Stocks Shrug Off World War 3 Risk, But Bonds, Bullion, & Bitcoin Surge To Start The Year

World War 3 worries? Meh, we’ve got The Fed to handle that shit!!

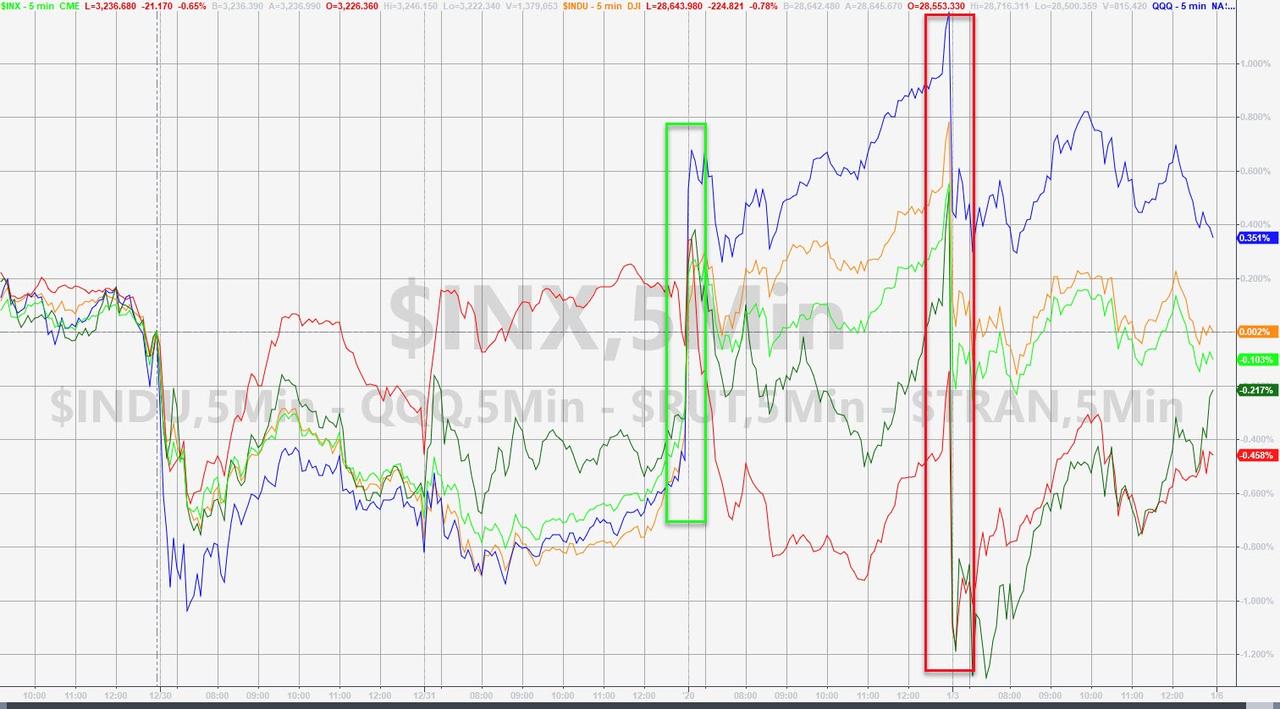

Weakness in early going in stocks – due to the potential for global war after Soleimani’s killing – were nothing but an opportunity to buy the f**king dip once again today…(as the machines used VWAP as support)…

