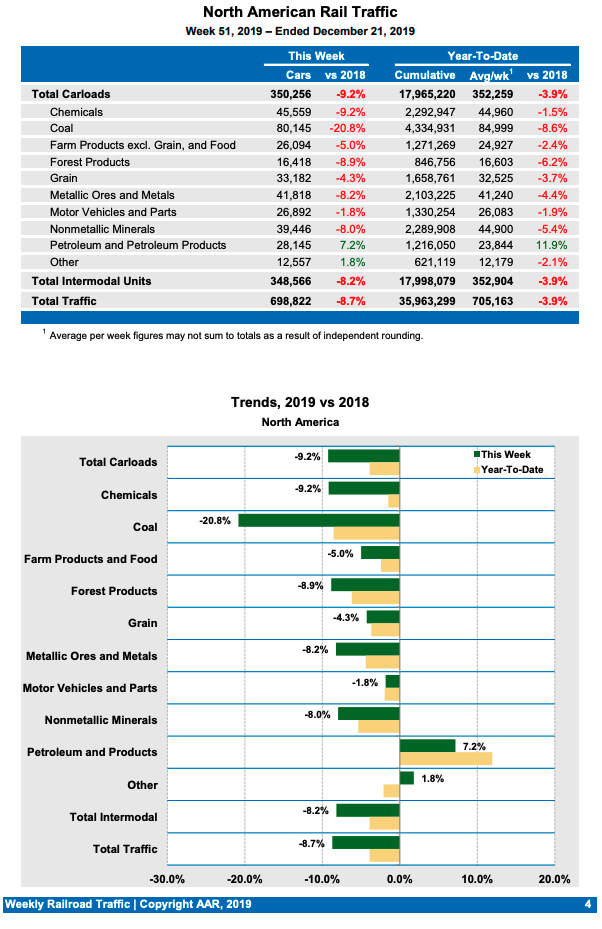

North American rail volume for the week was down 9.2% to 350,256 carloads over the same week last year, and 348,566 intermodal units, down 8.2 % over the previous year. Total combined weekly rail traffic in North America was 698,822 carloads and intermodal units, down 8.7%.

North American rail volume for the first 51 weeks of 2019 was 35,963,299 carloads and intermodal units, down 3.9% compared with 2018.

In a separate report, AAR described how 400,000 railcars currently sit in storage amid slumping rail demand.

But it’s not just rail traffic that is tumbling, class-8 truck orders collapsed last month, all of this is a symptom of an industrial recession that shows no signs of abating into 2020.

Tyler Durden

Fri, 01/03/2020 – 18:05

via ZeroHedge News https://ift.tt/36kRZwI Tyler Durden