With China Markets Set To Re-Open, US Traders Are Ignoring Two “Blatantly Obvious” Issues

Authored by Richard Breslow via Bloomberg,

It isn’t hard to find assets that have clearly shown distress by how they’ve reacted to the current news. But it’s also easily enough done if you are looking for evidence of remarkable sangfroid in the face of what can only be described as scary events.

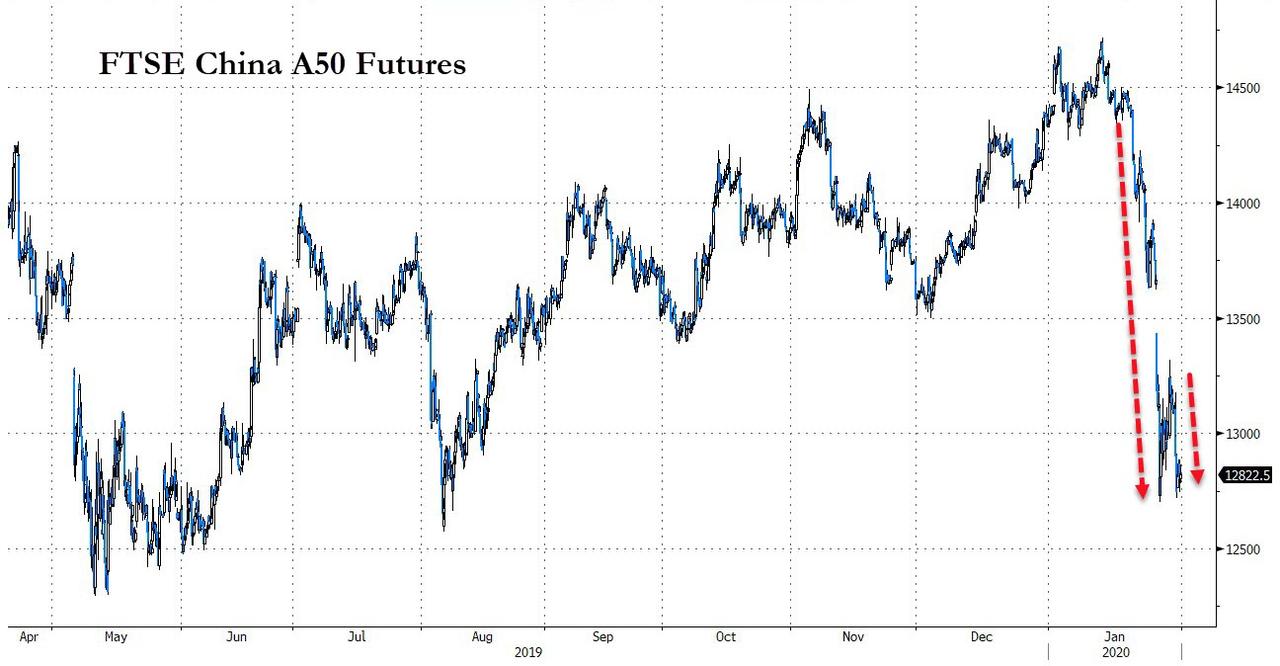

All in all, taken collectively, from an asset price point of view, things have held up remarkably well. How traders approach the coming weekend and the prospect of China’s market reopening will be very telling. Friday is unlikely to be quiet and whatever happens, someone is going to insist it was obvious.

What has been striking is that, on the face of it, markets appear to be debunking two cliches that we accept as so blatantly obvious that they need no discussion.

-

We take for granted that traders don’t like uncertainty,

-

and place the much-lamented diminished market liquidity near the top of any list of systemic concerns.

Maybe, these are worth reconsidering, at least in part

Watching how and, how far, things have moved, made me wonder if these don’t hold as true as we think. Or, we have been conditioned to simply ignore our natural instincts certain in the belief that the famous “put” is as alive and kicking as ever. And maybe it always will be.

Many economists and analysts are trying to fine-tune their calculations about the economic effects from the virus. And suggesting trades based on them. They are attempting to put a number on something that, at this point, can’t be measured. And appending a caveat like, “if things work out just so, this is how things will play out” really isn’t all that helpful. But it doesn’t seem to be stopping anyone from taking that ball and running with it.

If you survey various asset classes, however, you might come to very different conclusions about how investors are reacting. Traders are likely to pick the biggest and deepest markets to stock their portfolios and be far more circumspect about others. One market looking good won’t necessarily translate to an all-clear signal for everything else. Simplicity and familiarity will continue to look comparatively attractive. Esoterica will have to wait for a renewed day in the sun.

Correlation matrices should be used more carefully as they will churn out some difficult to interpret signals while they learn. Investors will need to reconsider how quickly they let their time series data decay. There is going to be a lot of asset-class rotation. And then, at a time uncertain, it will, hopefully, all have to be unwound. We will need to be much more circumspect when claiming we are, in some generalized fashion, risk-on or off.

It’s not that traders don’t dislike uncertainty. They have just found ways of dealing with it. But this strategy ultimately relies on central banks continuing to play their parts. They undoubtedly don’t want a repeat of the late 2008 price action where, just like now, everyone was busy getting long — or longer.

Investors have been forced to ignore liquidity concerns in order to survive in this low interest-rate, volatility-suppressed world. They’re probably going to have to give this more consideration, even if it’s precipitated by an upset. They’ve often been accused of protesting too much about the lack of liquidity but refusing to pay for it. Electronic platforms make it look like it’s for free when times are good. I suspect most traders just hope this too shall pass. It will be interesting to see if, in the interim, less liquid assets will finally be charged a liquidity premium.

It’s probably true that most traders still stick to the notion that uncertainty and liquidity concerns have merit. But if they don’t guide behavior in the way they used to in the past, we might want to stop taking them for granted. Sometimes they simply work in very different ways.

Tyler Durden

Fri, 01/31/2020 – 11:40

via ZeroHedge News https://ift.tt/2S9YMmK Tyler Durden