Trader: Nothing Like A Lousy Number To Make Markets Happy

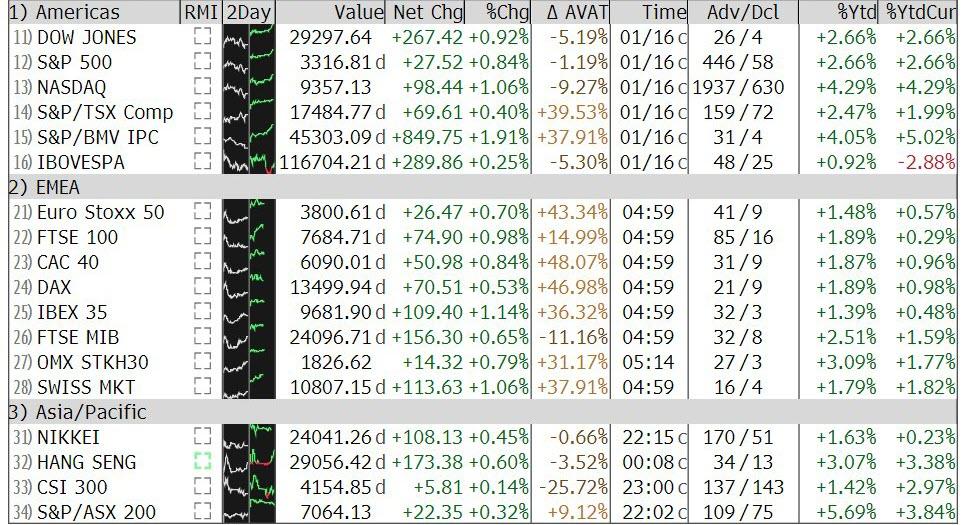

Global stock trading screens are a sea of green this morning, despite a slew of key data coming in below expectations and doing anything but confirming the market’s narrative that everything’s about to be awesome again.

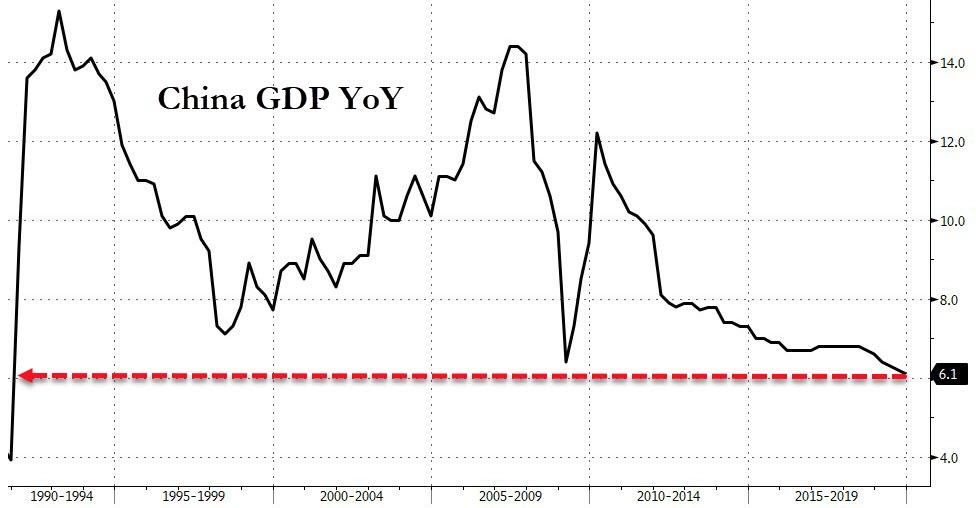

Overnight saw the big one from China disappoint with economic growth the weakest in 29 years. But, as Bloomberg’s Richard Breslow notes, if you want to feel good about the equity market today, there is no need to look further than today’s U.K. retail sales report. It was a stinker. Following close on the heels of Wednesday’s CPI miss.

The market pricing of the chances of a cut in rates as soon as this month are now showing an expectation that it is just about baked in the cake. And this at a time when surveys show that most economists think it is too early for a move. When have we seen that before? The U.K. economy may not be as influential as it once was on global matters, but it is still of material consequence.

And every stock index loves it when a major central bank moves to the left.

Progress on trade matters between the U.S. and China is a positive development. It doesn’t matter if it isn’t as good as it gets.

Increasing talk of election year fiscal stimulus in the U.S. has stock investors rubbing their hands together. But nothing gets them more stoked than rate cuts and the possibility of more QE.

Yesterday, two of Germany’s leading industry groups, the BDI and BGA, urged the government to do more to stimulate the economy. Yes there have been green shoots trying to poke their heads out of the ground. But, as the BDI’s managing director said, “Better-than-expected still doesn’t mean good.”

As one of ECB President Christine Lagarde’s biggest fans, I continue to maintain confidence that, ultimately, she will be able to wring some action out of the German government. But all of the European and euro bulls need to accept the reality that it doesn’t count until they show us the money. And it remains true that the global economy won’t ever be able to “run hot,” as we understand the concept, without Europe contributing its fair share.

All of the trade recommendations calling for the much-anticipated move in bund yields back to the lofty zero level may have to wait for some confirmation from the foreign exchange market, where implied volatility in the options market continues to suggest that we are going nowhere fast. Little episodes of short-term, event-driven optimism continue to have little influence on the pricing for the longer-dated outlook. That can always change, but it is devilishly difficult to anticipate.

Europe aside, the economic results out of China were quite good (except for GDP).

Who wouldn’t want numbers like these? With a dovish PBOC to boot. At least we know there is one country where there is demand for automobiles. Chinese equities had a so-so session but with reportedly so much new money having been piling into that market it wasn’t a bad performance ahead of the weekend. Of greater note, and importance for the moment, Asian equities as a group had a solid showing, in sympathy, and have their sights again set on the spike high from earlier this week.

The very crowded emerging market currency trade continues to hang in there. This is something to keep an eye on. Trending assets can, by definition, stay over-bought for a long time, but the risk also increases. This market can correct a fair way without doing anything wrong in the grand scheme of things. Nevertheless, it is a sign that carry and risk remain in vogue.

The dollar continues to go nowhere, but remains resilient, despite its naysayers. I’m not sure why I keep being told that if the euro goes up and breaks resistance, it will be a bullish sign.

Also watching the 10-year Treasury versus bund spread. That spread narrowing is a popular trade that is showing signs of being called into question.

Perhaps the most interesting question in the short-run is how the Treasury yield curve behaves. It’s a little steeper on the 20-year announcement. But things won’t really get interesting, and perhaps more volatile, until we see it do so in a bear market.

Tyler Durden

Fri, 01/17/2020 – 08:21

via ZeroHedge News https://ift.tt/2R2wZ8D Tyler Durden