WTI Extends Losses After Failed Missile Attack, Big Crude Build

Oil prices surged overnight after API’s surprise draw and headlines about a Houthi missile attack on Aramco facilities, but after tagging unchanged from Friday’s close (erasing the post-virus drop), comments that all missiles were intercepted sent prices lower and refocused traders’ attention on the potential for an imminent demand crisis due to the ‘Devil’-Virus spreading across the world.

Refinery utilization rates have been sluggish for this time of year, says Bob Iaccino, market strategist at Path Trading Partners:

“If refineries are not operating at capacity, it’s because they don’t have the demand, a lower draw or a build could make the demand fear worse”

So all eyes once again revert to inventories..

API

-

Crude -4.27mm (+500k exp)

-

Cushing +1.02mm (-870k exp)

-

Gasoline +3.27mm (+1.3mm exp)

-

Distillates -141k (-1.1mm exp)

DOE

-

Crude +3.548mm (+500k exp)

-

Cushing +758k (-870k exp)

-

Gasoline +1.203mm (+1.3mm exp)

-

Distillates -1.289mm (-1.1mm exp)

A big surprise crude draw from API was not enough to trump china demand fears but the official data from DOE shows a much bigger than expected 3.548mm crude build

Source: Bloomberg

As Bloomberg warns, the world is swimming in refined products. Gasoline stockpiles hit a seasonal high in data going back 29 years in last week’s report. Demand is likely to be soft, especially if we see a big slowdown in exports to Asia as fears persist about the coronavirus.

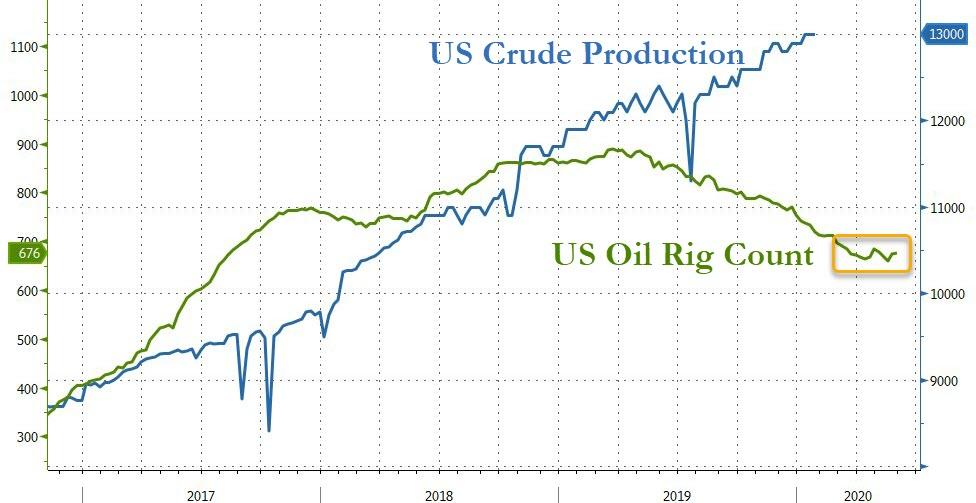

US Crude production remains at a record high, as forward-looking rig-counts begin to stabilize after their collapse…

Source: Bloomberg

WTI had dropped back to just above $43 before the DOE data – close the levels before API’s surprise draw was reported.

Finally, as Bloomberg Intelligence Senior Energy Analyst Vince Piazza explains, measured against the 2002-2003 SARS outbreak, the coronavirus situation in China will have a larger absolute effect but about the same effect on a relative basis.

Daily demand may be curtailed by more than 200,000 barrels vs 100,000 in the earlier incident, but China now accounts for 15% of global use vs 7% in 2003.

U.S. exports and therefore inventories may show a more marked effect, however, as China is now more integrated into the global economic system.

Tyler Durden

Wed, 01/29/2020 – 10:36

via ZeroHedge News https://ift.tt/2RBdvYS Tyler Durden