Repo Shrinkage Begins In February: That’s When Fed Cuts Each Term Repo By $5 Billion

With everyone (grudgingly or otherwise) now admitting that the Fed’s repo and QE4 was responsible for the miraculous surge in stocks since the start of Q4 2019, traders were especially focused on today’s release of the next monthly schedule of repo operations to see if the Fed would, as Powell hinted, start reducing the liquidity injection via repo. And sure enough, that’s precisely what happened when the NY Fed announced that starting February, the term repo, which had been kept constant at a level of $35 billion since mid-December, would be reduced by $5 billion to $30 billion for every new term repo.

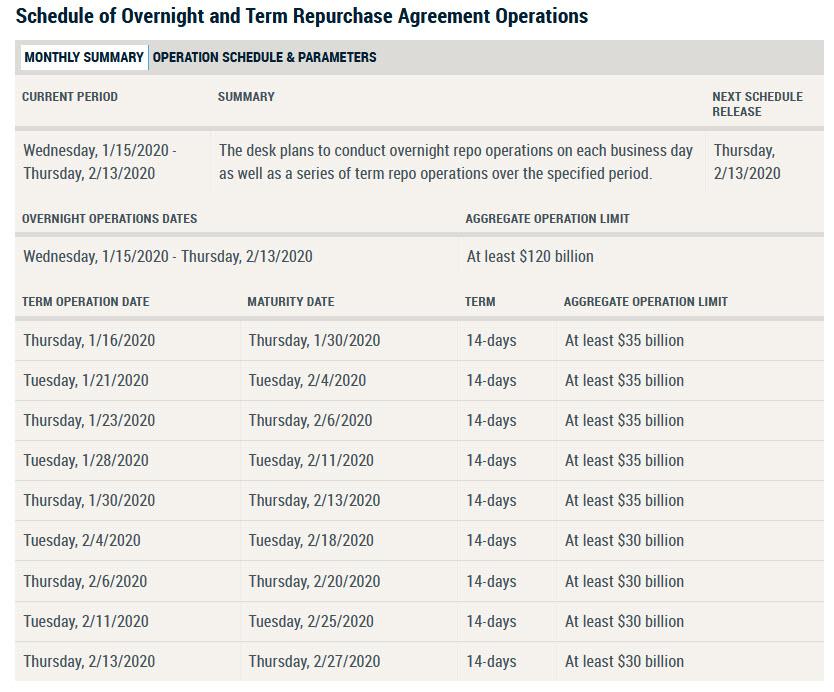

As shown in the latest schedule below, the New York Fed announced that overnight repos would remain at their prior limit of “at least $120 billion”, but it was the term repos where the Fed confirmed that the massive liquidity glut triggered by JPMorgan the Sept repo crisis would finally being to taper, starting with the Feb 4 two-week term repo, which would decline from $35BN to $30BN.

In the aggregate this is a modest drop, reducing overall liquidity by just $20 BN over the month of February as existing repos roll into smaller operations, but assuming there are no incidents, one assumes that in March (and then April, and May), the shrinkage will continue apace, with the total amount declining by a similar or greater amount.

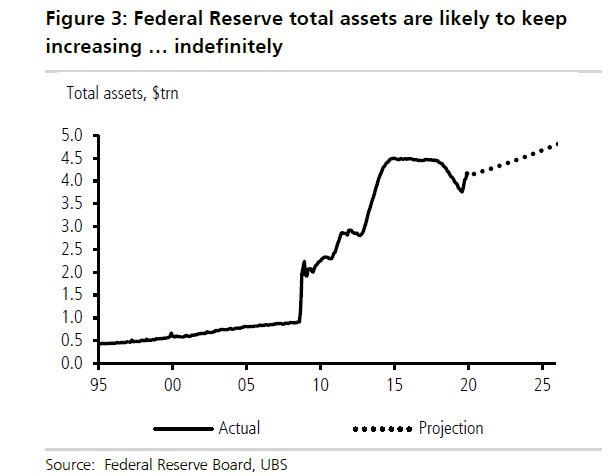

Of course, on net the total liquidity will actually increase as in February the Fed will inject at least $60BN in liquidity via T-Bill monetizations courtsy of “NOT QE 4”, and then another $60BN in March, then April and so on. In other words, while there Fed confirmed a modest repo shrinkage starting in two weeks, this will be more than offset by permanent open market operations which will see the Fed continuing to grow its balance sheet, in the words of UBS, “indefinitely.”

Tyler Durden

Tue, 01/14/2020 – 15:20

via ZeroHedge News https://ift.tt/387I0eE Tyler Durden