Markets In Turmoil: Corona-Chaos Sparks Carnage In Crude, Credit, & The Yield Curve

JPM and MS (and almost every asset-gatherer on CNBC): “probably nothing, BTFD”

Rest of world sees “Outbreak”…

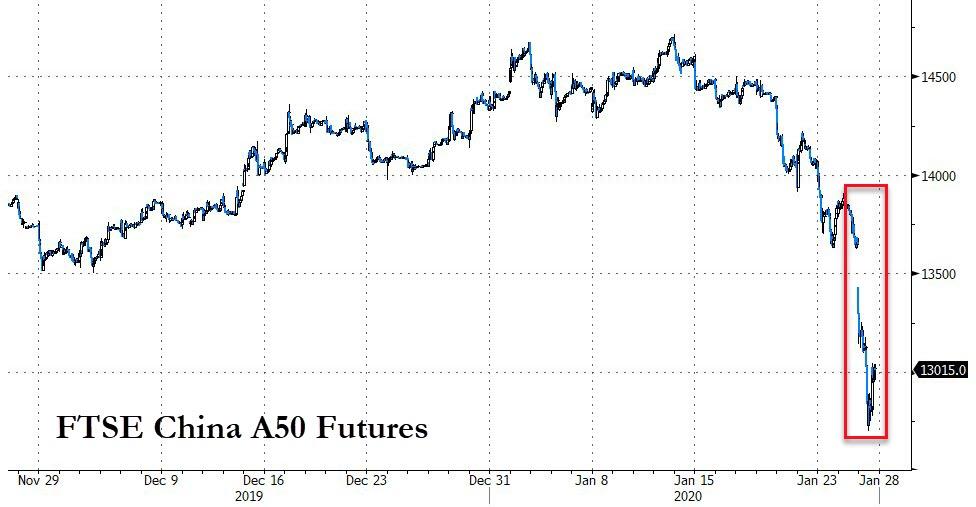

China cash markets remain closed for the lunar new year but futures crashed overnight…

Source: Bloomberg

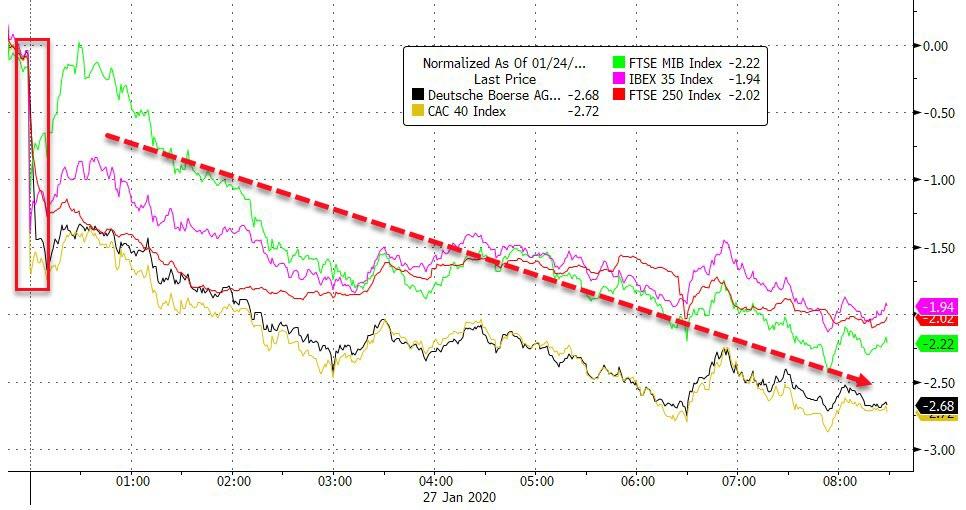

Europe gapped down at the open, the machines tried hard to bid it back but all the majors ended notably lower…

