Stock Futures Stage Tremendous Rebound From Overnight Crash On Optimism Worst Of Iran Crisis Over

S&P500 index futures erased their earlier crash, after tumbling more than 50 points following news Iran launched ballistic missiles at US airbases in Iraq, as investors turned optimistic and looked past the missile strikes focusing instead on Iran’s comments that the country isn’t “seeking escalation or war” and Trump’s tweet that “all is well.” As a result, S&P 500 e-mini futures up around 0.1%, after earlier sliding as much as 1.7%, with global markets broadly in the green too.

Following the targeted strikes, both Iran and U.S. President Donald Trump left the door open for lowering tensions: Iran’s Foreign minister Javad Zarif said the country had “concluded proportionate measures” and didn’t seek war, while Trump tweeted “All is well!” and plans to make a statement later Wednesday.

Oil had surged above $70 a barrel, while gold held at new seven-year highs after the missile attack on the Ain Al-Asad air base and another in Erbil in Iraq, hours after the funeral of an Iranian commander who was killed by a U.S. drone strike last week. But with no human casualties from the attack, the dash for safe-haven assets petered out, allowing S&P500 futures, down almost 2% at one point, to trade around flat.

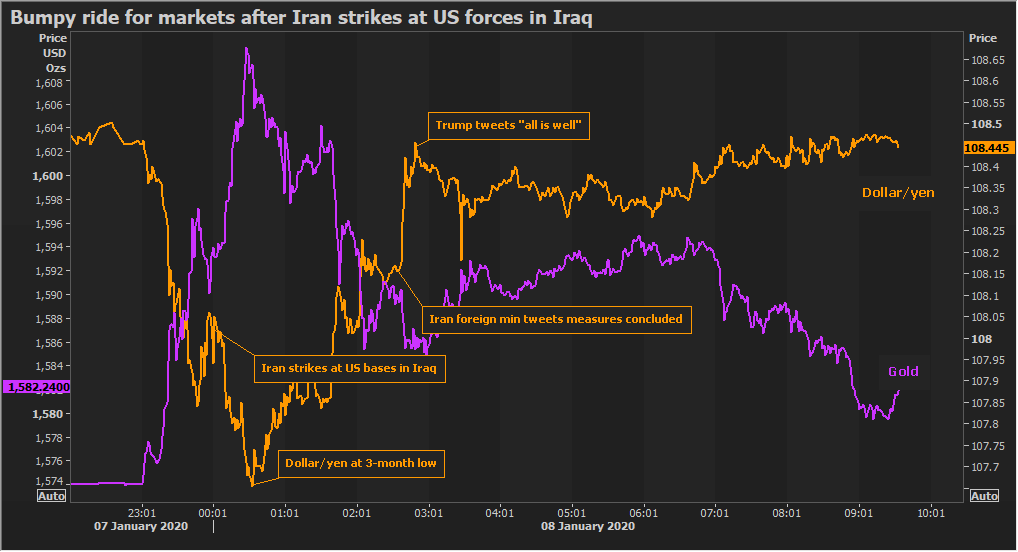

The Japanese yen, which surged almost 1% to three-month highs after the attacks, also eased back to trade flat on the day at 108.450. Brent crude futures slipped off highs to below $69 a barrel.

“The live situation was optically quite dramatic but the important thing to focus on is the no-human-casualty dimension, which gives ample space to de-escalate the situation,” said Salman Ahmed, chief investment strategist at Lombard Odier Investment Managers. “The Trump factor is the random factor but what’s visible is that no one wants war and that’s what markets are focusing on.”

Separately, Boeing shares slipped in pre-market trading after one of its 737s crashed after take-off in Iran, with early assessments suggesting the incident was caused by a technical issue.

In Europe, the Stoxx Europe 600 Index erased most of an earlier decline after opening 0.5% lower, while all major Asian equity markets fell earlier as they closed before the wave of “optimism” spread across markets. The MSCI Asia Pacific Index declined for a third time in four days, with regional markets a sea of red. Japanese shares were some of the biggest losers, with Toyota Motor Corp. and Mitsubishi UFJ Financial Group Inc. leading the drop in the Topix index. The Shanghai Composite Index fell the most in two weeks, with Industrial and Commercial Bank of China Ltd. and China Life Insurance Company Ltd. down. World leaders have urged restraint and moved to recall their citizens after Iran fired the missiles in its first counterattack since the killing of General Qassem Soleimani by American forces. U.S. President Trump said in a tweet that “all is well,” and he will be making a statement. Get Used to the Swings

A gauge of high-yield credit risk in Europe rose to the highest in about a month. Gold punched above $1,600 an ounce for the first time since 2013 before the move eased.

