All Eyes On Apple: Will The Market’s Biggest Pillar Finally Crack

It is safe to say that of all the companies reporting this earnings season, only one truly matters: Apple, which is reporting today after the close at 4:30pm ET.

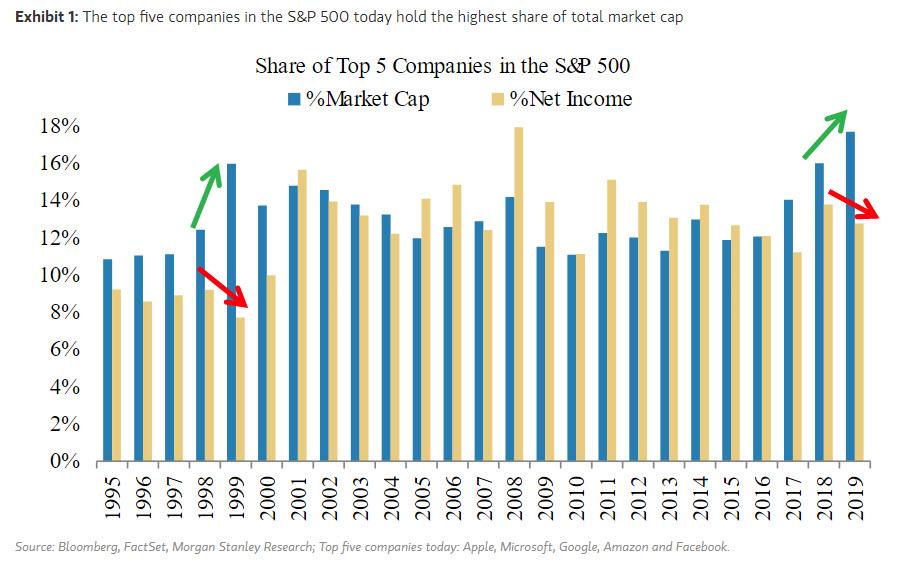

As we showed recently, tech firms have driven over half of market cap appreciation in the S&P 500 in the last 12 months, and not on earnings growth but purely on multiple expansion. Furthermore, as Morgan Stanley recently calculated, currently the top five companies in the S&P 500 make up 18% of the total market cap.

And no company plays a bigger role in this total than the world’s most valuable company, Apple, whose $1.4 trillion market cap is 130% higher since Tim Cook guided down expectations just one year ago.

But what is even more mind-blowing is that AAPL managed to more than double its market cap even as its earnings have been virtually unchanged over the past year, once again showing the power of central banks in expanding P/E multiples, which for AAPL is now the highest in a decade at ~24x.

Apple’s average PE over the past decade was about 14x, lagging other high-growth companies with recurring revenue and reflecting its singular dependence on iPhones sales and reliance on persuading consumers to upgrade their phones year after year.

“The run-up in the stock is a concern, and I wouldn’t be surprised if we see a bit of a pullback in the near future,” said People’s United Advisors chief equity strategist John Conlon, who added that Apple’s services business has become his main reason for owning stock.

Even more remarkable is that as AAPL exploded higher, the company stopped reporting the number of iPhones since “it wasn’t a good metric” although what it really meant is that iPhone sales growth for years had been declining.

And so, instead of pure iPhone sales, services and wearables have taken up the slack, although a big part for the recent surge has been “hopes for 5G iPhone” which will be released later in 2020 (yet which some have warned will be a huge dud). What followed was an unprecedented scramble by sell-side analysts to chase the price, which also benefited from Apple’s record buyback, and raise price targets without raising earnings forecasts.

And so, as Hedge Fund Telemetry writes, “the bar is high headed into this report” – indeed, with the stock priced beyond perfection and at the highest PE in decades, any adverse surprises would have a dire effect not only on the stock prices but the broader S&P which has used ETF-darling AAPL as its core support pillar.

So what that in mind, here is what the market is expecting (although note that Apple will no longer be reporting broken out iPhone numbers):

- Q1 revenue estimate $88.38 billion (range $85.99 billion to $90 billion)

- Services revenue $12.98 billion, up 18.9% y/y

- Wearables revenue $9.51 billion, up 29.8% y/y

- Q1 EPS estimate $4.56 (range $4.30 to $4.85)

- Q1 gross margin estimate 38.0% (range 37.5% to 38.8%)

- iPhone units 66.67 million

- iPhone ASP $785.07, down 3.7% y/y

While there is probably not much room for surprises in the current quarter numbers, all eyes will be on the company’s forecast for next quarter, which Wall Street expects to look as follows:

- 2Q revenue estimate $62.33 billion (range $57.0 billion to $65.71 billion)

- 2Q gross margin estimate 38.1%

Needless to say, any Apple commentary about the impact of Coronavirus on iphone demand or supply chains will be critical. As a reminder, earlier today the Nikkei leaked what could be seen as both positive and negative guidance.

