Bill Dudley: The Fed’s Balance-Sheet Expansion Has No Effect On The Stock Market

The dust still hasn’t settled on the shock and outrage that followed Bill “let them eat deflationary iPads” Dudley’s oped in which he suggested that the Fed could crash Trump’s reelection chances by sinking the economy into a recession, when today the former NYFed president and Goldman Sachs economist and current Bloomberg op-ed writer decided to lend some support to his colleague Neel Kashkari by writing yet another op-ed titled “Fed’s Repo Response Isn’t Fueling the Stock Market” in which Dudley “explains” that “equities are being driven by low rates and a healthy economy, not central bank T-bill purchases.“

As a reminder, two weeks ago, Neel Kashkari sparked a vocal response among Fed watchers when he urged “QE conspiracists” to show him how the Fed is moving stock prices. And while we did just that, using none other than a recent BIS article to explain to Kashkari precisely how the Fed is “moving stock prices”, Neel probably did not anticipate that one of his own FOMC colleagues, Dallas Fed president (and another former Goldmanite), Robert Kaplan, would join the ranks of “QE conspiracists” when he told Bloomberg that what the Fed is doing now is “a derivative of QE when we buy bills and we inject more liquidity; it affects risk assets” adding that “growth in the balance sheet is not free. There is a cost to it.”

Kashkari certainly did not expect Trump’s top economic advisor, Larry Kudlow, and Morgan Stanley CEO James Gorman to also admit that the Fed’s balance sheet expansion is quantitative easing, as more and more establishment luminaries joined the ranks of “QE conspiracists.”

So with Neel suddenly feeling all alone in his lack of understanding of monetary policy, Bill Dudley decided to join the fray, and ignoring all the recent statements from Kaplan, Kudlow and Gorman, trumpeted today that he is “skeptical that the Fed’s balance-sheet expansion is having a major effect on U.S. stock prices.”

Dudley is of course referring to the fact that ever since the start of the repo “bailout” by the Fed in September, when Powell launched hundreds of billions in overnight and term repos and especially with the start of “Not QE” on October 11, stocks soared, something we have shown virtually every week since October when we demonstrated the uncanny correlation between the rise in the Fed’s balance sheet and the S&P. This is how Dudley framed this:

During the past few months, the U.S. stock market has surged as the the Federal Reserve bought hundreds of billions dollars of Treasury bills to add reserves to the banking system and calm the repo market.

To Dudley none of this matters because “of course, correlation isn’t the same as causation. Just because two things are moving together doesn’t mean that one causes the other” which would be a great argument if one were to exclude, for example, the fact that global central bank liquidity and the market’s performance ever since the Fed’s infamous pivot, have moved tick for tick. In other words, according to Dudley the chart below is pure coincidence:

Second, and more importantly, Dudley continues, “the notion that the Fed’s actions are fueling a stock market bubble isn’t supported by how the Fed’s T-bill purchases are affecting short-term interest rates or how the Fed’s actions are increasing liquidity in the financial system.”

As Dudley then “explains”, the “Fed’s T-bill purchases substitute a bank reserve (essentially equivalent to a one-day T-bill) for a slightly longer risk-free asset (a T-bill) that the Fed now holds in its portfolio. But that’s it. There are no funds created to purchase equities.”

This is great, and if correct would certainly validate Kashkari’s skepticism… if it were true. Unfortunately it isn’t. As a reminder, none other than the BIS explained how generous commercial bank leverage was necessary and sufficient to allow hedge funds to engage in massively-levered, repo funded Treasury pair trades, and that without this liquidity – which the Fed directly enabled – hedge funds would be forced to unwind trillions in trades, resulting in a liquidation cascade. But don’t take our word for it, this is what Claudio Borio, head of the monetary and economic department at the BIS, said to explain the dramatic surge in funding needs among commercial banks which was to meet…

… high demand for secured (repo) funding from non-bank financial institutions, such as hedge funds heavily engaged in leveraging up relative value trades

In short: whereas both Kashkari and Dudley only look at the supply side of the newly injected reserves into the US commercial banking system, they both ignore the demand side, i.e., all those funds whose very existence is dependent on there being a generous excess of liquidity in the US financial system, or else all those “free” pair trades that boost returns would collapse overnight. What happens then? See LTCM.

Dudley’s third, and final point is the most laughable: “there is a more obvious explanation behind the stock market’s rise: the prospect of a sustained economic expansion and a Fed that is likely to stay on the sidelines and not raise its federal funds rate target in 2020.”

