Futures Flat With US Closed For Holiday; Nat Gas Craters

With the US on holiday celebrating MLK Jr. day, volumes around the globe are abysmal and sentiment has seen a modest drift even if the the general market tone has remained upbeat after the signing last week of the US/China Phase 1 trade deal, which helped push Asian shares to 20 months high this morning after US equities last week hit another all-time high on Friday.

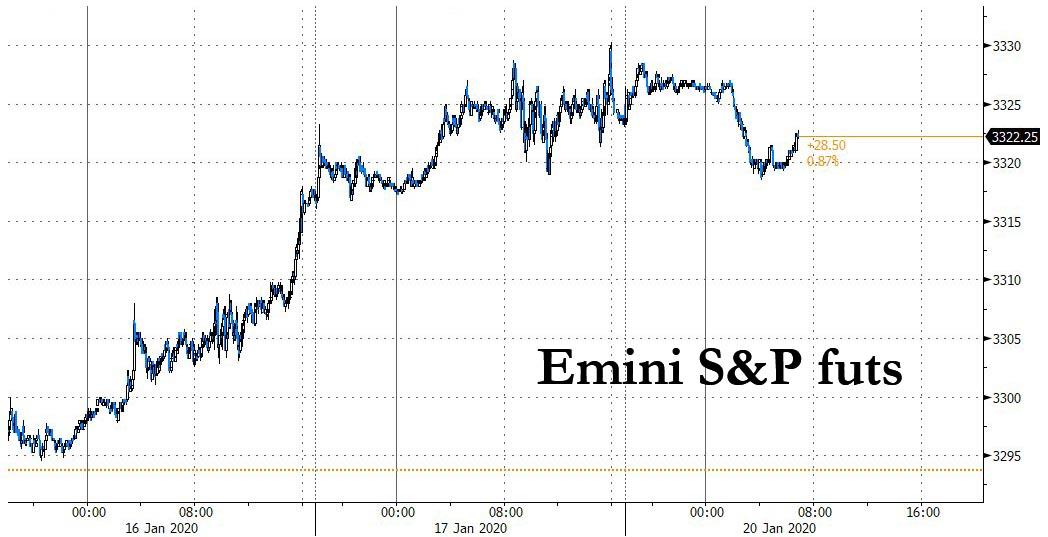

MSCI’s s all-country index is up almost 2.5% for the first three weeks of the year and was holding near record highs on Monday along with Wall Street and European benchmark equity indices. Just three weeks into the new year, the S&P 500 has gained just over 3% and the NASDAQ almost 5%.

“The feel-good factor appears to be driven by a number of factors including better than expected economic data, as well as the dialing back of trade tensions between the U.S. and China as the low-hanging fruit of a phase one trade deal was being signed off,” Michael Hewson, chief market analyst at CMC Markets told Reuters. “If you also toss into the mix some better than expected earnings reports from U.S. banks and other multinationals, it makes a heady cocktail of optimism on which to push stock markets higher.”

US cash markets are closed, but US equity futures remained open and drifted lower as investors awaited the first full week of corporate earnings and some key central bank meetings this week. Crude oil first rose following supply disruptions in Libya and Iraq, but then faded most of its overnight gains.

European stocks were modestly in the red after striking a record closing high in the previous session, as investors paused before launching into a week packed with economic data and the European Central Bank’s first policy meeting of the year. The pan-European STOXX 600 index traded down as much as 0.3% before recovering much of its losses, after gaining nearly 1% on Friday on optimism around U.S.-EU trade talks to address long-standing issues such as a French digital tax and aircraft subsidies.

Among individual movers, Germany’s diagnostic company Qiagen rose 4% to the top of the STOXX 600 index after a report the firm was talking to an interested party about a possible acquisition, while British shopping center operator Intu Properties tumbled 7.5% after saying it was targeting an equity raise by the end of February to tackle debt. Also in the UK, tonic water maker Fevertree Drinks Plc hit its lowest level in over two years as it said annual revenue growth of 10% would be below its expectations, hurt by subdued Christmas trading in Britain. The company’s shares were on track for their worst session ever.

The benchmark European index has risen about 2% in January, as investors bet on faster global growth amid improving economic indicators and cooling U.S.-China trade tensions. For the week, all eyes will be on PMI readings from the euro zone, after a recent Reuters poll showed economists expected a slowdown in the bloc to have bottomed out in 2019.

