UN Warns Of Slowbalisation As Economic Growth In 2019 Plunged To Lowest In Decade

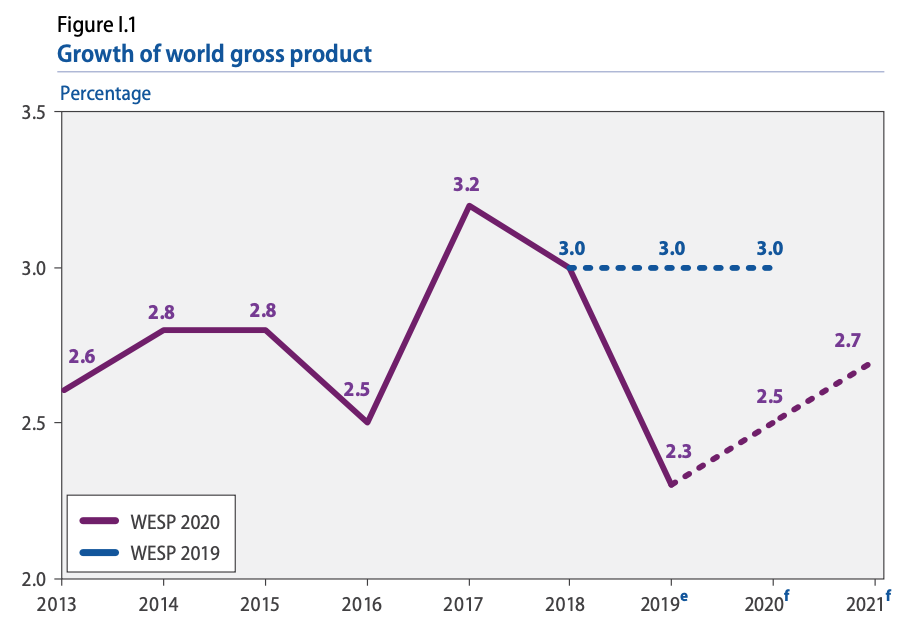

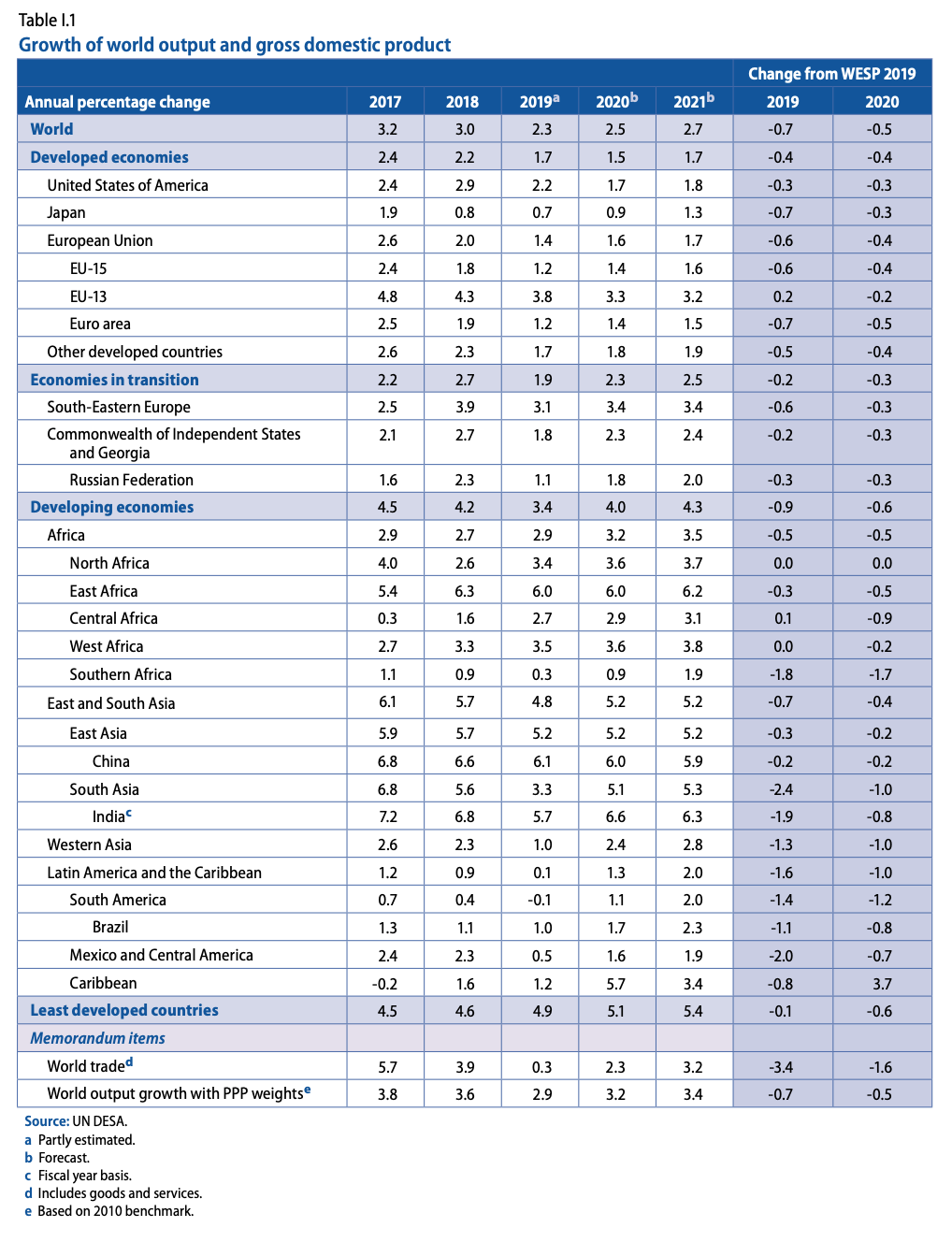

The U.N.’s annual report, the World Economic Situation and Prospects 2020, has said the global economy recorded its lowest growth in a decade in 2019, falling to 2.3% as a result of the U.S. and China trade war and sharp pullbacks in investment.

The report warns of slowbalisation will define the global economy in the early 2020s. Growth is expected to pick up slightly across the world from 2.3% last year to 2.5% in 2020, but that depends on the effectiveness of monetary policy and if all trade disputes can be resolved.

The U.N. warned that if trade disputes aren’t resolved this year, geopolitical tensions spiral out of control, and for whatever reason, central banking monetary policies are ineffective in stimulating growth, then the global economy could register a depressing 1.8%.

It said that slowbalisation “threatens to undermine progress towards eradicating poverty, raising living standards, and creating a sufficient number of decent jobs.”

To give readers a sense of the below-trend growth seen across the world, actually starting before the trade war. The U.N. had global growth forecasts of 3.2% in 2017, 3% in 2018, and 3% in both 2019 and 2020. Obviously, that’s not the case today, and the global economy is rapidly slowing as central banks are freaking out with over $1 trillion in money printing in the last four months and 80 rate cuts over the previous 12 months.