Source: Bloomberg

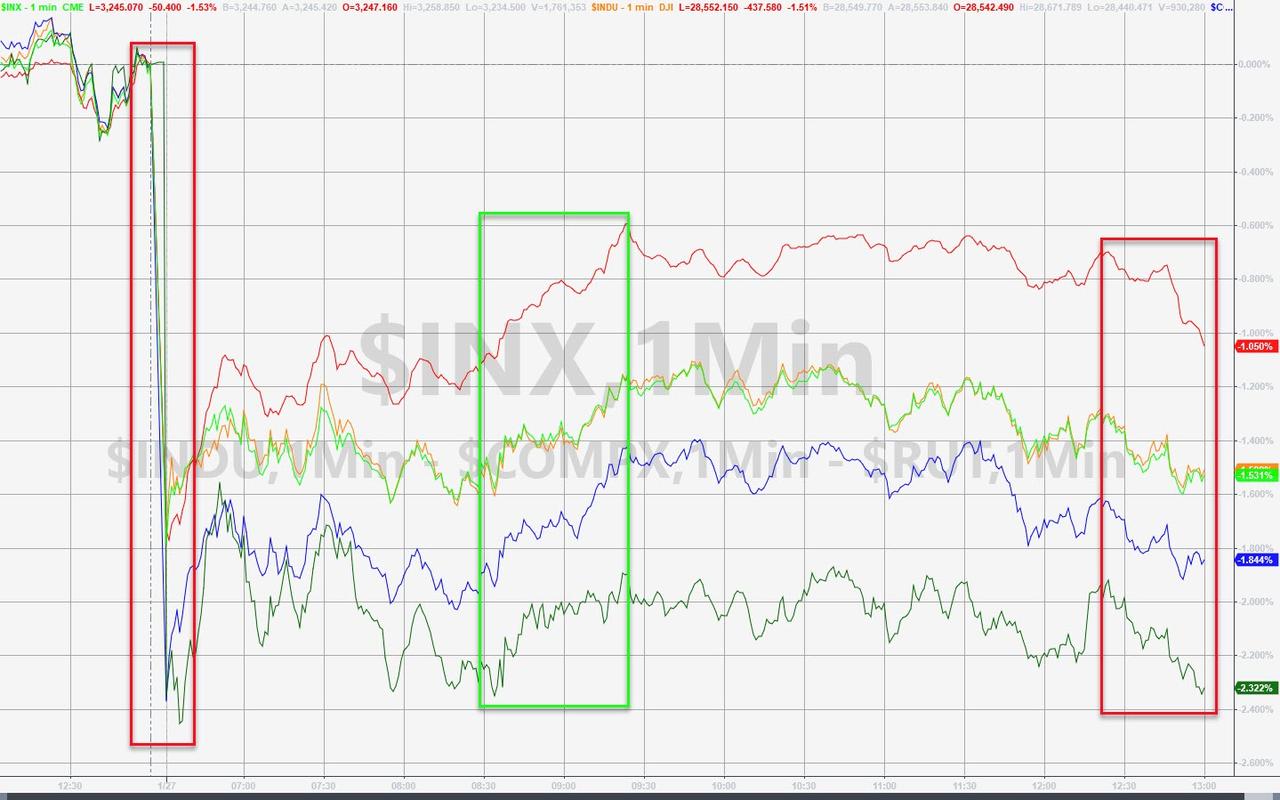

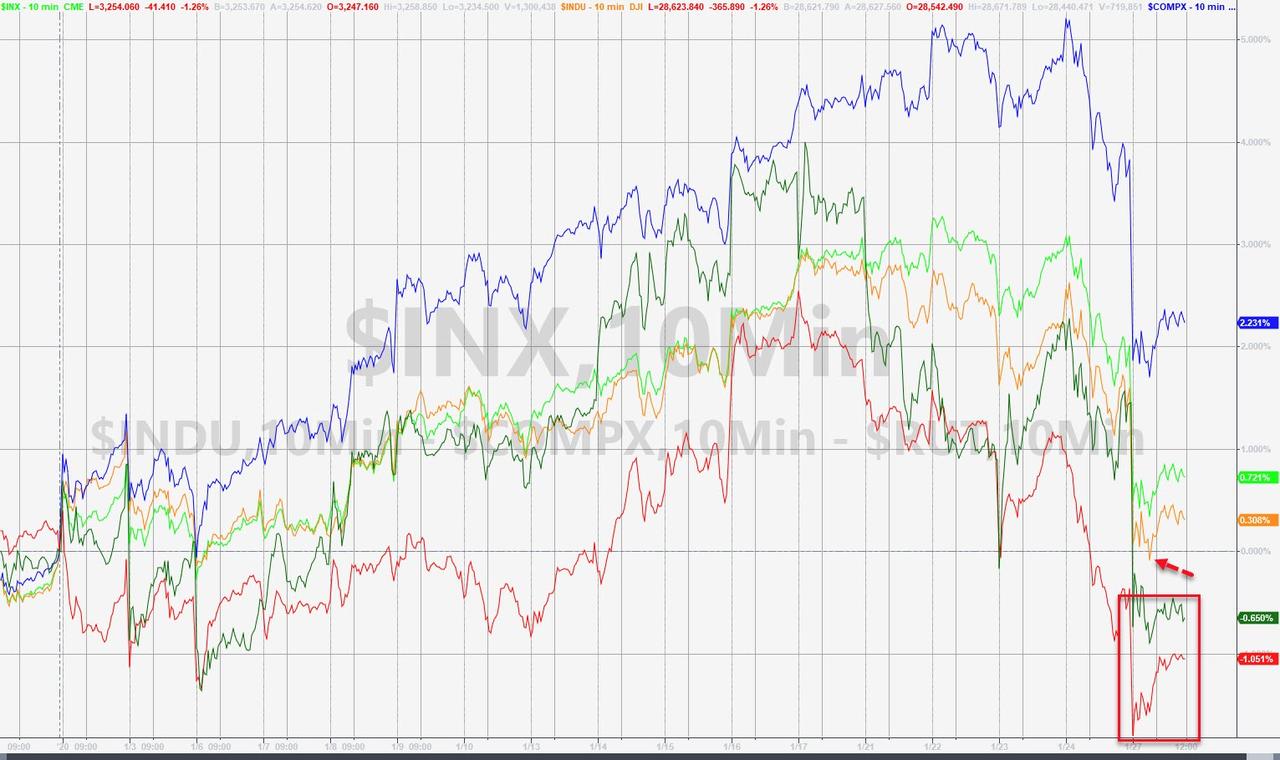

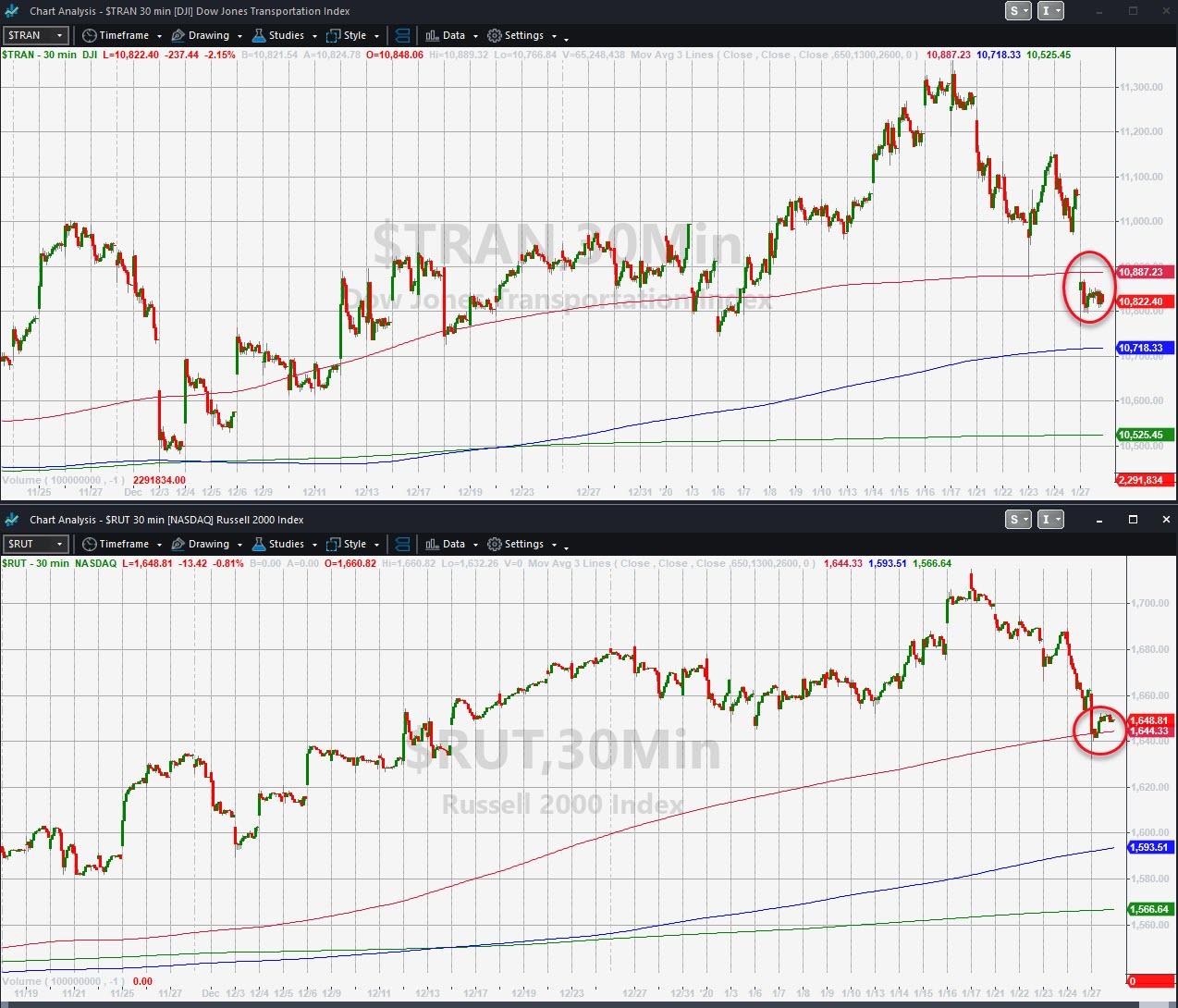

US markets were all ugly – Dow and S&P worst day since October – Trannies