“Markets increasingly think that we have seen the bottom regarding the industry so if the PMIs would surprise on the downside, that would be a risk to market sentiment,” said Teeuwe Mevissen, senior market economist at Rabobank.

Traders will also look to comments from ECB Chief Christine Lagarde on inflation and economic growth in 2020 at the central bank’s first policy meeting for the year on Thursday, where the bank is expected to keep the deposit rate unchanged after cutting it in September for the first time since 2016. “The ECB rendezvous will likely be the most interesting one as the new president launches the central bank’s second strategic review in the euro’s two decade history,” said Hussein Sayed, chief market strategist at FXTM.

Earlier in the session, MSCI’s index of Asia-Pacific shares ex-Japan was flat having risen to its highest since June 2018. Asia shares pared initial gains as Philippines, Hong Kong and Indian stocks fell with the MSCI Asia Pac Index starting Monday in the green before erasing most of the gains in the afternoon. The Philippines was the region’s worst-performing, with its benchmark index closing at the lowest level since Oct. 3. Hong Kong shares extended declines, as casinos including Sands China Ltd and Galaxy Entertainment Group Ltd slumped amid growing concern over the risk of China’s corona-virus outbreak on travel ahead of the lunar new year holidays. India’s Sensex snapped two days of gains. South Korea’s Kospi index rallied, helped by battery makers after Hyundai Motor said it’s considering cooperating with various companies to secure a stable supply of batteries. Japan’s Topix climbed to a one-month high while the Nikkei added 0.2% to be near its highest in 15 months.

“We are entering 2020 on a more stable footing with economies globally stabilizing and looking like they’re turning up, and the phase one trade deal,” UBS fixed income strategist Anne Anderson told Bloomberg TV in Sydney. “So it’s a bit more positive with regard to the economic fundamentals.”

In rates, US cash Treasuries are closed for the MLK holiday; Germany’s 10-year yield gained less than one basis point to -0.21%, while Britain’s 10-year yield advanced less than one basis point to 0.636% and Japan’s 10-year yield climbed one basis point to 0.01%.

“In 2020 we don’t expect the pace of growth to slow as much as it did last year,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “Accommodative policy and the reduction of downside risk following the signing of the Phase 1 U.S.-China trade deal will help support the economy and risk assets.”

In FX, a string of mostly solid U.S. data helped underpin the dollar. Figures on Friday showed U.S. homebuilding surged to a 13-year high in December and a gauge of manufacturing activity rebounded to its highest in eight months. The dollar last traded at around 110.17 yen, not far off an eight-month peak of 110.305 last week. while the Bloomberg Dollar Spot Index up 0.1%; the euro was little changed at $1.1087 ahead of this week’s ECB meeting. The British pound sank 0.2% to $1.2986 as a string of poor British economic news has fanned speculation about a cut in interest rates soon, weighing on sterling. In Asia, the onshore yuan decreased 0.2% to 6.8715 per dollar, while the Japanese yen was little changed at 110.18 per dollar.

