Stocks Slip From Record Highs As Risk Demand Reaches “Historic Turning Point”

The market’s relationship with The Fed explained…

Market.

Fed.pic.twitter.com/6Jr9wgX8GR— Sven Henrich (@NorthmanTrader) January 13, 2020

The US market’s price-to-sales ratio has reached a new record high (but it’s different this time)…

Source: Bloomberg

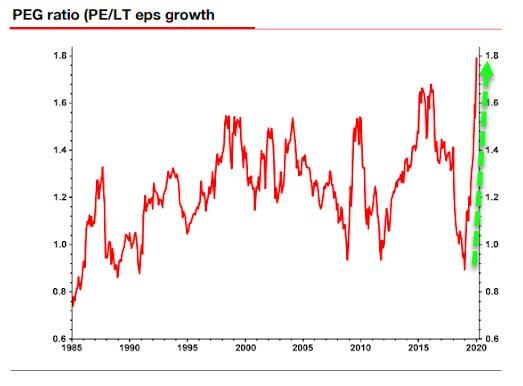

And its PEG ratio has also never been higher…

Nomura’s Charlie McEllligott lays out what is holding this malarkey toegther…

-

“perpetually easy” US financial conditions make this an “everything rally” environment for investors, where risk assets / spread product should be supported by “firm” USTs over the course of 2020 (as I do not see scope for a large US Rates selloff as some are expecting, nor a massive rally for that matter)

-

“Goldilocks” US economic backdrop with benign inflation

-

Fed reaction function clearly skewed asymmetrically (super-low bar to ease, almost impossible bar to hike)

-

My belief that the current “QE-Lite” (in that the Fed are NOT buyers of “Duration,” just short-term Bills) will transition to standard “QE” over time, moving toward towards USTs / outright “Duration” purchases in an effort to provide “ample” reserves in the banking system and offset money market stress points

-

Long-term view from investors that the “Three D’s” will continue to create secular disinflation which makes will keep policy “easy” and rates “low”—the overall 1) trajectory of Debt growth, 2) fading Demographic impulse and 3) tech Disruption.

