Negative Rates Are Forcing German Banks To Hoard So Much Cash They’re Running Out Of Space

The increasingly unstable and unpredictable world isn’t the only reason why betting on safe-makers and security companies might not seem like a bad idea to some savvy investors. But those aren’t the only reasons.

In the era of NIRP, “cashless societies” like Sweden are at a clear disadvantage. When banks are charging wealthy customers additional fees for storing their cash on deposit, the option to transition a chunk of one’s fortune to cash suddenly makes sense. And as Bloomberg reported Friday, this phenomenon hasn’t been lost on German banks.

To help them keep as little money in reserve accounts as possible, banks in Germany are reportedly stuffing vaults with euro banknotes in to keep them handy for customers (and avoid the additional NIRP tax on deposits). Some banks have hoarded so much cash that they’re running out of room and are searching for more storage. This behavior has been going on for years, practically since Draghi introduced negative rates almost six years ago.

But the trend has gotten so out of hand German banks are running out of space to stash the notes.

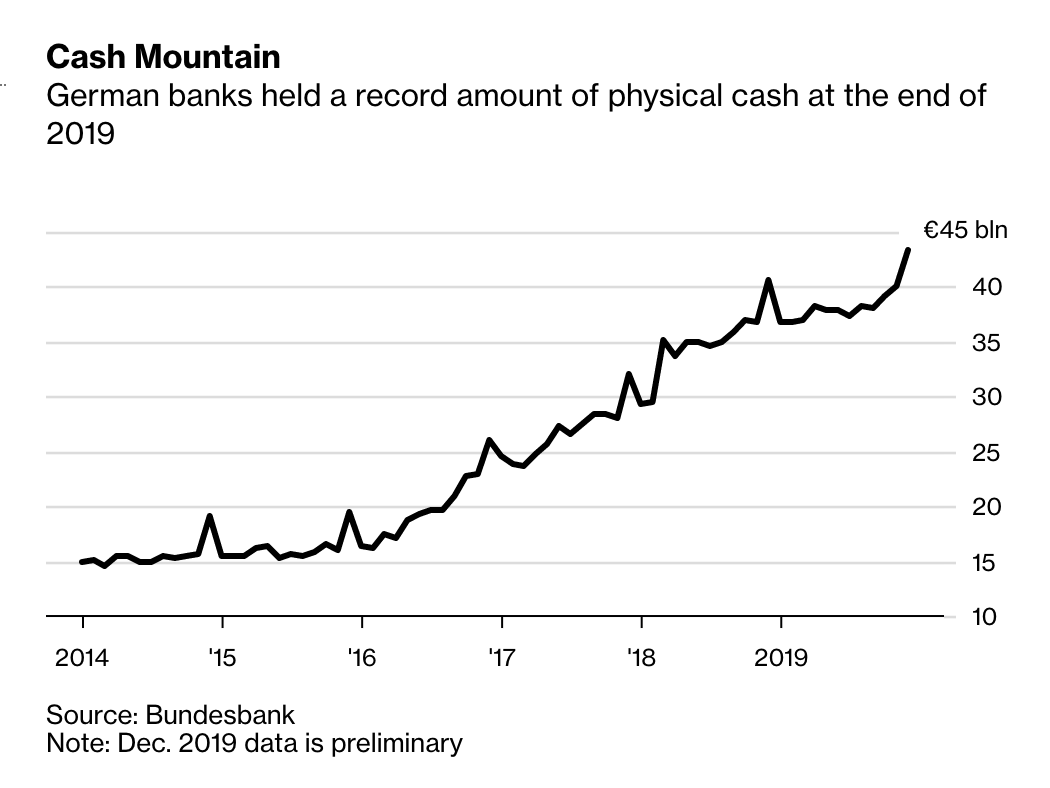

The physical cash holdings of German banks rose to a record 43.4 billion euros ($48 billion) in December, according to Bundesbank data published on Friday. That’s almost triple the amount at the end of May 2014, the month before the European Central Bank started charging for deposits and raising the pressure on Germany’s already beleaguered banks.

By the end of last year, German banks were holding a record amount of physical cash.

In theory, negative interest rates are supposed to spur inflation and economy growth by encouraging businesses to borrow, however, the policy has arguably failed in Europe, as growth has remained sluggish over the last five years, while the eurozone’s savers and bankers have suffered.

