Multi-Billion Levered Options Strategy Fund Finally Faces The Music For Fraud

Three years ago, we first introduced the world to Catalyst Capital, and its Hedged Futures Strategy Fund, which wasn’t a managed futures fund after all…

“It was miscategorized,” said Morningstar (MORN) analyst Jason Kephart, noting that Morningstar analysts don’t cover the fund. The Catalyst fund uses put and call options on Standard & Poor’s 500 stock futures, with the aim of reducing volatilty and overall correlation to the blue-chip index.

Morningstar moved the fund into the options writing category Feb. 1, Mr. Kephart said.

For many, it was the first time they had seen the power of ‘short gamma’ to create a massive market melt-up in practice as at the time, chatter about a multi-billion-dollar levered options strategy fund getting caught offside (and being forced – by its own strategy’s hedging requirements – to buy into the rally, acting as the ‘catalyst’ for the almost unprecedented move) had been rife.

Catalyst Capital CEO Jerry Szilagyi told Bloomberg in Feb 2017:

“It’s just people looking to sensationalize things and make headlines,” adding that “our exposure was greatly exaggerated, and our impact on the market was greatly exaggerated.“

Which rang a bell to more than a few…

Bear Stearns CEO Alan Schwartz goes on CNBC in March 2008 and assures viewers that the firm has ample liquidity. “Part of the problem is that when speculation starts in a market that has a lot of emotion in it,” Schwartz says he has numbers to back up his insistence that the bank’s position is solid.

As we mocked at the time, the first rule of crisis management… “blame the speculators”

Well, three years later, it appears we were right, and Szilagyi was lying about the exposure as The SEC today announced charges against the New York-based investment adviser for misleading investors about the management of risk.

Catalyst Capital Advisors LLC (CCA) and its President and Chief Executive Officer, Jerry Szilagyi, agreed to pay a combined $10.5 million to settle the charges…

…although CCA told investors that it abided by a strict set of risk parameters for the Catalyst Hedged Futures Strategy Fund, it breached those parameters and failed to take the required corrective action during a majority of the trading days between December 2016 and February 2017.

As alleged, the fund lost hundreds of millions of dollars – approximately 20% of its value – from December 2016 through February 2017 as markets moved against it. The SEC’s complaint against Walczak alleges that he told investors that the fund employed a risk management strategy involving safeguards to prevent losses of more than 8%, when in fact no such safeguards limited losses and Walczak did not otherwise consistently manage the fund to an 8% loss threshold.

“CCA’s misrepresentations, and Walczak’s alleged departure from his stated approach to managing risk, deprived investors of accurate information about an important aspect of the fund’s management.”

In parallel action, the Commodity Futures Trading Commission (CFTC) today announced settled charges against CCA and Szilagyi, and a district court action against Walczak.”

Finally, we note that Feb 2017’s unprecedented decoupling between fundamentals, flows, bond yields, and in fact anything else that was in any way rationally discounting risk mimics the recent few months of farce that has been evident in the so-called markets as gamma built up and the virtuous cycle escalated stock prices to record high valuations.

The funny thing is – just like in Feb 2017 – Catalyst Capital was seeing a massive liquidation as the collapse in its assets under management suddenly accelerated once again…

Source: Bloomberg

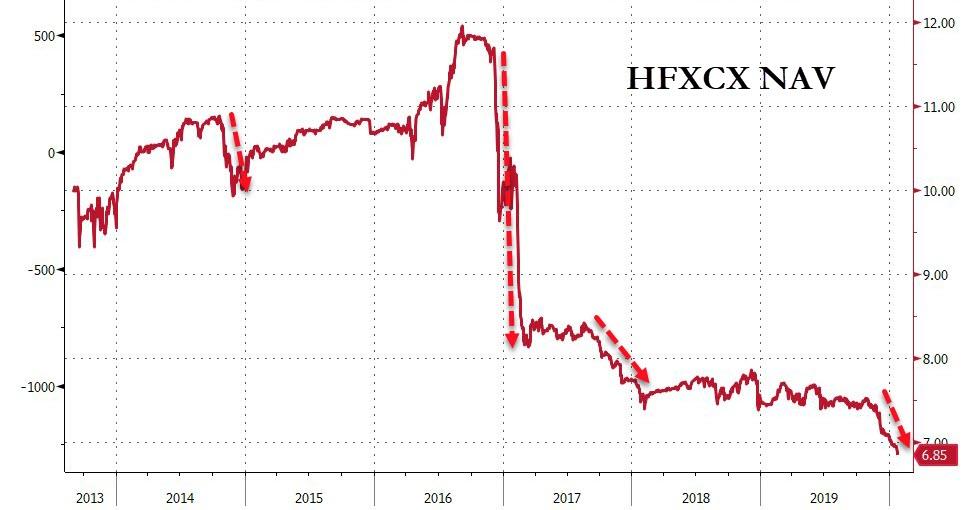

The fund’s net asset value tumbled…

Source: Bloomberg

And its NAV’s decline perfectly synced with the surge in the stock market – as once again – the fund’s strategy forced them to buy more and more as prices rose, sustaining the rally…

Source: Bloomberg

And as is clear from the chart above, the decoupling in the last couple of days suggests things are about to get a little hectic for this strategy.

So, was Catalyst’s fund once again the driver of irrational buying panics as it liquidated its positions with forced buying into ever-rising index prices? We will see…

Tyler Durden

Tue, 01/28/2020 – 08:16

via ZeroHedge News https://ift.tt/2RC4PBP Tyler Durden