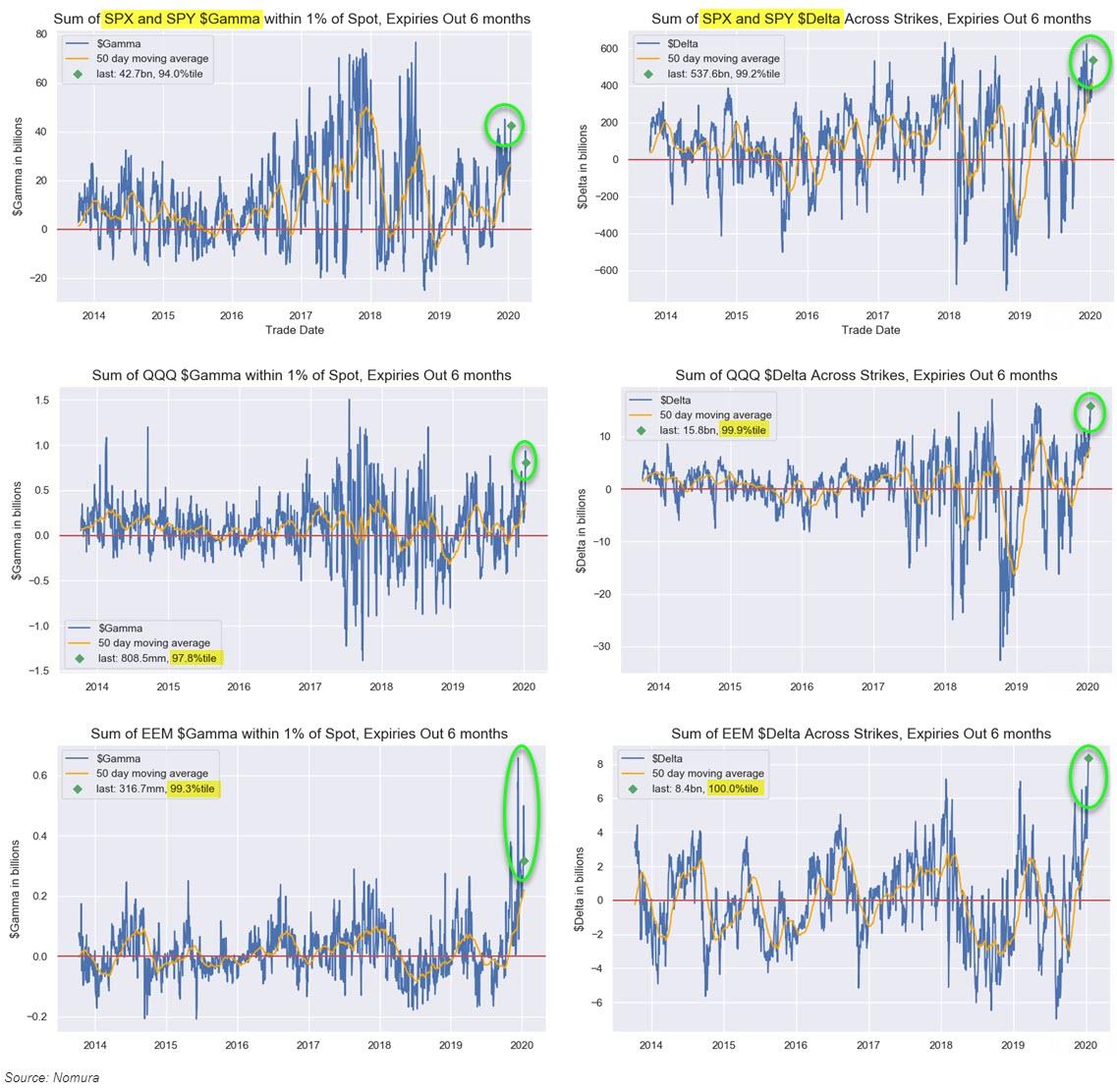

And positioning in options is extreme to say the least…

And the market keeps rising on the back of the biggest 2-day short-squeeze in 2 months…