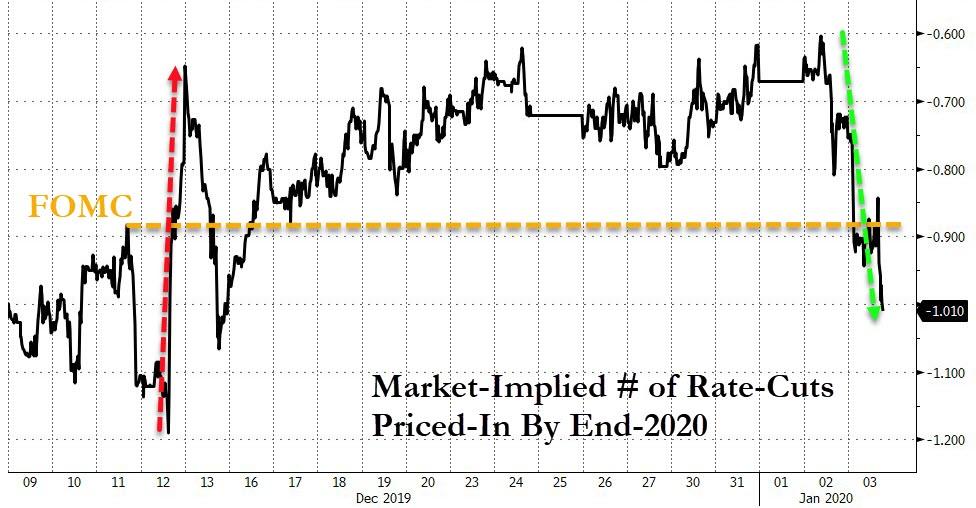

As the market immediately priced in a Fed rate-cut to save the world…

Source: Bloomberg

Oil prices spiked but ended only around 3% higher on the day…

Of course, defense stocks soared…

Source: Bloomberg

But bonds and bullion were bid as safe-havens…

On the week, only Nasdaq is notably higher…

And since the start of 2020, only Small Caps are red…

VIX and stocks remain decoupled…

Source: Bloomberg

Credit markets widened notably today, relatively more than equity protection…

Source: Bloomberg

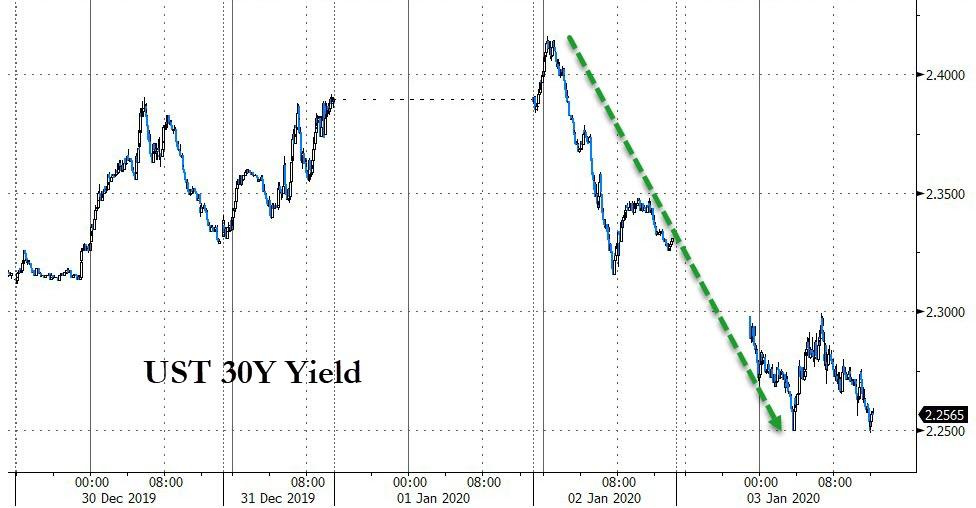

Treasury yields collapsed since the start of 2020 with 30Y yields down 13bps…

Source: Bloomberg

The 30Y Yield dropped to 4-week lows…

Source: Bloomberg

The yield curve flattened dramatically…

Source: Bloomberg

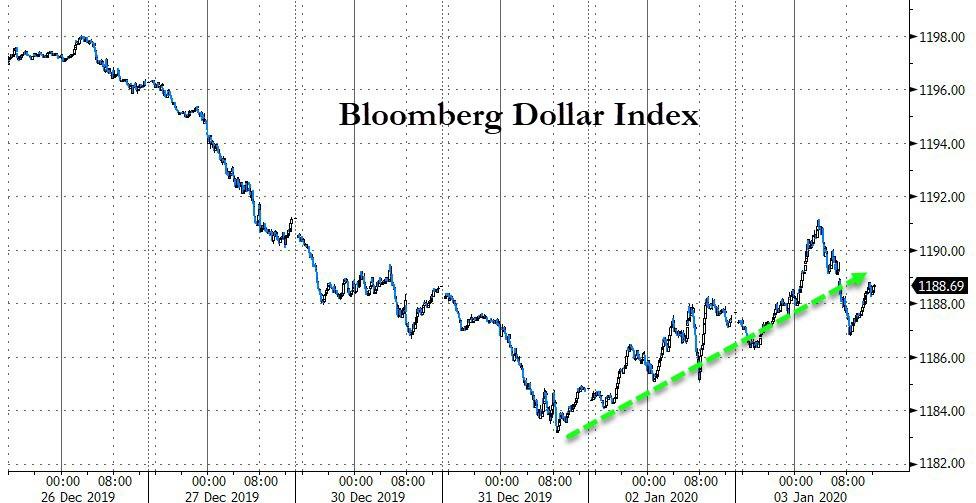

The dollar rallied for the second day in a row (despite some volatility today)…

Source: Bloomberg

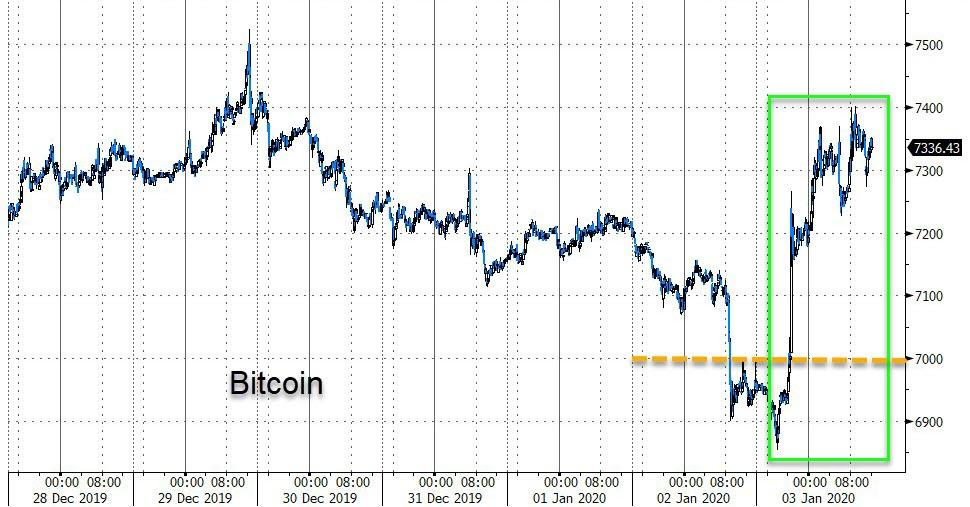

Cryptos were notably bid today following the Soleimani killing…

Source: Bloomberg

After another drop below $7k, Bitcoin surged today…

Source: Bloomberg

Copper tumbled today as gold and oil rallied…

Source: Bloomberg

Gold topped $1550 – back to its highest in 4 months…

And as Bloomberg reports, heightened Middle East tensions are boosting bets on further gains for gold as a haven asset. Volatility in call options giving holders the right to buy futures at a pre-set price reached the highest in almost three months against puts, which provide the right to sell the metal.

The skew shows that investors are increasingly bullish on bullion, even with prices already near a six-year high in the wake of the U.S. air strike that killed a top Iranian commander.

Source: Bloomberg

Finally, US macro data is negative and disappointing notably (today’s ISM at 10 year lows) with stocks just shy of record highs…

Source: Bloomberg

And some remember what happened last time…

Source: Bloomberg

Tyler Durden

Fri, 01/03/2020 – 16:01

via ZeroHedge News https://ift.tt/37zeVs2 Tyler Durden