MSCI’s index of global equities pulled back 0.2% but remained less than 1% off recent record highs.

That said, some are stunned at the market’s reaction, pointing out that there is no reasonable argument why stocks should be higher than their Tuesday close.

The idea of futures being green is the market literally saying “things are better off since yesterday’s close”

Since yesterday’s close Iran has fired a dozen missiles at a US base without a response from Trump & an airliner that’s a major Dow component suffered another crash

— Quoth the Raven (@QTRResearch) January 8, 2020

Wednesday’s swings mark the latest bout of volatility sparked by U.S.-Iran tensions, as investors tried to assess how far the situation will escalate. As Bloomberg notes, the nervousness is denting optimism spurred by the improving outlook for global commerce, with a Sino-American trade deal expected to be signed next week.

The missile attacks “triggered a short period of market volatility overnight but FX and bond moves have largely been reversed,” Kit Juckes, the chief currency strategist at Societe Generale SA in London, wrote in a note. “The consensus view is still that major escalation is unlikely.”

Some argue it will take a hawkish statement from Trump or more attacks by Iran to drive the next phase of the risk selloff.

“We are looking out for whether the U.S. is going to retaliate, so it’s going to be a big wait-and-see mode until we hear from Trump,” Ashley Glover at CMC Markets in Sydney. “We are seeing that ‘buy the dip’ mentality creeping in as big long-term investors like to buy into these weaknesses.”

Bond-buying also faded, with yields on benchmark 10-year U.S. Treasury notes at 1.81%, down one basis point on the day but well off session lows around 1.705%. The 10-year German government bond yield was unchanged on the day at -0.284% after earlier falling to -0.299%. U.S. 10-year Treasury futures had earlier peaked at their highest level since November, and were last up 0.18%.

On currency markets, the attacks had sent the yen spiralling to three-month highs beyond 107.7 per dollar but gave up all those gains to trade flat at 108.4. Another safe-haven currency, the Swiss franc, also gave up knee-jerk gains. “If the market was really worried that the end of the world was nigh, dollar/yen would have collapsed, and that’s clearly not been the case,” said Stuart Oakley, global head of flow FX at Nomura in Singapore. The euro was 0.2 weaker, buying $1.1129 and the dollar index was up 0.1% at 97.10.

The buying of gold and oil also eased as the trading session wore on – Brent crude futures which had shot to $70 per dollar, were last up 0.5% at $68.1 per barrel. Gold, which earlier brushed through $1,600 an ounce, eased to $1,582.

Lombard Odier’s Ahmed said he had not reduced equity holdings overall but had increased exposure to energy stocks. “We adopted a long oil hedge to portfolio and we are maintaining that… Oil may be one market that’s not reflecting geopolitical risks.”

Economic data include mortgage applications, ADP jobs report. Walgreens, Constellation Brands are due to report.

Market Snapshot

- S&P 500 futures little changed

- MXAP down 0.8% to 169.90

- MXAPJ down 0.6% to 551.59

- Nikkei down 1.6% to 23,204.76

- Topix down 1.4% to 1,701.40

- Hang Seng Index down 0.8% to 28,087.92

- Shanghai Composite down 1.2% to 3,066.89

- Sensex down 0.1% to 40,811.86

- Australia S&P/ASX 200 down 0.1% to 6,817.63

- Kospi down 1.1% to 2,151.31

- STOXX Europe 600 down 0.2% to 416.67

- German 10Y yield rose 4.5 bps to -0.24%

- Euro down 0.1% to $1.1137

- Brent Futures up 0.5% to $68.62/bbl

- Italian 10Y yield rose 1.6 bps to 1.207%

- Spanish 10Y yield rose 0.7 bps to 0.404%

- Gold spot up 0.5% to $1,581.82

- U.S. Dollar Index unchanged at 97.01

Top Headline News from Bloomberg

- President Donald Trump tweets “All is well! Missiles launched from Iran at two military bases located in Iraq. Assessment of casualties & damages taking place now. So far, so good! We have the most powerful and well equipped military anywhere in the world, by far! I will be making a statement tomorrow morning”

