77% Of CFOs Say Stock Market Is Overvalued Even As They Order Record Stock Buybacks

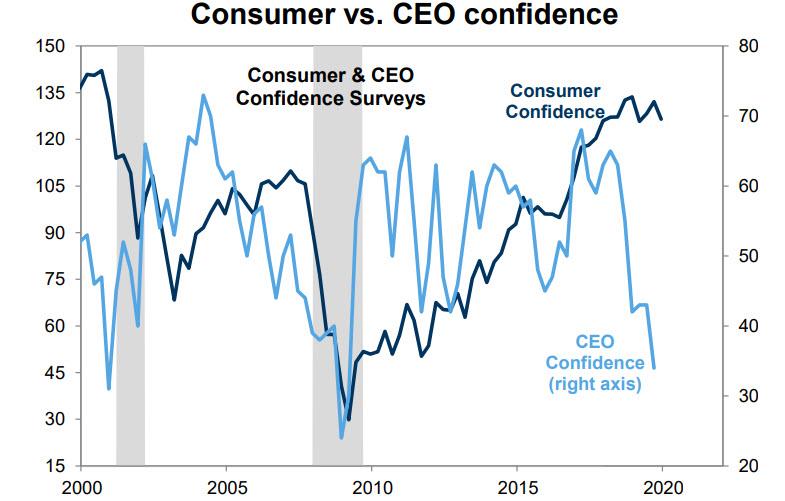

Over the past two years, a dramatic, profound divergence emerged between consumer and CEO (or corporate professional) confidence, with the former soaring to record highs while the latter tumbling to financial crisis levels.

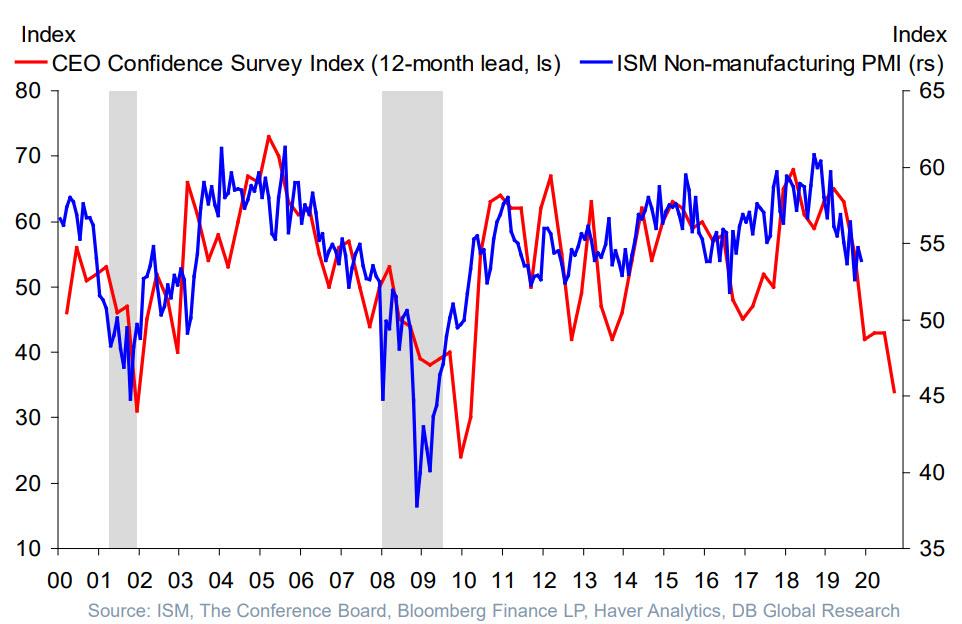

While there was no immediate explanation for this, some such as Deutsche Bank showed that CEO Confidence tends to lead the ISM Non-Mfg PMI by 12 months with uncanny accuracy, suggesting that CEO confidence and sentiment may be – as one would expect – a far more accurate indicator of where the economy is headed, where consumer confidence is merely a lagging representation of of the economy and/or stock market at any given moment.

So now that we are two weeks into the new 2020, with the worst of the trade war with China behind us and the repo crisis supposedly over (if only until April tax season), has there been any material improvement in corporate executive confidence. As it turns out, according to the latest Deloitte CFO Signal Survey, the answer is not only no, but quite the opposite, because despite the record S&P high and the recent rebound in the US economy, CFOs at big US companies entered 2020 with almost all anticipating an economic slowdown against the backdrop of an overvalued stock market.

