Global Stocks Sink On Wuhan Worries, Bonds Bid Back To 2020 Highs

“My name is Coronavirus… and I remember everything”

AsiaPac stocks were not pretty overnight as Coronavirus contagion fears spread (Hong Kong was worst)…

Source: Bloomberg

European markets were punished out of the gate also on the same fears, but DAX managed to get back to close extremely minimally higher…

Source: Bloomberg

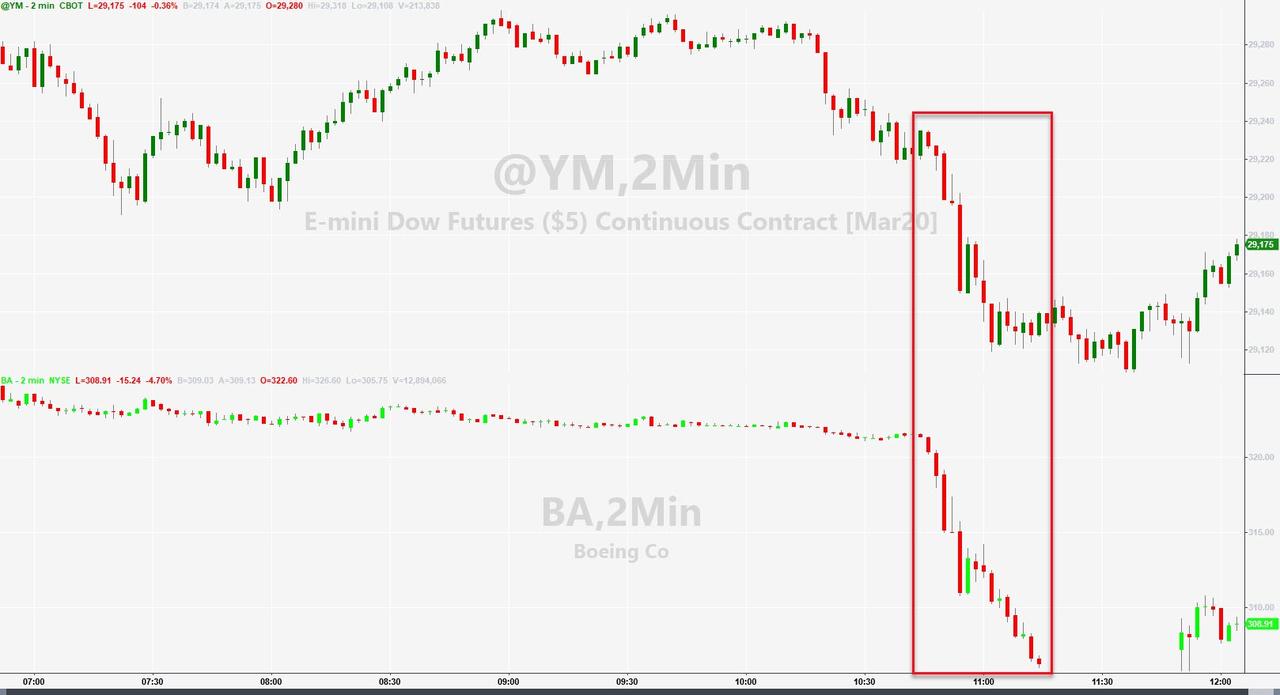

US markets were red, despite the machines best efforts to BTFD. Between Boeing’s delay effects and Coronavirus headlines, Transports were hit hardest…