- The Islamic Revolutionary Guard Corps claimed responsibility for the barrage, which the Pentagon said was launched from Iran. A total of 15 rockets were launched, 10 of which hit the Ayn al-Asad base in western Iraq and another facility in Erbil, according to two U.S. officials. Another struck the Taji air base near Baghdad while four fell out of the sky. Iranian Foreign Minister Mohammad Javad Zarif said on Twitter that the government took “proportionate measures in self-defense” after the Soleimani strike

- Iranian Foreign Minister doesn’t have any statistics on fatalities in the Iranian attacks on U.S. targets in Iraq, he told reporters in comments broadcast on TV. Zarif said he’s sent a message to the Americans “immediately after the attack” but did not elaborate on its contents; both Iran and Trump left the door open for lowering tensions after the Islamic Republic’s retaliation for the killing of General Qassem Soleimani last week

- U.S. aviation regulators issued new restrictions barring civilian flights over Iraq, Iran, the Persian Gulf and the Gulf of Oman, the agency said Tuesday night in an emailed statement. A Boeing Co. 737 jet carrying at least 170 people crashed in Iran due to technical problems shortly after taking off, according to a local media reports

- Global crude markets are well supplied, and OPEC and allied producers will respond if necessary to spiking tensions in the region, U.A.E. Energy Minister Suhail Al Mazrouei told reporters in Abu Dhabi

- Currency traders in Asia were left nursing losses after algorithmic programs exacerbated a whipsaw session caused by Iran’s response to the U.S. attack

- Riksbank Governor Stefan Ingves signaled that the Swedish central bank’s decision to raise its main rate to zero last month won’t be followed by more tightening for a very long time. German manufacturing orders unexpectedly fell in November, adding to signs that Europe’s largest economy is still struggling to overcome its worst industrial downturn in a decade

- Boris Johnson will tell European Union Commission President Ursula von der Leyen on Wednesday that his government is only interested in negotiating a free trade agreement with its largest market, and that he’s determined to achieve it by the end of the year

- House Speaker Nancy Pelosi said she wants to see the resolution that Senate Majority Leader Mitch McConnell plans to put forward setting out the rules for Trump’s impeachment trial. McConnell says Republicans have votes to set Trump trial terms

Asian equity markets traded lower across the board, albeit well off lows – as sentiment took a hit after Iranian forces carried out multiple attacks on Iraqi bases housing US personnel and allies, as part of the IRGC’s operation to avenge its commander’s assassination. Nikkei 225 (-1.6%) initially plumbed the depths and underperformed amid headwinds from a geopolitically bid JPY and with the index briefly dipping below the 23k level as almost all its stocks traded in the red. ASX 200 (-0.1%) fared better as downside was cushioned by the large-cap miners and energy names benefitting from price action in the respective complexes. Elsewhere, Hang Seng (-0.9%) and Shanghai Comp (-1.2%) conformed to the risk aversion, with losses in the mainland initially mitigated to an extent by the anticipated US-Sino Phase One trade deal signing next week. Finally, KOSPI (-1.1%) failed to glean support Samsung Electronics’ (+2.3%) prelim earnings – which flagged a smaller-than-forecast fall in quarterly operating profits, with some analysts noting it indicates that memory chip prices have bottomed out quicker than anticipated. APAC bourses climbed off lows after reports that US President Trump will not be addressing the nation – seen as a positive at the time as it indicates the US may not immediately retaliate. Furthermore, sentiment showed a slightly more pronounced turnaround after President Trump acknowledged the missile attack and noted that “all is well”.

