Guggenheim’s Minerd Warns Global Central Banks Are Fueling A Ponzi Market

Authored by Scott Minerd, Global CIO Guggenheim Investments,

One of the topics that I am focused on in Davos is the deterioration in the quality of the corporate bond markets.

The disturbing trend is that despite the rally in risk assets in the prior year, the number of defaults rose by approximately 50 percent, according to data compiled by J.P. Morgan. Additionally, the number of distressed exchanges increased by 400 percent.

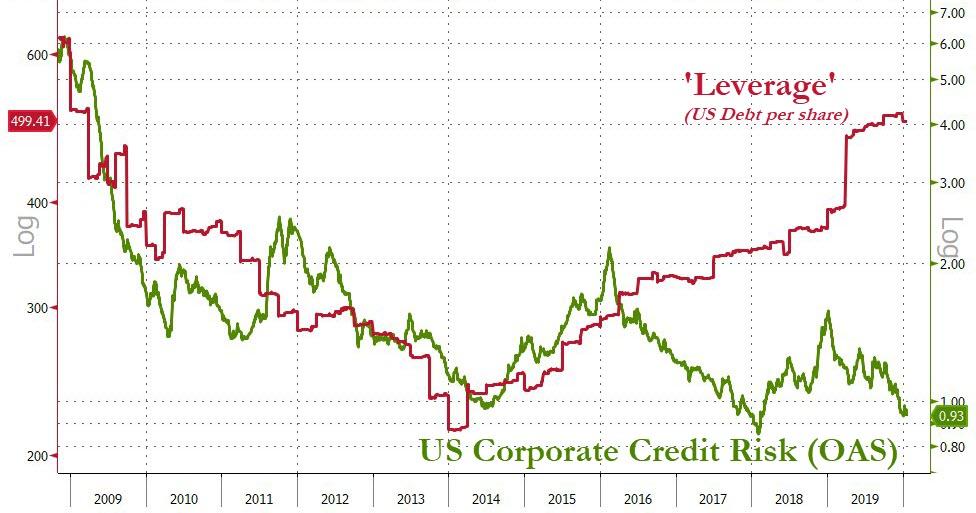

This correlates well with our observation that the number of idiosyncratic defaults has been increasing. Ultimately, markets will need to reprice for this rising risk with increased bond spreads relative to Treasury securities. However, that day of reckoning when spreads rise is being held off by the flood of central bank liquidity and international investors fleeing negative yields overseas.

And let’s not forget downgrade risk of BBBs: today 50 percent of the investment-grade market is rated BBB, and in 2007 it was 35 percent. More specifically, about 8 percent of the investment-grade market was BBB- in 2007 and today it is 15 percent. It has more than quintupled in size outstanding, from $800 billion to $3.3 trillion. We expect 15–20 percent of BBBs to get downgraded to high yield in the next downgrade wave: This would equate to $500–660 billion and be the largest fallen angel volume on record—and would also swamp the high yield market.

Ultimately, we will reach a tipping point when investors will awaken to the rising tide of defaults and downgrades. The timing is hard to predict but this reminds me a lot of the lead-up to the 2001 and 2002 recession.

The prolonged period of tight credit spreads experienced in the late 1990s lulled investors into unwittingly increasing risk at a time they should have been upgrading their portfolios.

This brings to mind the famous observation by economist Hyman Minsky, who stated that stability is inherently destabilizing. That is to say that long periods of relative stability in risk assets causes investors to keep upping the risk during a long period of calm.

Ultimately, this leads to what he called a Ponzi Market where the only reason investors keep adding to risk is the fear that prices will be higher tomorrow (or in the case of bonds, yields will be lower tomorrow).

Daniel Kahneman observed this behavior in his own work, when he identified that investors’ fear of missing an opportunity induces them to buy when they should be selling.

Even though the recession clearly has been put off until 2021 and perhaps 2022, in the lead-up to the 2001 recession, credit deterioration started to be evidenced three years earlier in 1998 as defaults and credit spreads were rising.

This would sound like good news for yield starved investors and I would agree.

But patience will lead to bigger opportunities for disciplined investors who don’t wander off into exotic asset classes or chase current returns.

Tyler Durden

Tue, 01/21/2020 – 09:35

via ZeroHedge News https://ift.tt/2ujcMT5 Tyler Durden