The Question For 2020: Can Fundamentals Ramp Up Before Policy Fades

Authored by Morgan Stanley’s chief cross-asset strategist, Andrew Sheets

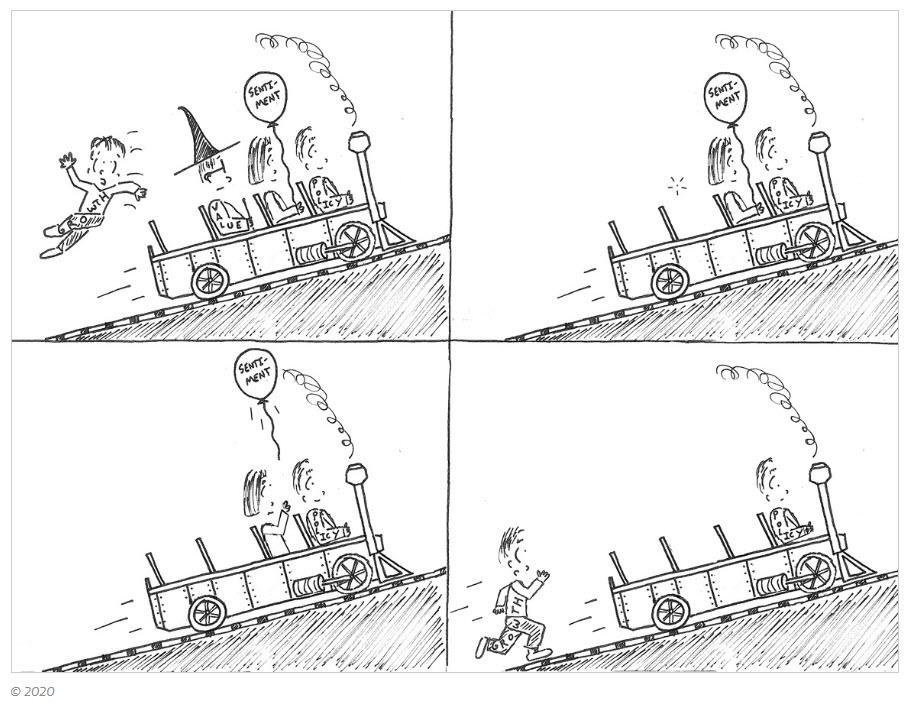

Markets are always subject to varied and shifting sets of drivers. Over the last 12 months, it has been a story of four – policy, sentiment, valuation and fundamentals. The question for 2020 is whether the last (fundamentals) can ramp back up before the first (policy) fades. It’s a race that makes us more nervous about the market after April and tactically mindful that several of our sentiment measures are now flashing red.

In the first phase of last year’s rally, policy, valuation and sentiment offset weak fundamentals. Global earnings revisions, trade volumes and manufacturing data all deteriorated sharply in early 2019. But the other three factors were still there, and in a big way. The Fed responded aggressively with easier policy via rate cuts. Valuations had adjusted meaningfully in late 2018, providing a more supportive base. And sentiment, if not universally negative, was a long way from optimistic.

Then, as markets rose, valuations fell by the wayside… By the middle of 2019, valuations for both global equities and credit had moved back above their five-year (and 10-year) averages. Fundamentals remained weak, which together with richer valuations might explain why global equities trod water between May and September. But thankfully (for the market), supportive policy and sentiment were hanging around. The Fed began increasing its balance sheet again at a US$60 billion/month clip in October, and measures of investor positioning remained subdued, reflecting continued concerns about fundamental weakness.

…and then sentiment melted away… With markets pushing higher into the new year, a wide variety of measures suggest a significant increase in optimism. Net length in S&P 500 futures contracts is the highest since 2014. The put/call ratio has plunged. Morgan Stanley’s Global Risk Demand Index (US Pat. No. 7,617,143), which measures ‘fear’ and ‘greed’, is near its highest levels in the last 10 years. And to put a human face on these datapoints, investor polling of the 160+ investors who attended our recent Global Insights Day in London this week was the most positive in years.

…which leaves policy. Whether or not the Fed intended to provide material easing when it restarted purchasing securities in October at a US$60 billion/month clip, that was the effect. Stocks rallied, credit spreads tightened further and the dollar fell, all easing financial conditions. But with valuations higher, sentiment positive and fundamentals still soft, policy is now carrying a heavy load.

And so the race with fundamentals begins.

Our interest rate strategists expect the Fed to end its US$60 billion/month of T-Bill purchases at the end of April and replace them with US$15 billion/month of purchases across the Treasury curve. This ‘step-down’ in Fed support lends credence to the idea that gains in 2020 will be front-loaded.

The question will be whether fundamental improvement can get there first. Our economics team sees global growth rebounding and key parts of the manufacturing cycle picking up. But so far, we see this driving only a modest and highly uneven recovery in global earnings. One reason why we remain positive on equities in Korea and Japan is conviction that the earnings pick-up in these markets is real and can meet bottom-up consensus expectations.

But there’s also a risk that fundamental improvement has even less time. While the pace of increase in permanent assets on the Federal Reserve’s balance sheet should remain steady through April, my colleague Kelcie Gerson from our interest rate strategy team notes that the growth in reserves may be ending around now, as the Fed dials back on repo operations. If the size of reserves, rather than the balance sheet, is a better measure of policy support, fundamentals have even less time to pick up, and the current earnings season becomes more important.

Tyler Durden

Sun, 01/19/2020 – 17:05

via ZeroHedge News https://ift.tt/2R8hlsd Tyler Durden