Boeing knocked 100-plus points off the Dow…

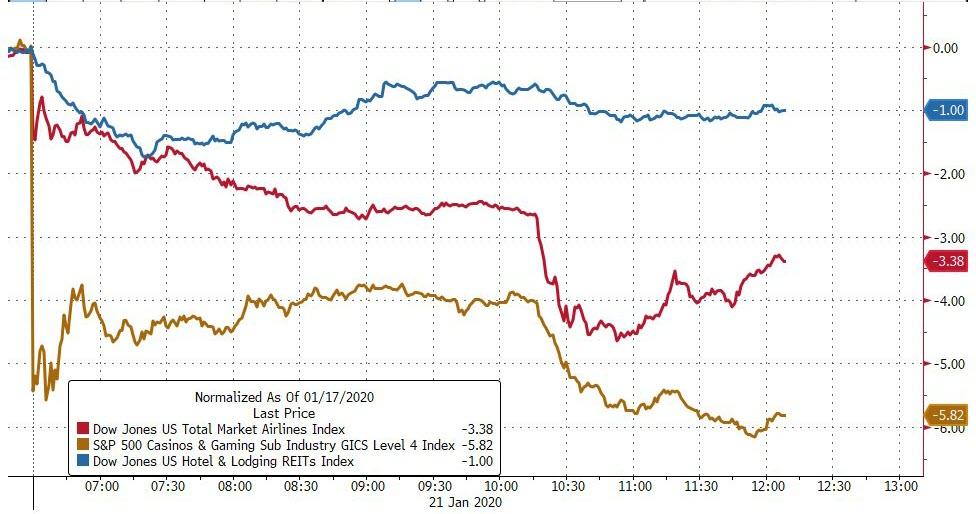

While the broader market – and travel, lodging, and gaming stocks – were all hit hard on the coronavirus headlines…