worst, Small Caps best today though all ended with a weak close…

Futures show the opening gap down, then another lurch lower as Europe opened, and the standard magical bid at the US open…

With Small Caps, Transports, and The Dow all dipping red for 2020 intraday…

Source: Bloomberg

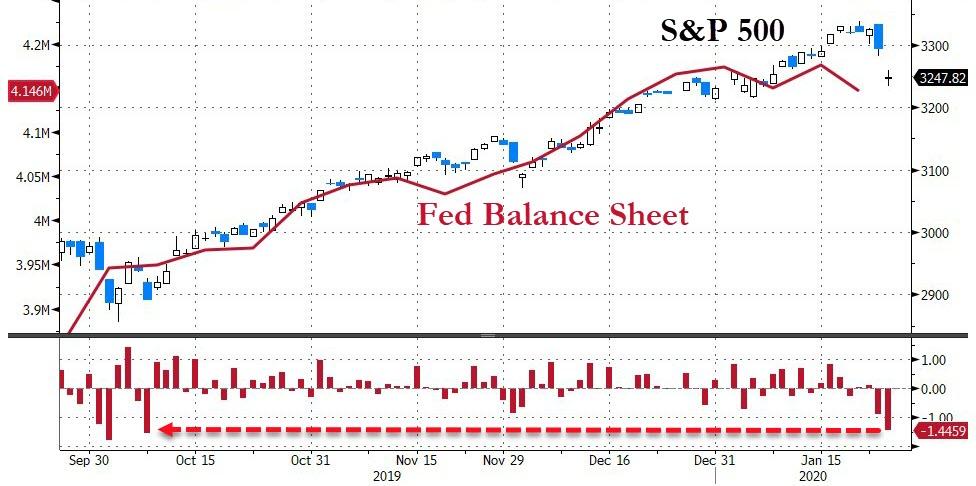

This was the first 1%-plus loss for the S&P in 76 days! (since The Fed started its shenanigans)