Source: Bloomberg

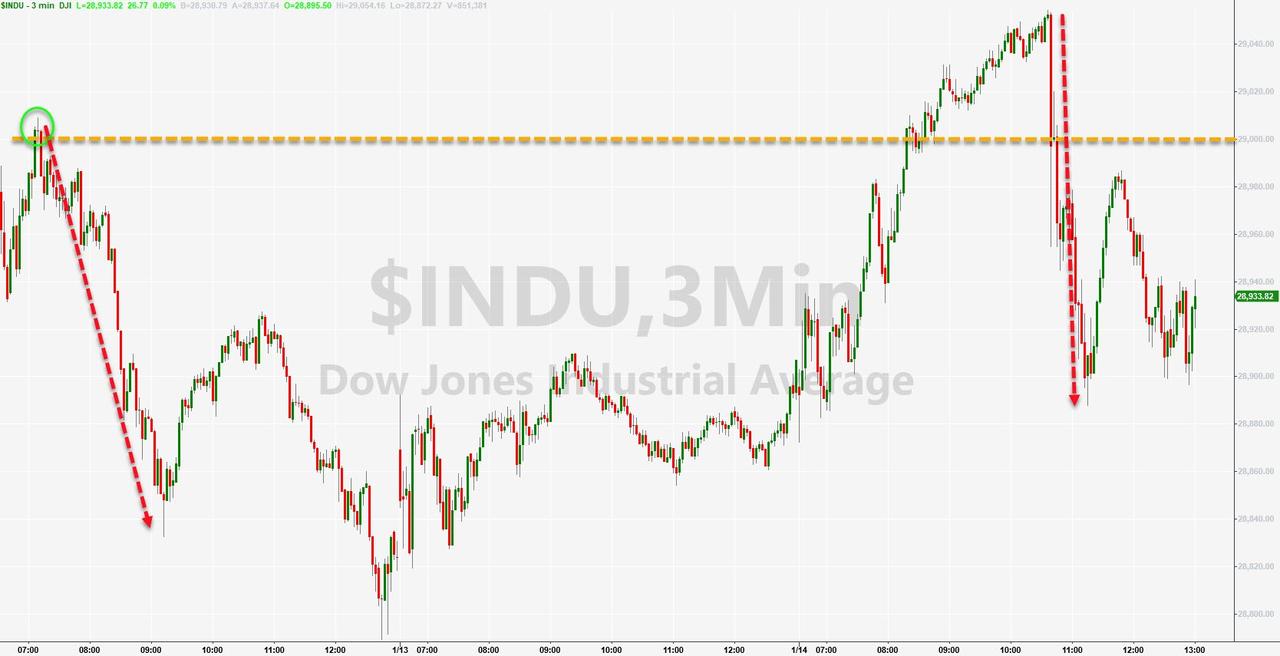

For a few brief minutes today, the machines hiccup’d on China tariff headlines… but that didn’t last… until NYFed reduced the size of its repo plans and that dipped stocks again (briefly)… S&P and Nasdaq dared to close red!

The Dow topped 29k once again, but couldnt hold it…

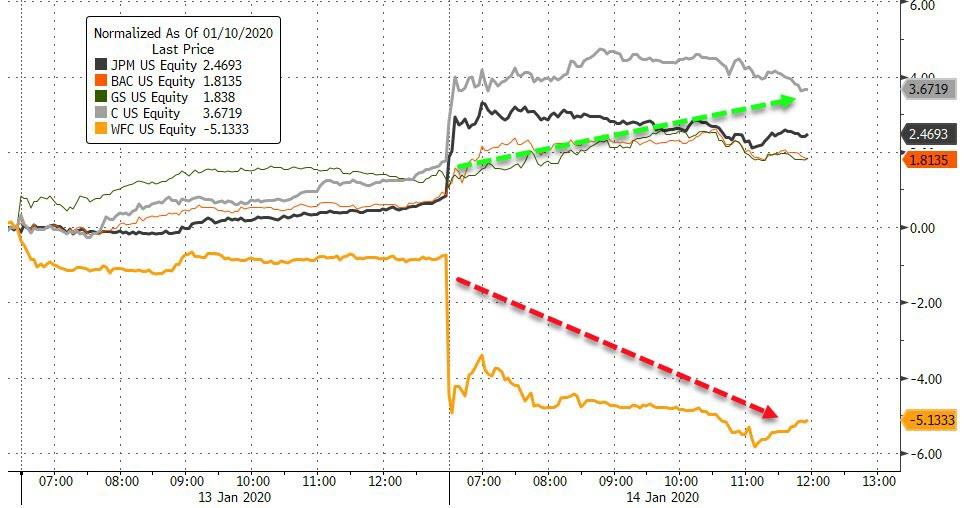

Bank stocks were mixed after earnings with C and JPM rallying as WFC tumbled…

Source: Bloomberg

The recent gains in the broad market have been driven by a resurgence in a defensive bid…

Source: Bloomberg

TSLA continued its parabolic ride, almost tagging $100bn market cap…

And while BYND continued its epic squeeze, after it was halted, it did start to fade fast…

But AAPL dared to close red…

Credit markets are (for once) leading the shift in protection costs higher (even if VIX was also higher today)…