Top Asian News

- China’s 58 Home Is Said to Seek U.S. IPO of Online Services Arm

- Why in India, 5% GDP Growth Is Cause for Alarm: QuickTake

- EF Education First Is Said to Shortlist Bidders for Chinese Unit

- Ghosn Nearly Crossed Paths With Japan Prime Minister as He Fled

European bourses are softer this morning, as sentiment has switched from yesterday’s cautious optimism back into a firm risk-off frame of mind. Losses across indices are not too pronounced, recovering from overnight price action in futures, as we await the response from US President Trump; further analysis available in the Commodity section and the Newsquawk headline feed. In terms of sectors, this has also switched from yesterday with energy names now the only sector in positive territory; although, similarly to bourses, losses across the remaining sectors are relatively modest. As such, energy names are leading the Stoxx 600 while Co’s which are typically afflicted by higher prices are holding up relatively well roughly unchanged on the day e.g. easyJet (EZJ LN). Elsewhere, its comparatively quiet on the European stock stories front. Although, the situation is significantly different in the US where focus is on Boeing (BA), -1.9% in pre-market trade, after a 737-800 craft crashed in Iran shortly after take-off. This is reportedly due to technical issues and is not, at present, believed to be linked to the ongoing Middle-East tensions; interestingly, reports note that the Iranian Civil Aviation Chief will not be returning the black box from the craft to Boeing.

Top European News

- Knot Says Brexit Deal Should Sort Out Financial Services Role

- Jefferies Keeps Aston Martin Covenants Call After Clarification

- Abu Dhabi Sovereign Fund Sells $947 Million Stake in UniCredit

- Danske Bank Fixed Income Sales Veteran Claezon Leaves

In FX, the Dollar’s broad recovery from post-Iran retaliatory strike lows is fairly representative of the overall retracement in currency and other financial markets amidst a relatively rapid turnaround in sentiment from aversion bordering on a scramble out of risk assets into safe-havens, albeit less pronounced. The DXY has reclaimed 97.000+ status and eclipsed yesterday’s high even though US Treasuries retain an underlying bid and the curve is marginally flatter awaiting the official US response after a full inspection of the bases hit in Iraq, and ahead of the next pre-NFP proxy for Friday in the form of ADP, assuming attention returns to fundamentals at some point.

- EUR – The G10 laggard after yet another shallower rebound vs the Greenback and what looks like a fix-related run against the Pound that tripped stops in the cross through 0.8465, but stopped short of testing 0.8450 or last week’s low. The single currency now appears vulnerable to Eur/Usd sell orders said to be residing near/on Tuesday’s circa 1.1125 low that could then expose decent option expiry interest at 1.1120 and even between 1.1100-05 (in 1 bn and 1.2 bn respectively).

- CHF/JPY/XAU – Very volatile trade given the aforementioned risk-off flows followed by a sharp/abrupt unwind of safe-haven premiums, as the Franc reverses from around 0.9665 back below 0.9700, Yen rotates more than a full big figure either side of 108.00 where there is a 1 bn expiry and Gold slides to circa Usd1573/oz compared to over Usd1610 at one stage.

- NZD/GBP/AUD/CAD – All narrowly mixed vs the Buck, or holding up better amidst its revival, as the Kiwi keeps tabs on 0.6650, Aussie holds off fresh 0.6850 lows, with the aid of some welcome better news on the data front via building approvals, Sterling maintains 1.3100+ status and Loonie pares some of its losses around the 1.3000 handle. However, price action remains choppy/fluid across the board, and the Pound may be prone to more Brexit headlines in wake of UK PM Johnson’s date with new EC President von der Leyen to discuss the post-January 31 transition period and Britain’s relationship with the EU thereafter.

- NOK/SEK – Some Norges Bank and Riksbank diversions for the Scandi Crowns to ponder, but not a lot new in comments from Governor Olsen or the December policy meeting minutes in truth. Hence, Eur/Nok and Eur/Sek are both largely tracking wider developments and the much improved risk tone, with the former lagging as crude prices come off the boil.

- EM – Most regional currencies are benefiting from the considerably calmer mood, bar those with close commodity links that are underperforming/hampered by the retreat in oil, bullion etc.