Source: Bloomberg

Trannies and Small Caps broke their 50DMAs today…

Source: Bloomberg

Source: Bloomberg

Cyclicals have plunged into the red year-to-date with Defensives bid (even though they were sold today)…

Source: Bloomberg

“Most Shorted” stocks are down 6 of the last 7 days (biggest drop since early October)…

Source: Bloomberg

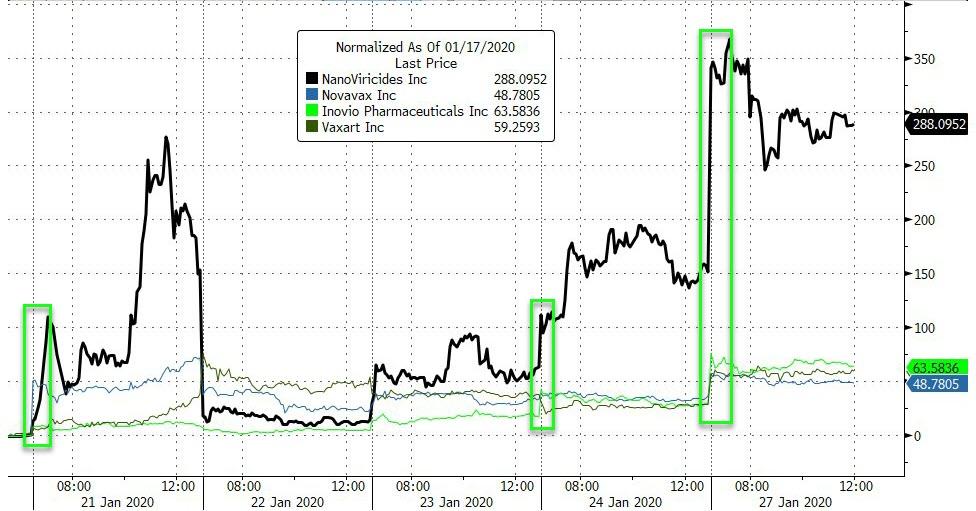

Flu-shot makers soared again led by NNVC…

Source: Bloomberg

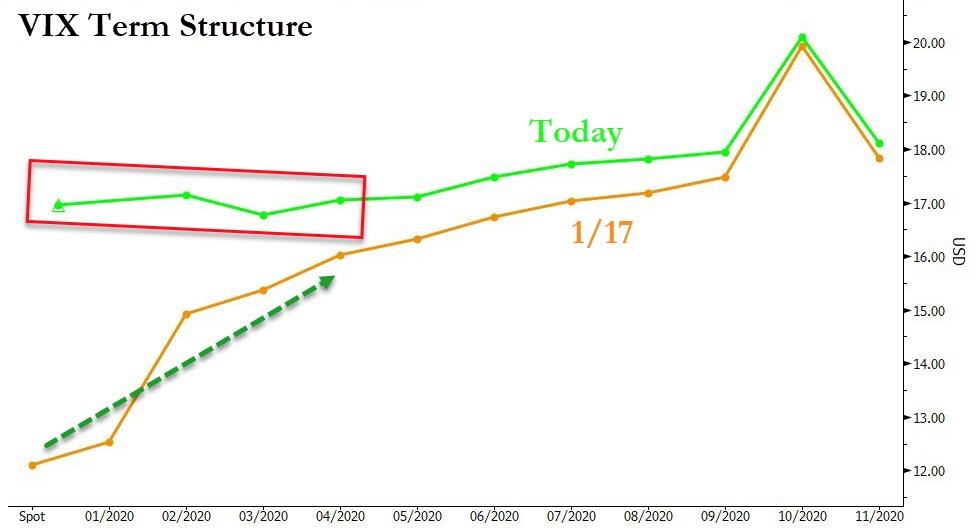

VIX spiked above 19 intraday…

The VIX term structure inverted today…

Source: Bloomberg

And as equity protection costs spike, so do credit risk premia…

Source: Bloomberg

Credit markets crashed in the last few days (and perhaps most ominously the market may be closing down as five IG issuers put bond deals on hold Monday)…