Source: Bloomberg

But Junk credit spreads collapsed to their lowest since 2007…

Source: Bloomberg

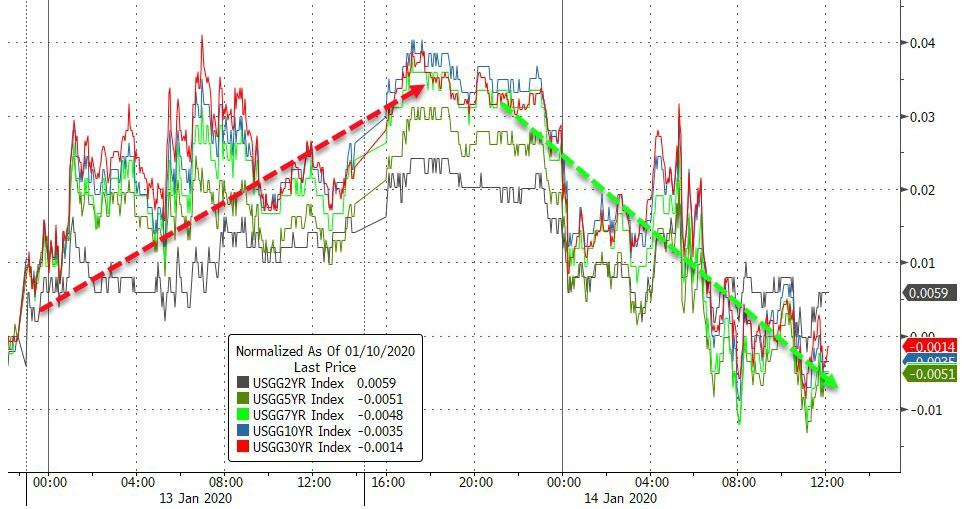

Despite the gains in stocks, bonds were also bid with Treasury yields down 2-3bps (short-end underperformed)… Today’s rally erases yesterday’s losses…