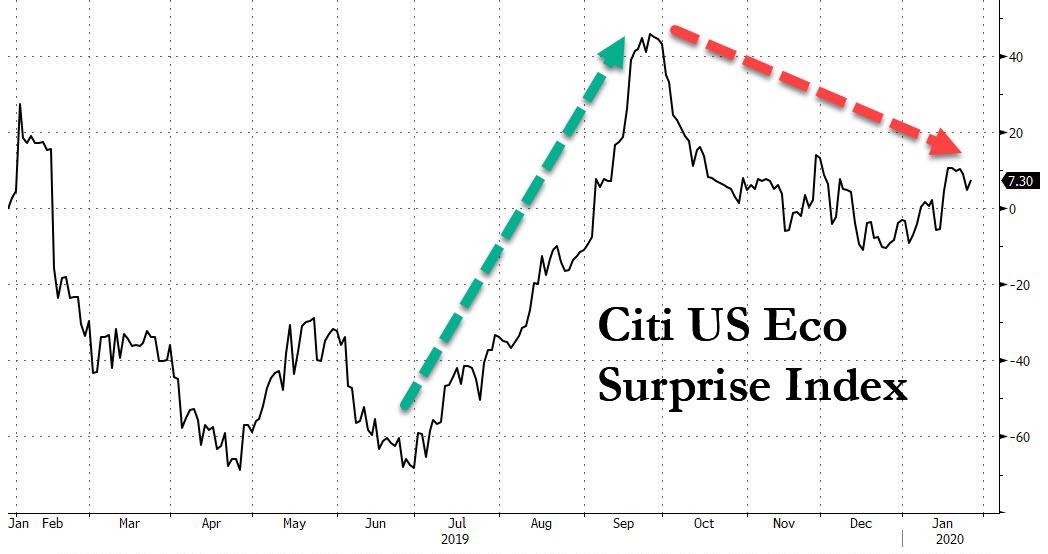

We have no idea what is going on here: maybe Dudley was busy eating iPads last Monday when the IMF cut its global economic forecast for a 6th consecutive time, including slashing its US GDP forecast for 2020. Or maybe he has not pulled up the Citi US econ surprise index, which after – ironically – surging into the September repocalypse, has since drifted lower and has been hugging the flatline for the past 5 months?

So three specious, if not outright fallacious, arguments down, what is the real purpose behind Dudley’s screed? It’s simple: as Dudley himself says, the answer is important whether the Fed’s balance sheet expansion is pushing stocks higher “because the Fed’s large T-bill purchases will end soon. If the central bank’s balance-sheet expansion is truly lifting stocks, then the market is vulnerable when these purchases cease.“

And it is here, where Dudley’s op-ed shifts from facts to hope:

The Fed’s expansion of its balance sheet and the increase in bank reserves have stabilized U.S. money markets. As a result, the Fed is likely to gradually taper its repo-market interventions and significantly slow its T-bill purchases after the April tax season. The end of this aggressive provision of bank reserves, however, is unlikely to create major problems for the U.S. equity market.

And there you have it: all Dudley hopes to do by siding with his Minneapolise Fed colleague is preparing the market for what comes next, namely the tapering of QE4 and the tremendous growth of the Fed’s balance sheet, which as most sellside strategists expect to start slowing sometime in late Q1 and certainly Q2. It explains why at the very end of his op-ed the former NY Fed president has nothing more to offer his read than a hope that “the end of this aggressive provision of bank reserves, however, is unlikely to create major problems for the U.S. equity market.”

In other words, nothing more than his own, biased opinion; the opinion of a man who outraged even his former employer when he suggested the Fed should prevent Trump’s reelection.

Well, Bill, you know what they say about opinions and anal sphincters. As for Dudley’s emotion appeal, we have a simple counterargument, the same one we offered Neel Kashkari: announce today that QE4, pardon “NOT QE” is ending and surprise the market. Let’s see what the reaction will be.

Of course, that won’t happen for the simple reason that markets would instantly crash, and instead the Fed will make such an announcement in the coming weeks, giving markets plenty of advance notice of what is coming. It is then that all future debate on whether this was or wasn’t QE will finally, mercifully end, as the market’s reaction will give us all the answers we need, and it is then that we will see if Dudley’s conclusion that “it is unlikely to create major problems for US equity markets” is correct.

Tyler Durden

Wed, 01/29/2020 – 11:20

via ZeroHedge News https://ift.tt/3aSPowA Tyler Durden