Source: Bloomberg

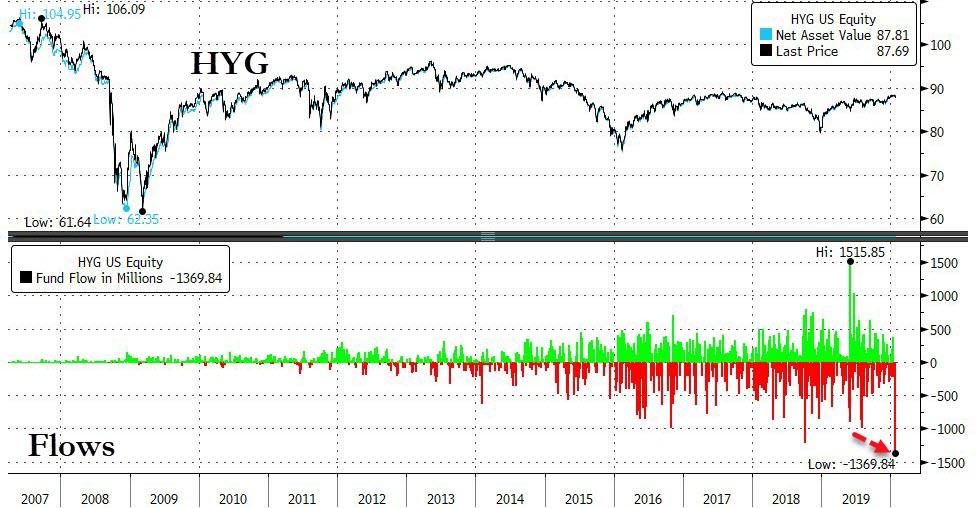

Investors pulled close to $1.4 billion – a record outflow – from the biggest junk bond ETF on Friday. The $18.1b iShares iBoxx High Yield Corporate Bond ETF fund, known by its ticker HYG, is on pace for its third straight month of outflows.

Source: Bloomberg

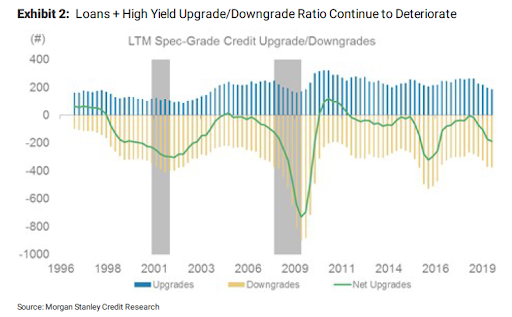

None of which should be a big surprise given that net downgrades are at their worst in 4 years…

Stocks started to catch down to bonds’ version of reality but yields are still leading the charge lower…