Source: Bloomberg

30Y Yields fell back below pre-Soleimani levels…

Source: Bloomberg

And the yield curve flattened to almost one-month lows…

Source: Bloomberg

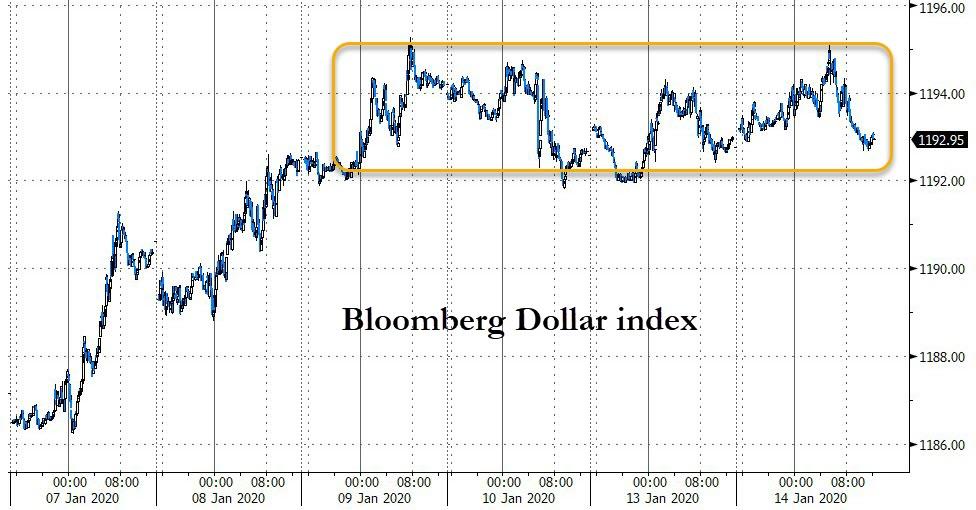

The Dollar trod water for a 4th day…

Source: Bloomberg

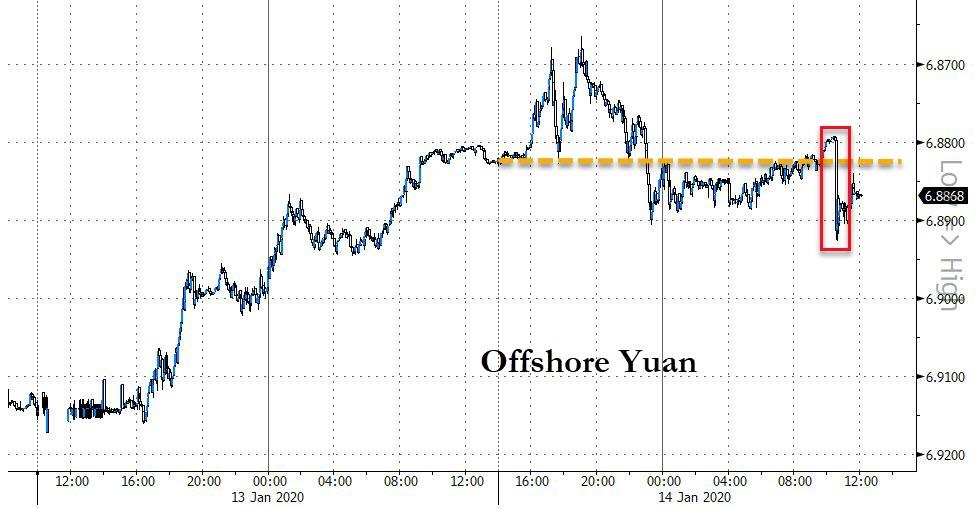

Yuan ended modestly lower after the trade headlines…

Source: Bloomberg

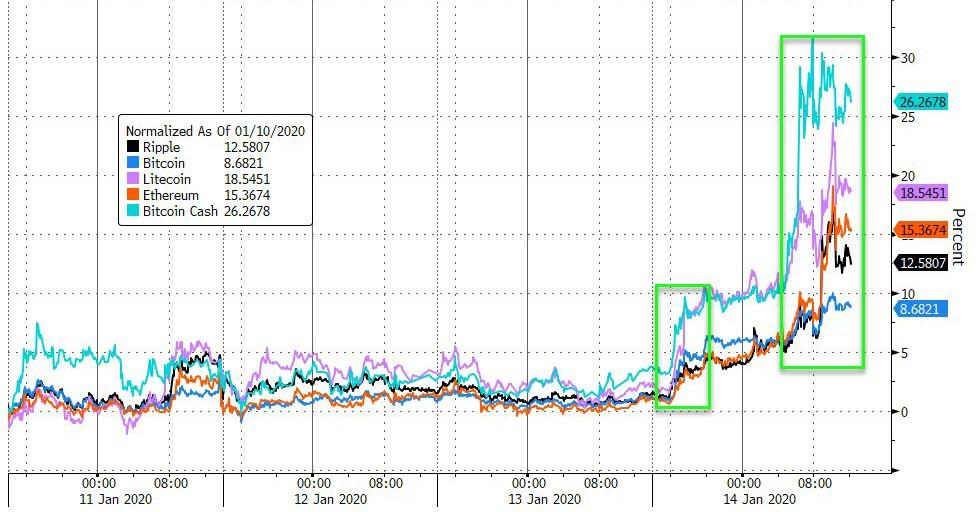

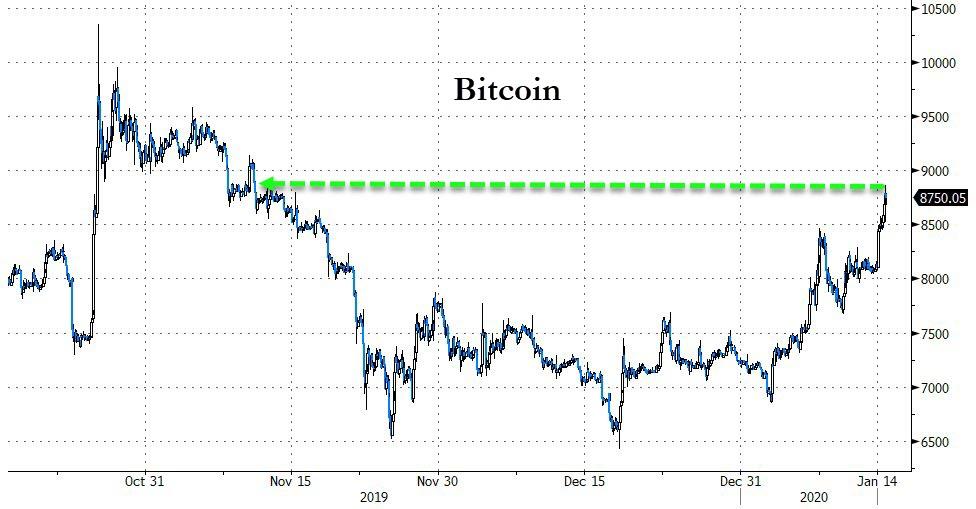

Cryptos surged today…

Source: Bloomberg

With Bitcoin jumping back above $8800 – 2-mointh highs…

Source: Bloomberg

Copper extended yesterday’s gains as PMs mirrored that to the downside, oil managed a modest gain…