In commodities, another tumultuous day for markets, particularly the commodity complexes, due to the magnitude of news-flow and in the interest of time, a full briefing on recent events, including what’s next, responses so far and market reaction, is available on the Newsquawk feed. To briefly surmise the main points, overnight Iran launched missiles at two Iraqi bases (Al-Asad and Erbil), currently reports indicate that no US troops were killed but we await official confirmation of this. Markets took a firm risk-off tone, with WTI and Brent experiencing significant upside; high prints of, USD 65.65/ bbl and USD 71.75/bbl respectively. Subsequently, much of this move has pared back, with WTI now below the USD 63/bbl handle, given that comments have pointed towards a de-escalation in tensions between the US and Iran; notably, from POTUS himself. Looking ahead, focus is almost entirely on the announced press conference from US President Trump at some point today; the timing of this is currently unclear. Middle-East updates aside, we do have the weekly update from the EIA where headline crude is expected to print a draw of 3.572mln barrels which, if correct, would be a smaller draw than the 5.9mln barrels reported via API. Although, it is worth caveating that the release may draw less attention than normal given the Middle-East developments. Moving to metals, where spot gold overnight printed a fresh six-year high surpassing Monday’s just above the USD 1610/oz mark. However, similarly to crude, the yellow metals prices have drifted to reside within proximity to the USD 1580/oz figure.

US Event Calendar

- 7am: MBA Mortgage Applications

- 8:15am: ADP Employment Change, est. 160,000, prior 67,000

- 3pm: Consumer Credit, est. $16.0b, prior $18.9b

DB’s Jim Reid concludes the overnight wrap

Morning from Copenhagen for my first trip in a busy month that will take me to 11 European cities before January ends and not one of them coincides with a Liverpool game! Shame but anything to get away from the germs at home.

While I’ve slept Iran has retaliated to the killing of General Qassem Soleimani by American forces last week by firing a series of missiles at two US-Iraqi airbases. A total of 15 missiles were launched, 10 of which hit the Ayn al-Asad base in western Iraq and another facility in Erbil, while another struck the Taji air base near Baghdad and four fell out of the sky, according to US officials. Iranian Foreign Minister Mohammad Javad Zarif said after the attack on twitter that the government “concluded proportionate measures in self-defense” after the Soleimani strike. He further said that, “We do not seek escalation or war, but will defend ourselves against any aggression”. However, the Islamic Revolutionary Guard Corps (IRGC) said that further responses will be on the way while, calling the attack as the start of its “Martyr Soleimani” operation. The IRGC also said in a statement on its Sepah News website that any US response “will be met with much more pain and destruction.” There were also some unconfirmed reports that there were no US casualties in the attacks (Iranian TV says the opposite) which might be an important part of whether they feel the need to respond. Meanwhile the Pentagon said in a statement post attacks that “As we evaluate the situation and our response, we will take all necessary measures to protect and defend U.S. personnel, partners, and allies in the region.” President Trump refrained from making a statement right away after the attack and subsequently tweeted that “All is well!” and “So far, so good!” while adding that battle damage assessments continued. He said that he will make a statement this morning Washington time. It’s also of note that in the past President Trump has shown restraint in previous attacks in the region blamed on Iran which didn’t kill any US citizens. This gives a glimmer of hope that this might not lead to an all-out escalation in the conflict. There are already some commentators saying that if the US doesn’t ratchet up tensions further this could be good news for risk as it might be spun by Iran as a big response and the world can move on for now. In what seems like a tragic coincident a Boeing 737 has crashed in Iran after take off killing all on board. Usually the aircraft manufacturer will be involved in the investigations but given the tensions between the countries this story may have an unusual outcome.

The price action in the financial markets post the attack also gave a feeler that markets might not be expecting an all-out confrontation, with the futures on the S&P 500 paring losses to -0.35% after being down as much as -1.7% immediately after the attack. Similarly, Gold initially advanced +2.35% to 1611.42/ ounce, the highest since 2013 and is currently trading up +1.12% to 1591.96/ ounce while brent crude oil prices jumped to 71.75 before settling at 69.18 this morning.

Elsewhere in Asia, equity markets are seeing losses but are off their lows with the Nikkei (-1.68%), Hang Seng (-1.11%), Shanghai comp (-1.22%) and Kospi (-1.15%) all down alongside almost every index in the region. Elsewhere, yields on 10y USTs are down -4.4bps this morning while those on 10y JGBs are down -1.1bps. As for overnight data releases Japan’s November real cash earnings came in at -0.9% yoy (-0.7% yoy expected) and December consumer confidence stood at 39.1 (vs. 39.5 expected).