Source: Bloomberg

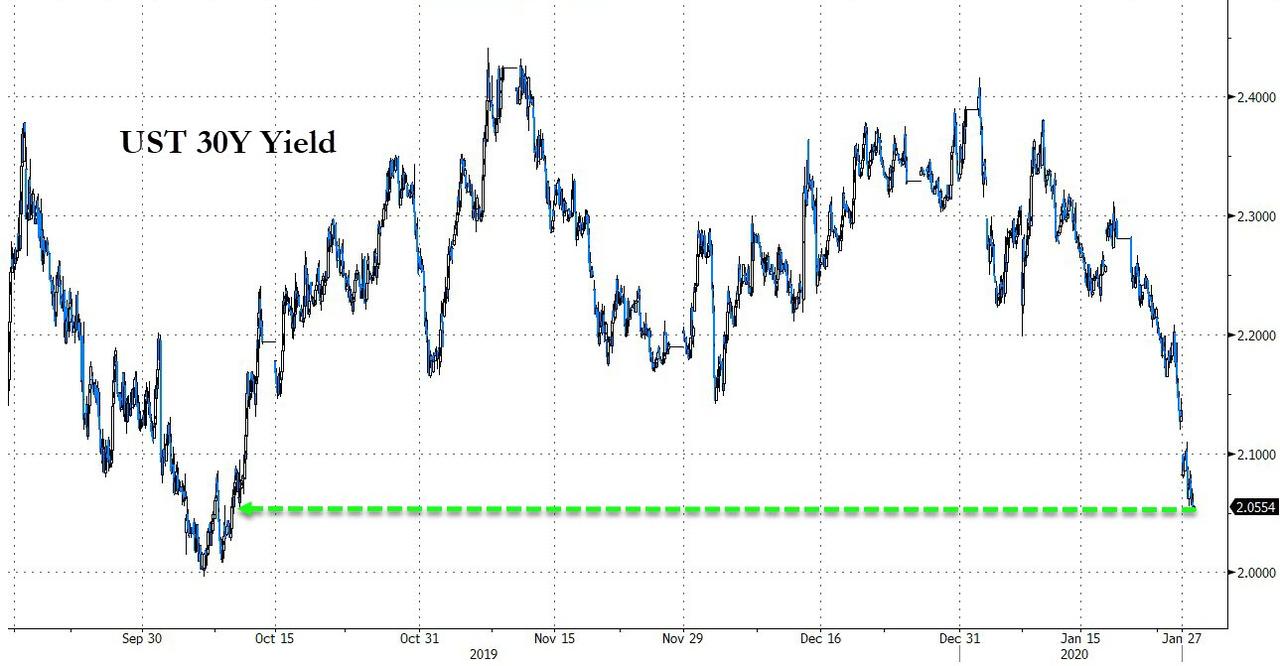

The entire Treasury curve accelerated lower in yields today, leaving 30Y now down 35bps in 2020…

Source: Bloomberg

30Y Yields tumbled to their lowest since Oct 9th (this is the biggest 30Y Yield drop to start a year since 2015)…

Source: Bloomberg

Yield curve collapsed as yields dropped with 2s10s at 2-month flats…

Source: Bloomberg

And 2s5s inverted once again…

Source: Bloomberg

The Dollar extended its gains, pushing up to the Dec FOMC highs (USD’s best start to a year since 2016)…

Source: Bloomberg

Yuan was clubbed like a baby seal today…

Source: Bloomberg

Cryptos were all higher over the weekend and extended gains

Source: Bloomberg

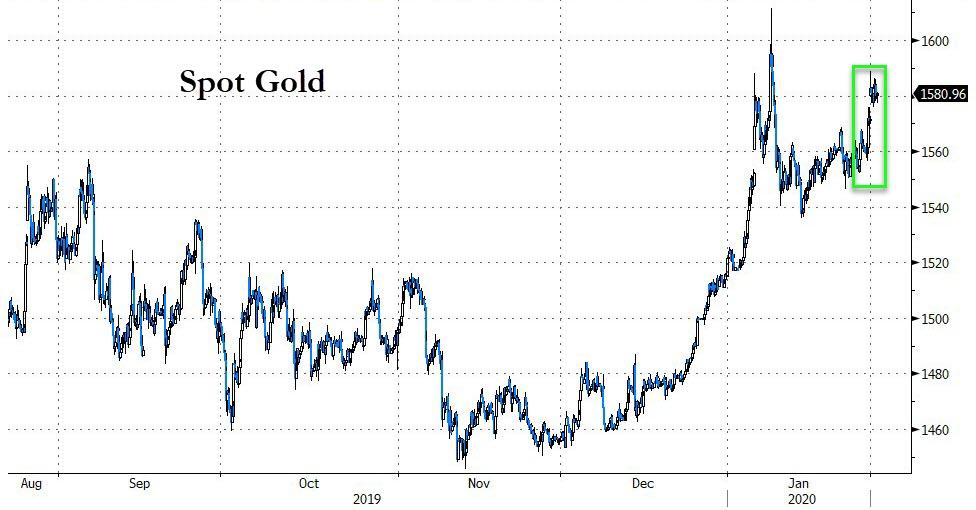

Copper and crude once again hit hard on China demand fears as those same fears sparked a bid in PMs…