Source: Bloomberg

Gold is back below pre-Soleimani levels…

WTI managed a small gains, bouncing off $58-the figure…

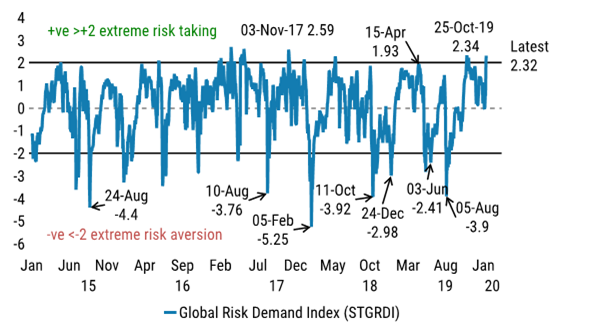

And finally, in case you wondered when this malarkey would end, Morgan Stanley’s Global Risk Demand index soared to +2.3 – above 2.00 has historically been a significant turning point for risk…

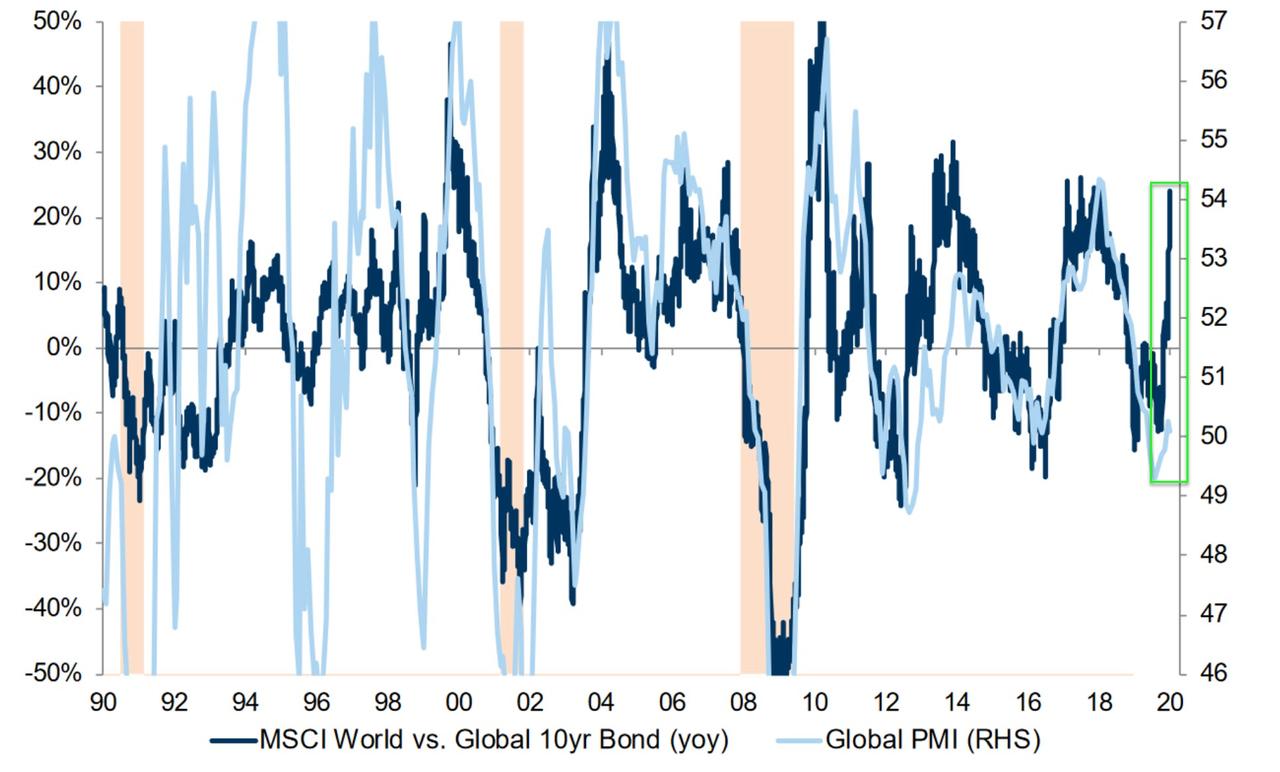

And don’t forget, stocks have priced-in a dramatic rebound in growth… that is failing to appear for now…

This won’t end well…

Source: Bloomberg

You are here…

..How I feel being long in the Market at these levels.. pic.twitter.com/DrhLqQaupz

— Chris (@Freedomtrader77) January 14, 2020

Tyler Durden

Tue, 01/14/2020 – 16:01

via ZeroHedge News https://ift.tt/2slxqBk Tyler Durden