The report noted that 2019 was the slowest year in global growth since the financial crisis a little over a decade ago, with all major economies sharply slowing except Africa.

“This slowdown is occurring alongside growing discontent with the social and environmental quality of economic growth, amid pervasive inequalities and the deepening climate crisis,” it said.

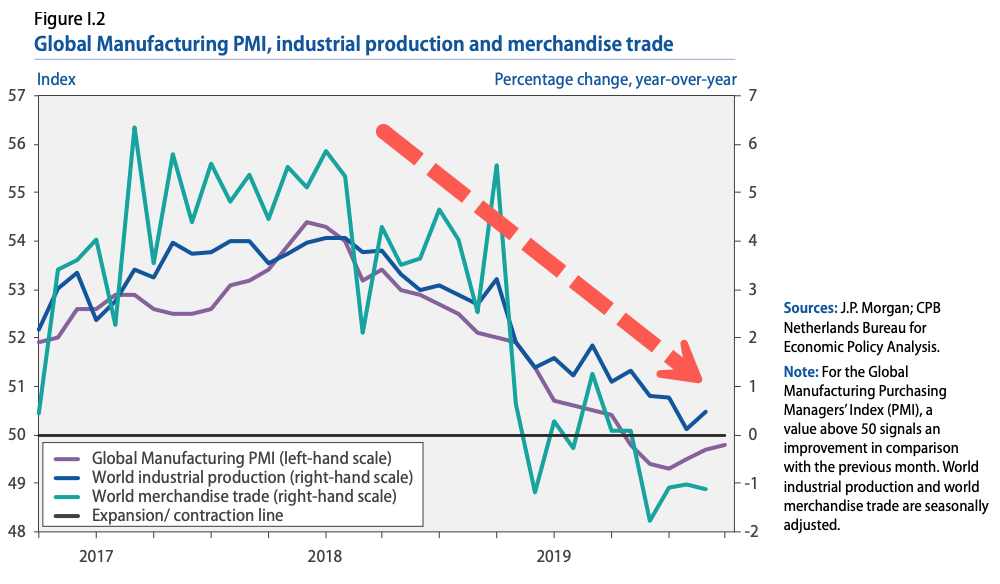

The U.N. said the epicenter of the slowdown is the “global manufacturing” recession that spread across most G20 countries.

It said the shift in trade policies between the U.S. and China also led to declining investment in major economies and will lead to slower economic growth in the years ahead. Trade disputes also weighed heavily on commodity prices, especially crude and petroleum products, and industrial metals.

“A significant number of countries are still suffering from the effects of the 2014-2016 commodity price downturn, which has resulted in persistent output losses and setbacks in poverty reduction,” the U.N. said.

U.N. Secretary-General António Guterres warned: “These risks could inflict severe and long-lasting damage on development prospects. They also threaten to encourage a further rise in inward-looking policies, at a point when global cooperation is paramount.”

Global central banks have had no other choice but to print like crazy and hyperinflate asset prices as their ammunition to combat the next global crisis is running low.

Tyler Durden

Fri, 01/17/2020 – 08:04

via ZeroHedge News https://ift.tt/2uQi34L Tyler Durden