The Deloitte CFO Survey – which polled 147 CFOs from U.S., Canada and Mexico from companies that have more than $3 billion in annual revenue – showed that while the corporate leaders see the economy as “good,” they anticipate that before the year is over, conditions will slow. They also see consumer and business spending slowing, and 82% anticipate taking more defensive actions, like reducing discretionary spending and headcount, as a way to stave off the looming headwinds, CNBC reported.

In short, the people who know their companies – and the economy best – are confident that the conventional wisdom about a pick up in economic growth is dead wrong.

According to the survey, the coming slowdown is likely to be particularly acute in Europe and China, because while 69% of respondents see conditions in North America as good, the number is just 7% in Europe and 18% in China, the latter a three-year low as the country’s shift to a more consumer-focused economy and its trade battle with the U.S. both conspiring to hold back growth.

“North America is clearly the place where companies are continuing to increase their investment focus,” said Sandy Cockrell, Deloitte Global CFO program leader. “There’s still a high level of caution.”

The good news is that while CFOs do see a downturn, they’re not foreseeing a worst-case scenario… yet: expectations for an outright recession fell to just 3% in the fourth-quarter survey, down from 15% in the first-quarter 2019 survey (when stocks had just emerged from a vicious if bread Q4 2018 bear market). However, 97% say a slowdown already has begun or will start sometime in 2020.

These concerns, CNBC notes, are consistent with a recent Conference Board CEO survey that found recession at the top of the list of things to fear.

What could help reverse sentiment sharply higher? In a word (or three): trade war peace. Cockrell said a lasting peace between the U.S. and China would be a big help. While the two countries are about the sign a phase one trade agreement, uncertainty over the impact tariffs the two sides have levied and could reinstitute remain problems.

“If we can get these trade deals done, that would be the biggest thing,” he said. “Uncertainty of having to price your supply chains makes budgeting and forecasting extremely difficult. From a CFO’s perspective, naturally they are going to be a bit on the conservative side, which they should be. But if they can get some clarity behind that, I would view that as a tailwind.”

Besides trade, CFOs are also closely watching the 2020 presidential election, with some 65% saying economic performance will depend significantly on the outcome, though few are making business adjustments yet based on the political landscape.

But the biggest paradox is CFO sentiment toward the market: as the S&P hits new record highs on an almost daily basis every day since the Fed launched QE4 last October, 77% of respondents said stocks are overvalued, the highest level in nearly two years. Just 4% said equities are undervalued, down from 10% in the last reading.

