Blain: “It’s Not About Infection Rates Or Mortality: The Economic Damage Is Already Very Real”

Blain’s Morning Porridge, submitted by Bill Blain

Stock markets shrugged of the Coronavirus yesterday, and staged a buy-the-dip rally. Are they right to discount the threat? It’s not about infection rates or mortality – the economic damage is already very real.

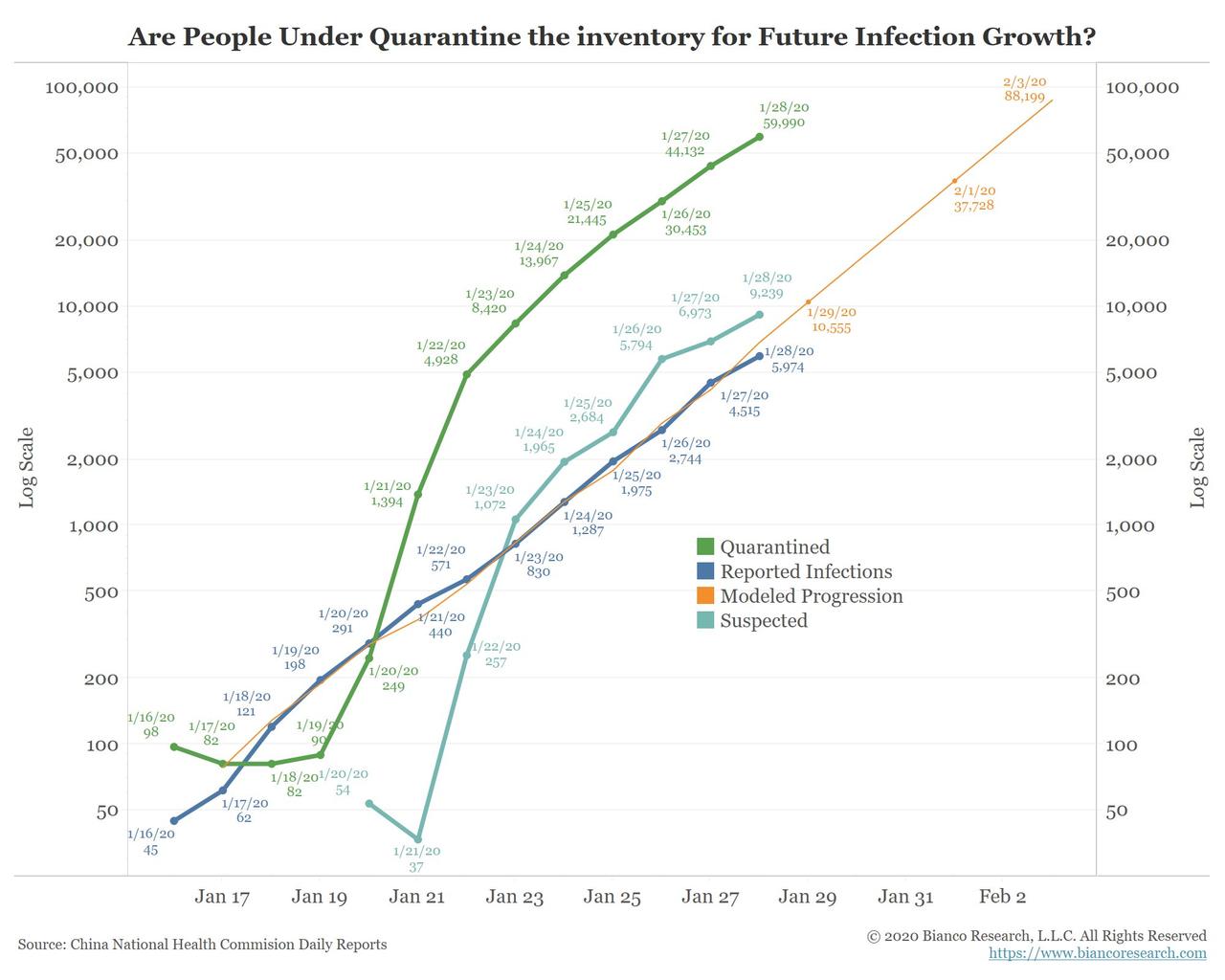

I am concerned Wuhan flu should not be lightly discounted. The numbers appear to show its spreading faster than anything previous like SARs, it shows few signs of topping, and the mortality rate seems to be rising faster than in previous China originated epidemics. That could be because it was given an opportunity to become more widely established – its now known local Wuhan authorities first knew about it in December, but did little for nearly 6 weeks. It’s now erupting in clusters away from China – like in Germany – spread by single travelers unaware they were carriers.

