Morgan Stanley: “The Correction Has Begun” But The Fed Will Keep It To 5%

Having gotten dragged kicking and screaming into validating the late-2019 market meltup and even hiking his own year-end price target for the S&P500, Morgan Stanley’s bearish equity strategist, Michael Wilson, was looking for just the right catalyst – such as the Chinese coronavirus pandemic – to announce that the Fed-liquidity driven rally is over and a long-overdue correction has begun. However, with the Fed still injecting ample liquidity into the market every month to the tune of about $60-80BN, Wilson finds himself trapped as he can’t go “full bear” and instead has to be cognizant that the factor that dragged him into the bullish camp is still there, and will likely be there (or become larger) throughout the pandemic, which limits how bearish Wilson can be.

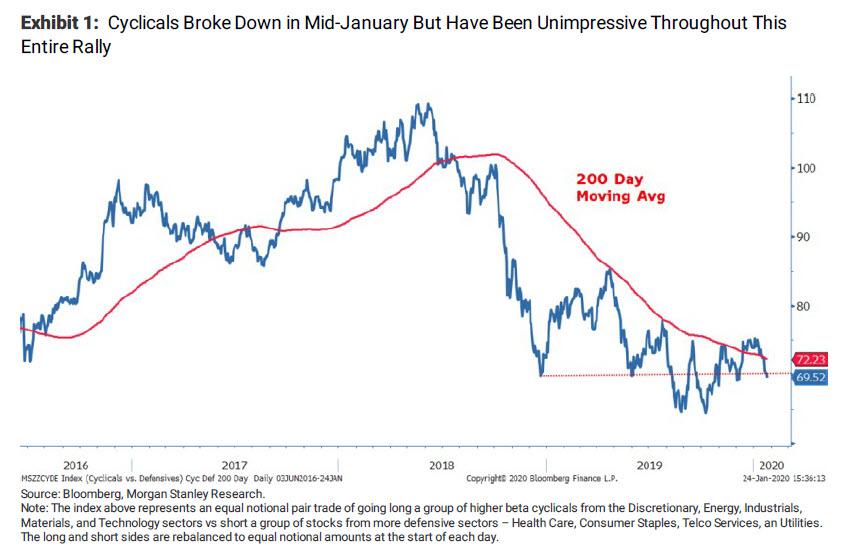

All of this emerged this morning when in his latest Weekly Warm Up note, Michael Wilson wrote that “market internals were already suggesting skepticism on a big growth reacceleration prior to the outbreak of the Coronavirus. However, with the breakdown of cyclicals and other “reflation” trades last week, concerns about the nascent recovery are rising.”

As noted above, Wilson was quick to acknowledge that “liquidity has played a large role in the rally since October and index level prices appear ahead of the fundamentals” and as such, while he suspects “the first correction since October has begun”, it will be contained to 5% or less for the S&P 500 as the Fed won’t let sto(n)cks drop too much as “liquidity remains flush and high quality/low beta/defense (i.e. S&P 500) outperforms lower quality/high beta/cyclicals (small caps, EM, Japan, Europe).”

Coronavirus aside, Wilson first addresses the breakdown in cyclicals, which took place even before the pandemic headlines spooked traders, Wilson writes that he has “remained steadfast in our view that investors should stay up the curve on size and quality and favor defensive stocks relative to cyclical ones. That view has been anchored in our opinion that the recovery in global growth will be modest and led by EM as the US economy decelerates further in 1H2020 before stabilizing.”

In January, Wilson’s skepticism has been proven correct, “with the barbell of large cap quality growth and defense leading the way. This has become even more extreme in the past week, with cyclicals taking it on the chin, especially relative to defensives. In fact, this ratio is now trading below where it was in December 2018 when the S&P 500 was trading at 2400, nearly 30% percent below current levels.”

