“If You’re So Smart, Why Aren’t You Rich?”: Bridgewater’s ‘Principles’ Don’t Apply To Ray Dalio

Bridgewater founder Ray Dalio has been a fixture in the financial press for more than a year now as he has transitioned from running his firm to establishing himself as a media commentator and pseudo-prophet, loudly exhorting the public to heed his warnings about capitalism and its shortcomings. Economic inequality is an imminent threat to societal cohesion in the US, Dalio claims. And in a series of disorganized screeds published on LinkedIn and accompanied by charts that were presumably assembled on the fly by a team of Bridgewater analysts (since computers handle most of the actual investing at Bridgewater now), the billionaire has laid out his plan to repair the damage caused by decades of corporate greed (allegedly unleashed during the 1980s by Ronald Reagan’s free-market reforms).

Not only is Dalio’s plan hopelessly unworkable, and not only because it hinges on the emergence of a kind of mythical technocratic champion able to bend Congress to his or her will and push through a slate of reforms that would undoubtedly infuriate corporate America, all while preventing it from doing everything in its power to undermine the administration and its economic agenda in retaliation.

It’s unworkable because we tried all that. The answer to America’s ills isn’t more government giveaways – that’s what got us here. But politics aside, WSJ published a scathing deep dive in its weekend edition examining the turmoil at the top of Bridgewater, which has long been the subject of gossip and speculation in the industry. Dalio is 70 years old, but despite claiming that he’s not really responsible for the company’s day-to-day operations, WSJ reporters found that this isn’t true. Dalio is still very much in charge, and after a series of botched succession plans – which all fell apart because his handpicked executives eventually clashed with Dalio’s dictatorial style – it’s not exactly clear what Bridgewater’s plan is for the coming decades.