Source: Bloomberg

…flu-shot makers soared with NNVC up over 300% at one point…

Source: Bloomberg

Defensives dominated trading today as Cyclicals sank…

Source: Bloomberg

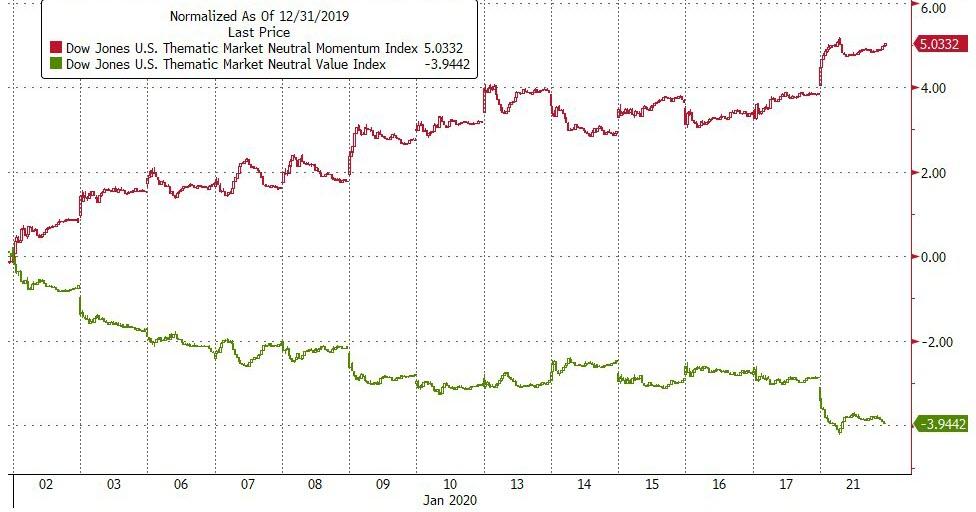

Momo continues to soar in 2020…

Source: Bloomberg

Bonds and stocks remain dramatically decoupled on the year…

Source: Bloomberg

Treasury yields were down hard today with the long-end outperforming…

Source: Bloomberg

30Y Yields tumbled back near Soleimani is dead headline spike lows…

Source: Bloomberg

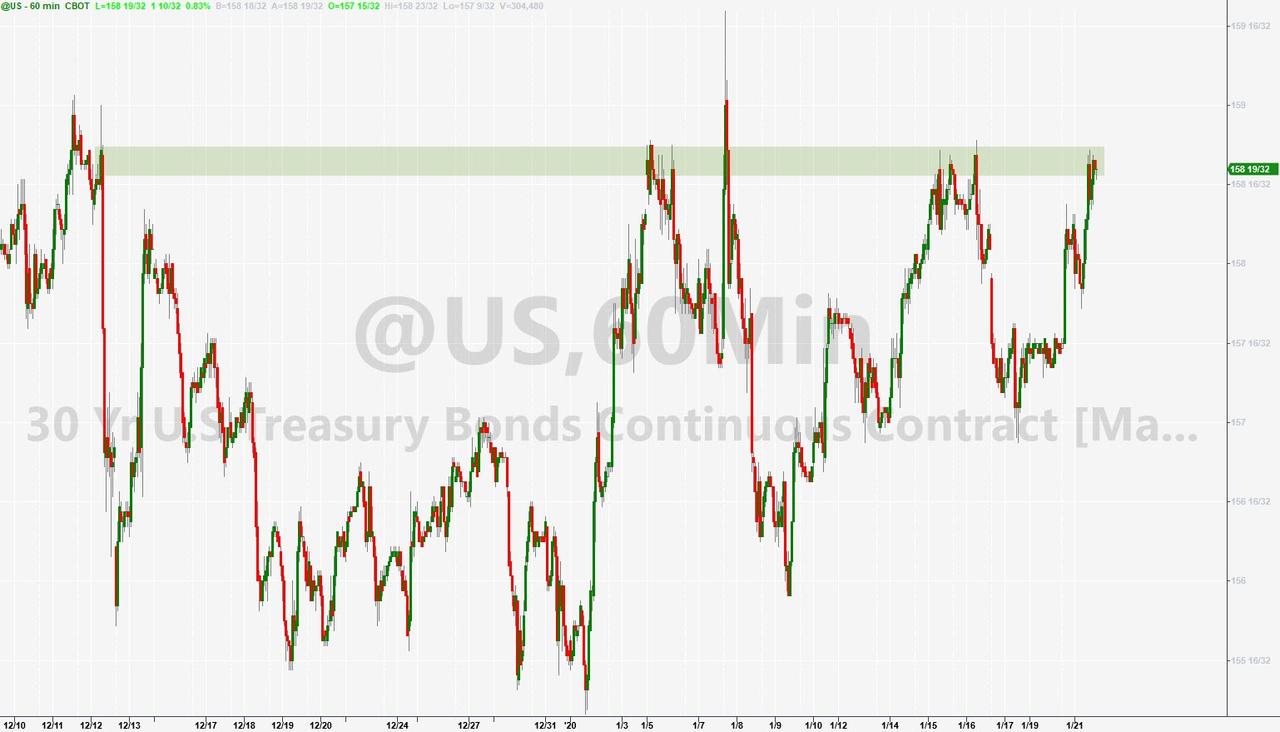

Long Bond Futs prices are back at their highest since early December…

The yield curve flattened back towards 2020 lows…

Source: Bloomberg

The Dollar legged higher during the US session, holding its gains on the week…

Source: Bloomberg

Yuan tumbled overnight…

Source: Bloomberg

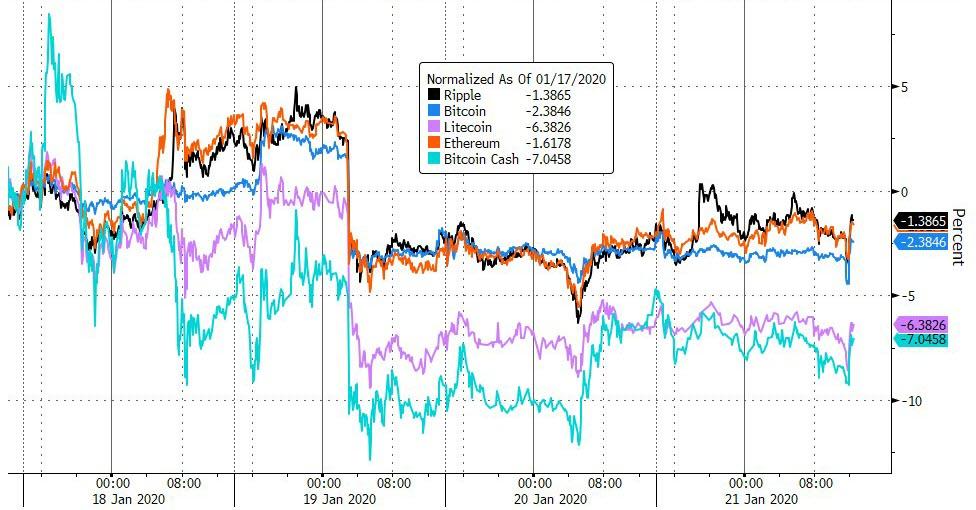

Cryptos were flat-ish for the second day in a row…

Source: Bloomberg

Commodities were all broadly lower today with copper leading the way lower (China growth proxy), but Silver was hit for no good reason…