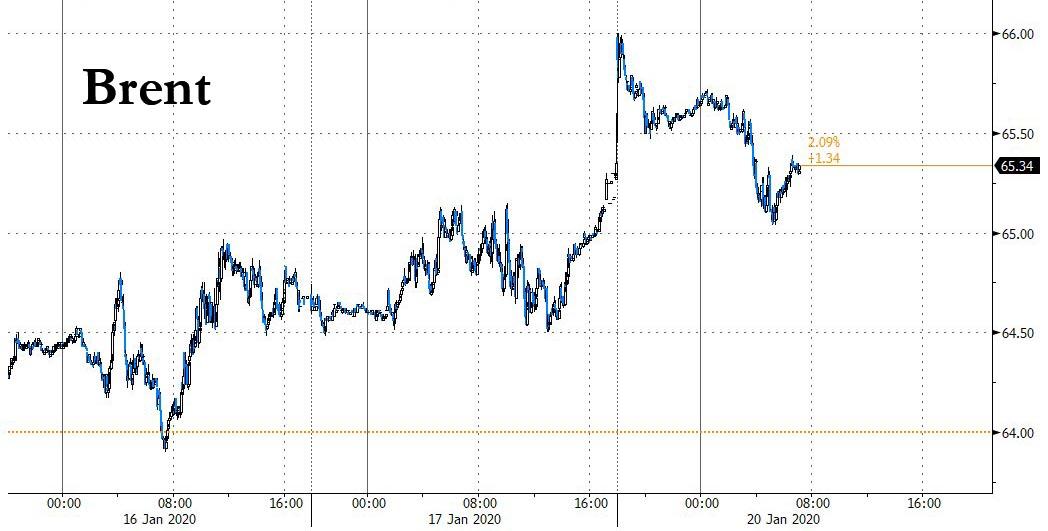

While equities movers were few and far between, the big overnight action was in commodities, as Brent jumped back above $65 a barrel as unrest hit key production regions: Iraq temporarily stopped output at an oil field on Sunday, while Libyan production almost ground to a halt after armed forces shut down a pipeline. However, much of the initial gains were faded.

Another major mover was nat gas futures, which were briefly halted at the start of trading, when $2.00 stops were hit for the first time since May 2016 amid growing fears of a massive inventory glut.

Elsewhere in commodities, iron ore decreased 0.4% to $94.11 per metric ton. Gold gained 0.2% to $1,559.62 an ounce.

With geopolitics on the backburner for now, investors now turn their attention to the Trump impeachment drama set to begin this week, and to corporate earnings after average results from the biggest banks on Wall Street. Companies including Netflix, IBM, UBS, Procter & Gamble and Hyundai will post results. Key central bank meetings in Europe and Japan are also on the agenda. The world’s biggest billionaire boondoggle also begins: the World Economic Forum, the annual gathering of “global leaders in politics, business and culture”, opens in Davos, Switzerland.

DB’s Jim Reid summarizes all the weekend/overnight events:

I hope you had a good weekend. I spent the weekend watching Toy Story 4 twice (wife cried first time, daughter the second time as she was scared), having a blazing row with my wife in a public park as I forgot to put the break on the occupied pram and it started the very early stages of a journey down a hill that could have terminated in a lake had my wife not ran and intervened, getting hay fever in-spite of it being frosty and then attending a 5 year old’s party where they unfortunately had two cats which I was allergic to. At the party they showered us all with glitter and I’m not sure I’ve got it all off yet which as I head off to Davos this morning probably isn’t a great look.

Around the sparkles from my suit we will be having conversations about growth in Davos and ahead of that we published a note last week (link here) looking at how wonderful growth has been for humankind relative to the stagnant bleak existence before the first industrial revolution. However, we acknowledge the side effects to growth in recent decades, which are higher debt, domestic inequality and the most worrying of all environmental damage. Concerns over the environment are only going to escalate further and it is fast becoming the topic of our age. Action needs to be taken but we wanted to stress that for many reasons (which we discuss) we can’t ignore the need for growth in looking for solutions.

Moving on, the highlights for this week are policy meetings from the ECB (Thursday) and the Bank of Japan (tomorrow), along with the release of the flash PMIs from around the world (Friday). Earnings season also continues with a number of key releases, while events at the World Economic Forum in Davos will dominate the news cycle throughout the week. Note that there’s a US holiday today so equity and bond markets will be closed there.

Joining me at Davos (main events Tuesday to Friday) will be a number of world leaders and senior central bankers.Ahead of this, the IMF will be releasing their World Economic Outlook update today, which includes their latest economic forecasts. Tomorrow there’ll be an opening speech from US President Trump, and on Thursday, there’ll be another from German Chancellor Merkel. Lastly, on Friday, there’s a panel on the Global Economic Outlook, with a number of key speakers, including ECB President Lagarde, IMF Managing Director Georgieva, Bank of Japan Governor Kuroda.

With regards to the ECB meeting on Thursday, the main focus will be perhaps be on whether Lagarde announces something on the upcoming strategic review. See here for a preview of the ECB meeting on Thursday and here for the BoJ meeting tomorrow.

In terms of data, the main highlight will be the preliminary January PMIs coming out on Friday. One in particular to follow will be the UK reading, as it comes ahead of the Bank of England’s decision the following week, where investors have recently ratcheted up their expectations that the BoE might cut rates. Also worth keeping an eye on is Germany, where the composite PMI was back in expansionary territory in December for the first time since August. The rest of the day by day data calendar is at the end.

Elsewhere earnings season continues apace this week with Europe starting to join in. Highlights include Netflix, UBS Group and IBM tomorrow. Then on Wednesday, we’ll hear from Johnson & Johnson, Abbott Laboratories, ASML and Texas Instruments. Thursday sees releases from Procter & Gamble, Intel, Comcast and Union Pacific. Lastly, on Friday, there’s American Express and NextEra Energy.

