Greenlight: “In Q4, Our Longs Went Up Less Than The Market And Our Shorts Went Up More”

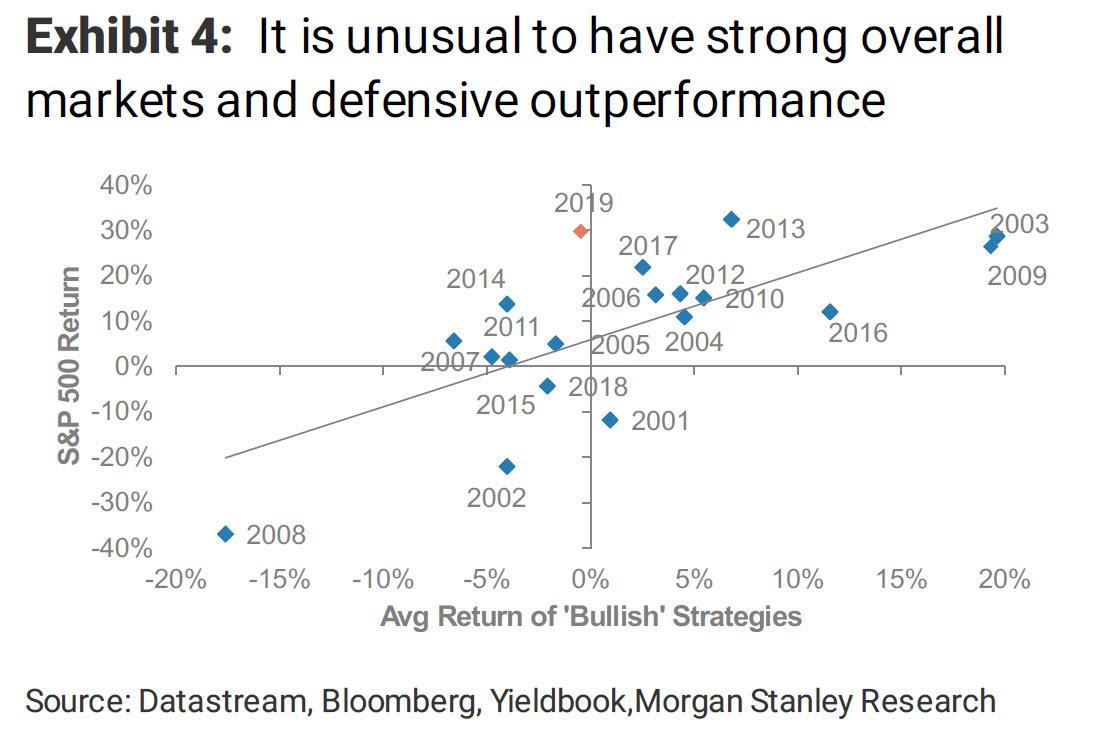

2019 was a very strange year for the market, one in which stocks were up almost 30% despite no earnings growth and only multiple expansion, and yet not a single popular strategy worked. As a result, it was also an extremely painful year for hedge funds who were up for the year, but once again failed to catch up to the risk-free benchmark, the S&P500, and in fact, this was the 10th consecutive year in which active management underperformed the cheapest possible market investment, the S&P500 itself (and explains why there was a record-matching 8 consecutive months of hedge fund outflows in 2019). Most notably, it was a year in which despite the near record market performance, “bullish” strategies actually closed in the red.

Furthermore, as we reported in December, the max pain for hedge funds was Q4 when not only a variety of popular factors short-circuited following the quant crash of Sept 2019, but is also when the market got dislocated from any fundamental anchor on the back of the Fed’s repo liquidity injection and QE4.

Today, none other than David Einhorn’s Greenlight Capital confirmed just how painful both 2019 in general, and Q4 in particular, were for hedge funds – courtesy of the Fed’s latest market interventions masking as repair for the repo market – when it published its latest investor letter in which it revealed that “for the year, our long portfolio contributed 37.4%, our short portfolio lost 20.1% and macro added 1.5% to the returns before fees”.

What happened?

As Einhorn explains in the very next line, “all told, our longs went up slightly more than the market while our shorts went up slightly less than the market”, and then qualifies by adding that “in the fourth quarter, our longs went up less than the market and our shorts went up more than the market”, i.e., the infamous quarter in which the Fed launched QE4, crushing virtually everyone who was positioned to trade on fundamentals, and which is also why hedge funds remain an anachronism in a time when central banks actively managed risk, volatility and the overall equity markets, as even a single downside hedge assures a huge hit to P&L once the Fed steps into the market and sends every short ripping higher, as happened in Q4.

Even though last year’s performance wasn’t a disaster for Greenlight, unlike 2018 and 2019, the letter notes that “the result feels a bit disappointing because at September 30 we seemed on track to have an excellent year, rather than just a decent year.”

What changed after? Why the Fed retarted QE and the rest is history.

Below are some of the key excerpts from the core of the letter (we will have more on Greenlight’s latest portfolio comments in a subsequent post):

The Greenlight Capital funds (the “Partnerships”) returned 13.8% in 2019 compared to 31.5% for the S&P 500 index. Since its inception in May 1996, Greenlight Capital, L.P. has returned 1,592% cumulatively or 12.7% annualized, both net of fees and expenses. Greenlight’s investors have earned $4.5 billion, net of fees and expenses, since inception.

For the year, our long portfolio contributed 37.4%, our short portfolio lost 20.1% and macro added 1.5% to the returns before fees. All told, our longs went up slightly more than the market while our shorts went up slightly less than the market. Even so, the result feels a bit disappointing because at September 30 we seemed on track to have an excellent year, rather than just a decent year.

There was a brief period in September when the environment was favorable for us. WeWork failed in its IPO attempt and subsequently some high-profile money-losing companies saw their share prices cut. Growth stocks in general underperformed. There were musings that value investing was ready to rebound. But that dynamic reversed in the fourth quarter and by year-end, growth stocks had outperformed value stocks for the year by 15% (40% vs 25%).

In the fourth quarter, our longs went up less than the market and our shorts went up more than the market; we underperformed on both sides by similar amounts. Tighter corporate credit spreads drove a small loss in macro during the quarter.

We tend to take comfort in low multiples and we are generally skeptical of high multiples – a framework that is a hallmark of a disciplined value orientation. Until recent years, value investing has tended to outperform growth investing. But over the last three years, growth has knocked the stuffing out of value (106% vs. 17%) – enough so that the long-term outperformance of value stocks has now reversed.

Against this backdrop, many of our longs – including some that contributed positively to 2019’s result – are just as cheap today as they were at the beginning of 2019. Likewise, many of our shorts are more expensive today than they were a year ago. The gap between how we perceive the operating business fundamentals of our investments and their market valuations has never been wider.

Thus, we begin 2020 with a portfolio that continues to be concentrated in our best ideas. We currently have 96% of capital in our top 10 longs and 47% of capital in our top 10 shorts.

So how is Einhorn positioned now with the Fed back in the market? More on that shortly in a subsequent post.

Tyler Durden

Tue, 01/21/2020 – 13:05

via ZeroHedge News https://ift.tt/3avU2R6 Tyler Durden