Lurking Risks

Authored by Sven Henrich via NorthmanTrader.com,

According to the current market action there is no risk. None. Risk doesn’t exist. Whatever wobbles there may be on occasion it’s all priced in within a few minutes and markets proceed toward their daily ascent to new all time highs.

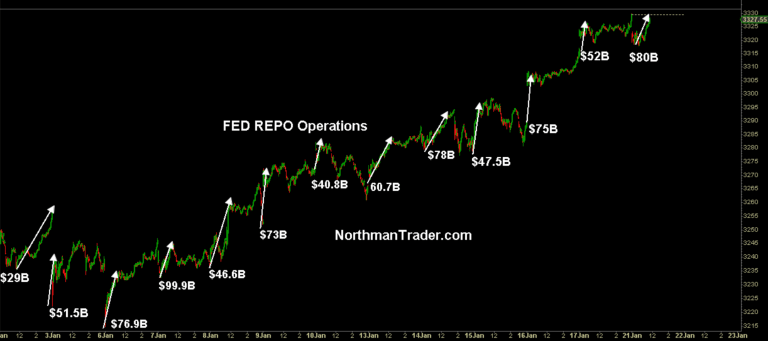

Permanent asset price inflation. The driving force remains the same. QE by the Fed and liquidity operations via repo:

But there are lurking risks currently ignored. Risks are just that until they actually trigger. Some risks go away on their own and don’t manifest themselves in a market reaction, some hit out of the blue because they are not taken seriously until they hit. Some risks are unforeseen as they can hit out of the blue.

Here are a few known potential immediate risks currently ignored by markets:

The China coronavirus:

This one popped on the radar out of the blue and caused some temporary overnight weakness in markets. Why? Because nothing inspires fear like a contagious virus that’s deadly. The world has been lucky to dodge bullets on the infectious disease front for decades. Stunning actually considering how the population has exploded to over 7.5 billion and ever more growing. Never before has the world been so interconnected and the notion of a deadly airborne virus spreading around the globe via air travel is the CDC’s nightmare scenario. AIDS and Ebola have offered scares but are not airborne and hence inherently containable. The Ebola scare in 2015 contributed to market fears coinciding with a market correction. Medical advances over the last 100 years have done wonders to help the world contain spreading viruses. And don’t kid yourself: The risk of a new contagion is always lurking. Viruses are not static, even the flu mutates every single year and brings about new strains.

This virus here has so far resulted in 4 fatalities and several hundred infected. If it gets contained it won’t have much of a lasting impact. If it spreads and starts resulting in dozens or hundreds dead and thousands infected then I suspect markets would pay rapid attention and not ignore it as they did today. After all a spreading virus would impact behavior and creates massive uncertainty & fear until contained. Hopefully it will be contained in short order, but if it doesn’t, watch out. Risk happens fast.

Impeachment:

Wide spread and virtually unanimous consensus is that the Senate led GOP will acquit President Trump and that will be the end of it. I’ve no reason to believe that this will not be the case, but I’ll offer this caveat: Witnesses. A trial can be managed and contained in terms of risk if there are no witnesses testifying. Polling seems to suggest a sizable majority of Americans and a not insignificant number of Republicans being supportive of new witnesses to be called. How this turns out I can’t say, but if witnesses are called there’s a new element of uncertainty currently not quantified in terms of risk.

The thing with witnesses is one never knows what they will actually say. So far the impeachment process has heard from non principal witnesses. Bolton, Pompeo, and others, if called to testify, are principal actors and/or witnesses with first hand knowledge and as such may carry much more weight in the eye of public opinion. At the end of the day, whatever one may believe or not on substance, it is public opinion that matters and any damaging testimony that influences public opinion may change the impeachment risk assessment.

It’s only hypothetical at best at the moment, but this process is beginning today and markets have priced in zero risk of impeachment at the moment. If no witnesses are called risk will likely remain at zero. If witnesses are called risk may suddenly be higher than zero.

The Fed meeting:

Today even Kudlow called not QE to be in effect QE. Jay Powell may now be the only person not yet having admitted to not QE being in fact QE. Pressure is building on the Fed as the cat is very much out of the bag:

The cat is so out of the bag pressure is building for the Fed to explain themselves at the next meeting.

No matter their intentions this is what happened.

They once again expanded the wealth inequality equation and blew an asset bubble.

Reckless. https://t.co/VIQsV9kBzP— Sven Henrich (@NorthmanTrader) January 20, 2020

Major banks have all come out and have called the Fed’s action QE and being directly responsible for goosing asset prices. The Fed may not have intended it, and they may have desperately try to claim it not being QE, but the market has declared it to be QE by its reaction, and that’s what matters. Not to acknowledge the now obvious effects of repo and QE on asset prices would further erode the Fed’s credibility.

And now the Fed is under pressure and they have to extract themselves from their own hubris. ANY form of reduction in repo and balance sheet expansion will be in effect a form of relative tightening. Buybacks are running at a reduced pace as well, that’s in effect a reduction in relative liquidity:

Buybacks better start picking up again…. pic.twitter.com/0jBNBC9d2V

— Sven Henrich (@NorthmanTrader) January 12, 2020

All of which means that asset prices may well peak here in Q1 of 2020 in terms of the liquidity equation.

To sustain extraordinary valuations you either need extraordinary growth or extraordinary liquidity. We just had extraordinary liquidity and we don’t have extraordinary growth. A reduction of liquidity in the months ahead then is a lurking risk to asset prices and next week’s Fed meeting will then be a test of narrative and communications.

Yields:

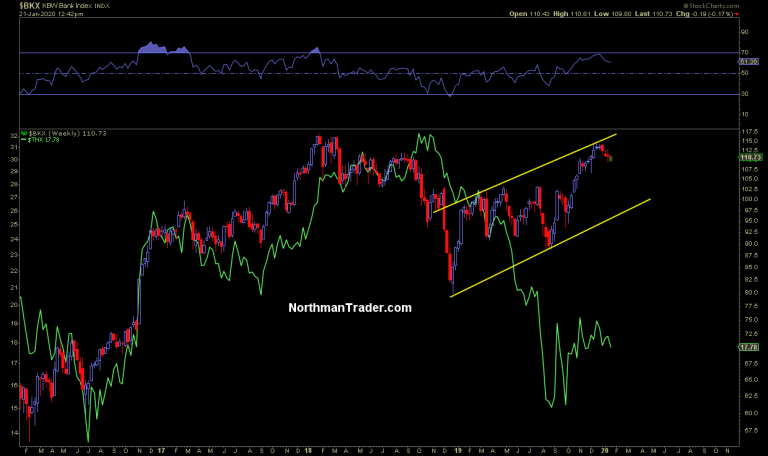

Finally, an ongoing lurking risk currently also ignored: The message from the bond market. Where is the confirmation of reflation and a booming economy?

This market remains priced to perfection on artificial liquidity. With liquidity bound to be reduced expanding growth needs to emerge for valuations to be sustainable.

The bond markets signals no such growth emerging. Either the bond market has it wrong, or it represents a lurking risk.

This tight rope market remain vastly overbought and pushing against resistance but is currently impervious to risk. The next few days and weeks may put this risk free attitude to the test. Key to keep an eye on all of these lurking risk factors.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Tue, 01/21/2020 – 15:50

via ZeroHedge News https://ift.tt/2RDjdsb Tyler Durden