Over the weekend U.K. chancellor Sajid Javid said in an interview with the FT that the U.K. will not be looking to align itself with the EU in many sectors after Brexit thus hinting that the government won’t be looking towards the close relationship that the market wants. He also reiterated that the government doesn’t plan an extension to the transition period. Overnight the pound is trading down -0.15% to 1.2996. It was above $1.31 early Friday before the week data (see below).

Oil has been a major mover in Asian trading this morning with Brent oil prices being up +1.31% at $65.71 after Libya’s biggest oil field began to halt production as armed forces shut down a pipeline. The country’s oil output is likely to be limited to 72,000 barrels per day, the lowest since August 2011, once its storage tanks are full and down from more than 1.2 million barrels a day on Saturday. This coincided with the ongoing protests in Iraq which led to a temporary closure of an oilfield yesterday with the production from another facility at risk of closure today. Meanwhile, most Asian equity markets are advancing this morning with the Nikkei (+0.28%), Shanghai Comp (+0.49%) and Kospi (+0.77%) all up. The Hang Seng is trading down (-0.58%). In terms of overnight data releases, the UK’s January Rightmove house price data showed that prices increased by +2.3% mom (vs. -0.9% mom last month), the most for any January since the data became available in 2002. In London, they gained +2.1% mom, also the highest for this time of the year since 2002. There will have been a post-election bounce but with Brexit battles looming it’s unlikely that this will be prolonged.

To recap last week now, the global equity advance continued, with the S&P 500 up +1.97% (+0.39% Friday) to yet another record high, having risen for 13 of the last 15 weeks. The NASDAQ also climbed +2.29% over the week (+0.34% Friday) to another new record, and it was very much the same story in Europe, where the STOXX 600 rose +1.29% (+0.96% Friday) to a record high. Although as we said last week record highs for Europe leave it only c.5% above the peaks seen in 2000 and 2007. The US market has more than doubled since these two points. Over in commodities, Brent crude ended the week down -0.20% (+0.36% Friday), its second successive weekly decline, but the real story was going on with Palladium, which rose for a 12th consecutive day, up +7.98% on Friday, its strongest day since December 2009 and a record high for the commodity. The metal has been affected by a supply deficit, and on a YTD basis it’s now up +28.41%!

Over in sovereign debt the picture was more muted, with 10yr Treasury yields up +0.2bps on the week (+1.4bps Friday) to close at 1.821%, while the 2s10s curve steepened +1.3bps (+2.1bps Friday) to 26.0bps. 10yr bund yields fell -1.6bps (+0.3bps Friday), though peripheral spreads over bunds widened, with the spread of Italian 10yr debt over bunds up +7.1bps last week (partly on ongoing political uncertainty – see here our economists’ recent piece for more) while the Spanish spread over bunds was up +3.9bps.

In terms of the data from Friday, US housing starts were incredibly strong in December, coming in at a seasonally-adjusted annual rate of 1608k (vs. 1380k expected), surpassing all expectations on Bloomberg and their highest level since December 2006. Building permits were slightly below expectations, however, at 1,416k (vs. 1,460k expected). Staying with the US, the University of Michigan’s consumer sentiment index dipped slightly to 99.1 for the preliminary January reading, (vs. 99.3 expected), while the current conditions index ticked up slightly to 115.8 (vs. 115.3 expected), its highest level since December 2018. Lastly, US industrial production fell -0.3% in December (vs -0.2% expected), and the number of job openings available fell to 6.8m in November, the lowest since February 2018. The falling number of job openings provides some evidence of weakening labour demand, something we’ve already seen with lower wage growth recently, after the previous week’s jobs report showing wage growth in December was at its lowest since July 2018.

It’s also worth noting the UK data, where retail sales unexpectedly fell -0.6% (vs. +0.6% expected) in December, helping to fuel investor expectations that the Bank of England will cut rates at their meeting next week. It follows weak data on inflation and growth earlier in the week. The odds of a rate cut have moved up to 70.5% on Friday, having been at 61.6% on Thursday and after starting the week at just 23.1%. The data from the UK this week (employment on Tuesday and PMIs on Friday) will therefore take on added significance for the decision.

Tyler Durden

Mon, 01/20/2020 – 07:32

via ZeroHedge News https://ift.tt/2RCw3Hj Tyler Durden