Mediocre 7Y Auction Tails As Yield Tumbles To 6 Month Low

Following two tailing coupon auctions, which saw both the 2Y and 5Y note sales tail the When Issued as a result of this week’s sharp drop in yields across the curve, today was no exception and moments ago the Treasury concluded the week’s accelerated bond issuance calendar when it sold $31BN in 7 Year notes at the lowest yield in six months.

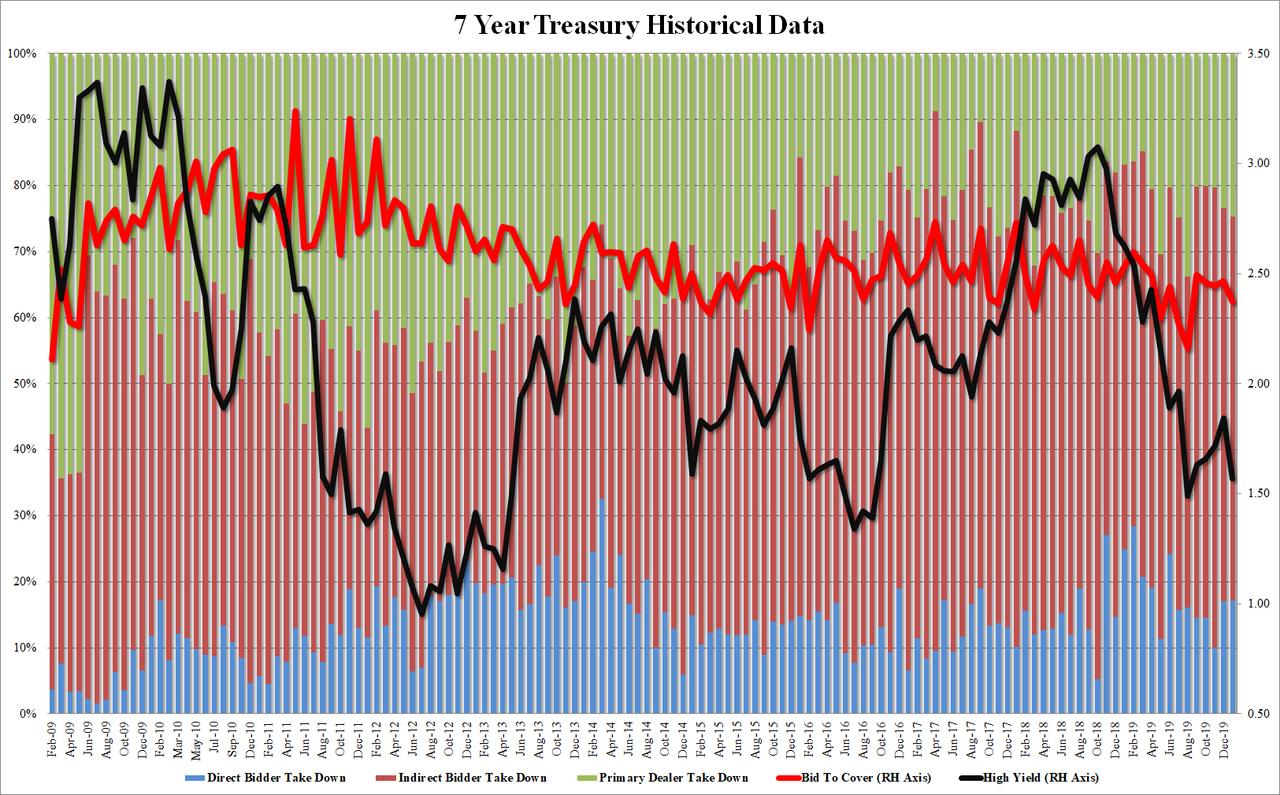

Stopping at a high yield of 1.570%, the lowest since the 1.489% printed in August and sharply lower from December’s 1.844%, the 7Y auction tailed the 1.566% When Issued by 0.4bps, the second consecutive tail.

The Bid to Cover of 2.371 suggested a lack of buyside demand, with a notable drop from the 2.466 in December, and was the lowest since the 2.16 in August.

The internals were also disappointing, with Indirects taking down just 58.1%, below the 59.4% in December, under the 61.5% six auction average, and the lowest since August. Directs also dipped, taking down 17.2% in January after 17.1% in December; this left Dealers holding 24.7% of the auction, fractionally higher than the 23.4% in December.

Overall, another average, tailing auction which however was to be expected in light of the sharp pulling back in yields observed this week.

Tyler Durden

Tue, 01/28/2020 – 13:16

via ZeroHedge News https://ift.tt/2RwNDgX Tyler Durden