Now governments are playing catch-up. However, many investors suspect the recent market stumble was due to Government over-reaction than any real contagion threat. They’re looking to buy the market cheap to the fears triggered by over-reactive policy to contain the outbreak.

Maybe, the virus is more serious than the market hopes. Hope is never a good strategy. It could well be dismissing 2019-nCoV as not particularly relevant, and no more dangerous than SARS is the right call, but maybe not. But, there are two threats; the virus itself, and policy consequences. If the virus is already widely established, continues to balloon in numbers of infections, then it’s likely to trigger further government action – for instance there were rumours of US China flight ban yesterday. BA have cancelled their flights to China this morning. Economic effects will escalate and seriously impact business. There is a serious threat of China slowdown translating into a global event.

That is what markets should be pricing – the economic slowdown caused by the virus. If it gets worse, the consequences will be so much more painful.

It’s clear any business connected with China is going to suffer some form of Q1 hit from the impact in China. We still don’t know how much more economic damage may be inflicted from policy responses to the virus. Firms like Honda are shuttering China factories. Plans to evacuate foreign nationals from China are being put in place – will they all be put in quarantine?

Don’t discount Coronavirus. It is not over yet.

An Apple a day keeps my Pension OK

Apple results certainly distracted markers in a positive way – beating estimates with a $91.83 bln revenue post.

Here is great statistic, courtesy of the FT: Apple’s Market cap is $1.354 trillion. The Market Cap of the Entire DAX 30 German stock market is.. $1.350 trillion. (Well worth a read: FT – The Apple Effect: Germany fears being left behind by Big Tech)

Today I’d keep a close eye on Boeing and Tesla for the action. I can’t see anything good for Boeing – its increasingly a question of just how badly Boeing’s Management have screwed up over the years. Tesla will be a moment: if it beats, then whoopee… If it misses.. then hold on to your hats. (And probably worth noting how many Tesla Bulls are hyping the new Shanghai factory to drive the firm into sustainable profit – let’s see how that plays out in Q1 if China goes into virus lockdown.)

Let’s focus on Apple. Back in the early 20-teens, I went mildly bearish on Apple. For a company that had innovated wonderful new tech like the iPod and iPad, I wondered where the next must have bright shinny thing would be. As the years passed I continued to wonder where the companies design and innovatory mojo had gone. Fortunately, I didn’t dump my stock.

Looking round my home office this morning I can understand why Apple is such a screaming success. I’ll be replacing my i-Phone later this year. I’m writing this on the new iMAC I bought in December (with go-faster solid state hard drives and a massively pixelated screen). My Mac-Pro I use to write the porridge on the train is charging beside me. My i-Watch is charging on the other side. At least 2 i-Pads are elsewhere in the house, while another is on the boat – my main navigational aid these days. I might play some music later – on Apple Music, and tonight we’ll be watch “For All Mankind” on Apple TV. (It’s an interesting thesis, imagining the Russians got to the Moon first, and how that would galvanise the American exploration of space.) In the last 10-years I’ve owned at least 5 iPhones, bought 3 iMAC’s, 3 Mac Books plus bought the kids iPads and Mac Airs for university and travel. Even when the product is crap – I bought it. There is an Airpod in the Kitchen with a resentful Siri inside that’s never asked for anything… Despite my first iWatch falling apart, I bought another. (I don’t use the apple ear thingys.. I got much nicer ear-buds.)

I am a therefore an Apple retail sucker. Just like the other 100 million Bright Shiny Thing Addicts who keep buying over-priced Apple ecosystem stuff we don’t really need. It’s a very sustainable business. It doesn’t rely on a small number of business buyers, but a massive pool of discreet retail fans. And, that’s why I hold Apple Stock PA.

Apple have cracked it – for the time being.

Tyler Durden

Wed, 01/29/2020 – 10:20

via ZeroHedge News https://ift.tt/3aRZnSY Tyler Durden