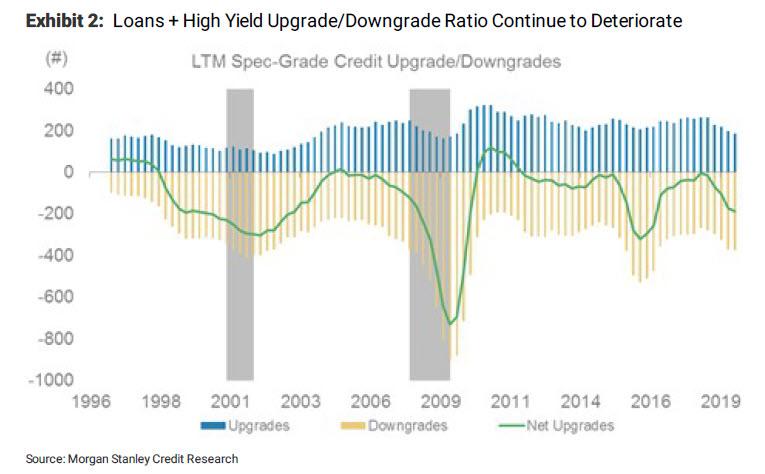

In the same vein, Wilson also notes that small caps continue to underperform large, as “markets agree with the view that earnings growth is likely to remain disappointing for the small caps relative to large due to margin pressure and perhaps building credit issues as indicated by the persistent increase in downgrades within the high yield and loan markets.” As shown in the chart below, the ratio of net upgrades is now the worst (most net downgrades) since the shale E&P crisis in 2015/2016 which sent dozens of energy companies into Chapter 11.

While this increase in downgrades had not hurt the performance of credit markets until last week, when a gaping divergence opened up between stocks and junk…

… Wilson believes it may have been holding back the performance of small caps all along, at least on a relative basis. In short, “it makes sense to stay underweight small caps until these credit downgrades subside, earnings expectations get more realistic, or the US economy shows signs of reacceleration rather than just stabilization.”

Alas, anyone hoping that this is the signal for fundamentals to once again matter, not so fast.

While Wilson does not exactly jump on the JPMorgan bandwagon, which as a reminder earlier today urged its clients to “please buy the dip“, he still thinks “liquidity is playing a large role in equity markets and with evidence of just a modest recovery led by ex-US economies, index level prices appear ahead of the fundamentals with a large skew toward large-cap, high-quality growth and defensive stocks.”

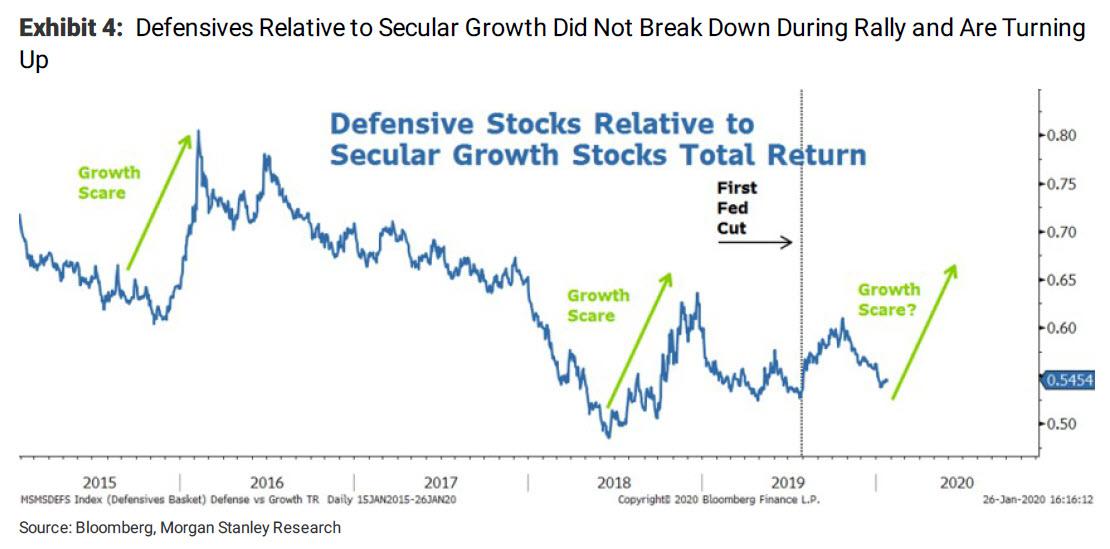

Alas, and as Eric Peters said yesterday when he cautioned that “in each downturn, central bankers must step in more and more aggressively…. the process is reflexive and ultimately leads to a Minsky extreme,” this means that while near-term risks have increased, Morgan Stanley believes that “corrections at the index level will be contained to 5 percent or less while the defensive skew outperforms both growth and cyclicals until rates show some signs of actually bottoming or hard data suggests the recovery will be more robust than we currently expect.” The next chart shows that defensives relative to secular growth remain above the lows from last summer when the Fed cut rates for the first time this cycle and appear to be turning up again as growth concerns perhaps return.

Paradoxically, this means that the Fed’s safety net will prevent a major selloff even if, or rather especially if the coronavirus epidemic results in collapse in economic supply chains and economic devastation. The irony: for stocks to drop, the economy and corporate profits will have to finally bottom and be on a solild uptrend, also known as just another day in the bizarro upside-down world of the “new abnormal.”

Tyler Durden

Mon, 01/27/2020 – 15:24

via ZeroHedge News https://ift.tt/36yCtwg Tyler Durden