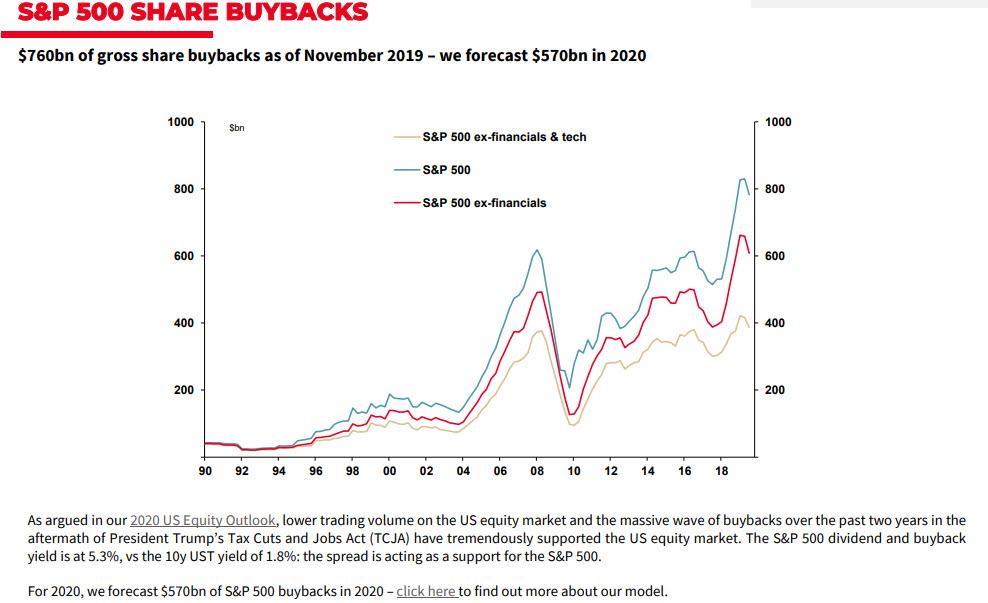

Why is this a paradox? Because while over three-quarters CFOs lament just how expensive the market has become, virtually all of them are scrambling to repurchase their “overvalued” stock, with total buybacks in 2018 and 2019 hitting record highs on largely thanks to Trump’s tax law, which allowed US corporations to repatriate about $1.5 trillion in offshore cash, much of which was then used by companies to buy back their stock. Other companies merely issue debt and use the proceeds to also buyback stocks. Meanwhile, looking ahead, SocGen forecasts that in 2020, S&P500 companies will buyback another $570BN in stock, just shy of the 2019 record highs.

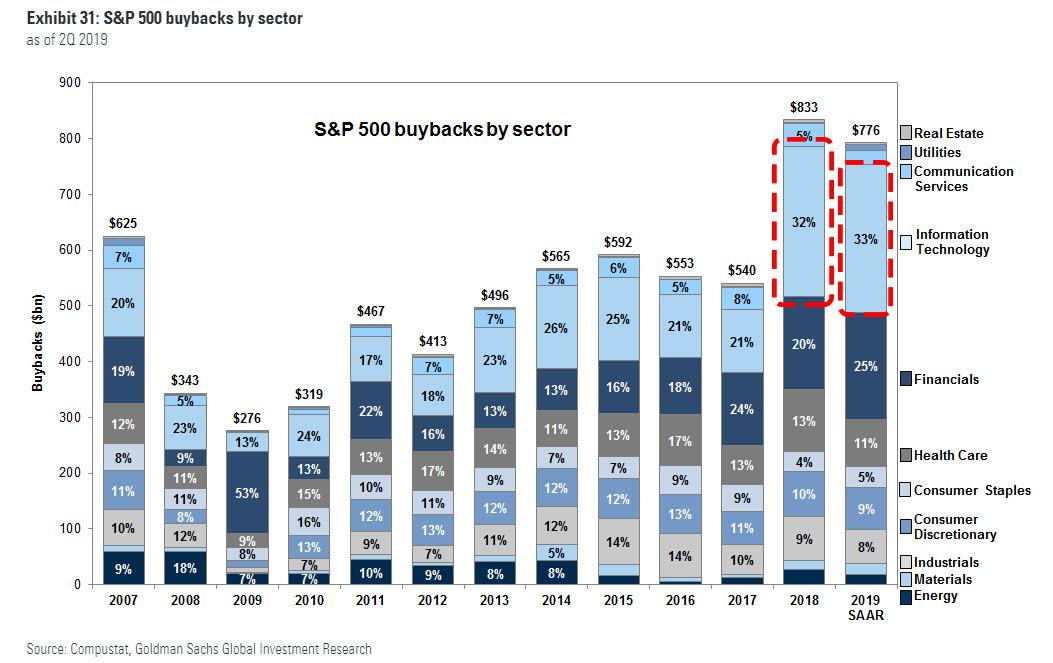

So while most corporate Corner Suites are now convinced all stocks are overvalued, they keep a special place in their heart for their own stock, which they all are rushing to repurchase – especially tech CFOs…

… as the higher their own stock goes, the greater their equity-linked comp. In other words, while most agree stocks are overvalued, they will keep buying (back) these overvalued stocks as their pay literally depends on it.

Meanwhile, as everyone rushes to buyback their own stock, the entire market just gets even more overvalued, and it is up to the Fed to make sure not even a modest market correction takes place, or else the correction will promptly transform into a full-blown crash.

And just to keep everyone distracted from this great discrepancy, CFOs had a convenient scapegoat on which to “focus”: global warming. According to Deloitte, CFOs were also asked about climate change, with more than 70% saying they are under some pressure from stakeholders to take preventive actions. Perhaps that “action” is to buyback their own stock?

Tyler Durden

Thu, 01/09/2020 – 15:26

via ZeroHedge News https://ift.tt/39UBJVj Tyler Durden