Source: Bloomberg

Gold is up 6 days in a row…

Source: Bloomberg

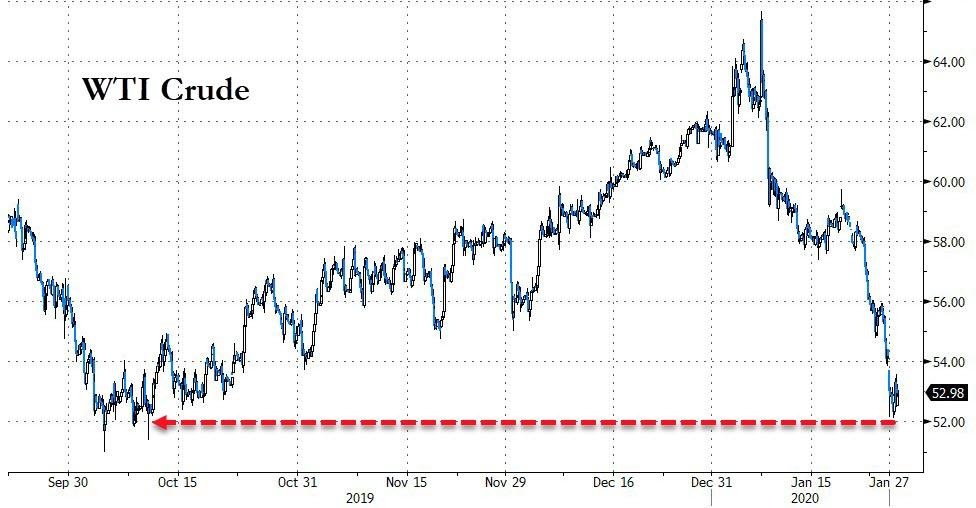

As oil drops for the 5th day in a row to its lowest since early October…

Source: Bloomberg

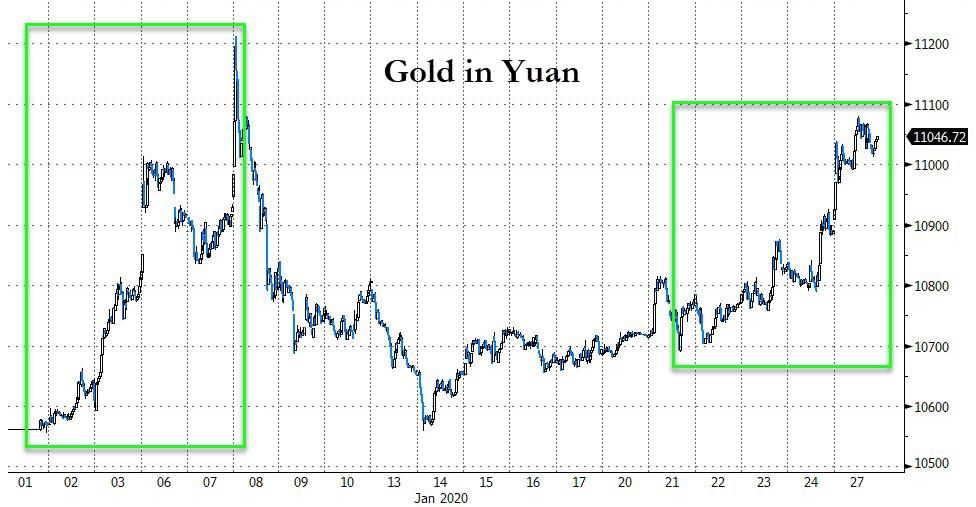

Gold priced in yuan has soared back to early Jan highs (near its highest since 2012)

Source: Bloomberg

Finally, we note that global negative yielding debt is on the rise once again – up $1.5 trillion in the last 7 days…

Source: Bloomberg

And Greed has been replaced by fear rapidly…

Of course, it could be worse…

Tyler Durden

Mon, 01/27/2020 – 16:00

via ZeroHedge News https://ift.tt/37yMo6j Tyler Durden