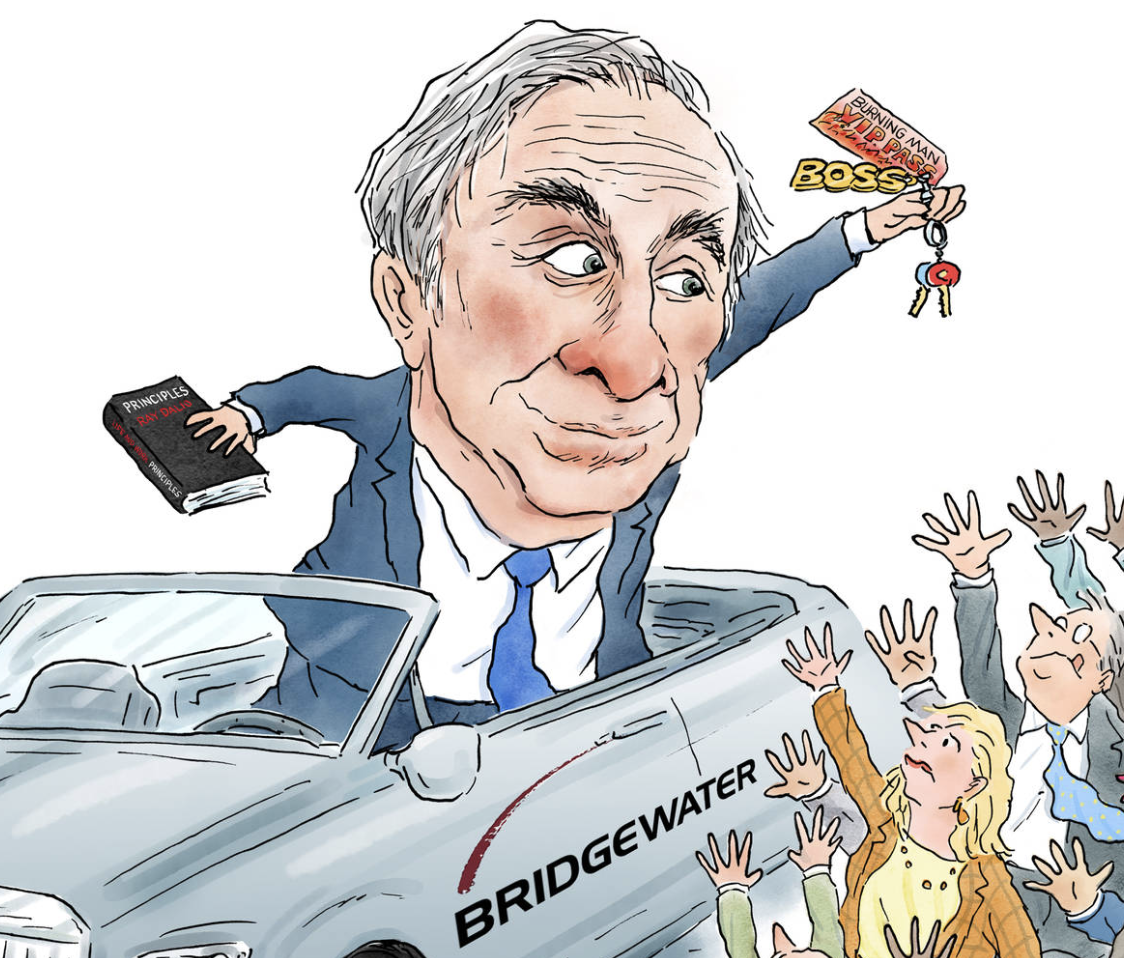

Ray Dalio caricature courtesy of WSJ

These questions are being posed at a difficult time for Bridgewater: the firm was recently the target of a harassment complaint filed by a former employee, and last year its flagship fund badly underperformed the market, during a year that was a bonanza for most investors.

Most recently, Eileen Murray, a co-CEO of Bridgewater along with David McCormick, has announced plans to leave the company at the end of Q1. Her decision, announced in December, followed reports that she was in talks to take the top job at scandal-scarred Wells Fargo. However, that job went to former BNY chief Charlie Scharf, and it’s unclear what Murray has in mind for her next move.

Since then, there’s reportedly been some bad blood with Dalio.

Mr. Dalio – who is co-chairman and co-chief investment officer – at age 70 isn’t giving up real control over the business that helped him amass a $19 billion fortune. His word nearly always wins out in debates at Bridgewater on topics from management, staffing and investments to compensation, personnel and the wisdom of meeting with an autocratic head of state, say current and former employees.

Mr. Dalio repeatedly overruled Ms. Murray on whom to hire, fire and promote, according to the current and former employees. She has told several friends she was exhausted and couldn’t do the job anymore.

Ms. Murray is still negotiating the terms of her exit; Mr. Dalio wants to cut the value of her stake in the firm, according to some of the current and former employees. Bridgewater bars employees from independently speaking with the press.

According to WSJ, it all goes to show that all of Dalio’s preaching about ‘radical transparency’ is just that. Talk – at least where Dalio is involved. And that’s why his senior managers never seem to pan out. Because employees at the firm, from the most junior to the most senior, understand that it’s extremely risky to challenge Dalio about anything, lest he respond thusly. Several witnesses told WSJ that Dalio mocked an underling when he objected to Dalio’s plan to meet with Russian President Vladimir Putin.

Several years ago, Mr. Dalio arranged a conversation with Russian President Vladimir Putin to discuss economic policy, said some of these employees. Employees expressed concerns about engaging with the autocratic leader, and Mr. Dalio told one that “if you’re so smart, why aren’t you rich?” according to people who heard the comment.

Mr. Dalio overruled the dissenters. Indeed, Mr. Dalio went on to meet with Mr. Putin several times in person, one of the people said. Other employees believed Mr. Dalio was right to discuss economic policies with Mr. Putin.

Representatives of Mr. Putin declined to comment, and Mr. Dalio declined to comment on the discussions. The company said it does not disclose “who Bridgewater people meet with.”

