Despite Ugly, Tailing 5Y Auciton, 2s5s Curve Inverts

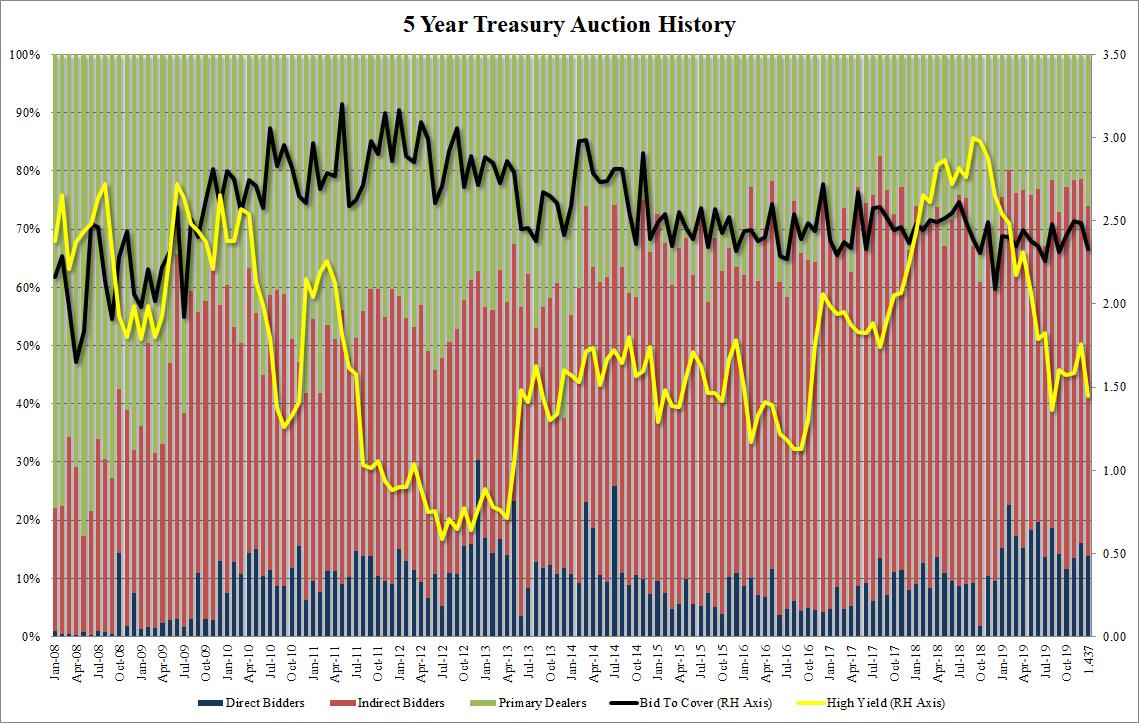

After a slightly tailing 2Y auction priced earlier today as yields tumbled across the curve, the lack of motivated auction buyers was that much more on display moments ago when the Fed sold $41BN in 5Y paper, at a high yield of 1.448%, the lowest since August 2019, but also the biggest tail to the 1.437% When Issued since December 2018, when the tail was 2.3bps compared to today’s 1.1%bps.

It wasn’t just the tail however, with the Bid to Cover today sliding from 2.49 to 2.33, below the six auction average of 2.41 and the lowest since September.

The internals were also on the ugly side with Indirects taking down 60.0%, a drop from December’s 62.4% , if just below the 60.8% recent average. And with Dealers taking down a substantial 26.1%, the highest since September, it left Directs with just 13.9% of the auction, below the 14.6% average.

Overall, an uglier auction than this morning’s sale of $40BN in 2Y paper, if still solid enough to keep the 2s5s curve inverted on the day, the first time the 2s5s has traded below 0% since early December.

Tyler Durden

Mon, 01/27/2020 – 13:13

via ZeroHedge News https://ift.tt/2RONTqw Tyler Durden