“These days it’s better to keep funds in cash rather than park them at the ECB,” said Andreas Schulz, who runs a savings bank close to Berlin. “That’s despite the risk, insurance costs and logistical hassle involved. It’s a ludicrous demonstration of the consequences of the ECB’s interest-rate policy.”

Munich-based precious metals trader Pro Aurum said it has received several requests from banks to store notes in its vaults, but the company had to turn them down.

“The ECB’s negative interest rates make hoarding cash attractive,” said Frank Schaeffler, a German member of parliament with the opposition Free Democrats. “This is just the beginning. If it continues, we’ll see a boom for vault makers and security companies.”

European banks have repeatedly warned that they can’t pass on all the liquidity they have as credit, but holding cash won’t help banks escape the entirety of the burden of negative rates. In fact, the volume of notes that banks are hoarding is still small compared with their overall deposits. But the trend has become grist for German critics of the ECB, who argue that negative interest rates are causing more harm than good.

Demand for safe deposit boxes has been growing for “months” according to one business owner.

“We’re seeing increased demand for our safe deposit boxes, frequently for storing cash,” said Markus Weiss, a managing director at Degussa Goldhandel. “That high demand has lasted for months now and we’re continuously expanding our capacities,” said Weiss, whose company sells gold and offers clients space to store their valuables.

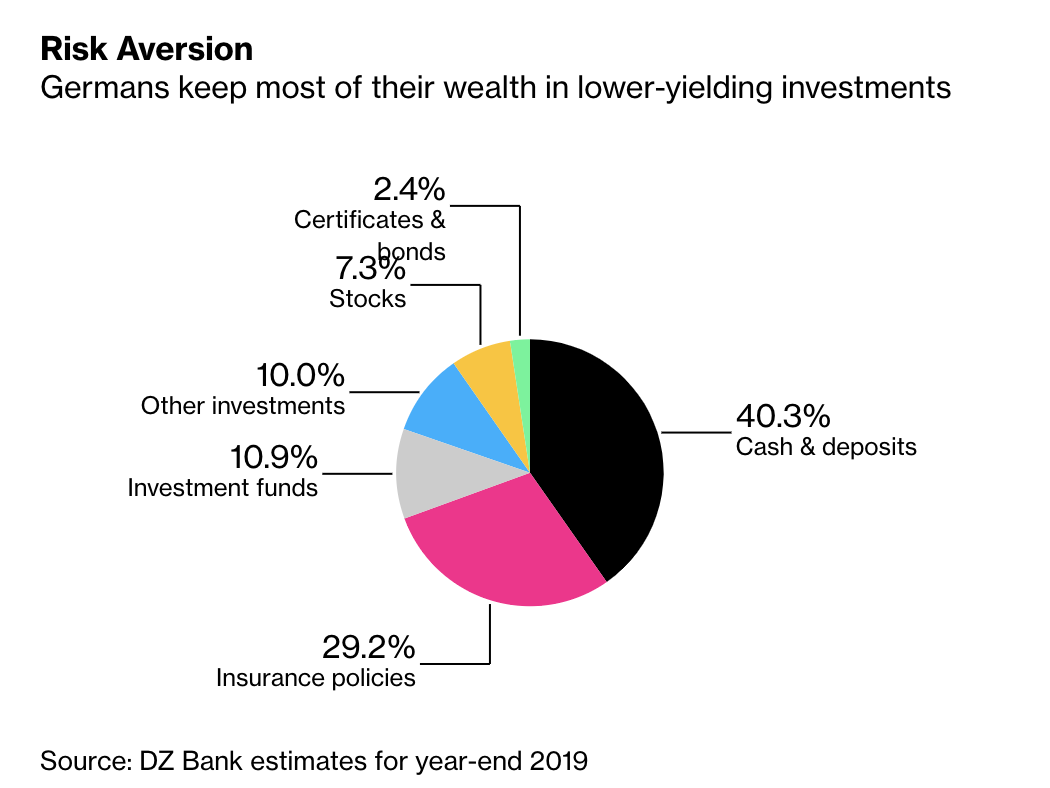

German banks have been especially hard hit (look at Commerzbank and Deutsche Bank), as Germans tend to keep most of their savings in low-yielding investments.

Unfortunately for them, the ECB selected Christine Lagarde as its new leader, a former finance minister who has given every indication that she intends to continue with Mario Draghi’s unprecedented monetary stimulus.

Tyler Durden

Sat, 02/01/2020 – 07:35

via ZeroHedge News https://ift.tt/2Okk0xh Tyler Durden