Positive in that “Apple has asked suppliers to make up to 80 million iPhones over the first half of this year, an increase of over 10% from last year’s production schedule that could boost the company’s near-record share price.”

Apple, which reports fourth-quarter results after Tuesday’s U.S. market close, has booked orders for up to 65 million of its older iPhones, mostly from the iPhone 11 series, and up to 15 million units of a new cut-price model that it plans to unveil in March. Apple ordered 73 million iPhones over the same period last year, according to GF Securities data.

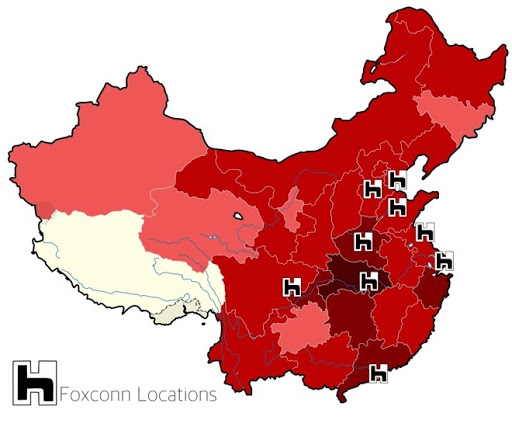

Yet the leaked guidance negative in that “suppliers warned that the blistering pace of production could be complicated by the outbreak of the coronavirus in China’s Hubei Province, given that their main manufacturing centers are in nearby Henan and Guangdong provinces, which had more than 100 confirmed cases as of Monday afternoon, and in Shanghai, with over 50 confirmed cases.”

In addition to the guidance, investors will be looking for fresh evidence the iPhone maker should be treated as a producer of high-margin, subscription services after its stock market value touched $1.4 trillion and its earnings multiple trades at decade highs. For the fiscal first quarter, which ended in December, analysts on average expect services revenue to jump 19.7% to $13.0 billion, according to Refinitiv.

Overall quarterly revenue is expected to rise 5.0% to $88.5 billion, with adjusted net income inching up 1.5% to $20.3 billion and earnings per share of $4.55.

In the September quarter, Apple said its services revenue hit $12.51 billion, topping analysts expectations of $12.15 billion. Services accounted for 20% of total revenue in that quarter, up from 17% in the same quarter the year before. Apple also gave cost of sales data showing gross margins for its services segment rose to 64% from a 61% a year earlier. That is far more generous than Apple’s overall gross margin of around 38% in recent years.

Apple has also increased the emphasis on its AppleCare, its extended warranty program. For example, the iPhone’s “settings” now includes reminders encouraging people to buy or renew their AppleCare plans.

As Reuters notes, Apple’s recent strong stock performance has been perpetuated by fund managers buying its shares in order to avoid underperforming their benchmarks, a trend that could reverse when the recent rally ends, Cowen analyst Krish Sankar wrote in a client note last week.

Finally, here are some additional thoughts on what to expect later today from Hedge Fund Telemetry:

Tim Cook has been smart by being cozy with President Trump to keep Apple away from the tariff risk. They have bought back in the past year nearly $50 billion in stock. Apple has attributed over 20% of the gains in the Nasdaq 100. It’s nearly worth $1.4 billion and the stock is trading at the highest multiple in ages ~26x.

It’s the most owned stock in the US within almost every type of fund or ETF. Short interest is low at 1.5 days to cover. Warren Buffett has Apple as his largest position that is now over 30% of his portfolio more than double his next largest holding. The front page holders of Apple have been net sellers in the last quarterly filings simply because it’s become too large of a position especially with Vanguard, Blackrock, and State Street the largest passive funds which hold nearly 20% of Apple.

Earnings tonight should be inline but the guidance for the next quarter is +7%. This is aggressive and likely will be guided down especially without any new products planned. The average price target for Apple with sell-side analysts is at 300 down 5% from here.

There are 27 buys, 14 holds, and 7 sell ratings. China sales early in the last quarter were burdened by the tariff war (and is an unknown) and should be at risk with the Coronavirus this quarter from a sales and supply chain point of view. (another big unknown).

And while the S&P has so far weathered the impact of the Chinese coronavirus relatively well, trading just 1% below its all time record high, a far bigger test for the broader market will be what happens if AAPL finally disappoints, and its stock tumbles after reporting earnings. For the answer: tune in at 430pm ET.

Tyler Durden

Tue, 01/28/2020 – 15:22

via ZeroHedge News https://ift.tt/2O7y2lJ Tyler Durden