Back to yesterday and markets were in a bit of a stalemate before the overnight attacks with investors still cautious on geo-politics but remembering that it was only three business days ago that everyone was discussing a January melt-up for markets after the first day of NY trading. Maybe the most notable development was the first decline of this calendar year for oil, with Brent ending the session down around -1% at $68.4. As we discussed above we’ve had a bit of a round trip overnight but as we discussed yesterday our oil analysts doesn’t think that oil infrastructure is as obvious target as people might think for Iranian retaliation if it comes. So he therefore doesn’t think the elevated oil risk premium will be long-standing. Here is a reminder to his piece and reasoning (link here).

US equities did fall though making the 2020 S&P 500 count even at two sessions up and two down. It fell -0.28% mirroring moves in the Dow Jones (-0.42%) and the NASDAQ (-0.03%). Market were probably a bit nervous about Iran’s comments that it was considering 13 scenarios for retaliation. They may have also been slightly concerned at the chaos around the Soleimani funeral procession that saw 50 dead (plus over 200 injured) in a stampede and pictures of hundreds of thousands, if not millions, of Iranians take to the street these past few days. This US action has certainly stoked feelings/emotions in the Middle East.

European equities were stronger than the US though, with the STOXX 600 up +0.25%, while the DAX outperformed to advance +0.76% but is still one of the few Western equity markets down in the early stages of the year.

In sovereign debt markets, Treasuries edged higher into the close (+1.2bps) after a relatively quiet day. Meanwhile in Europe, gilts underperformed again, with 10yr yields up +2.4bps, while both Germany (+0.3bps) and France (-0.2bps) were fairly flat. In FX, the dollar performed strongly with the dollar index being up +0.35% yesterday.

In terms of economic data releases yesterday, things were more positive in the US, with the ISM non-manufacturing index for December rising to a better-than-expected 55.0 (vs. 54.4 expected), its strongest level since August. This contrasts with the ISM manufacturing index out on Friday, which fell to 47.2, its lowest level since June 2009. The gap between the two (7.8) is the highest since late 2015 and close to the highest levels of the last couple of decades.

We also got data on the US trade deficit, which fell to $43.1bn in November (vs. $43.6bn expected), its lowest level since October 2016 before President Trump’s election. Data also showed the goods deficit with China fell to $25.6bn, which was the lowest since April 2013. Reducing the US trade deficit has been a key policy goal for President Trump, and it comes ahead of next week’s expected signing of the Phase One US-China trade deal, which is taking place on the 15th.

There were a number of data releases out in Europe as well. The main one was the Euro Area inflation reading for December, with the flash estimate in line with expectations at +1.3%, and its highest level since April. That said, there doesn’t seem to be a great amount of confidence that inflation over the medium term is going to rise much higher than this, with Euro five-year forward five-year inflation swaps trading at 1.311%. Over in Italy meanwhile, data showed inflation was lower still, at just +0.5%, though this was up from +0.2% in the prior 3 months. In more positive news, Euro Area retail sales rose by +1.0% in November (vs. +0.7% expected), while the German construction PMI came in at 53.8 in December, a 9-month high.

Turning to Spain now, and Prime Minister Sánchez’s coalition government received the narrow backing of the Spanish parliament yesterday, with a vote of 167-165 in favour, thanks to 18 abstentions. The country has experienced sustained political gridlock over the last year, having gone to the polls twice in 2019 after no government could be formed following the first election in April. The subsequent election in November then saw the formation of a new coalition between Sanchez’s Socialist party and the left-wing Podemos, but they still only have a minority of seats in Parliament, having relied on the abstention of Catalan separatists in order to win yesterday’s vote.

Now to the day ahead, and the data highlights include German factory orders for November, the Euro Area’s final consumer confidence reading for December, as well as French consumer confidence also for December. From the US, we’ll get the MBA’s weekly mortgage applications and the ADP’s employment change for December. On central bank speakers, we’ll hear from ECB Vice President de Guindos along with the Fed’s Brainard. Finally, European Commission President von der Leyen and chief Brexit negotiator Michel Barnier will be visiting Prime Minister Johnson in London.

Tyler Durden

Wed, 01/08/2020 – 07:48

via ZeroHedge News https://ift.tt/2QzS9uA Tyler Durden