Source: Bloomberg

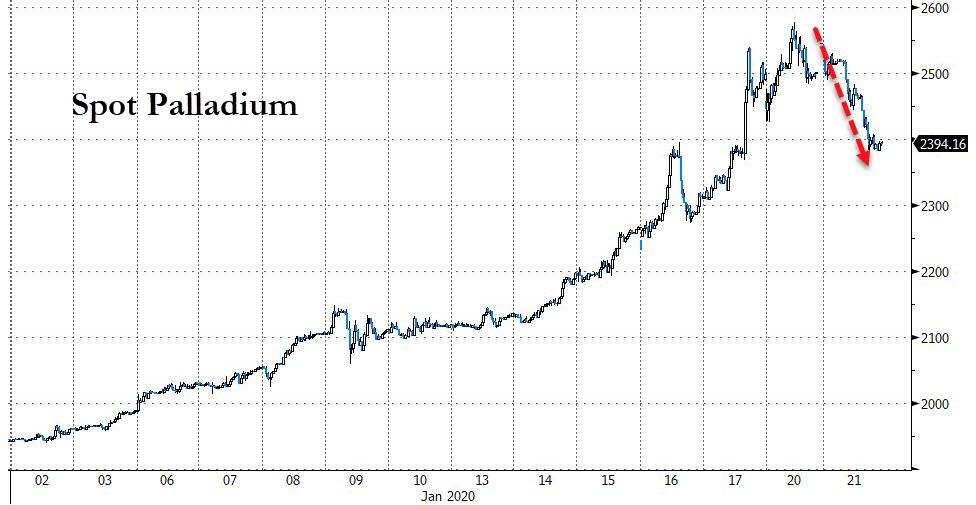

Palladium plunged around 6% today, its biggest daily drop since March 2019…

Source: Bloomberg

Gold bounced back higher after testing below $1550..

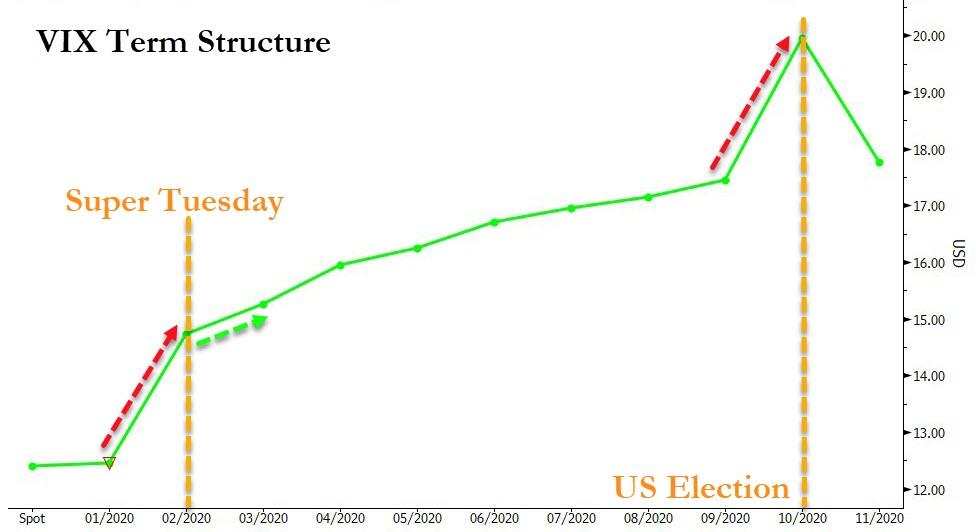

Finally, we note that there are some notable anomalies in the VIX term structure that could become problematic in the last few days. As contracts expire tomorrow, so the very steep term structure (fueling lots of short-vol-tilted carry trades) will flatten…

Source: Bloomberg

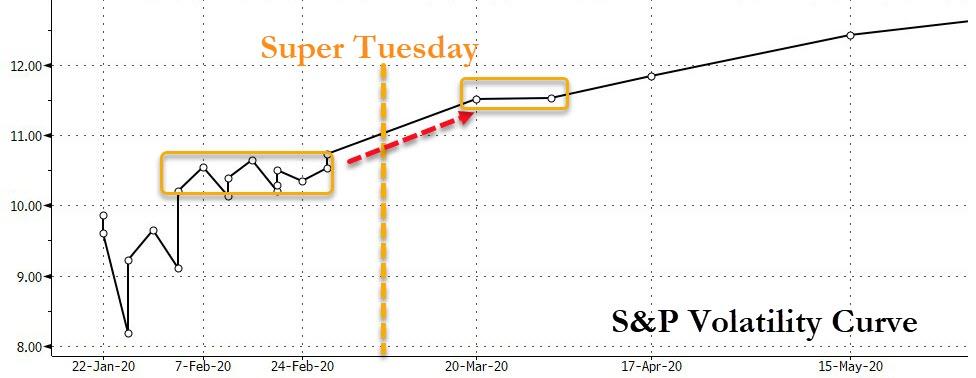

And thanks to the Super Tuesday risks, could lead to problems for those expecting the curve to roll-down faster…

Source: Bloomberg

A “potential unclenching” in the U.S. benchmark equity index may await if these options aren’t rolled, Nomura Securities strategist Charlie McElligott said.

But of course, there’s still a little further to run before this shitshow all falls apart…

Source: Bloomberg

Tyler Durden

Tue, 01/21/2020 – 16:01

via ZeroHedge News https://ift.tt/3awGmFh Tyler Durden