Would you look at that: Dalio, an ardent critic of President Trump, is a friend and routine business confidant of Putin. We’d be curious to see his FBI file.

Meanwhile, even the most senior employees like Dalio’s current co-CEO (who was just recently abandoned by Murray, his co-CEO) has reportedly complained about a kind of vindictiveness that Dalio displays toward departing employees that manifests in the form of frugality.

Dalio has reportedly worked to reduce senior employees ‘phantom equity’ to which they are entitled upon leaving the firm. However, the senior employees denied this to WSJ.

“He is so cheap,” Mr. McCormick told colleagues late last year, speaking about his boss, according to the contemporaneous notes of one person who heard the comment. “Not only did he want to sell the house but he wanted to get the nickels out of the couch.”

Mr. McCormick said the attempt to reduce his stake “did not happen and I did not make that comment.” He said he has a “terrific working and personal relationship” with Mr. Dalio. He also said “I never discussed a job at BlackRock.” A company spokesman added that Mr. McCormick “never discussed with Larry about leaving Bridgewater.”

Though as much as we might mock Dalio for his obvious hypocrisy and his laughably unimaginative plan to fix capitalism (hint, hint, hint: it involves raising taxes on the rich).

But there’s one thing about Bridgewater that nobody can dispute. The firm remains the world’s most successful hedge fund shop, with few qualified rivals for the crown. Surrounded by a sea of fakers, imitators and interlopers who together suffered some of their worst outflows in recent memory last year, Bridgewater continues to grow, and outperform, despite the flagship fund’s lackluster performance in 2019 (it outperformed by a wide margin the year before).

Since then, Bridgewater has delivered the biggest net gains of any hedge fund, according to a 2019 report from LCH Investments, a result due partly to Bridgewater’s large size. Its investors include endowments, public pension funds and sovereign wealth funds. It manages about $160 billion, making it the largest hedge-fund firm in the world.

But in recent years, Bridgewater has been less than impressive. The flagship hedge fund, Pure Alpha, barely made any money last year despite a banner year for assets of all stripes, according to data reviewed by The Wall Street Journal. It bets on and against markets world-wide in an effort to stay ahead of macroeconomic trends.

A smaller fund called All Weather that makes automated, computer-driven trades gained 16.6%. That lagged the 21.7% return of a Vanguard Group fund that uses a conventional mix of 60% stocks and 40% bonds.

Mr. Dalio has described the investment performance as embarrassing in meetings with staff, according to people familiar with the conversations. The company said in a statement that “we don’t know of any such comment.” It added that “while Bridgewater’s alpha last year was disappointing to Ray it was within the range of expectations.” Mr. Dalio said in a statement that “there is a waiting list to invest” in Pure Alpha, which he said made 10% in 2018 when “most assets were down.”

While we’re sure Dalio will blast the WSJ for fabricating its reporting (he does this every time WSJ writes about him), it’s worth noting that the genius comics behind 1990s sketch comedy “Mr. Show” came up with a name for Dalio’s professed money-based value system.

It’s called Worthington’s Law.

It was created by David Worthington – a truly great man. Quite simply, the law stipulates that an individual’s intelligence and overall value to society increases along with his or her personal fortune. By this logic, Jeff Bezos and Mark Zuckerberg are two of the smartest, most honorable and beloved individuals in all of America. So are Warren Buffett, and Bill Gates.

Oh, and Dalio, of course – but we have a feeling you figured that out already for yourself.

But the billionaire hedge fund founder took a major hit last year when he gave $100 million to the State of Connecticut to improve its schools, step 1 in his plan to save capitalism. But Dalio’s ‘philanthropy’ was a massive PR blunder, and his reputation took a serious hit.

Don’t be like Ray, kids. Hoard your money.

Tyler Durden

Sat, 02/01/2020 – 15:10

via ZeroHedge News https://ift.tt/36ORJFm Tyler Durden